© Getty Images/iStockphoto

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. This information and other information about the Funds can be found in the prospectus and summary prospectus. For a prospectus and summary prospectus, please visit our website at bailliegifford.com/usmutualfunds. Please carefully read the Fund's prospectus and related documents before investing. Securities are offered through Baillie Gifford Funds Services LLC, an affiliate of Baillie Gifford Overseas Ltd and a member of FINRA.

As with any investment, your capital is at risk.

For one, the workforce shrinks. The dependency ratio (the share of retirees to working-aged people) is rising globally. Entire economies will have to adapt to rising labour costs, lower productivity, higher workforce turnover, and changes in wealth distribution.

The pace of change might be slow – but its momentum, scope, and second- and third-order implications can be unpredictable. The UN have consistently missed the speed at which birthrates worldwide have fallen. Business leaders and politicians with a 4–5-year time horizon might underestimate the extent of the looming demographic crisis, but as long-term investors, our decades-long timeframe can help us anticipate it.

To paraphrase Hemingway, change happens “gradually, and then suddenly”. There will be challenges, but also chances for innovative companies to step up with solutions to the demographic crisis.

Virtually every stock held in the International Alpha strategy – one of our flagship funds available for US clients – will be affected, but some are especially well-positioned to seize the opportunities this globally urgent problem poses. Three areas are particularly worth highlighting, bearing in mind that all of our international specialist portfolios have varying degrees of exposure to these themes:

1. The management of age-related health conditions will be critical in supporting a larger elderly population and reducing the burden on healthcare providers.

This is as much, if not more, about long-term management of chronic health issues as it is about curing acute conditions. Roche is leveraging its investment in computational biology to augment its rich pipeline of medicines for age-related diseases such as Alzheimer’s, Parkinson’s, and vision loss. The company's additional focus on diagnostics complements this – with it, Roche could own the entire disease value chain: from detection, to management, to monitoring of a devastating disease such as Alzheimer’s.

Severe hearing loss is another growing public health issue. A quarter of all over-60s suffer from debilitating hearing loss, and this number is set to rise over the next decades. Product innovation, spearheaded by Demant, is helping destigmatize hearing aids and increase market penetration.

Finally, more and more solutions are emerging for the early detection, prevention, and eradication of cancer. BioNTech is building on decades of research on cancer and the immune system to bring revolutionary therapies to market, re-investing the proceeds from their Covid vaccine into a vast pipeline of new antibody drugs and mRNA therapies. Their mission: conquer cancer – whether it takes existing tools or newly invented ones.

On the prevention side, Olympus leads the market for endoscopes used in colonoscopies, which is by far the most prevalent early detection screening technique for colon cancer. Every American over 45 is recommended to have a colonoscopy every 10 years.

Endoscopes are also increasingly used for non-invasive surgery. Another portfolio company, Ambu, is innovating here through its single-use endoscopes, to decrease the risk of post-surgical infection – which is both more likely and more dangerous in elderly patients.

2. An ageing population needs funding for retirement and healthcare.

This is especially true for countries like China, where the onset of the demographic crisis has happened more quickly than in other countries. China's over-65 demographic, currently at 14 per cent, surpassed Japan's 1993 figure in just six years – a process that took Japan nearly a decade. Within the next 20 years, China's over-65 population is expected to outnumber the entire US population.

Providing for the retirement and healthcare needs of such a large and ageing population is impossible without a thriving private insurance sector. Ping An, for instance, is transforming itself into a health and elderly-care financial services provider by building a new healthcare ecosystem that integrates 'heart-warming' insurance – which encompasses health protection, medical and elderly care, and daily life services – with professional care and life insurance.

© Terry Vine/Blend Images LLC/ GalleryStock

AIA’s premium insurance products, on the other hand, benefit from growing demand within a rising class of older affluent Chinese for retirement savings and high-end pension services.

Elsewhere in the world, retiring entrepreneurs are grappling with succession planning and liquidating the proceeds of their lives’ work to fund their retirement. This phenomenon is particularly acute in Japan: by 2025, 64 per cent of the country’s small and medium-sized enterprise (SME) owners will be over 70, and half of them don’t have succession plans in place.

Nihon M&A Holdings is the Japanese market leader in SME mergers and acquisitions services, offering strategy consultancy, matching services, deal implementation, and operational support to retiring founders. Japan was early to this phenomenon, but other countries are following – meaning Nihon can capitalise on its existing network and expertise to expand globally.

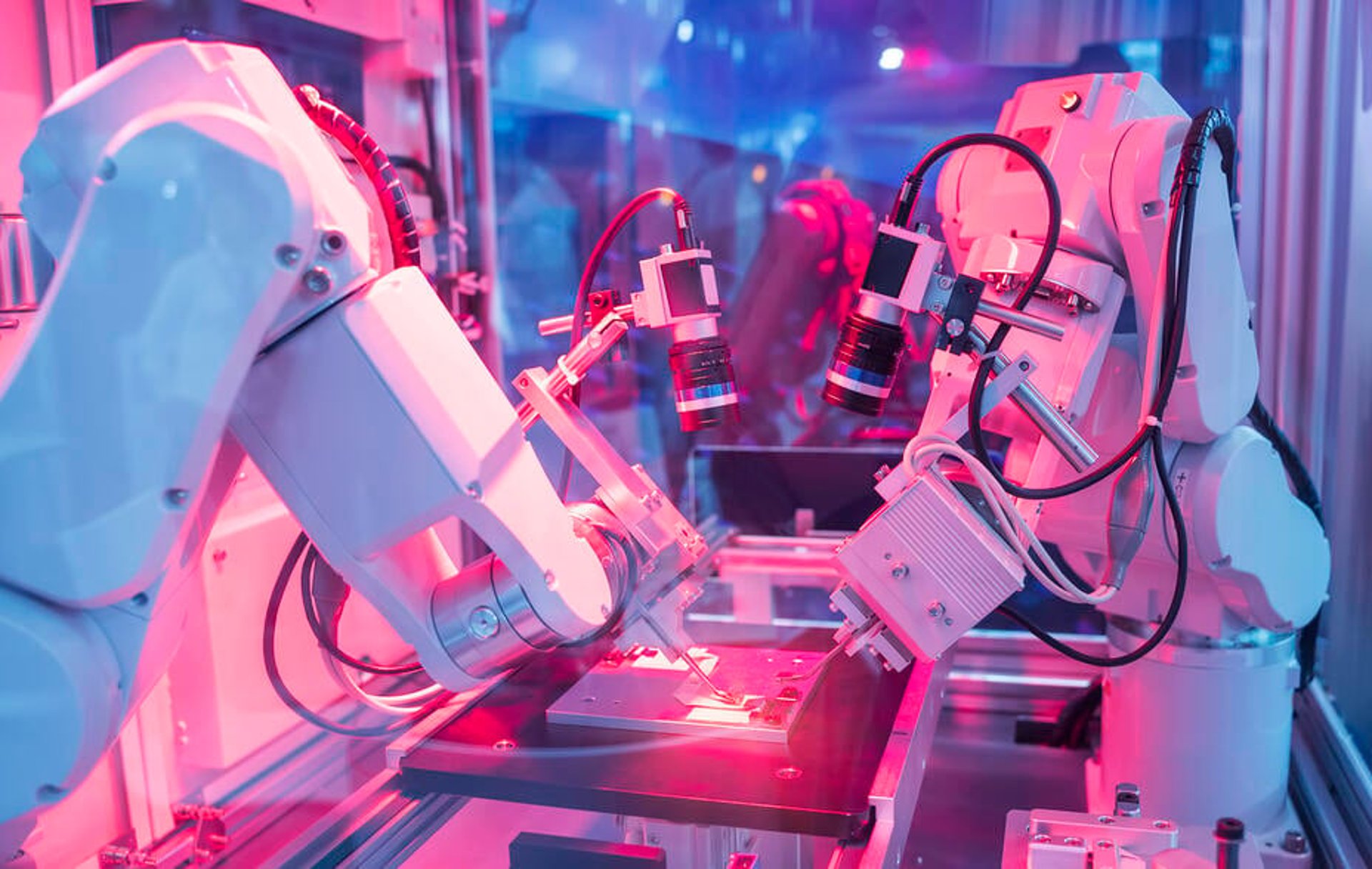

3. The final piece of the demographic puzzle is solving labour shortage and productivity problems that come with a shrinking workforce.

This area is rich with opportunities that many of Baillie Gifford's international portfolio companies are well-placed to capture. Having access to fewer and more expensive workers means that the demand for industrial and process automation, digitalisation, and outsourcing non-core activities rises exponentially.

It is no coincidence that Japan has been the pioneer of industrial automation, and the country’s champions are poised to expand their global reach. Fanuc, which has been part of the international portfolio since 1999, is the world-leader in industrial robots and has maintained its edge against intensifying competition through the quality and reliability of its products.

Thanks to Keyence’s machine vision systems, manufacturing companies can completely automate processes like visual quality inspection, reducing labour costs while improving reliability by ensuring high-quality and defect-free production.

Industrial software developed by Dassault Systèmes, the world leader in digital twins, can help with monitoring and controlling all automated processes in a production site through a unified system.

But process automation isn’t only valuable in manufacturing – it is revolutionising business operations, too. Monday.com’s workflow management tools are disruptive in their simplicity and ease of adoption and have helped customers as diverse as Canva, Glossier, and Coca-Cola cut production times and save on administrative tasks.

SAP’s full suite of business operations, technology, and planning software for large enterprises also benefits from the growing demand for process automation and productivity tools in the private sector, unlocking billions of dollars of value by helping companies run more efficiently.

© Getty Images/iStockphoto

As the world’s population gets older and the workforce shrinks, major global economies will have to adapt, meaning industries as diverse as healthcare, finance, and manufacturing will need rethinking. This opens huge opportunities that innovative companies can exploit.

Some of these already feature in Baillie Gifford's international portfolios; others, like humanoid robots, AI-powered telemedicine, and novel therapeutics, are just emerging but already on our radar. As long-term investors, our aim is not just to remain resilient to future shocks caused by the demographic crisis, but also ready to unlock value from innovative companies positioned to solve these challenges.

Important information and risk factors

The Funds are distributed by Baillie Gifford Funds Services LLC. Baillie Gifford Funds Services LLC is registered as a broker-dealer with the SEC, a member of FINRA and is an affiliate of Baillie Gifford Overseas Limited. All information is sourced from Baillie Gifford & Co unless otherwise stated.

As with all mutual funds, the value of an investment in the Fund could decline, so you could lose money. International investing involves special risks, which include changes in currency rates, foreign taxation and differences in auditing standards and securities regulations, political uncertainty and greater volatility. These risks are even greater when investing in emerging markets. Security prices in emerging markets can be significantly more volatile than in the more developed nations of the world, reflecting the greater uncertainties of investing in less established markets and economies. Currency risk includes the risk that the foreign currencies in which a Fund’s investments are traded, in which a Fund receives income, or in which a Fund has taken a position, will decline in value relative to the U.S. dollar. Hedging against a decline in the value of currency does not eliminate fluctuations in the prices of portfolio securities or prevent losses if the prices of such securities decline. In addition, hedging a foreign currency can have a negative effect on performance if the U.S. dollar declines in value relative to that currency, or if the currency hedging is otherwise ineffective.

For more information about these and other risks of an investment in the Funds, see “Principal Investment Risks” and “Additional Investment Strategies” in the prospectus. There can be no assurance that the Funds will achieve their investment objectives.

| Companies held by Baillie Gifford |

|---|

| Roche |

| Demant |

| BioNTech |

| Olympus |

| Ambu |

| Ping An |

| AIA |

| Nihon M&A |

| Fanuc |

| Keyence |

| Dassault Systèmes |

| Monday.com |

| SAP |

As at December 2024

128505 10051848