Key Points

- Nearly a century of investing has taught Monks’ managers the importance of staying true to our long-term approach to growth

- The best protection against periodic turbulence is a three-pronged approach to growth: investing in stalwart, rapid and cyclical growth companies

- It’s not the sector, or the country that a company is in that counts, but how well it exhibits the qualities of those kinds of growth

© NASA/Bill Anders

All investment strategies have the potential for profit and loss, your or your clients' capital may be at risk. Past performance is not a guide to future returns.

The Monks Investment Trust knows all about the twists and turns of the market. Founded in 1929, the Trust was only months old at the time of the Wall Street Crash. Baillie Gifford stepped in as manager in 1931 after the bank that had launched the Trust collapsed.

Since then, surviving – and thriving – through ten decades of change has taught the Trust patience. Monks has come to appreciate the importance of a long-term outlook, and of keeping faith with our approach to capital growth over five-to-ten-year time horizons, and beyond.

For Monks, fallen markets and low valuations present a long-term opportunity to deliver for our clients. And we don’t rely on a single definition of what ‘growth’ is. Instead, we look at growth in three dimensions: stalwart, rapid and cyclical.

Across the world, and in different industries we look for companies that show these qualities. Here are some examples:

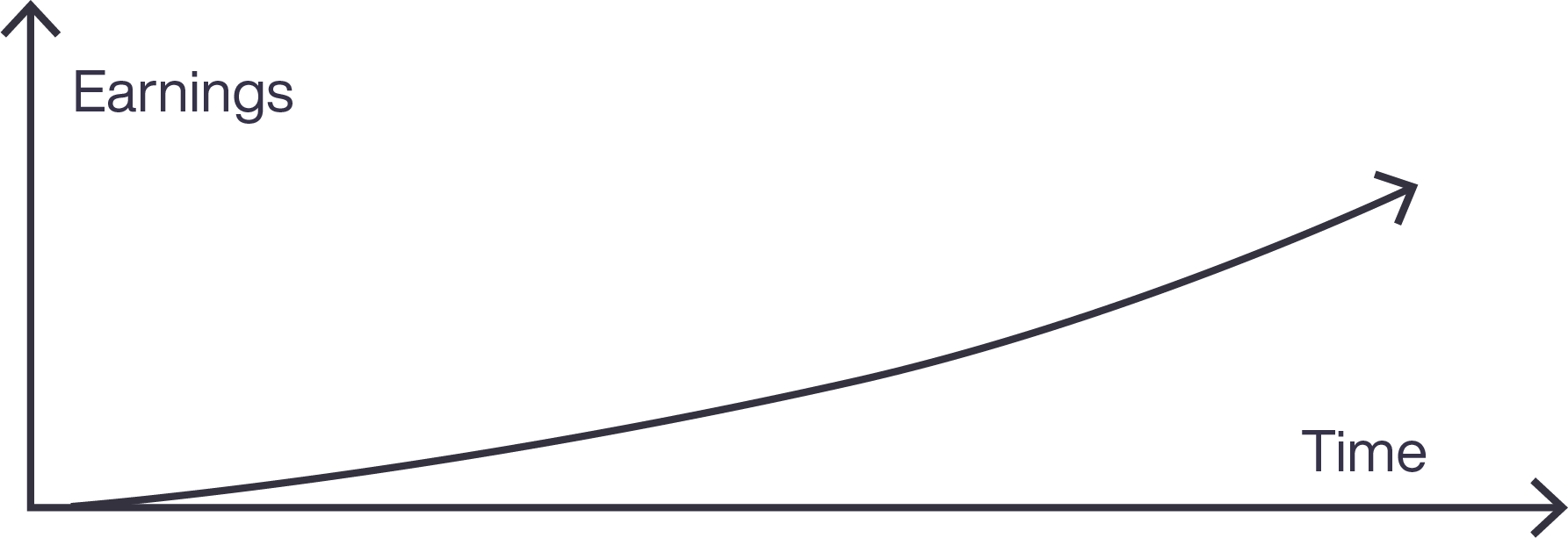

Stalwart growth

Established, dependable companies that grow profits year after year.

Microsoft

When Satya Nadella took charge of Microsoft nearly a decade ago, the firm was struggling in a smartphone world dominated by Apple and Google. He refocused the firm on future growth rather than managing decline in the shrinking personal computer market.

Instead of basing the business on one-off fees for the latest version of its Windows operating system, he shifted the emphasis to subscriptions to cloud-connected versions of its productivity apps and services with automated updates. Now an estimated 360 million people work with one or more of its Office 365 apps every day.

The turnaround, and the strategic focus on innovation that led the firm to invest in ChatGPT creator OpenAI, earned Microsoft a place in our portfolio as a ‘stalwart’: established companies that increase their profits year after year.

Picking quality stalwarts at the right price is key to Monks’ long-term strategy. Once they’re locked into the portfolio, we sit back and let the magic of compounding happen.

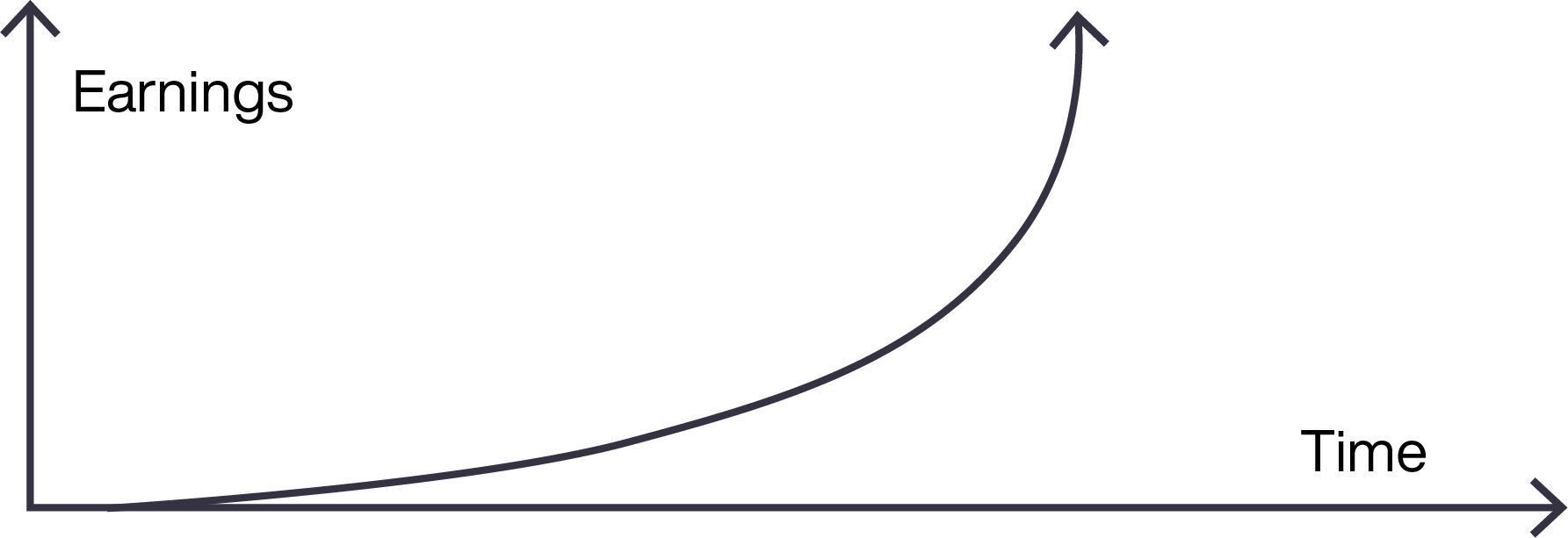

Rapid growth

Innovative, often early-stage companies with high growth potential.

MercadoLibre

Argentina’s MercadoLibre has leapfrogged established rivals lacking its impetus to innovate. It has become the dominant player in Latin American ecommerce, advancing country-by-country to create a vast digital empire that makes transactions easier for small businesses and low-income customers across the continent. Its platform connects millions of merchants and consumers, widening the choice of affordable products while its easy-to-use online and mobile payment solutions slash the cost of transactions.

Led by enlightened managers adept at fostering entrepreneurial energy among employees, MercadoLibre has grown fast. It helped that ecommerce in Latin America has been slow to develop, and giant rivals such as Amazon have failed to establish a lead. Also, the fulfilment infrastructure it has built has mitigated the region’s chronic logistical problems.

Progress has been turbocharged by network effects, which help increase the value of its platform over time, helping it to outpace competitors and introduce a range of offerings in fintech, logistics and advertising as well as ecommerce. Rapid growth companies such as MercadoLibre are seizing vast opportunities by going after existing profit opportunities while creating new markets.

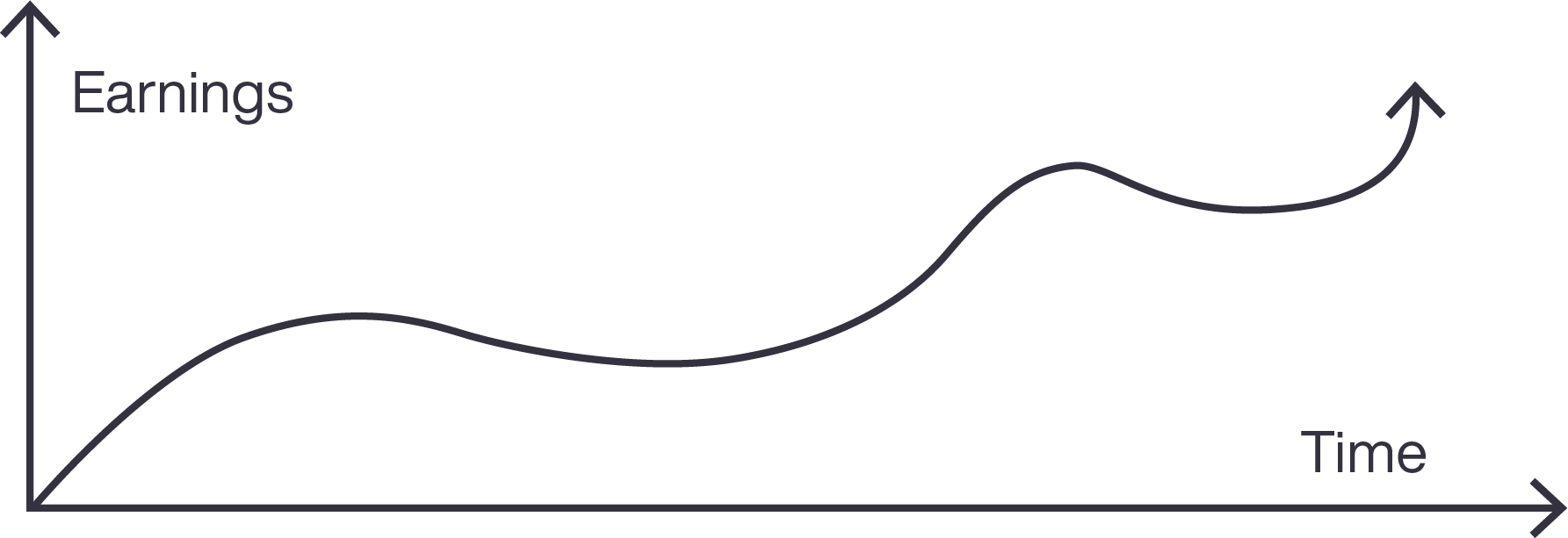

Cyclical growth

Businesses affected by economic cycles in the short term but which can invest at low points in the cycle to get outsized returns at the peaks.

Royalty Pharma

Royalty Pharma helps to fund pharmaceutical research and development in exchange for a share of future royalties from successful drugs. It addresses a funding gap for enterprising biotech businesses but it also benefits from allocating capital towards companies paying for expensive research before they achieve profitable success.

It turns between 80 and 90 per cent of its turnover into profit because it doesn’t have expensive research and development assets and is a specialist investment fund with a long-term outlook.

Royalty reallocates its income to what it sees as the most promising drug development projects. As those new drugs hit the market, they generate royalties themselves allowing the cycle to repeat. It’s just one example of a Monks portfolio company whose leaders’ expertise in allocating capital provides a dimension of steady income despite being in a cyclical business.

What links all three categories is change – changing ways of buying software, changing ways of buying goods and changing ways of developing drugs.

Monks knows how change and growth go hand-in-hand, which is why such a big part of Monks’ role is to scan the horizon for the companies likely to thrive over five-ten-year-plus time horizons.

By balancing all three dimensions of growth, Monks can better manage the uncertainty that change brings with it. Because, since our earliest Depression-era days, we’ve learned that diversity can beat adversity. To capture the growth that disruption brings with it, Monks has found that a three-dimensional approach works best.

Important information

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com

Ref: 58807 10035778