Your capital may be at risk.

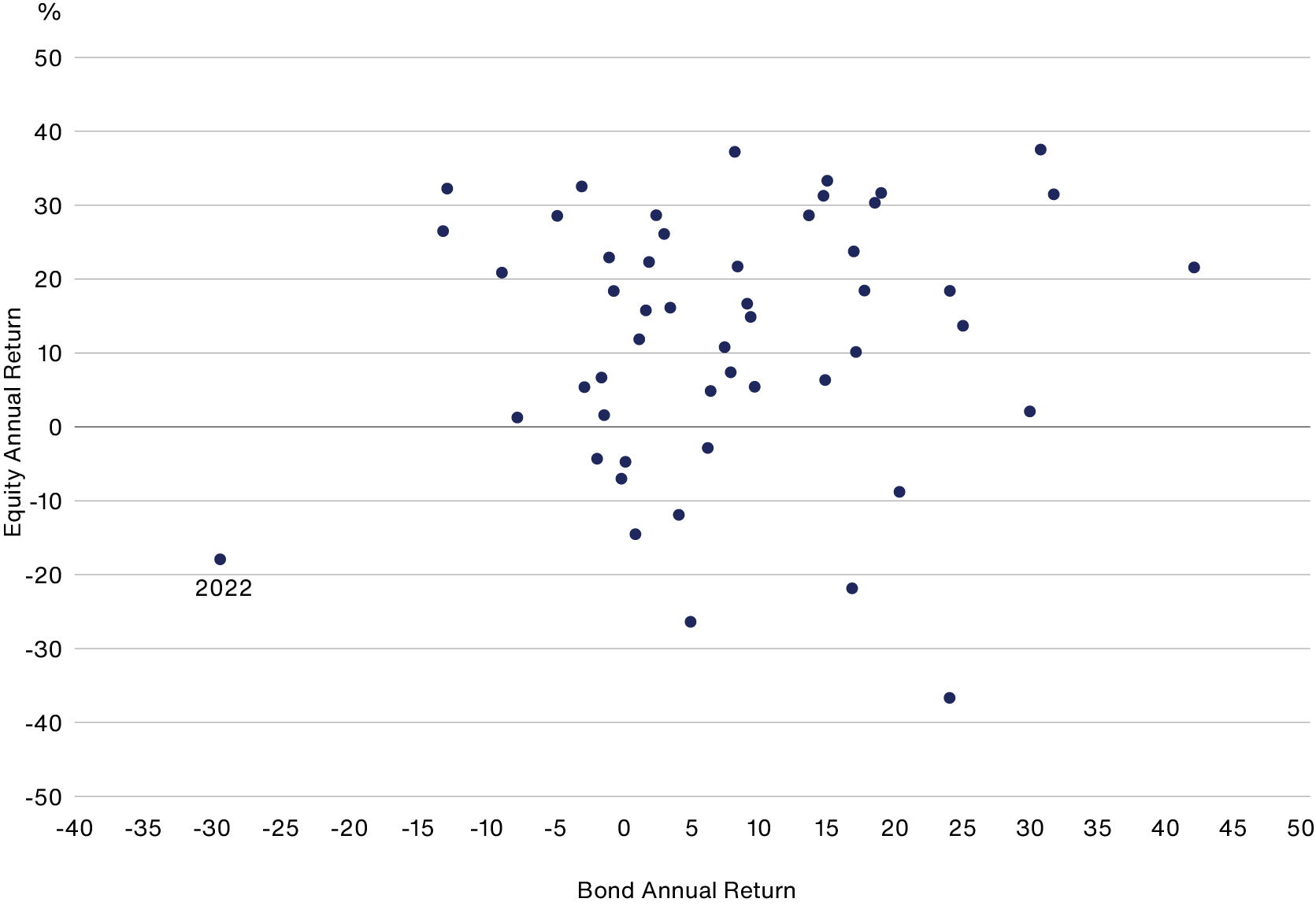

Is the balanced approach to investing dead? Many in the market believe so after 2022. The prevailing view is that investing in a mix of equities, bonds and cash can no longer deliver capital growth over the long term.

Indeed, 2022 saw the worst performance in the Baillie Gifford Managed Fund’s then 35-year history, as a dramatic (and rare) shift between growth and value equities dragged down performance.

In addition, an unprecedented equities-bonds correlation meant fixed-income holdings didn’t provide sufficient diversification. Undoubtedly, it has been a tough time for investors in the Fund – or indeed any balanced portfolio, passive or active.

2022 was an unprecedented year

Source: Morningstar Direct. Bloomberg US Treasury Long and S&P 500 total return, US dollar 1973-2023.

The following 16 months to end April 2024 were more positive for the performance of the Fund. Even so, some have asked: Shouldn't the Baillie Gifford Managed Fund have performed even better versus its peers?

Putting aside a value rally in Japan and the continued narrative around inflation and its impact on interest rates, the Fund’s allocation to US equities held back performance over the 12 months to end April 2024.

The Managed Fund seeks to avoid undue reliance on a single region to deliver superior returns over the long term. However, this meant that exposure of approximately 20 per cent, versus passive peers at likely 40 per cent plus, was unhelpful in a year when the US market dominated global equity returns.

Three possible scenarios

So, where does that leave us today? First and foremost, our nearly four decades of experience running the Baillie Gifford Managed Fund through an array of market cycles, booms and busts gives us confidence in our approach.

While trends may come and go, we believe that an actively managed balanced fund can deliver growth for client portfolios even in a highly uncertain environment.

From here, there are three broad scenarios that we might see playing out over the next few years. These are illustrated below.

We don’t position the Fund for one interest rate scenario versus another. Instead, each illustrates how we aim to generate superior long-term returns for clients by investing in exceptional growth companies and bonds.

1. It’s 2022 all over again

In this scenario, inflation stays high, and interest rates rise.

This will be tough for the Fund in the short term. Growth businesses are particularly vulnerable to rising interest rates because investors discount their long-duration cash flows more heavily, devaluing share prices. Fixed income would likely also face difficulties as higher interest rates make existing bonds (with lower interest rates) less attractive.

It’s difficult to assume that this scenario plays out given the interest rate moves we’ve already seen, but it’s not impossible.

The positive is that if you are worried about higher interest rates, you can have confidence that the Managed Fund is a resilient portfolio. The fund's low debt, high profitability and strong credit ratings mean that we believe it is well set for the long term.

Low debt, high profitability

Source: Baillie Gifford & Co. FactSet. Based on the Baillie Gifford Managed Fund. Data as at 31 March 2024. Net debt-to-equity figures are calculated excluding negative earnings. Benchmark: 25% MSCI United Kingdom, 25% MSCI North America, 25% MSCI Europe Ex-UK, 15% MSCI Pacific, 10% MSCI Emerging Markets.

2. Interest rates remain static

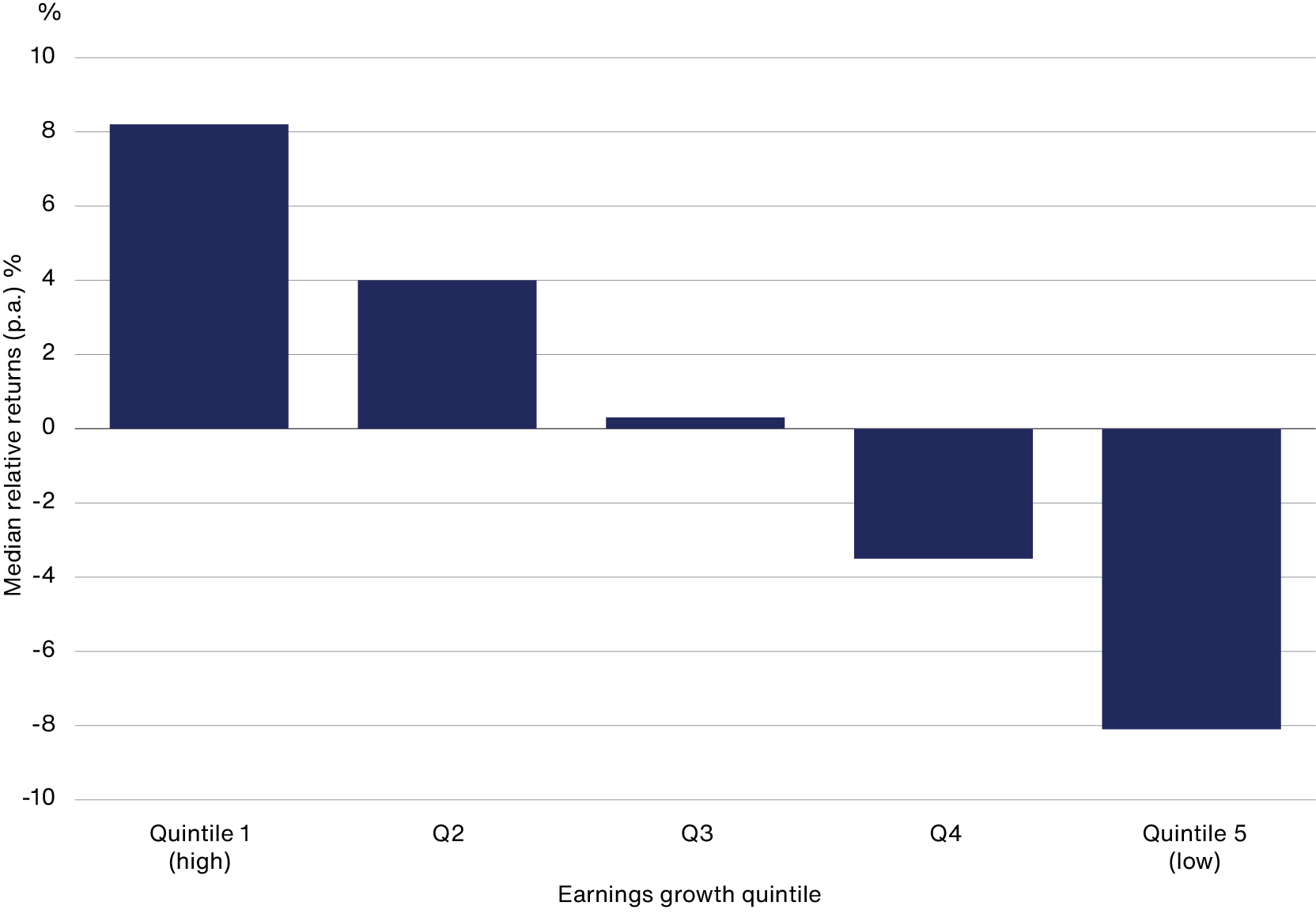

In this scenario, earnings growth drives share price performance.

As the chart below shows, from 1992 to 2021, the fastest-growing companies delivered the top quintile of returns. So, our focus is on identifying and holding these companies.

The good news is that the Fund’s holdings are expected to grow earnings at more than double the market’s rate.

Share prices follow earnings

Source: FactSet, MSCI. US dollars. The universe consists of all stocks listed in the FTSE ACWI and MSCI ACWI indices at each starting point, excluding repetitions. Median total returns by earnings growth quintile. Rolling five-year horizons (1992-2021).

Examples include TSMC, the Taiwanese semiconductor manufacturer, whose three-year forward earnings growth is 20 per cent per annum. It’s not just about technology, though – Marks and Spencer’s expected three-year earnings growth is 17 per cent per annum.

This Fund is not reliant on the US’s Magnificent Seven – Apple, Microsoft, Alphabet (Google’s parent company), Amazon, NVIDIA, Meta and Tesla – or any particular region to drive returns. The fund's bond investments also offer extra growth potential with a yield of 5.7 per cent.

3. Interest rates fall

In this scenario, earnings growth drives share price performance with a valuation re-rating (an improvement in a company’s valuation due to falling interest rates), providing an additional boost to returns.

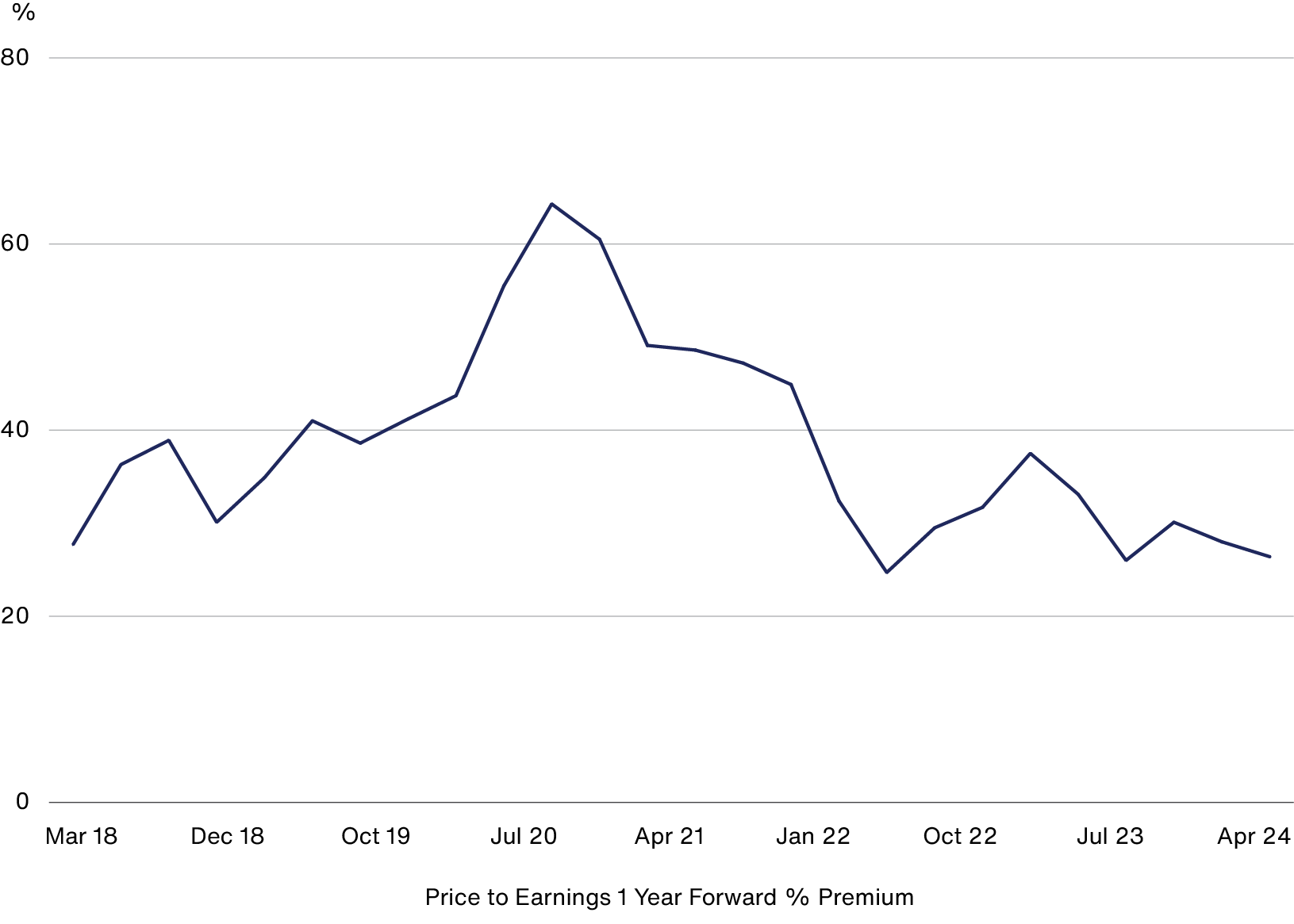

The Fund’s price-to-earnings premium (a measure of how expensive the Fund is compared to the index) is at its lowest point since 2018 despite higher earnings growth.

Growth at little premium

Source: Baillie Gifford & Co, FactSet. Sterling. Based on the Baillie Gifford Managed Fund. Data as at 30 April 2024.

We’ve sought to take advantage of valuations that we believe underappreciate the long-term attractive characteristics of a company.

We bought Insulet, a leading maker of insulin pumps for diabetics. We have also added to existing holdings, including the French biopharmaceutical equipment supplier Sartorius Stedim, poised for growth as demand returns.

Poised for growth

Hopefully, this shows that the Managed Fund is poised for growth regardless of these scenarios. Ultimately, investing in growing businesses is what matters for long-term returns, and we are very excited about the opportunity from here. That’s why the Fund is overweight equities by 4 per cent.

While our investment process will continually evolve, the core focus remains on identifying and investing in exceptional long-term growth opportunities.

In a rapidly evolving environment, we believe a focus on active stock and bond picking matters more than ever, and it is on this basis that we think the Baillie Gifford Managed Fund is poised for future growth – reports of the death of balanced funds have very much been exaggerated.

Past performance

Baillie Gifford Managed Fund

Annual past performance to 31 March each year (net %)

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|

Baillie Gifford Managed Fund B Acc |

0.2 | 46.4 | -8.2 | -8.5 | 10.2 |

| IA Mixed Investment 40%-85% | -7.8 | 26.3 | 5.4 | -4.3 | 10.2 |

Source: FE, Revolution, net of fees, total return in sterling. Class B Acc Shares.

Past performance is not a guide to future returns.

The manager believes an appropriate comparison for this Fund is the Investment Association Mixed Investment 40-85% Shares Sector median given the investment policy of the Fund and the approach taken by the manager when investing.

Investment markets can go down as well as up and market conditions can change rapidly. The value of an investment in the Fund, and any income from it, can fall as well as rise and investors may not get back the amount invested.

Important information and risk factors

This recording was produced and approved in June 2024 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, and Baillie Gifford and its staff may have dealt in the investments concerned.

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Further details of the risks associated with investing in the Fund can be found in the Key Investor Information Document, copies of which are available at www.bailliegifford.com, or the Prospectus which is available by calling the ACD.

108700 10048199