Key points

-

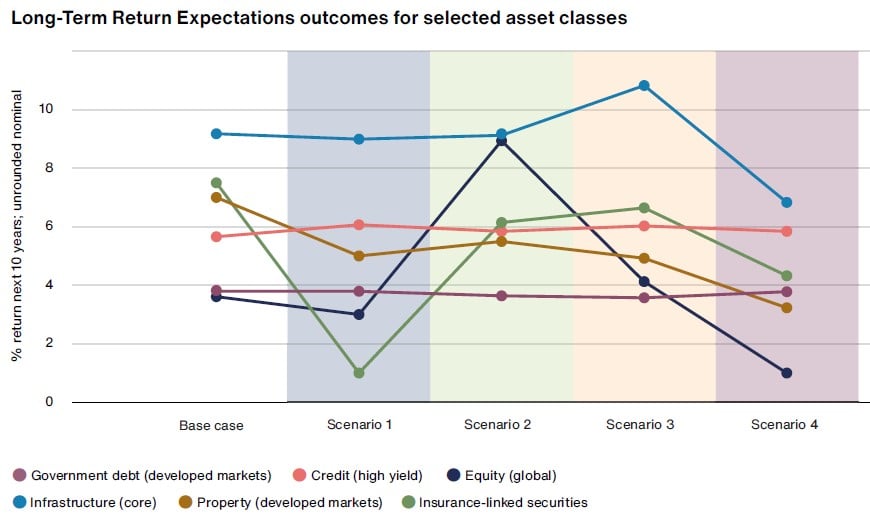

We examined four plausible climate transition scenarios over the next decade, including key drivers, challenges and potential macroeconomic impacts.

-

Different scenarios lead to varied economic and market outcomes, highlighting the importance of coordinated action.

-

The scenarios serve as tools for investors to stress-test portfolios, identify opportunities, develop robust long-term strategies and engage with companies.

©Getty images, Stephen Stringer

All investment strategies have the potential for profit and loss, capital is at risk.

Climate change is a defining challenge of our time. While its implications are as complex as they are profound, among these are its impacts on the global economy and financial markets.

As long-term investors, we appreciate the complexities of this task, with the interplay of physical climate risks, technological progress, policy shifts and societal responses that will shape the ultimate transition to a low-carbon future.

Background and scope

When it comes to the impacts of climate change on the global economy, the range of possibilities is mind-boggling. A key question is therefore, how can you get from considering an infinite range of transition possibilities to a set of plausible transition pathways?

To help navigate this uncertain landscape, we have collaborated with Independent Economics, a London-based consultancy and advisory firm, to produce this report. It follows our first report on the Climate Scenarios Project.

While the first report explored potential climate transition scenarios and their investment implications, the Part 2 report has narrowed its focus to four plausible and distinct scenarios for how the climate transition could unfold over the next decade:

Scenario 1: Physical climate risk

Major climate disasters in the US trigger a belated but strong policy response

Scenario 2: Positive technology momentum

Rapid green technological progress drives a private sector-led transition

Scenario 3: Significant scaling up of climate finance

Massive financial flows from developed to emerging markets accelerate the transition

Scenario 4: Recession and 'too little, too late'

Economic and geopolitical crises distract from climate action, leading to failure

For each scenario, we have examined the key drivers and challenges and how events might unfold. We then produced tailored macroeconomic forecasts and asset class return expectations.

The key questions we explored are:

What scale of physical damage could turn public opinion without undermining society’s ability to act?

What happens when green technology efficiencies drive private sector competition at scale?

How could a significant increase in financial flows to emerging market countries accelerate the transition?

What if economic and geopolitical distractions force climate actions to be too little, too late?

©Cavan Images / Alamy Stock Photo

Key insights

- Successful transition scenarios generally—and perhaps logically—lead to better economic and market outcomes than failed transitions, highlighting the economic benefits of coordinated action and, conversely, the risks of inaction.

- Different scenarios create very different winners and losers across asset classes, sectors and geographies. For example, emerging markets fare much better in the scenario where there is a significant scaling up of climate finance.

- Physical climate impacts can act as a catalyst for action, but if too severe could undermine society's ability to respond effectively.

- Private sector technological progress could potentially drive rapid decarbonization even without strong policy action.

- Massive climate finance flows from developed to emerging markets could accelerate the global transition while reducing inequality.

- Economic crises and geopolitical conflicts pose major risks to climate action by distracting policymakers and depleting resources.

Investment implications

In the report we have sought to provide detailed forecasts for how different asset classes might perform under each scenario. Some key takeaways include:

- Equities perform best in a technology-driven scenario, with green technologies and emerging market stocks particularly favoured.

- Government bonds are generally resilient, but emerging market bonds would benefit significantly in the climate finance scenario.

- Credit in the form of high yield bonds faces challenges in most scenarios due to transition risks, but opportunities exist in green tech and adaptation-focused sectors.

- Real assets, like infrastructure and transition commodities (metals), benefit in successful transition scenarios, while traditional fossil fuel commodities struggle.

- Alternatives, such as insurance-linked securities, face near-term risks from physical climate impacts but could see improved returns longer-term as premiums rise.

These are not forecasts

Rather, they are tools to stretch our thinking about possible futures. They argue that by deeply considering a range of scenarios, we can better prepare for an uncertain future as investors. This in turn leads to a number of practical applications:

- Risk management

The scenarios help identify potential vulnerabilities in portfolios, allowing investors to stress-test their allocations against different climate outcomes. - Opportunity identification

Each scenario points to potential winners and losers, helping investors spot emerging trends and position for long-term growth areas. - Strategic planning

By considering these divergent futures, investors and businesses can develop more robust long-term strategies that are resilient to different climate pathways. - Engagement

The scenarios provide a framework for engaging with companies on climate risks and opportunities, helping to assess their preparedness for different outcomes. - Policy advocacy

Understanding the economic implications of different transition pathways can inform constructive engagement with policymakers on effective climate action.

Looking ahead

This report does not have all the answers, but it does demonstrate how investors can move beyond simplistic assumptions to grapple with the true complexity of potential climate futures.

By combining rigorous quantitative modelling with imaginative qualitative narratives, we have sought to create a means of stress-testing our investment portfolios and strategies against a range of climate outcomes.

While the analysis is investment-focused, the scenarios explored have profound implications for policymakers, business leaders and society at large. Indeed, and as we wholeheartedly acknowledge, they highlight the immense challenges ahead in navigating the climate transition and potential pathways to success. Perhaps most importantly, however, they underscore the critical importance of near-term action to avoid the worst climate outcomes and position the global economy for long-term sustainable growth.

As investors, grappling with these scenarios can help us all play a more informed and constructive role in shaping a resilient, low-carbon future.

Read the full report >

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in January 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司 (‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional

investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia(Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

10052723 135821