Key points

- Decades of infrastructure neglect and disrepair in the US are giving way to an age of lavish spending

- Investment opportunities abound thanks to new laws to renew the nation’s transport, power transmission and broadband networks

- Long-term focused infrastructure suppliers including Comfort Systems, Advanced Drainage Systems, Stella Jones and Martin Marietta are poised to profit from bottlenecks in demand

WATCH: Investment manager Michael Taylor (right) explores exceptional companies rebuilding the US’s infrastructure in his Disruption Week briefing

Your capital is at risk.

Grubby, muddy, heavy and… lucrative: the companies set to benefit from the US’s rebuilding of its decayed roads, bridges and utility networks are totally free of hi-tech glamour.

But for those with eyes for the opportunity, argues investment manager Michael Taylor, there’s gold amid the grime. It’s thanks to what he calls the “infrastructure renaissance”.

“Infrastructure – the physical stuff that allows other stuff to move around – is considered boring because if it works, you don’t realise it’s there,” Taylor says. “The tap works. The trains run. You flip a switch, and the lights come on.”

The companies that make this happen are as unnoticed by the general public as they are indispensable. Stella-Jones is one example. The Canadian firm provides nearly half the wooden utility poles supporting the US’s power and communications grid.

Stella-Jones makes pressure-treated wooden products, including utility poles for the US’s power grid

Its specialist team scours North America’s forests for the 5 per cent of trees tall and straight enough to make usable products. Wooden poles are not, in themselves, exciting. But to investors, Stella-Jones’s dominance of the essential product’s supply very much is.

“The demand and supply imbalance should be good for pricing over the long term,” says Taylor. “That’s a pretty powerful recipe for profit growth.”

Cyclical industry

In total, US lawmakers have authorised more than $2tn of spending on infrastructure over the coming years. The American Society of Civil Engineers has said more than $5tn is needed. But whatever the final figure, it’s clear huge amounts must be committed to avoid things falling apart.

Taylor says that spending on physical essentials works in historical cycles. The post-war peak of infrastructure spending in the US was in 1967 with 2.5 per cent of GDP, but it subsequently slumped to little more than 1 per cent, far below the proportion spent in competitor economies, notably China.

That is now being put right with a raft of recent US government legislation focused on transportation, energy, water, broadband and climate resilience.

“The key thing to remember here is these cycles are tremendously long, Taylor says. “We’re not talking about a business cycle that might last a few years or even housing cycles that last five to 10. These are multi-decade cycles, so I expect to hold shares in the companies involved for many years to come.”

While much of the planned spending was signed into law by the Biden administration, Taylor expects infrastructure to remain a priority in the second Trump presidency, although some individual projects may fall by the wayside.

“The ability to get to work easily, the resilience of the electrical infrastructure, flooding: these things affect all Americans,” he explains. “Any administration has to confront those problems. Their scale makes this a bipartisan issue. That gives me a degree of comfort at the federal level.

“But much of the spending will take place at a state level. So while President Trump might not be the biggest fan of, say, renewable energy, if California and New York want to spend money on it, they will. And Trump broadly does support infrastructure investment, but he’ll put his own nuances on it.”

Storm damage

How did this need arise? Taylor explains that infrastructure was previously considered too mundane to catch the political limelight. The result is that there’s a lot to fix.

“A quarter of bridges in the US are structurally deficient,” he says. “Fibre broadband penetration is lower than in much poorer countries in South America.”

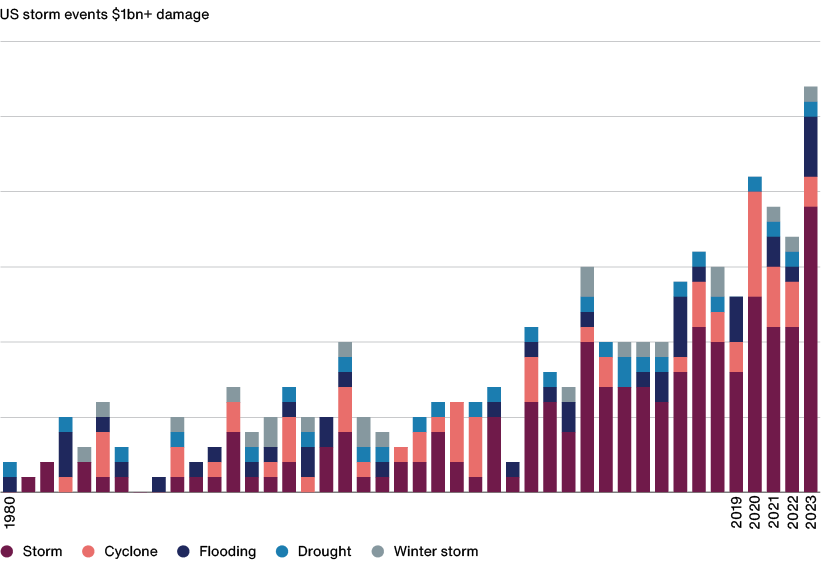

An increase in the frequency of wild weather has also focused minds.

Source: NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2024). https://www.ncei.noaa.gov/access/billions/

Advanced Drainage Systems (ADS), which produced the storm chart above, helps minimise the impact of heavy rainfall by selling products that collect water in underground basins and then transport it away to minimise flooding – filtering and treating the liquid before its release. It exemplifies our interest in companies positioned to benefit from current or anticipated supply chain bottlenecks.

The Ohio-based firm largely makes its drainage systems from recycled plastic. It can even make them close to the construction site with a portable injection moulding machine twice the length of a double-decker bus.

Advanced Drainage Systems can reassemble its giant injection moulding machine wherever it's needed

© ENGEL

Plastic drains have several advantages over the concrete systems they are replacing. They don’t crack, last longer and cost less.

“One of the big bottlenecks at the moment in the American construction industry is skilled labour,” adds Taylor. “Concrete is big, heavy, takes lots of trucks to get to the site and cranes to lift up and get into the ground. That takes a lot of workers and time. By contrast, plastic is lighter and easier to install.”

ADS is 15 times bigger than its nearest competitor and produces 60 per cent of the restricted supply of these utilitarian items. Currently, about 40 per cent of US piping is plastic, giving the company a long runway to further growth.

Gravel's growth

Aggregates supplier Martin Marietta is another Baillie Gifford infrastructure holding. The North Carolina company benefits from the fact gravel is uneconomic to transport beyond about 60 miles. That leads to local monopolies in the product’s supply.

Martin Marietta owns a large proportion of the quarries producing a product critical to repairing and creating roads, bridges, dams, ports, coastal protection and building foundations. Furthermore, it recently extended its presence by buying up existing operations in Alabama, South Carolina, Florida, Tennessee and Virginia.

“It’s pretty hard to build quarries,” Taylor notes. “Permitting is difficult. Not many new ones are being constructed. So that leads to a real supply-side advantage which expresses itself in pricing power.”

Datacentre cooler

New infrastructure is also required to serve a 21st century megatrend: the growing demand for datacentres to train and run AI models in addition to other online services. The US government has forecast that the number of such facilities will grow by 9 per cent annually between now and 2030.

Their computing equipment generates huge amount of heat, requiring vast, complex air conditioning and water-cooling systems. That plays to Baillie Gifford holding Comfort Systems’ favour.

Houston-based Comfort Systems installs and maintains cooling systems in data centres and other businesses

© Comfort Systems USA

The firm is based in Texas, close to the datacentre hotspots of Dallas-Fort Worth and North Virginia. It provides mechanical electrical and plumbing services and can help these giant installations optimise their energy efficiency.

“Comfort Systems has seen lots of examples of how to do this well, what the optimal way of fitting out the datacentre is, so it can also share best practice with its clients,” says Taylor.

“So if, during construction, your facility needs to become larger or use new types of chips, it can help you adapt to those changes. You could almost characterise it as a consultancy in some ways because it is an expert in this pretty niche but very important activity.”

Demand and talent

Infrastructure used to be seen as a place to lose money given the unreliability of funding and the weight of debt surrounding major projects.

Taylor and his colleagues base their conviction in some of the sector’s exceptional companies on a combination of strengthening demand and finding strong leadership capable of seizing this long-term opportunity.

“Baillie Gifford is a company which invests in outliers,” says Taylor. “And what we have here is the potential for volumes, pricing, margins all to inflect at the same time and for managing teams to invest really profitably.

“All of this is available at really quite reasonable valuations. So it’s time to be excited.”

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Words by Colin Donald

124230 10051043