Investors should consider the investment objectives, risks, charges and expenses carefully before investing. This information and other information about the Funds can be found in the prospectus and summary prospectus. For a prospectus and summary prospectus, please visit our website at bailliegifford.com/usmutualfunds. Please carefully read the Fund's prospectus and related documents before investing. Securities are offered through Baillie Gifford Funds Services LLC, an affiliate of Baillie Gifford Overseas Ltd and a member of FINRA.

As with any investment, your capital is at risk. Past performance is not a guide to future returns.

As active investment managers, the above question is existential for us. One of our Shared Beliefs states that ‘Our style of active investment management will add material value over the long term’. This isn’t just a soundbite or a nice-to-have, and it’s no coincidence it’s the first Shared Belief. It’s the reason our clients pay us.

Investors can access the market return by buying index funds, which are available at very low cost because it requires no research to invest in everything. If we don’t add material value above those index funds, and against competitor active managers, our future will hold some serious challenges.

The reason to not ‘just invest in the index’ is because there are a few good active managers out there who have shown themselves able to achieve better-than-index investment returns over long periods and, therefore, better outcomes for savers.

Baillie Gifford is one of those managers. This post is not a defence of active management generically - that would be pretty hard to do - it’s a defence of the thoughtful, real-world, fundamental deployment of capital by companies, generating growing cashflows over long periods, and thereby investment returns for their shareholders.

How do we stack up?

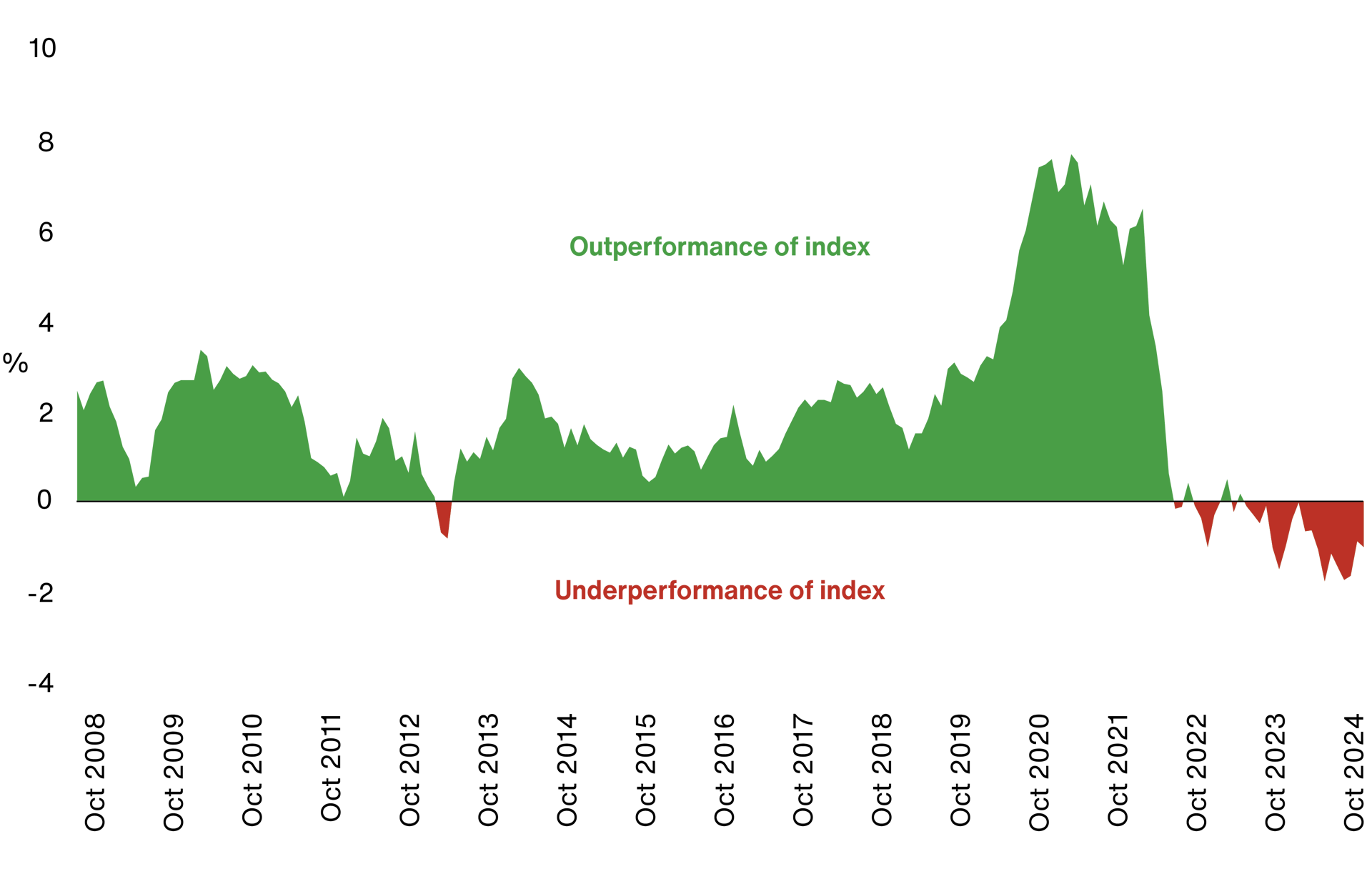

The good news is that over rolling five-year periods, which is a sensible period over which to measure success, Baillie Gifford’s approach very commonly adds value for clients.

Source: BNYM, Revolution and relevant underlying index providers.

We take the rolling 5 year NAV return for each Mutual Fund and the corresponding benchmark for every month that a 5 year return is available back to the inception of each share class used. We then take the geometric relative return of the NAV and benchmark return each month. Once we have the rolling 5 year geometric relative return for each month across all the Mutual Funds we take an average of these. In charting this, we looked at each funds outperformance (or underperformance) compared to the fund's relevant index over five-year periods for each quarter since that fund's inception. The returns presented above are net of fees. For more details about performance please visit the Baillie Gifford website. Past performance is not a guide to future returns. The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance please visit our website at www.bailliegifford.com/en/usa/non-professional-investor.

The vast majority of the time, we outperform the market for those who measure success over the same timeframe that we do. For periods of less than five years, the consistency of added value is progressively less. Why is this? It’s because many, many participants in stock markets are speculatively trading against each other.

These ‘investors’ (they’re not really investors) don’t care about the real-world progress of the companies they’re buying and selling, they simply see shares as vehicles for betting against others in some giant game of bluff. Only in the long term can we confidently say that share prices tend towards their intrinsic value – that is, the present day value of expected future cashflows from the underlying companies.

Trusting the process

Right now, we’re not on average outperforming over five years for our clients. This puts us in a tough spot, but it’s one that we can explain. Sometimes the market values of certain categories of companies get really far out of kilter, as they have for growth stocks in recent years, first on the upside and more recently on the down.

Occasionally, even five years isn’t enough to remove the noise. But our clients expect us to stay committed to our investment style—they have other managers who offset our ups and downs and clear expectations of the role we play in wider portfolios. The worst thing we can do is flip-flop our investment style.

However ‘just wait longer until we come back into fashion’ isn’t a terribly persuasive argument, even if it’s in large part true. We also need to constantly revisit our analysis of individual companies, checking our assumptions and expectations about what those companies might achieve.

We meet the management of those companies to reassure ourselves that they see the same opportunities that we envisage, and are working ambitiously towards achieving them. We consider whether anything in the wider environment has changed the outlook for the companies we favour, and we determinedly stay focused on the long-term direction of travel even as others drive share price volatility.

These are the hallmarks of successful active managers: the rare academic studies that don’t just lump all active managers together show that those with low turnover and high tracking error (that is managers who have conviction and who don’t fixate on short-term share price movements) have a much higher chance of outperforming in the long run.

Looking beyond the horizon

The index is often said to be backwards-looking, whereas more imaginative investors are forward-looking and can identify undervalued securities. This is an over-simplification: the index is forward-looking too. Prices are set by the balance of opinion of where people think the share price is going next. Nobody invests at yesterday’s share price.

The more nuanced and more valid point is that most investors just aren’t good at looking very far ahead, and in particular identifying change. Speculators aren’t even thinking about that – they’re just betting with each other. Up or down? Some can do this, but few are right consistently. More thoughtful investors try harder, but find it very difficult to embrace the uncertainty that comes from investing in companies that have new technologies or business models, or are just in a good place to take market share.

So, it’s not that the index is backward looking, it’s that most investors don’t look very far forward and avoid uncertainty.

Baillie Gifford is not the only good investment company. We try to be among the best, and we structure our whole company to allow us to stick to our long-term approach. Being worker-owned is an incredible luxury as it means we don’t have outside interests with time horizons that don’t align with our values.

Others may be structured differently, but the common thread among the best investment firms is the ability to think long-term, seek constant improvement and be unwavering in our investment styles.

Is it only about investment performance?

Errrr... kind of? There are many other things we do that add value – excellent client service ensures that clients understand how we’re doing, and that we’re always acting in their best interests. This helps us through more difficult times. We don’t just invest – we act as engaged owners of companies, holding management to account and encouraging them to be ambitious.

Some of our strategies deliver not just investment returns but also focus on controlling risk and volatility for clients to whom that is important. In private companies we might offer access to investments that clients simply can’t get anywhere else. We report to and help clients with the challenges they face, such as emissions reporting and regulatory returns. We work very efficiently with clients’ other service providers including custodians, auditors and others. So, it’s not only about performance, but none of those things in the end are enough if we don’t deliver after-fees returns that beat the index.

Going back to the question at the start: why not invest in the index? The answer to this is because it’s possible to do better. But pay careful attention to our Shared Belief: it is our style of active management that will add value in the long term. Others may approach it differently and that’s up to them.

Our job is to persuade and reassure investors that by working with us there is the opportunity of better than index returns. We can't rely on our past successes to tell us what returns will be in the future, but we do aim to make history repeat itself.

Important information and risk factors

The Funds are distributed by Baillie Gifford Funds Services LLC. Baillie Gifford Funds Services LLC is registered as a broker-dealer with the SEC, a member of FINRA and is an affiliate of Baillie Gifford Overseas Limited. All information is sourced from Baillie Gifford & Co unless otherwise stated.

As with all mutual funds, the value of an investment in the Fund could decline, so you could lose money. International investing involves special risks, which include changes in currency rates, foreign taxation and differences in auditing standards and securities regulations, political uncertainty and greater volatility. These risks are even greater when investing in emerging markets. Security prices in emerging markets can be significantly more volatile than in the more developed nations of the world, reflecting the greater uncertainties of investing in less established markets and economies. Currency risk includes the risk that the foreign currencies in which a Fund’s investments are traded, in which a Fund receives income, or in which a Fund has taken a position, will decline in value relative to the U.S. dollar. Hedging against a decline in the value of currency does not eliminate fluctuations in the prices of portfolio securities or prevent losses if the prices of such securities decline. In addition, hedging a foreign currency can have a negative effect on performance if the U.S. dollar declines in value relative to that currency, or if the currency hedging is otherwise ineffective.

For more information about these and other risks of an investment in the Funds, see “Principal Investment Risks” and “Additional Investment Strategies” in the prospectus. There can be no assurance that the Funds will achieve their investment objectives.

129511 10051943