All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Emerging Markets (EM) have always been regarded as the investment equivalent of terra incognita. While the very term ‘Emerging Markets’ was originally created as a clever piece of marketing to make it seem a less scary place – the bankers at JP Morgan knew that no-one in the early 1980s would buy the ‘Third World Equity Fund’ that Antoine van Agtmael was proposing – the connotations have been hard to shake.

Just open a newspaper: you can still read about the region’s apparent over-dependence on trade and dollar debt (never mind that external balances are the healthiest they have been in decades), the vulnerability of basket cases such as Argentina or Turkey (never mind that outliers like these are now a fraction of our investable universe), or the imminent collapse of the Chinese banking system (never mind that it didn’t happen amid bridges to nowhere in 2010, or the anti-corruption campaign in 2014, or the trade wars of 2017…).

For a more accurate picture of where the asset class is going, however, just look at what’s happening on the ground. For sure, there are giants: they are the titans of the memory and processing technologies that make our world a better, smarter and safer place. They are the colossi of the new energy supply chain that are helping to clear the skies from Shanghai to São Paulo. They are the hecatoncheires of the internet world, pivoting from one sector of the economy to the next with customer offerings that vastly outstrip anything that has come before. They are getting bigger and better. And they are multiplying.

This feels like an important coming-of-age for the asset class. After all, one of the longest-standing complaints that equity investors have had is its dearth of truly world-class companies. For too long, stock-picking in EM has often felt like trying to select the best-looking horse in the glue factory: investors could choose between trying to surf the cycles in a series of me-too national banks, resource plays and utilities, or pay eye-watering multiples for the relatively predictable but much more staid growth on offer at a cluster of multinationals in the consumer staples sector. Where are the impregnable moats, the visionary management teams, the products that people buy because they want to, not simply because they lack alternatives?

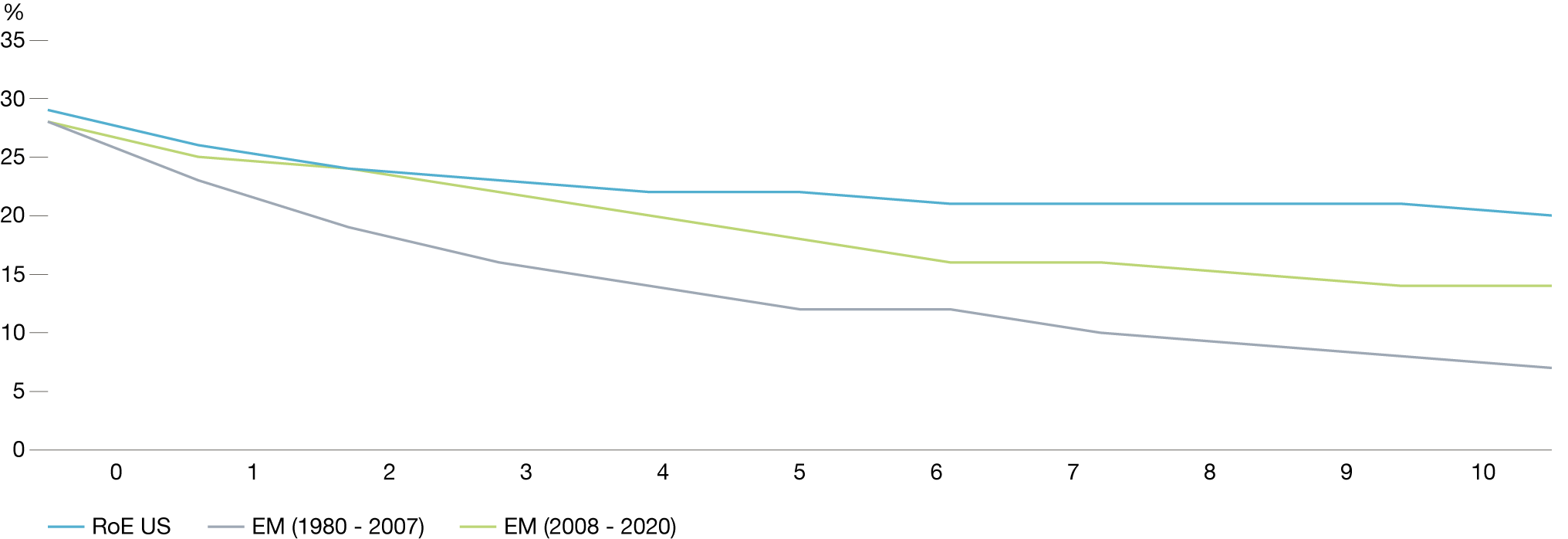

This dearth of ‘quality’ is sometimes illustrated by comparing the progression of returns on equity from emerging and developed equity indices. For example, as the chart below suggests, US companies that start with RoE in the top quintile tend to see relatively glacial declines in profitability over the years - the inference being that the best US companies are well-equipped to fight off the perils of obsolescence, competition and mean reversion. In EM, however, the decline in RoE tends to be much more rapid. The rationale? Take your pick from a lack of decent brands, a lack of scale beyond home markets, a lack of innovation, a tendency of governments to attack excess returns, or a bias towards sectors that are hostage to swings in macro fortunes. This is probably also why EM has historically been assumed to be more fertile hunting ground for value investors, as the promise of persistently high growth and returns in EM turns out to be a chimera. Indeed, while growth has had a better time of late, it’s worth remembering that for most of the 1990s and 2000s, value strategies in EM were generally on top.

But is this changing? As we can see, the persistence of returns from the highest quintile of stocks in EM over the last decade or so has been much more enduring than it was in previous decades. The relative performance of growth stocks makes sense in this context. However, it also jibes with our sense that there has been a meaningful upgrade in the quality of the investment opportunities available to stock-pickers in EM. We wonder if investors are paying enough attention to this shift: after all, most of the debate around emerging markets over the last decade has focused on the region’s failure to deliver much in the way of growth at the macro level. But if this bottom-up trend continues - and if, as we suspect is quite likely in the coming decade, it is accompanied by a far more benign top-down outlook - then the implications for the asset class could be profound.

RoE Trajectory (Top Quintile)

Source: Bloomberg, factset and BoA.

The first generation of truly ‘world class’ EM companies came from Korea and Taiwan – the only two economies of any size to have made it all the way from low- to high-income in the last 50 years. The road map mirrored the export manufacturing-led development model: embrace global markets at cheap price points, then work your way up the innovation ladder. The companies that succeeded usually had one thing in common: founders willing to pursue martingale strategies, doubling down after every cyclical setback. Samsung and TSMC’s ambitions have never been limited to simply copying what their developed market peers did; they’ve been mainstays of our EM portfolios for the better part of two decades for precisely this reason. Nonetheless, it’s hard to resist the symbolism of the recent revelation from Intel – a company that has negotiated Moore’s Law better than nearly everyone else in the world for most of the last 30 years – that its technology now lags that of its Taiwanese rival by at least two years.

The next generation of world class EM companies was different. Most have come from China, a country whose initial development largely followed the North Asian export manufacturing model successfully pursued by its neighbours. However, when the flywheel is a billion-plus home market, the need to go abroad is less pressing. But it’s not just domestic scale that has made world-class giants of Alibaba and Tencent. Any lingering suspicion that they were mere copycats benefiting from large and protected markets should have been removed by Mark Zuckerberg’s admission that Facebook was far too slow to learn from WeChat.

The existence of four indisputably world class companies is a great start, but it hardly makes a compelling case for active allocation to the broader asset class, especially when those four already account for 25 per cent of the MSCI EM index, and appear in pretty much every manager’s Global EM portfolio.1 This can certainly be an inconvenience for a manager like us, given our belief that all four remain badly mispriced, and our desire to retain substantial active positions. But what’s really exciting us is the fact that this list is growing.

If there’s one consensus that has emerged from the wreckage of Covid, it’s that our future is online. There is, of course, a more heated debate as to whether the gains from the internet revolution will continue to accrue to a relatively small number of outsize winners, or whether these winners will themselves succumb to the curse of bigness. Like Saturn, revolutions have a habit of devouring their own children.

1. Although interestingly Copley aggregate data suggests all four remain among the top stock underweights in GEM funds.

As observers of the Chinese internet, we’ve become much more relaxed over the past year or two about the risk of Alibaba and Tencent losing their dynamism and lack of challenge. Meituan, for example, appears to be managing to out-compete Alibaba in food delivery. If the company can retain leadership in an addressable market that founder Wang Xing has defined as more than 2 billion meals each day – it currently manages around 30 million – it’s recent success should continue.

Of perhaps even greater interest is ByteDance. Could this be the world’s most important company? For most people over the age of 30, the company’s rise to prominence reflects its status as a totem of Sino-US tension amid Mike Pompeo’s campaign to cleanse American networks of Chinese influence. But the company’s real significance was apparent well before this. In less than five years, ByteDance has not only developed a domestic ecosystem second only to Tencent in size, but in TikTok – developed in China for a global audience – it has created the world’s most downloaded app. In one fell swoop, Bytedance has forced us to rethink two investment shibboleths: that regulation is the only way to ensure a competitive internet industry, and that Chinese companies can’t produce globally sought-after brands.

This feels like a watershed moment. One of the most common rules-of-thumb you will hear as an EM investor is that aspirational brands come from the west. This has effectively put a ceiling on growth for EM equity investors – once income per capita reaches a certain point, consumers switch to foreign brands, and the upside accrues to companies listed elsewhere. Why bother allocating to EM when you can play catch-up consumption through western companies like HSBC or LVMH?

This is starting to change. Chinese brands accounted for only 40 per cent of search queries on Baidu in 2009; by 2019 this was 70 per cent. Nielsen surveys confirm a similar uptick in interest. Our holding in Li-Ning reflects this shift: although the Chinese sportswear market remains dominated by Adidas and Nike, Li-Ning appears to have been gaining ground on the back of revitalised brands that incorporate traditional Chinese embroidery.

Do these shifts in consumption patterns reflect a new-found confidence from home-grown brands that have finally become more adept than the multinationals at capturing the imagination of local audiences, or is it simply down to a surge in nationalist sentiment and patriotism? The debate over the resurgence of national brands in EM has become entangled in yet another post-Covid consensus: that globalisation is now at an end, to be replaced by a more fractious era of rising balkanisation and localisation. Unsurprisingly, the verdict from most commentators – having spent their entire careers extolling the virtues of unfettered trade and capital flows – is that this is unlikely to be a good thing. We don’t wish to trivialise this debate: geopolitical shifts can be unsettling, and the costs of miscalculation horrific. But surely this will offer up vast opportunities for our universe. After all, convergence theory has always emphasised the role of crisis as a catalyst for change – what Moses Abramovitz referred to in 1986 as “ground-clearing experiences that open the way for new organizations and new modes of operation”. The most obvious example is Chinese technological catch-up, which US sanctions have pretty much guaranteed to be one of the most powerful investment themes of the next decade, as China seeks to fast-track the development of domestic know-how and cutting-edge research. As a recent report from the Boston Consulting Group pointed out, US leadership of the global semiconductor industry – one that relies on a virtuous innovation cycle of R&D scale to stay ahead – could now be lost within as little as three years.

Important information

The views expressed in this communication are those of Will Sutcliffe and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in October 2020 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Stock Examples

Any stock examples and images used in this communication are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This document is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions ('FinIA'). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a 'wholesale client' within the meaning of section 761G of the Corporations Act 2001 (Cth) ('Corporations Act'). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a 'retail client' within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited ('BGO') neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 12716 10001413