Capital is at risk. Past performance is not a guide to future returns.

Is making long-term returns for clients compatible with making life better for millions around the world? Keystone Positive Change Investment Trust was founded in the belief that the two can be closely interconnected.

On our appointment as managers of the venerable Keystone Trust in 2021, Baillie Gifford’s Positive Change Team set out how the world’s best long-term growth businesses were often those seeking to achieve both aims. As newly-appointed managers, our contribution would be to identify exceptionally ambitious companies whose positive impact was potentially transformative in four key areas: social inclusion; environment; healthcare and help for billions of the world’s poorest people.

From the start, the Trust’s approach went beyond the do-least-harm principle of traditional ‘ethical investing’. Instead, we strived to do-most-good – prioritising companies actively pursuing positive change over merely screening and box-ticking to weed out those whose impact could be harmful.

Three years on, our conviction about the quality and range of such positive change-making firms has grown. So too have the revenue* and profits of many of the firms now included in our portfolio. We group them around four broad themes, laid out here with examples:

Social inclusion and education

Income and wealth inequalities have risen significantly over the past 30 years, threatening belief in capitalism as a force for good. We look for companies whose products and services contribute to a more inclusive society, including those promoting the spread of skills and knowledge – powerful tools against inequality.

- MercadoLibre Latin America’s largest ecommerce business helps merchants reach more customers by selling online. Its fintech products help improve access to finance, especially for low-income consumers underserved by incumbent banks. Amid higher interest rates, aggressive competitors have pulled back to conserve capital, allowing MercadoLibre to exploit its competitive advantage to grab more market share.

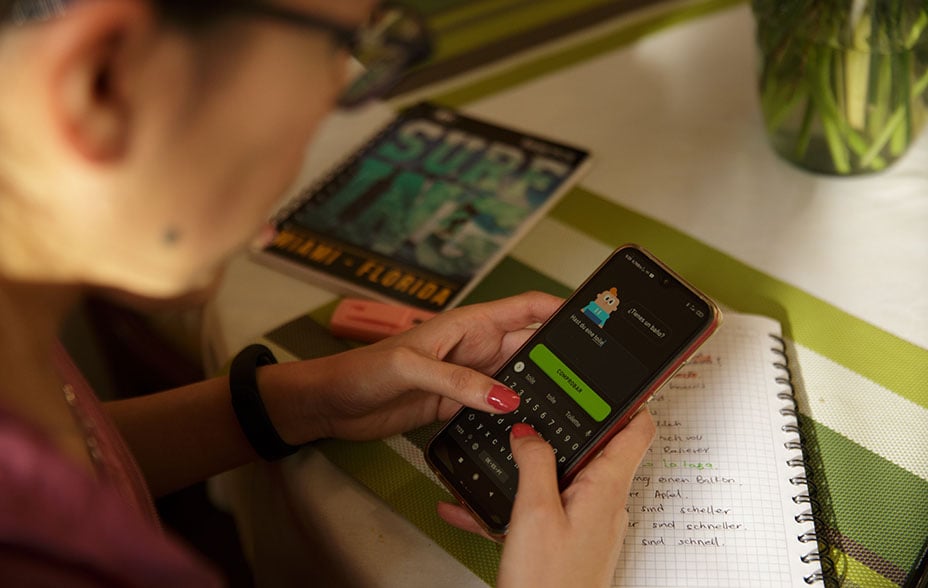

- Duolingo, the US language learning app founded in 2011 has grown swiftly and now has over 500 million users worldwide by breaking down and 'gamifying' language learning into easy, engaging, bite-sized chunks. In 2022 monthly active users increasing 43 per cent year-over-year and revenue growing 47 per cent in 2022. Many users are from lower and middle-income countries, where learning a language can open up employment and education opportunities.

Environment and resource needs

The negative impact of our species on the planet is increasing. Basic resources such as food and water are becoming scarcer. Climate change and famine have repeatedly limited development, and left unresolved, those problems could destabilise society. Keystone Positive Change looks for companies that are improving our resource efficiency and reducing the impact of economic activities.

- Climeworks a leader in ‘direct air capture’ (DAC) technology, the Swiss company has developed giant plants in Iceland and elsewhere that use renewable energy to suck carbon dioxide out of the atmosphere using special filters from which concentrated CO2 can be extracted and safely stored underground. Climeworks helps companies such as Microsoft, BCG, UBS and Swiss Re achieve carbon neutrality.

- Boston Electrometallurgical Corporation: A private company, ‘Boston Metal’ has pioneered ways of making ‘green steel’. Its direct electrolysis technology is a lower-cost method of removing the need for the dirty chemical reductants used to ‘clean’ iron ore of oxygen. The technology is still being perfected, but the potential impact and financial returns are high. It’s now making its first facility for high-value metal recovery in Brazil.

Healthcare and quality of life

We’re living longer but not always healthier, as chronic diseases proliferate. We’re richer but not necessarily happier. The stress of modern life is damaging our physical and mental health. Keystone Positive Change searches for companies that are actively improving quality of life in both developed and developing countries.

- Dexcom: The maker of continuous glucose monitoring systems – devices that help diabetic patients, particularly type 1, to manage their condition more easily than with a finger-pricking test. It lowers the cost of treating the disease and its associated health complications. Dexcom's revenue increased by 19 per cent between 2021 and 2022, while its operating margin* reached 13 per cent.

- WuXi Biologics: A Chinese contract research, development and manufacturing organisation that provides services to small biotech and large pharma companies in drug discovery and commercial manufacturing. Scale and expertise allow WuXi to save time and money for biotech companies lacking the deep pockets of big pharma. Between 2017 and 2022, revenue compounded at 57 per cent per year, while operating profit rose from 21 per cent to 36 per cent.

Base of the pyramid

Economic growth has led to big improvements in living conditions all over the world. However, the fruits of human ingenuity have not always filtered down to everyone. We’re looking for companies addressing the basic needs and aspirations of the billions of people struggling at the bottom of the global income demographic ‘pyramid’.

- Remitly: The US mobile remittance company transfers money quickly and cheaply ensuring more of its migrant worker users’ hard-earned income goes to family and friends. This is especially impactful as 75 per cent of that remittance goes on essentials such as food, rent, and healthcare. The company has grown revenue by at least 40 per cent year-over-year since it floated in 2021 and competitive advantage seems to be strengthening.

- Bank Rakyat Indonesia (BRI): In a country where half the adult population remains unbanked, BRI’s competitive advantage in microfinance stems from its vast network of rural branches and increasingly its investment in mobile and agent-based banking, which engages it to build trust and relationships with customers and provide financial services at low cost. The lack of such provision in this vast archipelago gives BRI a vast opportunity to achieve growth and impact.

*The operating margin measures how much profit a company makes in sales after paying for variable costs of production, such as wages and raw materials, but before paying interest or tax.

*The total amount of money brought in by a company's operations.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Keystone Positive Change Investment Trust plc | 23.3 | -0.8 | -4.8 | -33.6 | 9.4 |

| *MSCI ACWI Index (GBP) | 22.4 | 13.2 | 20.1 | -7.6 | 15.9 |

Source: Morningstar, MSCI, share price, total return in sterling.

*MSCI ACWI Index (GBP). Changed from FTSE All Share Index on 10/2/2021. Data chain-linked from this date to form a single index.

The index data referenced herein is the property of one or more third party index provider(s) and is used under license. Such index providers accept no liability in connection with this document. For full details, see www.bailliegifford.com/en/uk/legal

Past performance is not a guide to future returns.

This communication was produced and approved in January 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

For a Key Information Document for the Keystone Positive Change Investment Trust plc please visit our website at www.bailliegifford.com

This communication does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies and are not authorised or regulated by the Financial Conduct Authority. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA).

The specific risks associated with the Trust include:

- Unlisted investments such as private companies can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater.

- The Trust's risk is increased as it holds fewer investments than a typical investment trust and the effect of this, together with its long-term approach to investment, could result in large movements in the share price.

- The Trust invests in companies whose products or behaviour make a positive impact on society and/or the environment. This means the Trust will not invest in certain sectors and companies and the universe of investments available to the Trust will be more limited than other funds that do not apply such criteria. The Trust therefore may have different returns than a fund which has no such restrictions.

- Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Company may issue new shares when the price is at a premium which may reduce the share price. Shares bought at a premium may have a greater risk of loss than those bought at a discount.

- The Trust can borrow money to make further investments (sometimes known as ‘gearing’ or ‘leverage’). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust's investments fall in value, any invested borrowings will increase the amount of this loss.

- The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

- The aim of the Trust is to achieve capital growth and it is unlikely that the Trust will provide a steady, or indeed any, income.

- The Trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

- The Trust's risk could be increased by its investment in private companies. These assets may be more difficult to buy or sell, so changes in their prices may be greater.

- The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

- Market values for securities which have become difficult to trade may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

- The Trust can make use of derivatives which may impact on its performance.

Further details of the risks associated with investing in the Trust, including a Key Information Document and how charges are applied, can be found in the Trust specific pages at www.bailliegifford.com, or by calling Baillie Gifford on 0800 917 2112.

Ref: 87811 10044075