© The Print Collector/Alamy

Please remember that the value of the investment can fail and may not get back the amount invested. Past performance is not a guide to future returns.

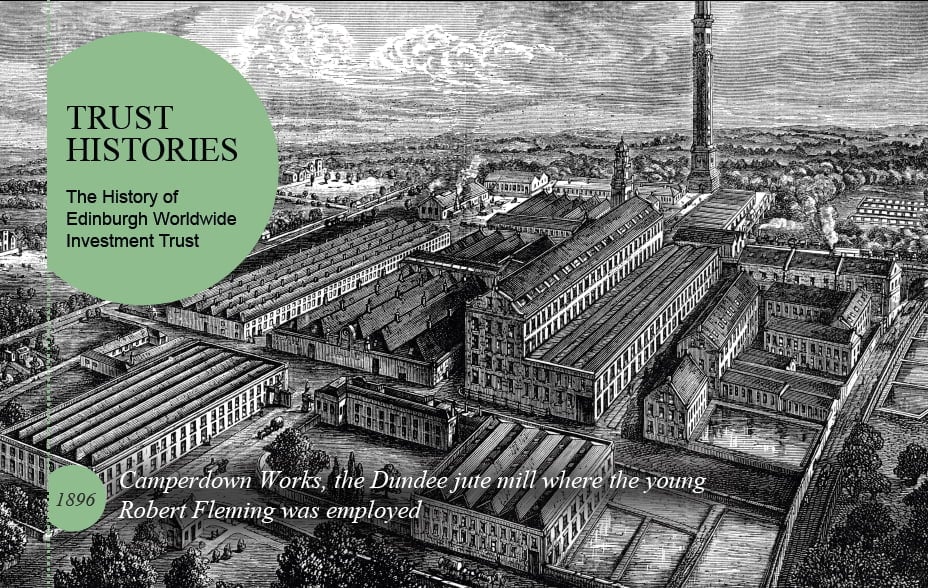

The forerunner of Edinburgh Worldwide Investment Trust (EWIT) was born in gaslit, wood-panelled offices in late-Victorian Dundee. Its creator christened it The Northern American Trust Company Limited. He was Robert Fleming, a globetrotting Scots financial wizard who nursed the trust through its first quarter century, and whose grandson Ian would pen the James Bond novels.

Fleming had left school at 13 to become a messenger in a jute mill. But before turning 30, he had launched Scotland’s first investment trust. His investigations into exciting companies in the booming US meant that he already bestrode the investment world on both sides of the Atlantic when he published Northern American’s prospectus in July 1896.

The trust, which had subscribed capital of £300,000 plus a further £300,000 of 3.5 per cent debenture stock, prospered from the outset. Within two years, The Dundee Courier crowned it “a phenomenal success”.

By 1913, the portfolio of 250 securities – 74 per cent invested in the US, mostly in bonds – had a book value of £2.6m. The first world war temporarily arrested its growth, but fixed dividends were paid to shareholders throughout the conflict, from which the trust emerged with 52 per cent of its assets in the US. Of the balance, chairman Ernest Cox reported, “only 5.5 per cent is invested in countries under the cloud of anarchy, Bolshevism or kindred retrograde agencies… even if we include Mexico.”

As the 1920s began to roar, the trust rebuilt its global portfolio. New holdings included preference shares in The African and Eastern Trade Company and ordinary shares in the soap giant Lever Brothers (now Unilever), Oriental Telephone and Electric Company and Portland Cement.

By the 1929 Wall Street Crash, the trust was worth £5m and had 658 holdings. It had diversified across bonds, equities, government gilts, debentures and preference shares. The Great Depression, which followed, hit hard. By 1933 a depreciation of £512,000 was reported against a book cost of £4.1m, while the dividend, which had reached 21 per cent by 1929, had been cut to 15 per cent. Luckily the trust had reserves of £930,000 to help it weather the crisis.

© Hulton Archive/Getty Images

The end of the second world war in 1945 saw the UK in a dire financial state. The threat of widespread nationalisation and strict exchange controls ensured that recovery would take time. Growth gained momentum by the mid-1950s, by which time the portfolio had swelled to a mind-boggling 1,018 holdings. Acquisitions included the Anglo-Persian Oil Company (later British Petroleum), the Caterpillar Tractor Company and Marks & Spencer.

In 1959, the trust began sharing offices and administrative functions with other trusts connected to Fleming, heralding the start of the management company era. What became known as the Belsize House Group flourished under the guidance of company secretary and later chairman Donald Marr, father of broadcaster Andrew Marr.

By 1964, gross assets had grown to £16m, while dividends had been increased every year since the end of the Suez Crisis. As the next decade began, the trust merged with the smaller Camperdown Trust, moving forward with £29m of gross assets and 313 portfolio holdings, about a third of the number 15 years before.

Recovery from the testing times of the 1970s was dramatic when it came. Over the 12 months to 1 November 1975, the trust’s share price surged by 82 per cent, while the net asset value (NAV) rose by 69 per cent.

After the 1979 general election, the Conservative Party returned to power. It cut income tax rates, raised tax allowances and swept away exchange controls. The trust had substantial dollar holdings valued, because of the difficulty of accessing US currency (a legacy of wartime conditions), at a substantial premium to the prevailing exchange rate. The removal of the currency controls meant the disappearance at a stroke of this premium and thus of a painful loss of £5m from the trust’s balance sheet.

But chairman Ivor Guild predicted long-term benefits, citing new freedom “to invest in areas such as Australia and the Far East, as well as in the Americas, where larger or faster-growing economies, fewer labour problems, or greater development potential promise higher profits”. This proved correct as the Japanese market blossomed and the trust’s investments there grew to almost a third of its portfolio.

© Gamma-Rapho/Getty Images

In 1985, Belsize House combined with The Edinburgh Investment Trust to create Dunedin Fund Managers. Then, during the trust’s centenary year in 1996, it was acquired by Edinburgh Fund Managers (EFM), presaging the trust’s permanent move to the Scottish capital. Reincorporated under its present name in July 1998, the trust set off on its new life with total assets just shy of £160m.

This was around the peak of the 1990s dotcom boom. Entering the new millennium, the bubble burst, and the FTSE 100 index recorded sharp falls in both 2001 and 2002. For EWIT, the downturn was even worse. The NAV per share fell by 34 per cent during the year to 31 October 2001 against its benchmark, which dropped by 26 per cent.

With EFM fighting fires of its own and the trust trading at a stubbornly wide discount, it was time to act. Following a review, Baillie Gifford was appointed to manage the trust with effect from 1 November 2003.

Over the next two years, the incoming management team, led by Mark Urquhart, reduced portfolio holdings from 106 to 41. It focused on companies “where we are genuinely enthusiastic about their growth prospects for the next decade”. Purchases included Amazon, Dell, eBay and Whole Foods Market.

© Getty Images North America

In November 2011, EWIT’s current chairman joined the board. Henry Strutt was a chartered accountant who had spent more than 20 years with the Robert Fleming Group, mostly in the Far East. Two years later, the now £241m trust had delivered a NAV increase of 191 per cent in total return terms over 10 years and an even more noteworthy 245 per cent share price increase on the same basis. That outpaced the MSCI All Country World Index’s more modest 132 per cent advance. From January 2014, following a review of long-term objectives, management of the portfolio moved to Baillie Gifford’s Global Discovery Team led by Douglas Brodie. He was later joined by two young deputies – Svetlana Viteva and Luke Ward.

In 2014, the trust sought shareholders’ permission to invest in companies at an earlier point in their growth cycle. Investments of up to 5 per cent of total assets would now be permitted in private companies, the earliest examples being the Middle Eastern ecommerce platform Souq Group (later bought by Amazon) and DNA sequencing specialists Oxford Nanopore Technologies.

© Oxford Nanopore

Over the following five years, the refocused EWIT enjoyed spectacular success. Boosted by the rapid growth of holdings such as Alnylam Pharmaceuticals, a genetics company, LendingTree, an online loan marketplace, and IPG Photonics, a manufacturer of fibre lasers used in metal processing, the trust’s NAV and share price performed handsomely.

Total assets passed the £500m barrier in 2018, up from £109m when Baillie Gifford assumed management 15 years previously. In 2020, many of its technology and healthcare investments grew during the coronavirus pandemic.

While the investment policy and geographical focus may have shifted over 125 years, key themes link the story of the trust then and now: an emphasis on meticulous primary research and a keen eye for the impact of technological developments. Geography has been no more a barrier for the successors of Robert Fleming than it was for the man himself.

Find out more about Baillie Gifford Edinburgh Worldwide Investment Trust

Important Information

This communication was produced and approved in September 2023 and has not been updated subsequently. It represents views held at the time of presentation and may not reflect current thinking.

This communication should not be considered as advice or a recommendation to buy, sell or hold a particular investment. This communication contains information on investments which does not constitute independent investment research. Accordingly, it is not subject to the protections afforded to independent research and Baillie Gifford and its staff may have dealt in the investments concerned. Investment markets and conditions can change rapidly and as such the views expressed should not be taken as statements of fact nor should reliance be placed on these views when making investment decisions.

Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority. Baillie Gifford & Co Limited is the authorised Alternative Investment Fund Manager and Company Secretary of the Trust.

A Key Information Document for Edinburgh Worldwide Trust plc is available here.

All data is source Baillie Gifford & Co unless otherwise stated.

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested.

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

The Trust’s risk could be increased by its investment in private companies. These assets may be more difficult to sell, so changes in their prices may be greater.

The Trust can borrow money to make further investments (sometimes known as “gearing” or “leverage”). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust’s investments fall in value, any invested borrowings will increase the amount of this loss.

Market values for securities which have become difficult to trade may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

The Trust can make use of derivatives which may impact on its performance.

Investment in smaller, immature companies is generally considered higher risk as changes in their share prices may be greater and the shares may be harder to sell. Smaller, immature companies may do less well in periods of unfavourable economic conditions.

Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Trust may issue new shares when the price is at a premium which will reduce the share price. Shares bought at a premium can therefore quickly lose value.

The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

The aim of the Trust is to achieve capital growth. You should not expect a significant, or steady, annual income from the Trust.

The Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

This information has been issued and approved by Baillie Gifford & Co Limited and does not in any way constitute investment advice.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Share Price | 7.1 | 35.9 | 37.2 | -51.5 | -18.9 |

| NAV | 8.4 | 34.7 | 37.5 | -42.4 |

-11.4 |

| MSCI AC World Index | 1.8 | -2.8 | 36.8 | -11.3 |

8.2 |

Performance source: Morningstar, S&P, MSCI, total return in sterling.

Past performance is not a guide to future returns.

Legal Notices

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

The S&P 500 and S&P Global Small Cap (‘Index’) are products of S&P Dow Jones Indices LLC and/or its affiliates and have been licensed for use by Baillie Gifford. Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www. spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.