© The Asahi Shimbun / Getty Images

Please remember that the value of an investment can fall and you may not get back the amount invested.

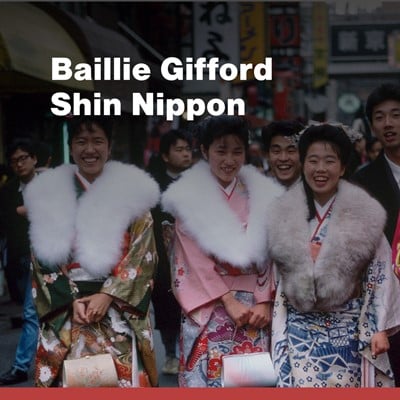

By the late 1970s, Japan had miraculously recovered from utter devastation in the second world war to become the world's largest economy behind the United States. In the UK meanwhile, the attractions of overseas investment had increased after the removal of foreign currency restrictions following the 1979 election of Margaret Thatcher’s new Conservative government.

This combination of circumstances prompted growing investor interest in the great Japanese success story, especially in the fields of electronics, automation and manufacturing. The time was right to create a diversified fund focused purely on the burgeoning economy. In December 1981 the Baillie Gifford Japan Trust PLC was launched, raising £10 million within weeks of incorporation.

The timing was fortuitous, given that Japan’s most explosive period of economic growth was just starting. But it didn’t look like that at the time. A slowdown in world trade hit Japanese exports, requiring government bond sales to shore up Japan’s budget deficit. In the accounts to 31 August 1982, chairman Malcolm Murray admitted disappointment that shares had “proved so unrewarding”. The net asset value per share had dipped to 85p from its 100p launch price. More than half of the portfolio at this time was exposed to hi-tech stocks, including a number of electronic holdings.

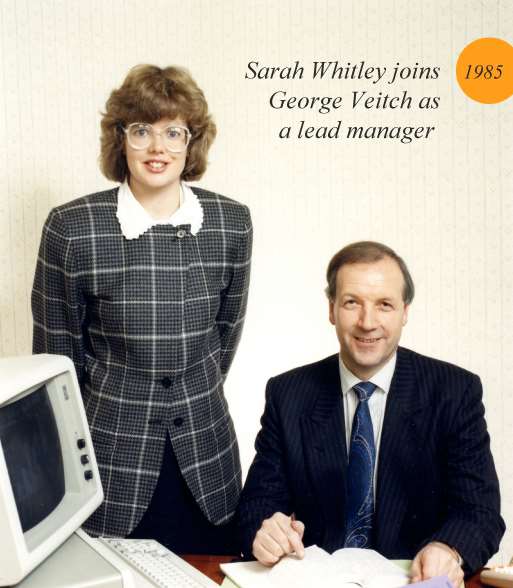

Under the leadership of George Veitch, supported first by Robin Menzies, then by rising star (and first female Baillie Gifford graduate trainee) Sarah Whitley, that inauspicious start was dramatically expunged. By 1986, after five consecutive years of growth, the trust’s value per share had climbed to 529p, while the size of the fund had grown more than fivefold to £53m. A year later, Murray could tell shareholders that, according to the Association of Investment Trust Companies (now AIC), Baillie Gifford Japan was the best performing investment trust over five years.

By then, one of the greatest stock market booms in history was in full swing. It was accompanied by a property price explosion that, as urban myth had it, valued the real estate of Tokyo’s Imperial Palace the same as that of the entire state of California.

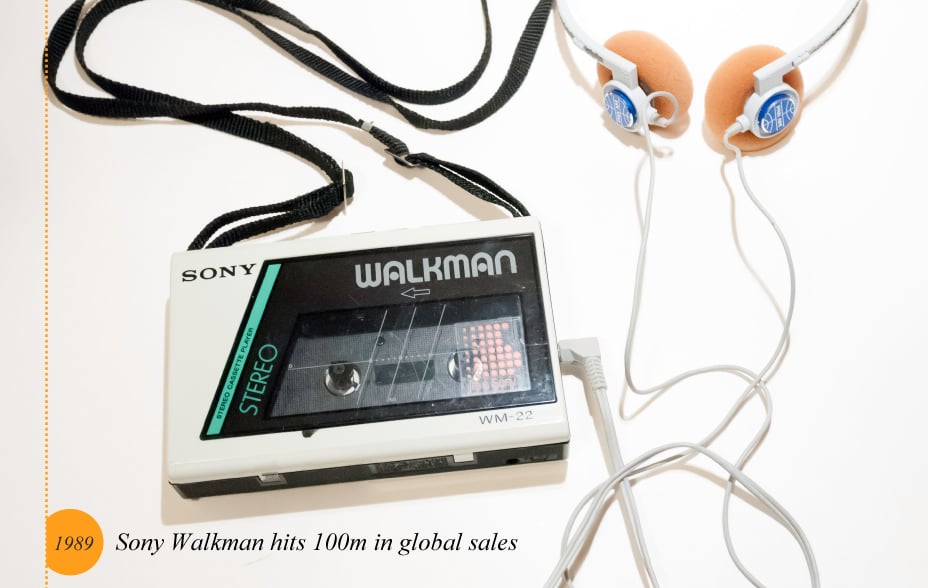

Throughout the 1980s, the Japanese were hailed as the masters of modern capitalism. In the US, books such as Ezra Vogel’s Japan as Number One: Lessons for America stoked fears of imminent economic eclipse, while consumers worldwide snapped up iconic Japanese super-products, from the Sony Walkman to the Toyota Corolla.

Stock prices suffered a setback in late 1987, triggered by the effects of the New York Stock Exchange’s Black Monday. But then they staged another strong rally that took the Nikkei 225 Index to a record high of 38,957 on 29 December 1989 (it didn't exceed 30,000 again until February 2021). No one predicted in the late 80s that ‘lost decades’ lay ahead.

© Peter Jordan / Alamy Stock Photo

What went wrong? Seeking to keep inflation under control, the Bank of Japan sharply raised interbank lending rates in late 1989. The unintended effect was the bursting of the bubble, causing equity and asset prices to collapse. Japan took a further hit from the 1995 Kobe earthquake, one of the severest in the country’s history. This was followed by another blow as Japan’s banks suffered in the Asian financial crisis which began in 1997.

The final decade of the 20th century, in short, was a testing period for investors in Japan. Active stock selection became paramount in such circumstances. Veitch and Whitley, the latter as lead manager from 1995, skilfully repositioned the portfolio as the economic background changed. This included reducing exposure to electronics and focusing on commerce and services and financials. Following a sharp upturn in Japanese markets in late 1998, the trust’s value rose by 128 per cent during the year to 31 August 1999, taking it to a new high of 1,024p per share, while assets reached £130m as the new millennium dawned. To boost liquidity in its shares, in November 2000 the trust split its shares in the ratio of five new shares for every existing share.

© The Asahi Shimbun / Getty Images

The first two decades of the 21st century proved to be something of a rerun of the trust’s first 20 years but played in reverse. The 2000s encompassed a series of challenges for the trust. These included the turbulent ending of the internet boom at the turn of the millennium and the global financial crisis of 2008-09. The decade to 2020, in which two-time Prime Minister Shinzo Abe attempted to boost growth through his ‘Abenomics’ reforms, proved to be a successful one for investors. Baillie Gifford Japan grew from £144m to £924m over the 10 years to 31 August 2020.

In April 2018 Whitley, a towering figure in the history of the Japan Trust, retired after 37 years with Baillie Gifford. A tireless investigative traveller to Japan and advocate of its growth companies – whatever the macroeconomic background – she was an early enthusiast for Japanese pioneers in fields as diverse as ecommerce, medical technology and fintech. Managing the portfolio as effectively in testing times as in bull markets, she won huge respect from clients and industry peers.

While it’s too soon for any sort of long-term perspective, the year 2020 presented the unique challenges of Covid-19 described by Prime Minister Abe as Japan’s worst economic crisis since the end of the second world war. Yet, as current Japan Trust Chairman Keith Falconer reported to shareholders, “[2020] has been an extraordinary year … [in which] equity markets appear to be ignoring the obscure economic outlook”.

© TOSHIFUMI KITAMURA / Getty Images

The market improvement during the last quarter of 2020 took the trust, now led by Matthew Brett and deputy manager Praveen Kumar, through the £1bn barrier for the first time. It is a notable achievement for a vehicle that started with £10m (less launch costs) and survived volatile decades featuring some of the most traumatic events in financial history. As Brett puts it: “Lost decades for Japan haven’t been lost decades for Japan Trust investors.”

The trust’s aim remains simple: pursuing long-term capital growth principally through investment in medium- to smaller-sized Japanese companies believed to have above average prospects for growth – simple, but not easy. "Progress in Japan is rarely straightforward,” Brett wrote recently. “Some areas jump ahead, and others are a bit behind. Its firms sometimes struggle with dynamic change.”

After four decades of highs and lows, and now backed by what Baillie Gifford believes is the largest specialist Japanese equities team outside Tokyo, the trust’s leaders know better than most investment managers the unique dynamics of change in Japanese life. Brett understands how “good ideas penetrate very quickly” in this market. In its fifth decade, and beyond, the task for Japan Trust managers is to keep spotting those good ideas, early and often.

Find out more about Baillie Gifford Japan Trust

Important Information

The views expressed should not be taken as fact and no reliance should be placed upon these when making investment decisions. They should not be considered as advice or a recommendation to buy, sell or hold a particular investment. If you are unsure whether an investment is right for you, please contact an authorised intermediary for advice. This article was produced and approved in April 2023 and has not been updated subsequently. It represents views held at the time of recording and may not reflect current thinking. The trust’s can make use of derivatives which may impact on its performance.

The trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up. Investment in smaller companies is generally considered higher risk as changes in their share prices may be greater and the shares may be harder to sell. Smaller companies may do less well in periods of unfavourable economic conditions. The Trust's exposure to a single market and currency may increase risk. The trust can borrow money to make further investments (sometimes known as “gearing” or “leverage”). The risk is that when this money is repaid by the trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the trust will make a loss. If the Trust's investments fall in value, any invested borrowings will increase the amount of this loss. Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA. For a Key Information Document for the Baillie Gifford Japan Trust, please visit our website at www.bailliegifford.com

10018900 36643

|

|

2019 |

2020 |

2021 |

2022 |

2023 |

|

Share Price |

-7.5 |

-16.8 |

70.8 |

-21.4 |

-9.1 |

|

NAV |

-6.1 |

-9.9 |

56.8 |

-15.8 |

-3.7 |

|

TOPIX |

-1.8 |

-2.5 |

24.8 |

-2.7 |

2.8 |

Legal Notices

Source: The TOPIX Index Value and the TOPIX Marks are subject to the proprietary rights owned by JPX Market Innovation & Research, Inc. or affiliates of JPX Market Innovation & Research, Inc. (hereinafter collectively referred to as "JPX") and JPX owns all rights and know-how relating to TOPIX such as calculation, publication and use of the TOPIX Index Value and relating to the TOPIX Marks. JPX shall not be liable for the miscalculation, incorrect publication, delayed or interrupted publication of the TOPIX Index Value.