Key points

- A diverse range of investments have driven the portfolio’s growth across various sectors, from semiconductors to social media and aggregates to credit ratings

- Monks has grown strongly in the 12 months to the end of September, with a 22.7 per cent increase in net asset value outperforming the market index

- Designed to capture a range of growth, the portfolio is well placed for a broadening of market returns in the years ahead

As with any investment, your capital is at risk.

Listen to this article

This audio is generated using AI

The latest quarter concluded a 12 month period that saw strongly recovering returns for the Monks portfolio. The Trust’s net asset value grew 22.7 per cent (share price +24.9 per cent) in the 12 months to the end of September 2024, outpacing an index up just over +20 per cent.

This was a good period for global equity markets. Inflation receded and central banks cut interest rates. Enthusiasm for artificial intelligence (AI) appeared in the share prices of several technology companies – a handful of which we own – driving an outsized proportion of the market's return.

Monks’ portfolio is designed to capture growth in all its forms. This means that we own companies such as NVIDIA (graphics chips), Amazon (ecommerce) and Meta (social media) now squarely in the limelight as likely beneficiaries of the AI revolution.

However, our search for diversity means we deliberately seek opportunities hidden in the long shadow cast by big tech. Indeed, holdings such as Comfort Systems (air conditioning installation), Advanced Drainage Systems (storm drains) and Stella Jones (utility poles) represent the opportunities offered by the growth of infrastructure needed to support emerging AI applications.

Over the past year, this diversity has been reflected in the range of companies contributing to our NAV performance, from AI darlings NVIDIA and Meta to CRH in aggregates (gravel), DoorDash in food delivery, and Moody’s in credit ratings.

However, with market returns being relatively narrowly driven, investors with highly concentrated portfolios and large positions in NVIDIA are sitting pretty. So why remain diversified?

Beyond the usual suspects

We know from experience – 20 years managing the Global Alpha strategy that underpins Monks – that diversification can help to generate outperformance over the long term. Through the lens of our growth ‘profiles’ (Stalwart, Rapid and Cyclical), the portfolio in aggregate outperforms more often than any profile in isolation. Furthermore, the diversity of the biggest winners in the portfolio speaks to the merits of embracing diversity.

While it’s no surprise to see Amazon and Tesla in the top positions, companies operating in digital payments (Mastercard), credit ratings (Moody’s) and industrial equipment (Atlas Copco) all make the top 10.

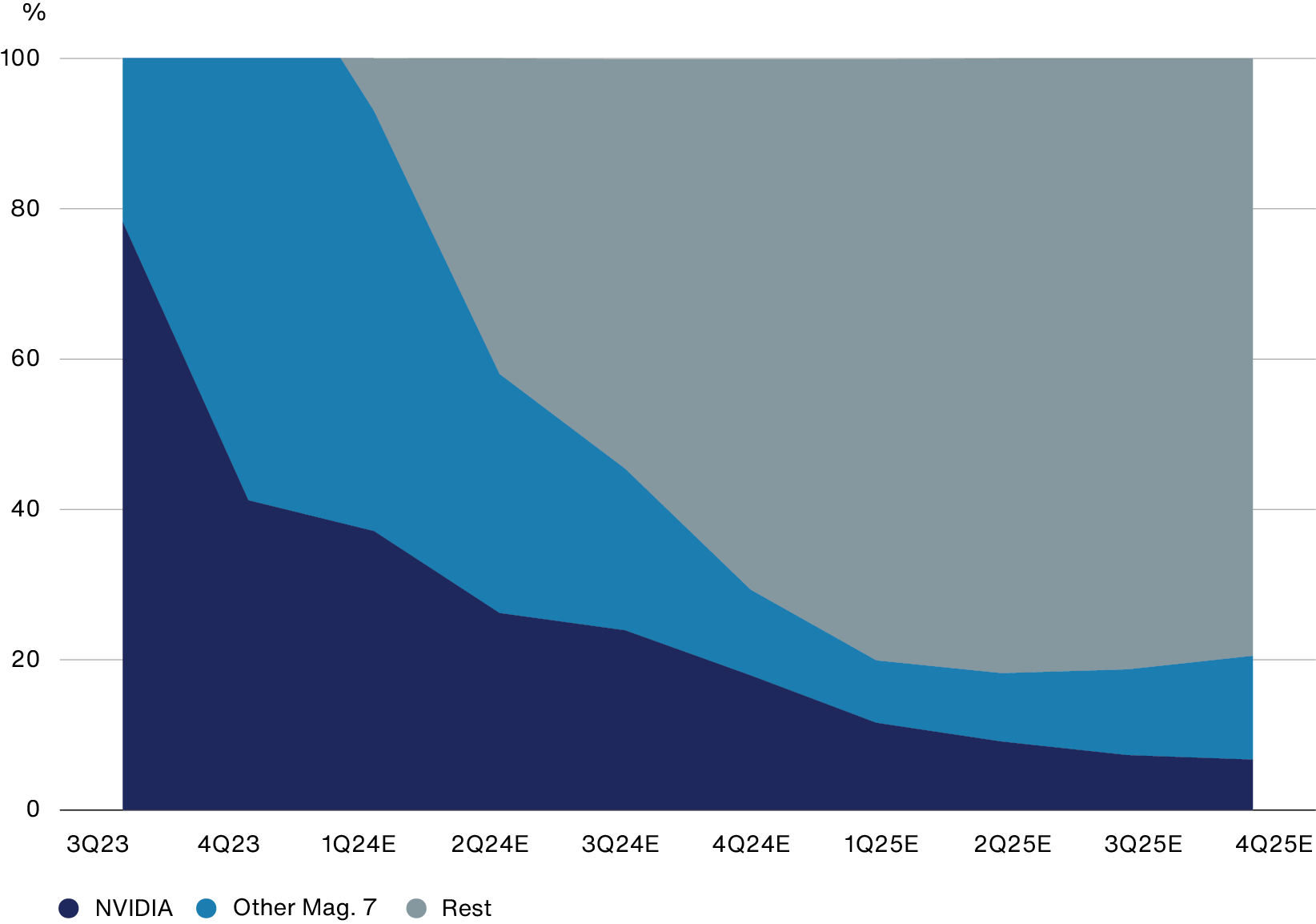

Over the past year, big tech's dominance of market returns has been supported by these companies' fundamental growth, arguably justifying much of the fanfare. Indeed, the so-called Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta and Tesla) has dominated the market's earnings growth over the year, but this may be changing. Forecasts suggest that significant growth will be delivered from the wider market in the months and years ahead.

Diversification will matter again

Percentage contribution from companies in the S&P 500 index to earnings growth year-over-year (Q3 2025; as of 16 May 2024).

Source: BofA Global Research, FactSet.

Seeking rewards

It’s been vital to retain our wide-angled lens on growth. The markets' focus on a relatively narrow subset of stocks has been an opportunity for those with a reward-seeking mindset.

We believe we’ve identified a range of new positions for the portfolio where growth is unrecognised.

Within the broader AI value chain, we purchased the materials science company Soitec. This French company has a key role in addressing the challenges of digitalisation, electrification and AI across end markets, including smartphones and data centres. It supplies the semiconductor industry with engineered substrate wafers, which boost chips and ensure more reliable connectivity, lower power consumption and better performance. The company’s proprietary technology gives it a strong position in a fast-growing niche. This, and its attractive valuation, given expected future returns, form a compelling investment case.

Texas-based Builders FirstSource operates in a different sphere from the high-tech world of AI, yet its growth potential is no less transformative. This new holding is the largest supplier and manufacturer of building materials, components and services for professional homebuilders in the US. It’s a leader in one of the world’s largest residential property markets, which is facing a shortage of affordable housing. Builders FirstSource is helping to address this challenge, as its products make constructing new homes faster and more efficient. With low penetration in a vast addressable market, we have conviction about the company’s expansion potential both through organic growth and strategic acquisitions.

From chips to construction to coffee. We’ve also invested in the US drive-through coffee chain Dutch Bros. The market does not appear to appreciate the scale of its store roll-out opportunity over the next decade or the enduring nature of the shift towards the newer caffeinated drinks it offers customers.

Also within the Rapid growth profile, we have added to several names where conviction in outlier potential is increasing. These include The Trade Desk (advertising technology), Adyen (payments technology provider), and DoorDash (food delivery). Despite the uncertain macroeconomic environment, all three are growing healthily and executing strongly.

Towards greater growth

We’re enthused by the growth potential of the portfolio. We believe its prospects are supported by a diverse collection of companies aligned with deep structural changes in our economy that will underpin long-term growth. Earnings growth remains our north star, underpinning our confidence in the portfolio’s ability to outperform. Forecast earnings growth for the portfolio remains ahead of the market average. Monks can invest in many of the world’s largest companies but it has the latitude to own an impressive collection of underappreciated growth stocks. We believe they can deliver compelling returns for shareholders in the years ahead.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Monks Ord | 24.9 | 23.8 | -30.1 | -2.6 | 24.9 |

| Monks NAV | 27.9 | 24.8 | -23.6 | 1.7 | 22.7 |

| FTSE World Index | 5.2 | 24.0 | -3.0 | 12.2 | 20.6 |

Performance source: Morningstar, FTSE, total return in sterling

Past performance is not a guide to future returns.

Important information

This communication was produced and approved in November 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

This article does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available at bailliegifford.com.

FTSE index data

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell ®, is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

124244 10051108