Insights

Filters

Future stocks

The future is unknown, but you can be certain that exceptional companies are driving it forward. Discover which stocks have caught the eye of our investment specialists in this series of short videos.

Quarterly investment updates

Keep up to date with the latest views of our investment teams in these short strategy briefings.

Long-term vision

It takes time to achieve transformational change. So we invest in companies for years, even decades. And we support their leaders in making decisions that can deliver strong, sustainable returns to you.

Recent insights

Emerging markets in 2050

Trade shifts and underserved populations are among the factors favouring world-class stocks.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

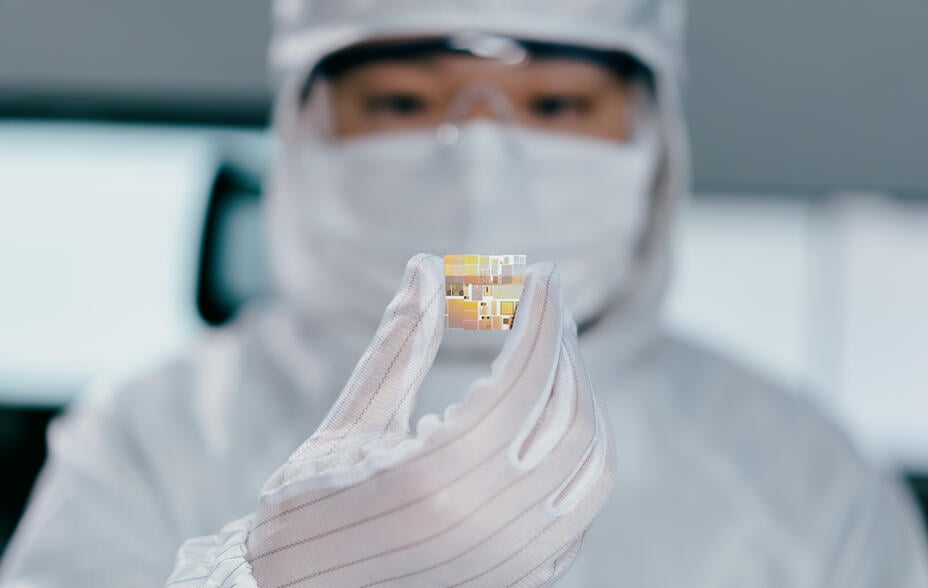

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

Europe: unique brands, hidden champions

Why a long-term approach to the continent’s growth stocks is more relevant than ever.

Why ants, scaffolding and long jumps matter to growth investors

Kirsty Gibson shares frameworks to analyse the cultures of exceptional growth businesses.

Going for growth: Digital infrastructure

Discover the transformative power of the chip revolution, led by industry giants TSMC and Advantest, in reshaping our world.

US perspectives: AI evolves again

Explore how the rapid market shift in AI and computer processing is transforming industries.

Positive Change: a review of 2024

A detailed overview of 2024 covering performance, portfolio and investment approach.

The power of external perspectives

Baillie Gifford's International Concentrated Growth strategy leverages research from external thought leaders to identify transformative growth opportunities.

International viewpoints: Shifting tides toward international markets

The US stock market has outperformed international markets in recent years, but signs suggest a change in this trend.

International Growth: Exceptional growth companies

The investment team discuss their approach to identifying exceptional companies and the importance of holding them patiently amongst global uncertainties.

Private growth: Looking over the overlooked

Learn more about the key features and attributes of the growth equity asset class.