All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk.

Reliance Industries is among the world’s most transformative businesses.

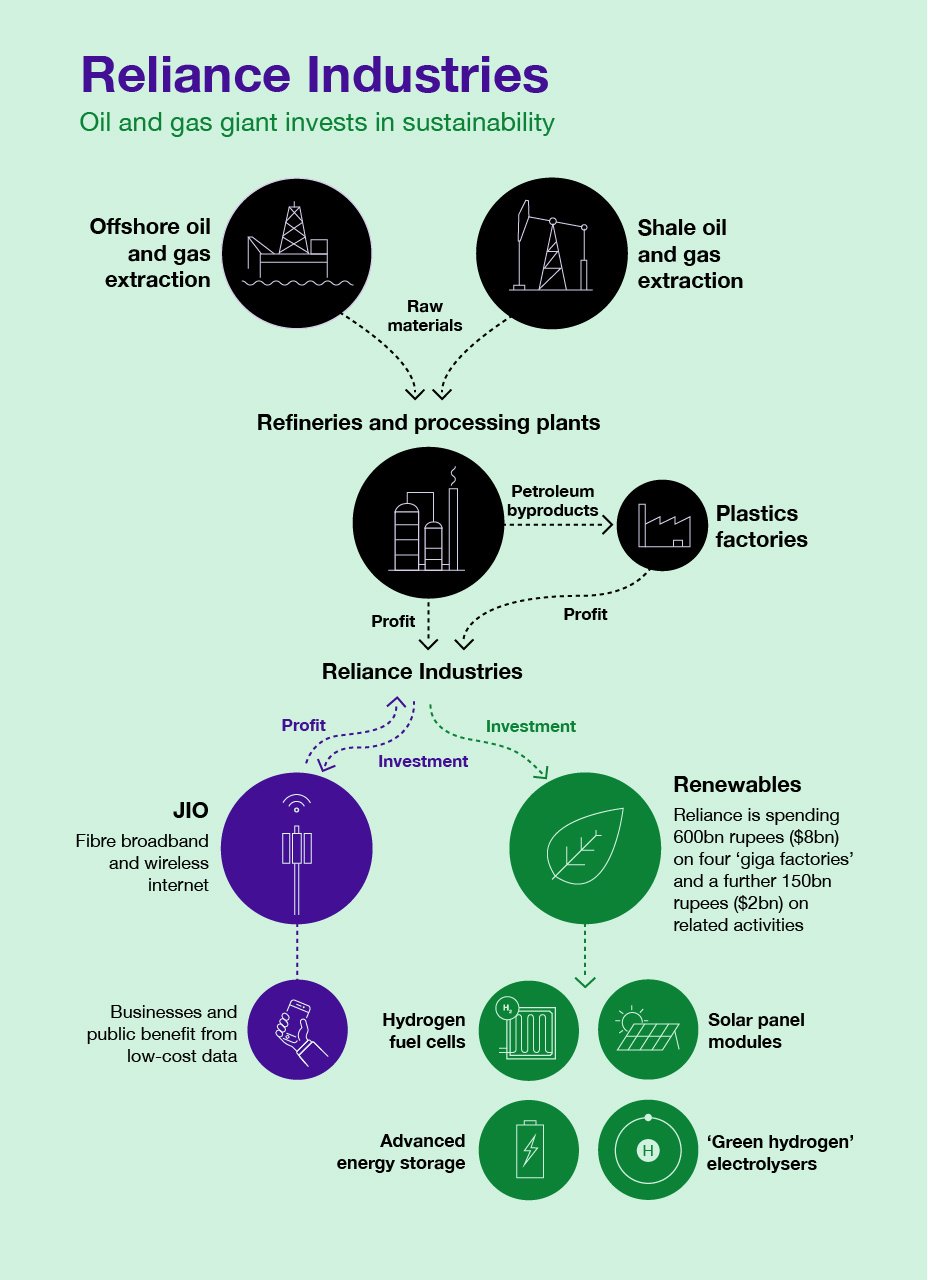

The conglomerate’s status as one of India’s biggest fossil fuel producers still drives much of its earnings, but increasingly its focus is on eco-friendlier sources of energy.

And its telecoms subsidiary, Jio, is already a disruptive force, helping digital businesses and poorer Indians by slashing the costs of mobile and broadband internet.

Yet it’s a company that many ESG (environmental, social and governance) rating agencies love to hate. And, as we’ve heard directly from Reliance, risk-dominated perspectives have a damaging effect on how existing and prospective shareholders engage with the firm.

When determining their scores, the rating agencies often focus on problems they find with a company’s activities. In the case of Reliance, they have flagged controversies including missing emissions targets, a workplace fire and fines for alleged regulatory breaches. As a result:

-

Sustainalytics rates Reliance as ‘high risk’

-

S&P Global scores it a relatively weak 22 out of 100

-

MSCI gives it ‘BBB’, representing ‘average’

These scores miss the company’s potential to be a positive social and economic force, improving hundreds of millions of lives.

A backwards-looking, risk-based approach can restrict market participants’ understanding of a firm’s real-world impact. Moreover, it can cause them to see ESG engagement solely as a risk mitigation exercise to point out flaws and preserve their clients’ capital.

At Baillie Gifford, we think ESG analysis and engagement can encourage responsible behaviour and meaningful change. And we think it should be about preserving potential returns. When clients give us money, they want to see that capital grow.

Our ESG engagement strategy identifies areas where we push companies to improve and mitigate risks with negative consequences. However, it spends just as much time finding ways to fight our holdings’ corners and encouraging them to take potentially beneficial risks.

By focusing on what might go right over the long term rather than what might go wrong in the short term, our engagements with company management are more likely to be constructive and ultimately productive for all involved.

Ambitious aims

There’s good reason to be optimistic about Reliance. In a literal manifestation of the adage “data is the new oil”, the company has ploughed billions of dollars from its core oil and gas business into data and is now expanding into green energy.

In 2016, Reliance rolled out a new mobile network in India that led data prices to collapse from an unaffordable $3 per gigabyte to less than eight cents today. Domestic calls became free.

This yanked India into the 21st century, as even the poorest Indians could finally get online. A new crop of digital businesses took off, and the country now claims to have the world’s third-largest startup ecosystem after the US and China.

Reliance aims to become one of the world’s largest green energy companies. It is spending $10bn over the next three years to generate 100KW of renewable energy by 2030.

Part of the plan is to create a fully integrated solar panels business to rival Chinese leaders, including LONGi and Trina Solar. It is also developing a complementary battery storage solution to deliver reliable, uninterrupted supply to electric grids so they don’t need to fall back on fossil fuels or other energy sources at night-time.

In addition, the company is investing in green hydrogen by creating electrolysers and fuel cells. These could provide a way to heat homes and power planes, among other uses, via renewably generated energy. Reliance’s incredible goal is to cut the cost of green hydrogen by about three quarters to $1/kg within a decade.

This forward-looking investment in renewables and data is not easily captured by ESG risk-based scoring. But it is critical to the company’s prospects and its contribution to society and the environment.

Accounts, disclosures and risk

As I’ve already mentioned, Reliance is far from perfect.

But we don’t believe that the accidents and other retrospective controversies flagged by the rating agencies suggest a wider malaise. Rather they represent the kind of growing pains that many fast-expanding enterprises experience – although they must still be addressed and learned from.

Undeniably, the company is a major source of carbon emissions. But the fossil fuels it produces play a critical role in India’s wider economy, helping to lift living standards and fund the clean energy transition to come. Reliance aims to be carbon neutral by 2035, and its giga factory bets could result in itself and others radically reducing their emissions over the long term.

There are, however, three sustainability challenges that are worth exploring further:

- Reliance’s accounting policies raise concerns

For instance, it depreciates Jio’s assets differently from how other companies do, including local rival Bharti Airtel. There’s also unease over how it redirects some costs onto its balance sheet – a process known as capitalisation. Subtracting the costs from its profits would be more transparent. - Reliance has raised further governance issues by stripping some granular detail out of its earnings

For example, it used to disclose separate figures for its refining of petroleum products and its production of petrochemical substances, such as plastics and rubber.

However, it now groups both under a single ‘Oil to Chemicals’ banner in its quarterly results.

Likewise, it no longer separates earnings from its various retail divisions to the same degree. These moves make it harder for analysts to determine how specific divisions have handled recent events or to compare their performance to other companies in the same sector. - Reliance is taking a high-risk approach to its green energy business

For example, it is pursuing sodium-ion batteries even though lithium-ion technology is more established.

We take a nuanced view in our response to these challenges.

Accounting policies matter for long-term investors like ourselves. We and the wider market need to have confidence in how Reliance reports its numbers. We have raised the issue in conversations with management and intend to press the point. We think the company is moving in the right direction, but it has much more work to do.

On disclosures, we support the company in deciding what it thinks is important to share with long-term investors. Shorter-term shareholders and sell-side analysts often request copious amounts of information to get their quarterly numbers right. But this sort of week-to-week or month-to-month data is less useful when you take a decade-long view.

In fact, too much disclosure involving meaningless metrics can be counterproductive. Earnings calls get crowded out by related questions and there is a real danger that management loses focus on decisions that could have the most positive lasting impact. So we push for disclosures where they matter, but we also back Reliance in not giving in to demands for data that just feeds quarterly models.

Finally, regarding technology risks, we think Reliance is making the right choices.

Its decision to become fully integrated from sand to solar panels makes sense if it is ever to compete as an equal with China’s champions, even though it may be the riskier path.

And its bet on sodium-ion batteries could well pay off as lithium, nickel and other metals needed for conventional batteries become scarce.

We are also comforted by Reliance’s track record of achieving great technological feats at scale.

They include building at speed the world’s largest oil refining complex at Jamnagar in North-West India. Challenges included dealing with a major cyclone partway through construction. And at one point, the worksite was larger than London.

Jio’s decision to go with Samsung as its sole 4G network provider is also notable. Many telecoms firms go with a mix of two vendors to reduce the danger of a fault taking their service offline. But by opting for one, Jio was able to roll out a nationwide service more quickly.

Samsung was also a relative minnow in the network infrastructure market when it was picked in 2013. That might have made it seem a risky choice. But it proved to be a highly engaged partner – more so, perhaps, than the larger players Nokia and Ericsson would have been.

Admittedly, past successes do not guarantee Reliance’s new bets will pay off. But they do provide a level of comfort.

Evolving ESG engagement

So, our approach to ESG at Reliance is to push hard for change where it matters for the long term.

In this case, that means encouraging the company to take big bets on paradigm-changing technologies.

We also fight the firm’s corner. This involves persuading others to see the value in capital expenditure that could take years to pay off and cause the firm’s stock to be more volatile in the short term.

This approach applies to other investments we make on behalf of our clients. When ESG engagements become entirely focused on risks and the downside, you miss the opportunity to help companies prosper and tackle some of the world's biggest challenges.

So, we tell management that we are providing them with patient capital and will support them in making tough choices for sustainability and long-term growth.

By doing so, we believe we can help Reliance and others be leaders in terms of transforming the world and delivering strong returns to our clients.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref:22012 10011627