Key points

- Emerging markets have evolved from manufacturing hubs to innovation powerhouses, with companies turning local constraints to competitive advantage

- Firms such as Pony.ai, Nubank and Sea Ltd are solving everyday problems through technology, and have the potential to leapfrog established Western competitors

- These businesses represent exciting long-term opportunities as they disrupt the status quo and expand into global markets

WATCH: Investment manager Alice Stretch (right) explores how emerging market innovators are leapfrogging advanced economy counterparts in her Disruption Week briefing

Your capital is at risk.

When typhoon Co-May hit Shanghai in July 2025, flights were grounded and ferries docked, but something remarkable happened on its roads: by coincidence, Pony.ai’s driverless taxis were making their commercial debut in the city.

Encouragingly for the startup, its autonomous cabs slowed whenever the rain intensified but otherwise handled the wild weather with ease.

Their edge? Relentless testing in conditions that would challenge any human driver. Self-cleaning sensors, meanwhile, handle conditions ranging from snow to sandstorms.

All-weather performance: Pony.ai’s autonomous vehicles can drive through the toughest conditions.

© pony.ai

What attracts investors like Alice Stretch is that Pony.ai’s ‘robotaxis’ cost a fraction of those of Western peers, helping the firm charge lower fares. That helps today, as Chinese citizens typically earn less than American counterparts. But it could also help the company compete globally at a later stage.

To the Baillie Gifford investment manager, Pony.ai is just one example of emerging market companies that have flourished by turning constraints into a competitive advantage.

“It’s innovation that disrupts the status quo and creates opportunity for investors, particularly those looking to hold companies over the long term,” Stretch explains. “Innovation improves the durability of growth, allowing companies to increase the potential size and scope of the end demand, driving revenues and profits.”

To Stretch, Pony.ai’s potential reinvention of the rules of the road exemplifies the excitement of the emerging market innovators.

"Pony.ai is the only Chinese company with full driverless permits across four of China’s biggest cities: Beijing, Shanghai, Shenzhen and Guangzhou. That's significant because it demonstrates regulatory confidence and technical capability."

“There are customers in Beijing who are hiring out one just to take a nap in their lunch break. And that really makes me think about all the ways autonomous driving could change the world.”

Leapfrogging western rivals

Pony.ai also highlights another competitive advantage Stretch looks for: businesses unconstrained by legacy infrastructure with the potential to leapfrog incumbents.

“We’re looking for companies that can reduce friction and pain points in people’s lives,” she says. “Another example of this is Nubank. Traditional banking in Brazil has been painful, marked by high fees, long queues and poor customer service.

“Nubank is the country’s first fully digitalised bank and has offered an escape from the old system of excessive charges. Moreover, by gathering about 30,000 data points per customer – enabling more accurate credit assessments – the firm can tailor its financial products to each user responsibly.”

Another market feature that Stretch looks for is the ability for an emerging market company to have what she calls a “multi-act growth story”.

For example, one of Baillie Gifford’s largest holdings, MercadoLibre, began in Latin American ecommerce but has discovered a new source of growth in fintech (MercadoPago) and, more recently, online advertising.

Singapore’s Sea Ltd offers another example. It started in video games (Garena), used the proceeds to bankroll an online shopping platform (Shopee) and then that expanded into digital financial services (SeaMoney). Its ability to do so rests largely in having a decisive founder-chief executive with the authority and ambition to make such decisions.

“Sea is led by Forrest Li, who combines vision with disciplined execution,” Stretch says. “Not only does he build high-performing teams, he allocates capital to technology-led growth and isn’t afraid to adapt or pivot when needed.

“We've spent a lot of time visiting Forrest and his team across Singapore, Indonesia and Brazil, and he has spent time with us in Edinburgh. These aren’t drop-in meetings about quarterly results, but about conversations about understanding the five-to-ten-year opportunity.”

No more haggling in the morning market, Bách Hóa Xanh delivers the same freshness and fair prices in a clean, convenient supermarket experience.

© MWG

Stretch cites Vietnam’s Mobile World as another company with a multi-act arc.

As its name suggests, the firm started as a mobile phone retailer. But it has since drawn on its relationship-building experience with suppliers, advanced inventory system and execution-focused culture to make the leap into groceries.

“Under its Bách Hóa Xanh brand, Mobile World has a chain of more than 2,100 physical stores,” Stretch says.

“And its scale and efficiency mean it can outcompete rivals on fresh food and packaged goods prices. What’s interesting is how it’s used its operational backbone to expand, at a time when political and economic developments in Vietnam have been highly supportive.”

E Ink’s durable appeal

As a member of the Emerging Markets Team with semiconductor expertise, Stretch also spends much of her time in Taiwan.

The island is home to TSMC, the world’s biggest manufacturer of high-end computer chips – with Apple, NVIDIA and Qualcomm among its many clients. Baillie Gifford first invested in the firm in 1999, and it is now one of our largest holdings. And our familiarity with the firm has also led us to invest in other companies that flourish in its wake.

Some are directly related, including Chroma ATE, which makes precision measurement equipment for the semiconductor industry. Others more tangentially, such as the recent purchase, E Ink

It creates ‘electronic paper’, a reflective screen that can hold an image without power. Stretch sees it as a potentially powerful disruptive force.

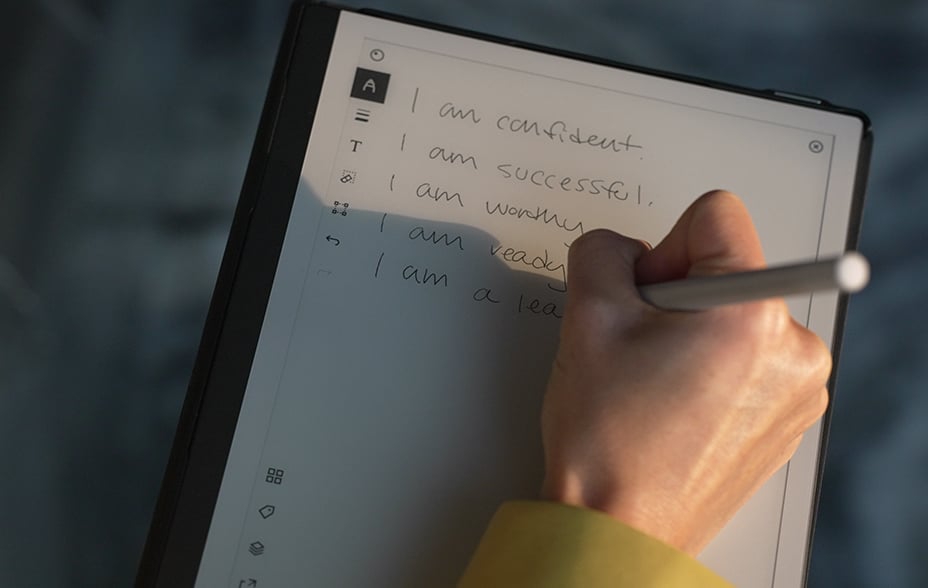

“You might be familiar with this from your Kindle or other ebook reader,” Stretch says. “But now E Ink tablets are catching on, with low enough latency to let you make notes, highlight text and draw diagrams naturally – some of which feature colour displays.

The feel of paper, the power of digital. E Ink tablets offer a cost-effective, eco-friendly way to read, write, and work anywhere

“E Ink is also creating e-paper for signage, which could be replacing big electricity-intensive LCD screens in cities, as well as electronic shelf labels in supermarkets. Walmart, among others, is installing these to update its prices automatically. It basically allows retailers to synchronise prices in minutes, cutting paper waste, and launch promotions at scale at speed.”

Of course, macroeconomic concerns remain when investing in emerging markets. Geopolitical tensions, currency fluctuations, and – as recent US tariffs demonstrate – policy volatility all pose distinct risks.

Stretch acknowledges that these can make investing in the sector challenging. But she adds that others’ caution can work to our clients’ long-term advantage.

“We know that even if a company’s the best at what it does in the world, the macro can easily overwhelm its growth. We can't predict every event, but we do control how much exposure we have when we take certain risks,” she says.

“And in many cases, these are profitable, innovative companies with years of growth potential ahead. Many global portfolios are still massively underexposed to emerging markets. We believe that’s likely to change. And if we’re right, investors who add to emerging markets will be rewarded.”

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Words by Colin Donald

179330 10058929