Key points

- Three private companies are tackling some of humanity’s greatest challenges

- PsiQuantum is building useful quantum computers, SpaceX is expanding access to space and SHINE Technologies is commercialising spin-offs from nuclear fusion

- Each is building a durable business in pursuit of a grand goal

WATCH: Investment manager Luke Ward’s podcast

Listen to the podcast on Spotify and Apple Podcasts

As with all investments, your capital is at risk

Every company wants to make an impact. But few can say without hyperbole that they could change the trajectory of human progress.

PsiQuantum, SpaceX and SHINE Technologies qualify. They are attempting, respectively, to build the world’s first useful quantum computers, make humanity an interplanetary species and harness nuclear fusion.

That’s not all they share. Each is a private company, meaning they get to pick who they sell their equity to. Each is founder-led and young, emerging after the millennium. And each has underpinned its grand mission with a viable commercial strategy.

“It’s all well and good to have a product that sounds really cool, but unless it’s affordable or easy to distribute, it’s not going to have the impact that people hope or be able to create the value that it should,” investment manager Luke Ward tells our Short Briefings on Long Term Thinking podcast.

“That’s what creates a long-term, durable edge around these businesses.”

Ward led Baillie Gifford’s investment into the companies, and Edinburgh Worldwide Investment Trust (EWIT)’s portfolio, which he co-manages, contains all three.

PsiQuantum’s photonic computers

The intricacies of quantum computing are notoriously hard to explain. But in simple terms, the machines tackle tasks that would be impractical or impossible to solve on ‘classical computers’ by harnessing the properties of matter and energy at their most fundamental level.

“There’s a class of problems where the complexity of simulation increases exponentially, so even as you throw more and more computing power at it, even the world’s largest supercomputers struggle,” Ward explains.

“And that’s because the nature of those problems is quantum mechanical. So we need a quantum computer to simulate them properly.”

Tap the icons in the graphic below to explore quantum computing’s potential uses:

While other firms have approached the challenge by trying to develop “exotic hardware”, PsiQuantum has focused on adapting existing semiconductor technology. This has the advantage of letting it draw on existing supply chains, and the firm intends to build two commercial-scale quantum computers by 2030. One in Brisbane, with financial support from the Australian government, and the other in Chicago, with funding from the US Department of Defense.

“These computers will likely be plugged into the cloud,” says Ward. “The question for us is what the business case will look like. PsiQuantum could say: there’s a biotech company that wants to produce a cure for a particular ailment, let’s partner with them rather than being a supplier and share in the overall value that creates.”

SpaceX’s satellite revolution

SpaceX is already generating billions of dollars, connecting customers to its Starlink internet service and delivering crew and cargo into orbit for governments and third parties.

By landing and reusing the rocket booster of its Falcon 9 spacecraft, the firm has radically cut the cost of sending payloads into space. And by demonstrating it can catch the booster of its larger Starship vehicle from midair, it has paved the way to a fully reusable system that would let clients deploy bigger objects at lower cost.

SpaceX caught Starship’s rocket booster for the first time in October 2024

© Anadolu/Getty Images

“Thanks to SpaceX, it’s increasingly affordable for everyday businesses to operate hardware in space,” Ward says. “This is a company that can get better as it gets bigger.”

Starlink uses SpaceX’s own satellites to provide a broadband-quality service to homes, businesses, ships and planes. But usage could balloon thanks to the advent of smartphones connecting directly to the network. Select Samsung Galaxy and Apple iPhone owners are testing the service in the US.

“You need a high-power signal to reach a telephone,” Ward explains. “Previously, it was too expensive to install a satellite with that power. Now, it’s possible because of the rocket innovation and learnings from running the satellite network.”

For SpaceX, these achievements are stepping stones to establishing colonies on Mars. And while that’s, at best, decades off, the goal still figures into Ward’s investment case.

“The stretching goal gives them a competitive advantage beyond a salary in hiring the best people in the world,” he says, explaining it’s also an incentive “to make space a hundred or a thousand times cheaper from where it is today. That’s phenomenally powerful as a value generator to unlock more and more applications.”

SHINE’s path to fusion power

SHINE Technologies’ multi-stage approach to nuclear fusion echoes that of SpaceX. It aims to replicate how the sun creates light and heat by combining atoms, unlike today’s nuclear power stations, which split them apart. This would provide an abundant, clean and safe energy source – without the expensive waste handling and disposal issues of legacy nuclear power.

“The problem is that taking the sun, miniaturising it and keeping it in a ‘little bottle’ in a power plant is enormously complex,” Ward says. “We find SHINE appealing because it’s not trying to leap straight to energy generation.”

The company's first step was to create neutrons – subatomic particles with a neutral electric charge – to test industrial components.

“Lightweight materials like carbon composites are hard to image with X-rays,” Ward says, adding that aerospace and defence companies now seek out SHINE’s service to detect potential flaws in plane wings, turbines and other mission-critical parts.

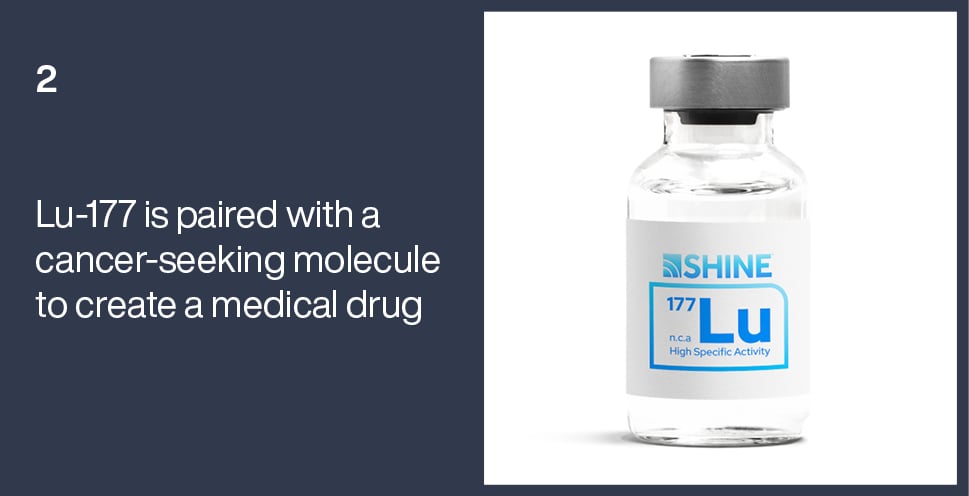

The company has reinvested the resulting revenue into running its fusion technology at a higher power level. Recently it has begun to produce medical isotopes: radioactive particles that can be used to diagnose and treat diseases.

“These pharmaceutical products sell for about $1bn a gram,” Ward says. “Lutetium, for example, in recent clinical trials has been found to cure some cases of prostate cancer.”

As its next challenge, the firm plans to generate fusion reactions powerful enough to recycle nuclear waste.

“The US government has about a $45bn nuclear waste liability,” Ward says. “You could make rare earth minerals out of it and not have to worry about storing the waste for millennia. So even before we start thinking about energy, SHINE could create enormous value with fusion.”

His broader point is that even if, within the next decade, quantum computers don’t become commonplace, humans don’t establish a base on Mars and nuclear fusion doesn’t become the dominant energy source, all three companies could still deliver exceptional long-term growth for our clients. But if any – or perhaps all – fulfil their true potential, the benefits to society would be colossal.

Words by Leo Kelion

Luke Ward

Luke is an investment manager in the Private Companies Team and a co-manager for the Edinburgh Worldwide Investment Trust. He joined Baillie Gifford in 2012. Luke graduated from the University of Edinburgh in 2012 with an MEng (Hons) in Mechanical Engineering.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in January 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 licence from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

129445 10052482