Filters

Filtered by

Insights

Viewing 15 of 23

SAINTS: adversity is opportunity

Finding diverse companies that share a great growth culture.

SAINTS: Manager Insights

James Dow shares SAINTS' 2024 performance and delves into the trust's dividend history.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

SAINTS spotlight: steady amid euphoria

A focus on diversification and long-term compounders positions the portfolio for the future.

SAINTS spotlight: turbulence beneath the surface

Exploring SAINTS' strategic moves in the face of economic shifts and the pursuit of compounding growth.

SAINTS: Manager Insights

James Dow shares SAINTS' 2023 performance and 50-year dividend growth milestone.

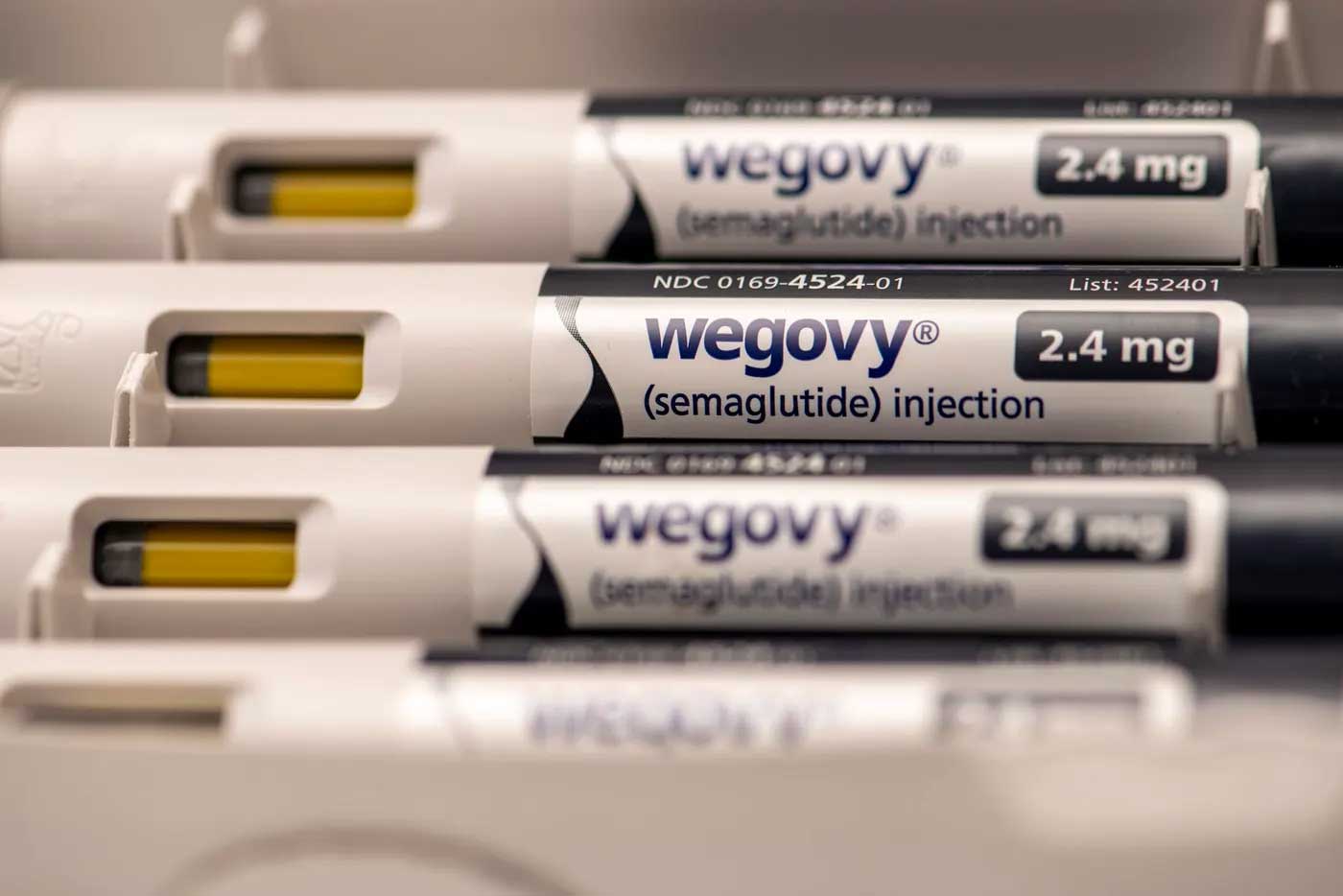

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

SAINTS: the case for dividend growth

Why we believe pursuing dividend growth rather than yield is the right way to grow capital.

The history of SAINTS

John Newlands reveals the roots of the SAINTS success story.

A century and a half of SAINTS

James Dow reflects on how the trust has changed over the decades, but stuck to its core values.

SAINTS: 150 years of income

John Newlands tells the story of the Edinburgh-based company that thrived in good times and bad.

A tight ship: lessons from Admiral

How Henry Engelhardt’s entrepreneurial flair helped create the car insurance giant

Webinar: the SAINTS approach

Co-manager James Dow explains why he believes in the Trust’s focus on sustainable compounding.

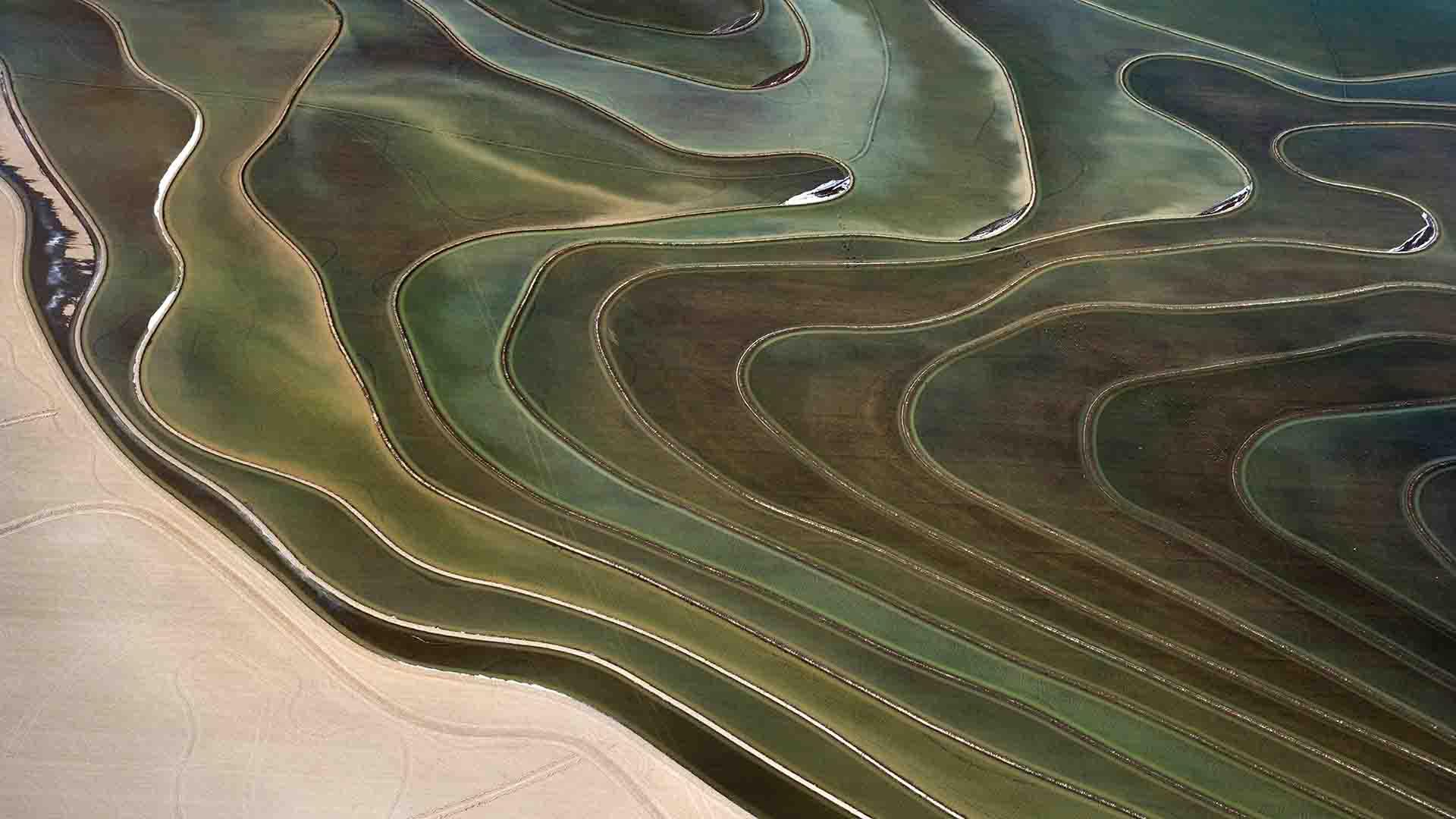

Compound interest: the snowball effect

Companies reinvesting profits to supply outperformance over decades are the market’s unsung heroes.