© Hulton Archive/Getty Images

Please remember that the value of an investment can fall and you may not get back the amount invested.

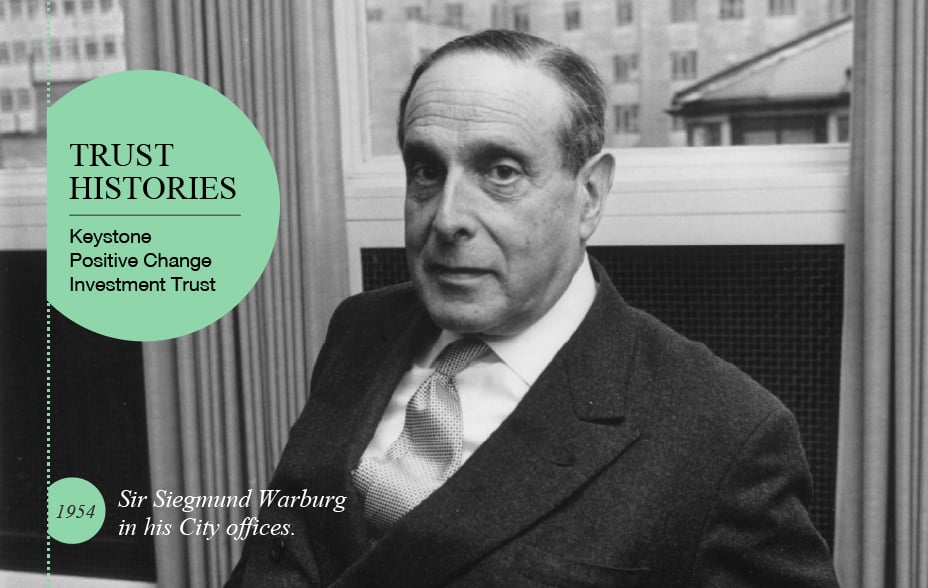

The backstory of the enduring Keystone begins in the mid-1930s when Siegmund (later Sir Siegmund) Warburg was forced to flee Germany in 1934 as the Nazis swept the country. Jewish-owned businesses were vulnerable to confiscation and individual businessmen arbitrarily jailed, as Henry Grunfeld, Warburg’s future business partner, found to his cost a year later. Grunfeld, a steel executive, was imprisoned by the Gestapo and held without food or water for 54 hours, only gaining release through his status as the Honorary Consul of Spain.

Exiled to London, the two men formed the New Trading Company to help other refugees get their money out of Nazi-dominated Europe and invest it elsewhere. In 1946, this company was renamed S.G. Warburg & Co. It would become, to quote from Peter Stormonth Darling’s 1999 book City Cinderella, “the most respected and feared merchant bank in London from nothing in a single generation”.

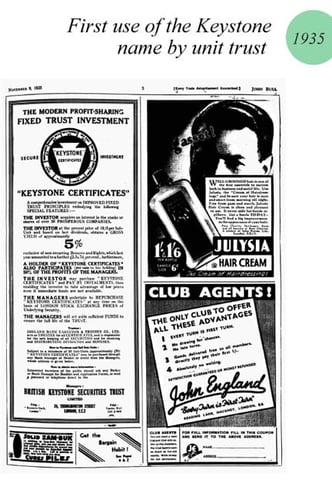

Keystone newspaper advertisement 1935

© TBC

The UK was still in the throes of post-war recovery when Keystone Investment Company Limited was launched in London on 10 September 1954. The origins of the trust lie in the takeover of the Keystone group of unit trusts by the merchant bank S.G. Warburg & Co. in the summer of that year.

The Keystone name was first used by the unit trust group in 1935 and depicted in the brand logo, which showed interlocking building blocks for ‘gold mines’ and ‘motors and aircraft’ bonded together against the shockwaves of the 1929 Wall Street Crash.

Incidentally, the name risked confusion with an earlier, now largely forgotten, Keystone Investment Trust formed in April 1923. This unfortunate namesake failed in the crash of 1929, leaving £80,000 of investors’ cash unaccounted for and its promoter floating face down in the Thames.

The backstory of the enduring Keystone begins in the mid-1930s when Siegmund (later Sir Siegmund) Warburg was forced to flee Germany in 1934 as the Nazis swept the country. Jewish-owned businesses were vulnerable to confiscation and individual businessmen arbitrarily jailed, as Henry Grunfeld, Warburg’s future business partner, found to his cost a year later. Grunfeld, a steel executive, was imprisoned by the Gestapo and held without food or water for 54 hours, only gaining release through his status as the Honorary Consul of Spain.

Exiled to London, the two men formed the New Trading Company to help other refugees get their money out of Nazi-dominated Europe and invest it elsewhere. In 1946, this company was renamed S.G. Warburg & Co. It would become, to quote from Peter Stormonth Darling’s 1999 book City Cinderella, “the most respected and feared merchant bank in London from nothing in a single generation”.

Algerian President Ahmed Ben Bella with Fidel Castro in Cuba.

© Gamma-Keystone/Getty Images

Having acquired the management of the Keystone funds, Warburg “now proposes,” Noted Truth, an investigative magazine, in 1954, “to convert these three unit trusts into an orthodox investment trust”. Keystone Investment Company Limited was duly incorporated on 17 September 1954, “to carry on business as a general investment company and to acquire and hold shares, stocks, debentures, debenture stocks and bonds.” The initial capital comprised £1 million in share capital, plus £250,000 of debenture stock.

Broadly diversified across a range of industrial companies, utilities, miners, railways and banks, the trust thrived from the outset, managing to grow healthy dividends. By the time of the 1962 Cuban Missile Crisis, which caused a severe setback in share prices, both the break-up value (net asset value) per share and annual dividends had approximately doubled since launch.

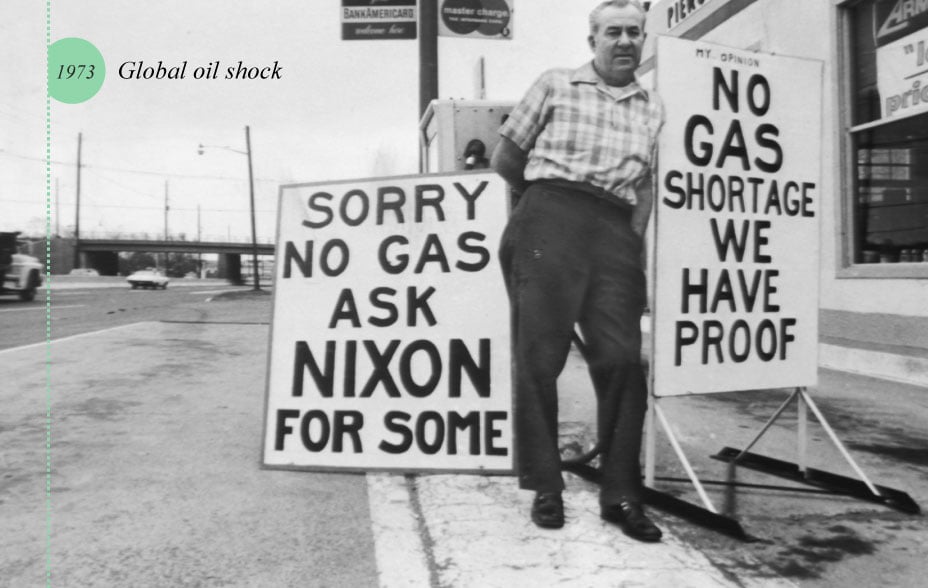

Paul Pierson with signs during New Jersey gas shortage.

© New York Daily News/Getty Images

In 1970, Keystone merged with Abchurch & General Investment Trust which, aided by further asset growth, took the trust through the £10 million barrier for the first time two years later.

Turbulent times were to follow, however. The trust was affected not just by global events such as the 1973-4 oil crisis but, closer to home, the miners’ strikes and the three day week. The UK stock market fell sharply in 1974, only to experience an extraordinary rebound the following year, in which the then FT Industrial Index rose by 78 per cent. Keystone was soon back on a sharp upward trajectory as the 1980s bull markets took hold. During that decade, despite investors’ brakes being applied by the temporary effects of the 1987 stock market crisis, assets soared from £16 million in 1980 to almost £70 million at the start of the 1990s.

© Corbis News/Getty Images

At Warburgs, meanwhile, change was afoot. In 1979, Sir Siegmund had appointed Peter Stormonth Darling as chairman of the firm’s investment management division with instruction to “get rid of it – give it away if you have to!”.

This division was subsequently renamed Mercury Asset Management (MAM), spun out and floated on the London Stock Exchange in April 1987, exploiting the new-found freedoms of the previous year’s big bang which swept away the City’s old restricted practices. MAM was sold to Merrill Lynch in 1997 for £3.2 billion.

For the investment trust, the transfer of ownership of its management company to MAM cut the old links to Warburgs. Its name would be changed, too, first to Mercury Keystone Investment Trust PLC in late 1993 and then to Merrill Lynch UK Investment Trust PLC in December 2000.

© Kpa/Zuma/Shutterstock

These were heady times. As the 21st century dawned, with the technology boom in full swing and the FTSE 100 Index touching a high not exceeded until early 2015, the trust’s net assets peaked at £170 million, before suffering sharp declines as the bursting of the internet bubble threw markets into reverse.

The founding name was reintroduced in January 2003, with the adoption of the title Keystone Investment Trust PLC and the appointment of a new manager, Invesco Asset Management. As on so many occasions in financial history, the market rebound was sharp when it came. Keystone recorded a share price return of some 51 per cent for the year to 30 September 2003, while the net asset value per share improved by some 29 per cent.

By 2007, the trust’s net assets had not just recovered their losses dating to the post-Millennium crisis but moved forward to a new high of £179 million. But disaster lurked in the form of the global financial crisis of 2007-2008, in which sub-prime mortgage lending in the US would unravel, creating the global credit crunch and the collapse of leading institutions including Lehman Brothers.

Markets turned upwards in the years that followed, with the trust’s net assets reaching £200 million in 2013 and then £250 million in 2014, the year of the trust’s 60th birthday.

The UK economy soon faced fresh headwinds. These included uncertainties following the June 2016 EU Referendum, endless Brexit wrangling and the onset of the Covid-19 pandemic in early 2020. Was the objective of long-term growth, primarily through UK companies, still right for Keystone?

Following a sweeping strategic review, resolutions were put before shareholders at a general meeting on 10 February 2021, to approve a change of the Company’s investment objective and policy and to appoint Baillie Gifford & Co Limited as new investment manager.

Under its new name of Keystone Positive Change Investment Trust plc, the trust, which is being managed by Kate Fox and Lee Qian, strikes out on a new path, actively investing in innovative companies that contribute to a more sustainable and inclusive world.

Find out more about Baillie Gifford Keystone Positive Change Investment Trust

Important Information

The views expressed should not be taken as fact and no reliance should be placed upon these when making investment decisions. They should not be considered as advice or a recommendation to buy, sell or hold a particular investment. If you are unsure whether an investment is right for you, please contact an authorised intermediary for advice.

This article was produced and approved in June 2021 and has not been updated subsequently. It represents views held at the time of recording and may not reflect current thinking.

The trust invests in companies whose products or behaviour make a positive impact on society and/or the environment. This means the trust will not invest in certain sectors and companies and the universe of investments available to the trust will be more limited than other funds that do not apply such criteria. The trust therefore may have different returns than a fund which has no such restrictions.

The trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

The trust's risk could be increased by its investment in unlisted investments. These assets may be more difficult to buy or sell, so changes in their prices may be greater.

The trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies. The Keystone Positive Change Investment Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

For a Key Information Document for the Keystone Positive Change Investment Trust, please visit our website at www.bailliegifford.com