As with any investment, your capital is at risk

We consider the Strategic Bond Fund an ‘all-weather’ strategy – a core corporate bond portfolio that can be held through the cycle. But is this just bluster?

Despite very strong long-term performance since the Fund’s inception in 1999, we struggled to keep pace with sector peers during the rapid interest-rate tightening cycle in 2021 and 2022. Can we genuinely describe the Fund as so if we can’t perform through all cycles?

To answer this, let’s first consider what the Fund is and is not.

Second, we provide context for the past few years’ performance in terms of the macro environment.

Third, we’ll explain why we strongly believe in the Fund’s future success and why current yields provide attractive return prospects for it.

What do we mean by strategic?

The idea behind the fund is a straightforward, no-nonsense approach to strategic bond investing. The Fund is a best-of-credit strategy. We invest in 60-85 of our best ideas from across global corporate bond markets, with a razor-sharp focus on adding value by pulling on two levers: bond selection and actively managing credit risk.

So, we keep things simple. Corporate bonds typically overcompensate investors for default risk (the chance they do not receive the payments due) and persistently offer a better yield compared to government bonds.

If we get the bond selection right, yield more than the index and avoid the defaults, the strategy should outperform the fixed-income market over the long term.

In portfolio positioning, we carefully consider the investment environment, adjusting allocations to where we see the best value or greatest margin of safety. This is the ‘strategic’ part of the strategy.

A key element of our process is assessing the market from the top down. We focus on the valuation opportunity, company fundamentals and the macroeconomic backdrop. These elements will influence portfolio positioning at any given time.

What we don’t do is take currency risk, meaningful interest-rate risk relative to our reference index (we maintain a broadly neutral duration to the corporate bond market) or make big macro-economic calls.

We believe the greatest inefficiencies in our markets lie at the level of individual bond issuers and with our focus and experience, we can exploit these.

Post-pandemic shock and awe

Most readers will be familiar with the events of the past few years. Widespread lockdowns and disruptions due to Covid-19 led to significant price increases and lower economic output, which were exacerbated by the subsequent war in Ukraine.

Further fuelled by record stimulus measures, inflation sky-rocketed, leaving central banks behind the curve. Rapid interest rate rises followed.

Like many, we were slow to recognise how severe this shock could be and underestimated the speed and scale at which interest rates would climb.

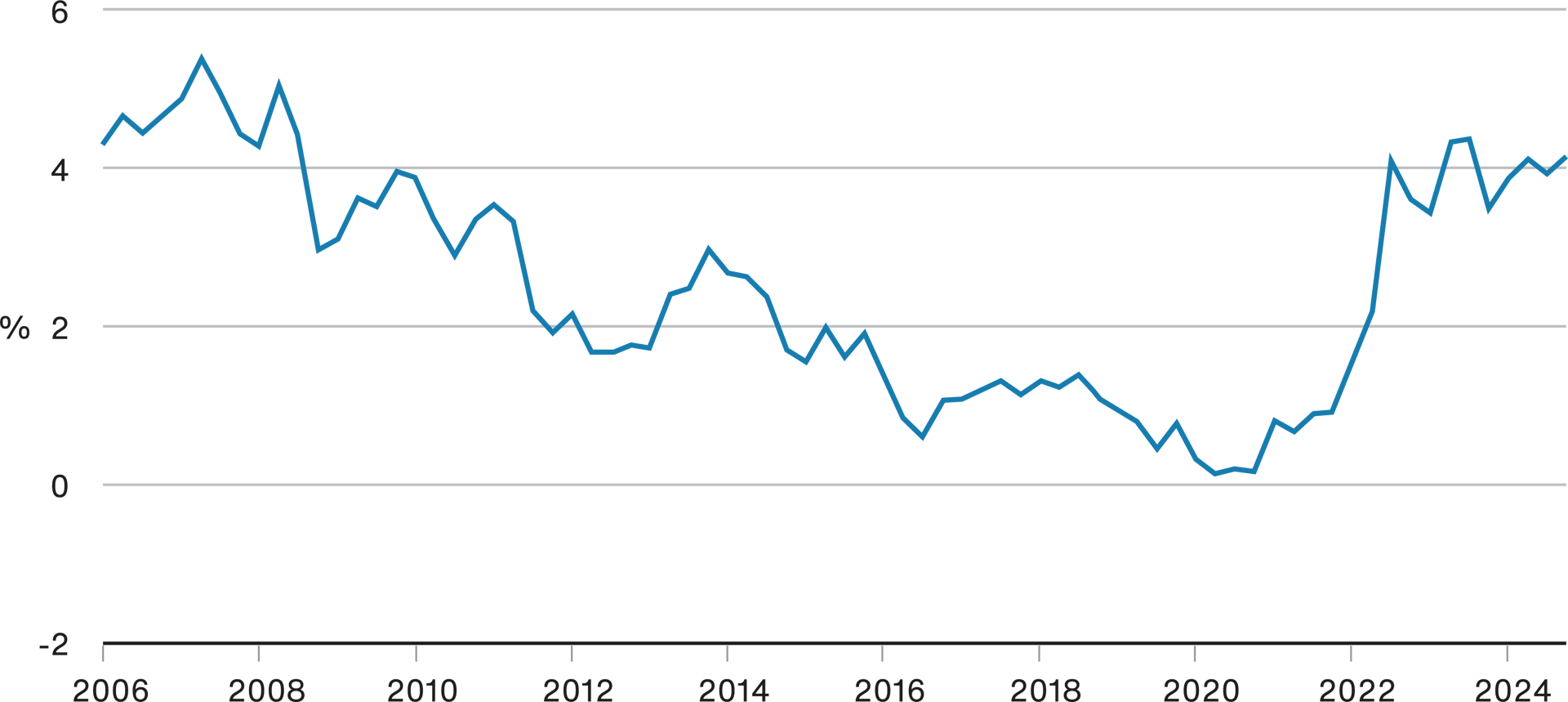

More than a decade of falling yields reversed in little more than 12 months

UK 10-Year Gilt yield, 2006 to end September 2024. Source: MarketWatch.

As we highlighted earlier, we choose not to run large exposures to changes in interest rates. Instead, we use the benchmark index as a guide to positioning the Fund’s duration (how sensitive it is to a change in interest rates).

This led us to underperform many of our sector peers in 2022, particularly those using greater flexibility or running short-duration strategies to reduce the impact of rising interest rates.

Context is important here. The year 2022 was one of the worst on record for corporate bonds due to the rapid rise in interest rates. Investors are typically rewarded for having some duration and there are diversification benefits for a balanced portfolio.

We have also seen value destroyed by those making incorrect duration calls in the past: we firmly believe in our approach of maintaining a broadly neutral duration relative to the corporate bond market.

Mea culpa

We cannot entirely dismiss the Fund’s underperformance in the recent past as being due to our structural duration positioning.

Active investment is inherently difficult and we expect to make mistakes when selecting bonds or positioning the Fund. It so happens that we got a few more things wrong than right when our duration positioning also held us back.

We usually get more things right than wrong: in 25 years, we’ve demonstrated beyond doubt that we can add value through bond selection.

As highlighted earlier, we didn’t make the perfect call on the macro-economic environment following the pandemic. We held some companies that relied on low interest rates to maintain the strength of their balance sheets: property companies, for example, and some earlier-stage companies with strong long-term prospects but lacking solid cash flows to service high debt levels in the short term.

We seek companies with resilient fundamentals but reflecting on these examples we should have factored in how much the rapidly changing backdrop would change the underlying fundamentals. This reminds us to consider cash flow and growth potential equally when analysing highly-indebted companies.

In addition, with perfect hindsight it was apparent we were too exposed to this factor by owning several such companies. Strengthening our scenario analysis and stress testing has further enhanced our portfolio construction and risk management processes. However implausible we believe certain events will be, we must challenge ourselves to imagine the widest range of potential outcomes to manage risk most effectively.

Looking ahead

Constant evolution is required to do the best for our clients in an ever-changing environment. We’ve learned valuable lessons from this recent period and enhanced our processes but, perhaps most importantly, our core philosophy remains unchanged.

Looking back gives us a great deal of confidence when looking forward. Our approach is relatively straightforward and has served us well: investing with patience in resilient companies whose bonds are underappreciated by the market.

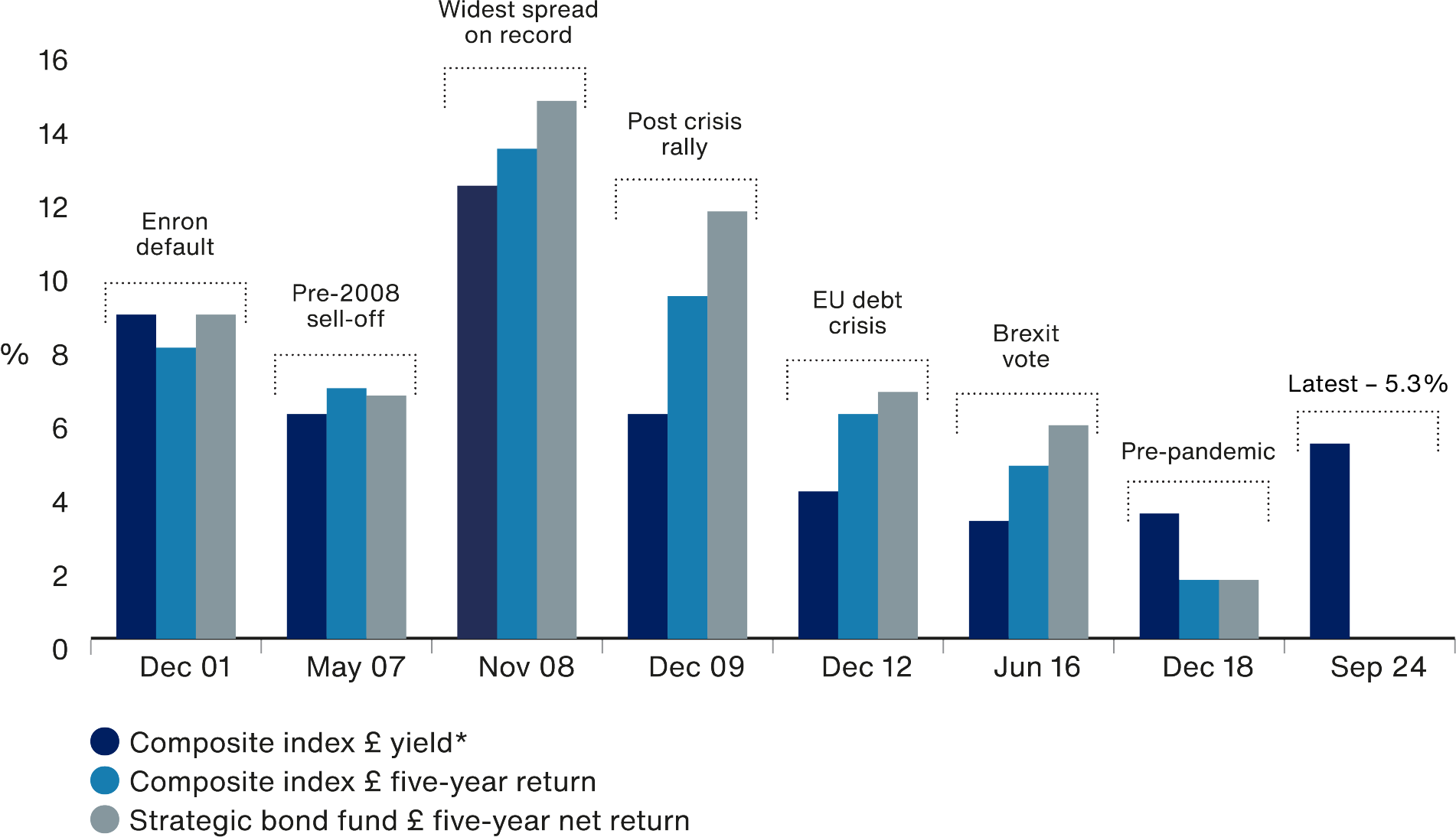

History has shown us that the current yield is the best indicator of future returns from corporate bonds. Today’s yields appear attractive compared to the past decade. And, as shown in the graphic below, the Strategic Bond Fund has delivered value for clients in most market environments.

Far from ‘all talk’, we can confidently ‘walk the walk' with a credit strategy fit for all seasons.

Return expectations: starting yield and five-year forward annualised return

Source: Bloomberg, FE, Revolution, ICE Data Indices. As at 30 September 2024. *Yield to worst as at date shown. Annualised five-year return beginning on date shown. Index is: 30% ICE BofA Sterling Non-Gilt Index and 70% ICE BofA European Currency High Yield Constrained Index. Sterling.

Past performance

Annual Past Performance to 30 September Each Year (%)

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Baillie Gifford Strategic Bond Fund | 2.4 | 4.3 | -21.1 | 7.7 | 13.0 |

| Index* | 2.9 | 2.8 | -20.0 | 9.1 | 11.1 |

| Sector Average* | 3.6 | 4.6 | -14.5 | 4.9 | 11.8 |

Source: FE, Revolution. Net of fees, total return in sterling. Class B Inc shares. Share class and Sector returns calculated using 10am prices, while the Index is calculated close-to-close.

*70% ICE BofA ML Sterling Non Gilts Index / 30% ICE BofA ML European Currency High Yield Constrained Index

**IA £ Strategic Bond Sector.

The manager believes that appropriate comparisons for this Fund are the Investment Association Sterling Strategic Bond sector average, given the investment policy of the Fund and the approach taken by the manager when investing and a composite index comprising 70%: ICE BofA Sterling Non-Gilt Index and 30%: ICE BofA European Currency High Yield Constrained Index (hedged to GBP) being representative of the strategic asset allocation of the Fund.

Past performance is not a guide to future returns.

Important information and risk warnings

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in October 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research.

The Fund's share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

Bonds issued by companies and governments may be adversely affected by changes in interest rates, expectations of inflation and a decline in the creditworthiness of the bond issuer. The issuers of bonds in which the Fund invests, particularly in emerging markets, may not be able to pay the bond income as promised or could fail to repay the capital amount.

Further details of the risks associated with investing in the Fund can be found in the Key Investor Information Document or the Prospectus, copies of which are available at bailliegifford.com.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Legal notice

Source: ICE DATA INDICES, LLC ("ICE DATA"), is used with permission. ICE® is a registered trademark of ICE DATA or its affiliates and BOFA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BOFA") and may not be used without BOFA’S prior written approval. ICE DATA, its affiliates and their respective third party suppliers disclaim any and all warranties and representations, express and/or implied, including any warranties of merchantability or fitness for a particular purpose or use, including the indices, index data and any data included in, related to, or derived therefrom. Neither ICE DATA, its affiliates not their respective third party suppliers shall be subject to any damages or liability with respect to the adequacy, accuracy, timeliness or completeness of the indices or the index data or any component thereof, and the indices and index data and all components thereof are provided as an "as is" basis and your use is at your own risk. ICE DATA, its affiliates and their respective third party suppliers do not sponsor, endorse or recommend Baillie Gifford & Co, or any of its products and services.

Ref: 121332 10050799