A collaborative approach

Founded in Belgium 15 years ago, argenx has grown to become a global biopharmaceutical company that focuses on developing and commercialising innovative antibody-based therapies for the treatment of severe autoimmune diseases.

Named after the collaborative work demonstrated by Jason and his Argonauts, famed in Greek mythology, argenx has a partnership-based approach to drug discovery. Leveraging its core skill set of antibody engineering, the company has established a broad range of academic partnerships and seeks innovation and biological insights in many different places.

argenx’s strategy is to identify those research groups that are genuine thought-leaders in the field, engage with them, learn about their work, build partnerships with those academic groups, and start developing drugs together.

It works closely with academic collaborators, creating multidisciplinary teams that include both argenx employees and academics to further its knowledge. It gets involved in programmes at a very early stage to help de-risk each project.

Platform technology

argenx utilises a unique antibody discovery platform that helps to identify and develop antibodies that target specific disease-causing proteins, harnessing the power of the immune system.

The process starts with the immunisation of llamas with a target protein. Llamas have a unique immune system, and using them as a source of antibodies offers advantages in terms of greater antibody diversity, including those that humans typically do not possess. Llama-derived antibodies are also similar enough to human antibodies to reduce the number of further modifications required and increase the chances of succeeding in developing a safe and effective drug.

Once the animals have been immunised, argenx extracts peripheral blood cells and isolates the genetic material responsible for antibody production. This genetic material is then used to generate large and diverse libraries of antibodies. This allows argenx to access and explore a broad antibody universe while reducing the long timelines associated with traditional methods.

Once an antibody of interest has been identified, a lot of work is then needed to modify it into a drug product. argenx has a range of technologies to design drugs that are suitable in terms of safety, efficacy, and patient convenience.

Scalable success

Building on the pioneering work of Professor Sally Ward at The University of Texas Southwestern on identifying the importance of the Fc receptor in the regulation of our immune systems, argenx collaborated with her group to develop its first commercial product, VYVGART. This first-in-class therapy has the potential to treat a broad range of autoantibody-medicated diseases by targeting the Fc receptor.

VYVGART launched in 2021 and is already annualising at over $1bn in sales for the treatment of one autoantibody-mediated disease, generalised myasthenia gravis (gMG). A chronic autoimmune neuromuscular disease, gMG causes weakness in the muscles, typically beginning around the eyes and eyelids, and then progressing to other parts of the body. For VYVGART, gMG is just the beginning. There are over 100 autoimmune diseases for which VYVGART may be a potential treatment option.

Recently, argenx reached another crucial milestone with a home-run Phase 3 clinical trial outcome for VYVGART in chronic inflammatory demyelinating polyneuropathy, or CIDP. CIDP is a neurological disorder where the immune system targets the body’s nerves and involves progressive weakness and reduced arm and leg senses.

Before the trial results, there was a general assumption that VYVGART would be suitable for around 40 per cent of CIDP patients and, therefore, the market would be limited. However, the trial demonstrated that it is suitable for the majority of cases, significantly broadening the market opportunity. argenx will likely dominate the treatment landscape in CIDP and displace the current treatment options, which are associated with significant drawbacks.

Many autoimmune diseases have no current treatment options and are massively debilitating for sufferers, reducing life expectancy in many cases. The majority of them are classified as rare diseases. In the US, this is defined as a disease affecting fewer than 200,000 people.

From a commercial perspective, this means the capability required to successfully promote new product launches requires only limited sales and marketing investment, as only a small number of prescribers manage these patient populations. Reimbursement for products designed to treat rare diseases is typically high to incentivise the development of drugs to treat unmet clinical needs.

Given the broad applications of VYVGART, argenx is having to prioritise which of these diseases it develops a treatment for next. The criteria are understanding the biology of each disease first, then the clinical unmet need and the commercial opportunities.

Management aims to have VYVGART either commercially available or in clinical development for 15 indications by 2025. We expect this number will continue to increase over time. Not all indications have the potential to generate $1bn in revenue, but the potential for VYVGART to be the biggest-selling drug for autoimmune disease is very real. It could become the biggest-selling drug of all time.

A position of strength

argenx has already created significant value for shareholders with the successful delivery of its first commercial asset. With high-margin revenues, healthy operating cash flow growth, and a robust balance sheet, argenx is investing in its future growth prospects from a position of strength. Following a recent $1.1bn equity capital raise, management now has $3bn to deploy, allowing it to accelerate investments in both product pipeline assets and commercial capabilities.

Beyond VYVGART, argenx is already developing its next two products, both targeting different areas of biology. Both of these assets are already in clinical development, with further proof of concept studies due to start later this year.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in October 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

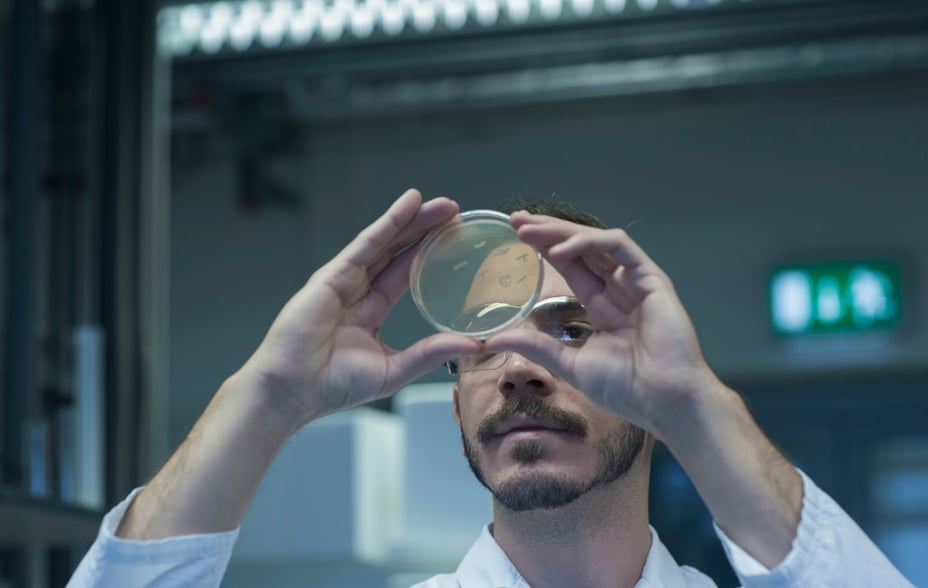

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 62546 10037482