Greener energy

Japanese sogo shosha, or trading companies, have traditionally had extensive exposure to energy and mining assets.

But both Itochu and Mitsubishi recently announced plans to exit certain coal-related projects and appear to be diverting their attention towards green energy sources.

For example, Itochu is involved in a project to commercially produce ‘blue’ ammonia in Canada from 2026. It will use a local source of natural gas to create the substance, which burns without generating carbon dioxide. The intention is to ship the ammonia to Japan for use by metal, power and petrochemical producers, while carbon capture and storage techniques will be used at the Canadian facility to minimise its own emissions.

Itochu has also teamed up with France’s Air Liquide to build a liquid hydrogen plant in central Japan that would create enough fuel to power 42,000 vehicles.

Meanwhile, Mitsubishi is developing an eco-friendly concrete designed to absorb and store emissions created by steel, energy and cement producers. It has also signed a deal with Amazon to supply the US firm’s Japanese data centres with renewable energy generated by a third-party solar power company.

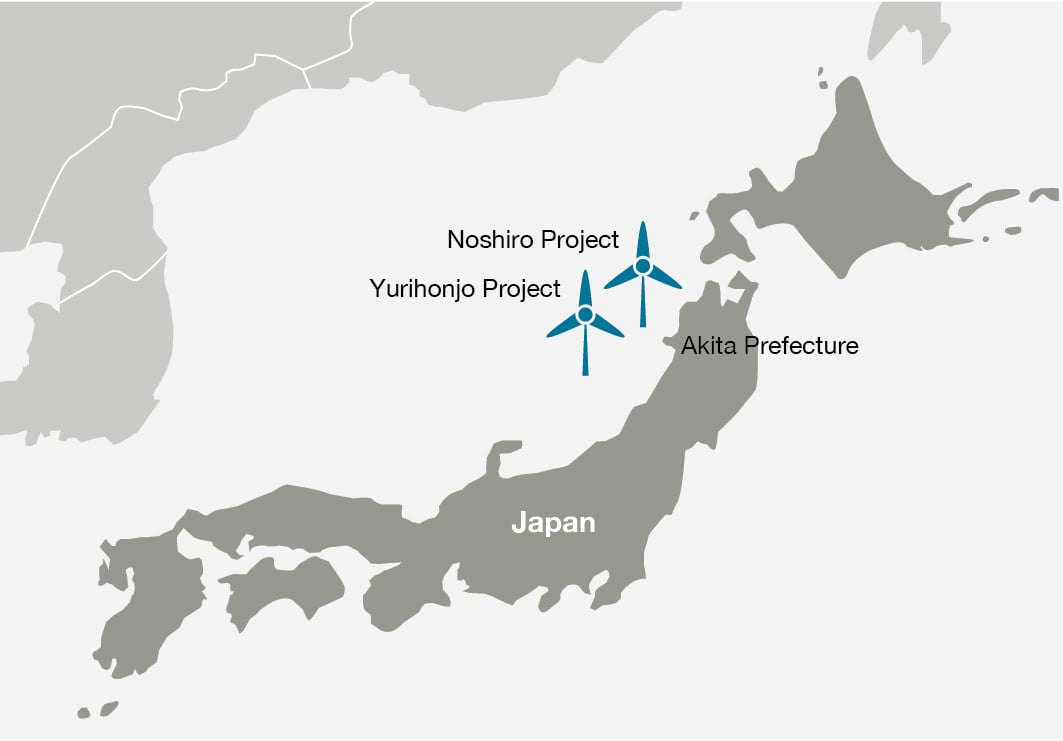

Japan’s number one wind power generator, Toyota Tsusho, is also seeking to increase provision of renewable energy via the development of two offshore wind projects off the coast of the Akita Prefecture.

The firm has bid in a government auction to build the schemes as part of a consortium involving Denmark’s Ørsted and Japan Wind Development. It’s envisaged the sites could produce more than 1.1 gigawatts of power – enough to light up about 130 million LED light bulbs.

Driving emissions down

Turning to the automotive sector, Toyota Tsusho’s close cousin Toyota Motor has long been a pioneer of eco-friendlier vehicle technologies.

It’s already the unrivalled leader in hybrid models, which combine use of electric and petrol engines, having launched its bestselling Prius range in 1997. The firm is also ahead of the curve in fuel cell technology, which produces electricity from a reaction between hydrogen and oxygen.

Next, it aims to take a leadership position in battery tech. To achieve this it has announced a $13.6bn investment plan. Its aim is to launch a next-generation solid-state battery in 2025. This would offer speedier recharges, greater driving ranges and improved safety over today’s alternatives. Toyota says it already has more than 1,000 related patents – more than any other carmaker.

The company is also addressing its own energy consumption. This involves making its own plants more efficient, as well as asking its suppliers to address their own emissions. One of those affected is another of our fund’s holdings: DENSO.

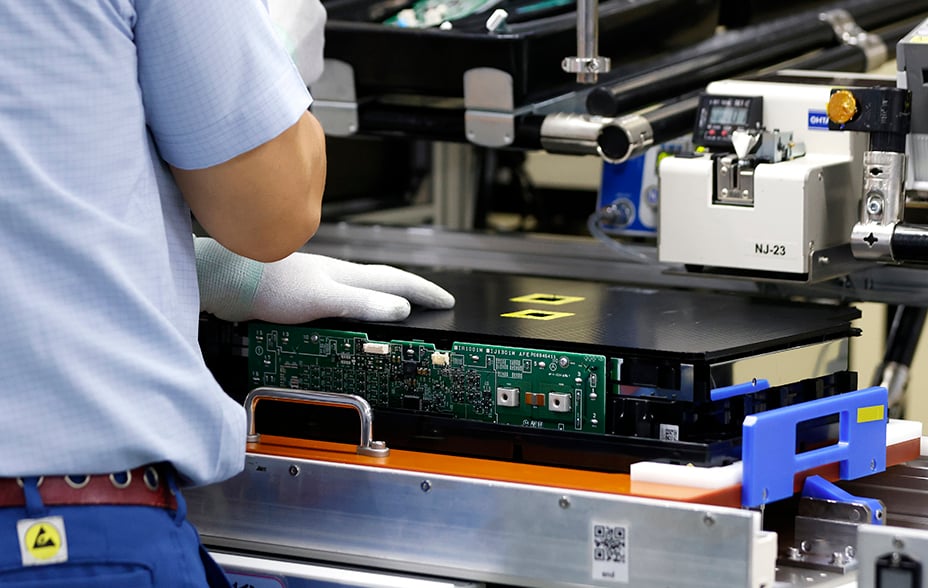

It provides Toyota and other carmakers with components for heating, air conditioning, power control and the removal of harmful substances from engine exhaust gases, among other tasks.

Between now and 2026, DENSO aims to double its sales of parts that support the electrification of vehicles, an ambitious goal made possible by China’s ballooning demand for EVs. Over the same period, the company intends to halve its energy use before becoming carbon neutral by 2035.

It is also working on the use of ‘artificial photosynthesis’, whereby solar power is used to convert carbon captured from machines in its factories into organic compounds. It ultimately hopes to commercialise the process to turn household carbon emissions into a renewable energy source.

Rohm Semiconductor is another company involved in the EV supply chain doing pioneering work. It manufactures next-generation silicon carbide (SiC) chips. These possess superior physical properties to silicon, enabling energy-saving efficiency gains. It expects SiC to become the mainstream material used in automotive electronics within four years.

Other holdings doing notable work include:

- Murata, whose energy-saving electrical components are used in a wide range of industrial, home, medical, automotive and data centre equipment

- Sumitomo Metal Mining, which has developed a world-first recycling process to recover and reuse copper, nickel, cobalt and lithium from spent lithium-ion batteries

- Nidec, the world’s largest manufacturer of miniature motors, is developing parts to help electric vehicles become lighter and cheaper

Net zero solutions

The technical edge won by Japanese companies from years of continuous improvement explains their sustained dominance in the areas outlined above as well as others including solar power tech, smart energy grids, high speed trains and robotics.

As a result, these companies allow Japan to remain one of the leading producers of energy-efficient goods.

There is further work to be done to reduce the nation’s use of carbon-emitting fuels. But Japanese companies’ general predisposition to take collective responsibility should be a real asset – both to tackle climate change locally as well as to deliver a blossoming range of net zero solutions to the wider world.

or for more detail view the Japanese Income Growth Fund Factsheet.

Important information and risk factors

The views expressed in this article are those of Thomas Patchett and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in January 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

The Fund's exposure to a single market and currency may increase share price movements.

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced. Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated. The images used in this article are for illustrative purposes only.

This is a marketing communication and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. No reliance should be placed on these views when making investment decisions. This article does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Past performance is not a guide to future returns.