Key points

The Global Alpha Team shares insights on Q4 2024, covering the strategy's recent performance, portfolio adjustments, and market influences.

Your capital is at risk.

2024 was a good year for equity returns. The Global Alpha portfolio delivered a double-digit return in US dollars, but this was outmatched by rising global equity indices.

We focus on much longer time frames in our investment thinking; five years and beyond. That’s where the market inefficiencies around growth companies tend to show up reliably. They are apparent even on a three-year view, which is the furthest out the analyst community is generally willing to look. The grid below highlights these features by showing the returns for groups of companies based on delivered growth versus starting analyst consensus expectations. Companies that deliver the most growth tend to produce the best returns to shareholders. This holds even when starting expectations are higher, though this eats a little into the returns. People can still underestimate the impact of growth while expecting it to happen. Of course, companies that grow a lot from low expectations produce the best returns of all.

Source: Baillie Gifford, FactSet, MSCI | USD

MSCI ACWI. Rolling quarterly 3-year attributions from March 1999 to December 2023.

Our approach aims to capture these enduring market inefficiencies in as many ways as possible. Rapidly growing disrupters can outpace high starting valuations to deliver big returns. Well-known businesses can compound their way to glory in established markets if you give them enough time. And great growth companies can emerge from unfashionable parts of the stock market where expectations have sunk too low.

We have reflected on why we have not captured enough of these opportunities over the past five years. We allowed successes from early-stage disrupters to become too large a part of the portfolio during Covid. We have also worked through a poorer period of returns from our Chinese holdings, which we have since repositioned, and adapted to the sustained outperformance from some of the largest US technology businesses.

We’ve learned important lessons from this period, built better portfolio analysis tools, and improved our processes. None of those inhibit our philosophical ambitions, and we continue to invest across all three of our growth profiles. The opportunities to outperform by finding disruptive, durable, and unfashionable growth companies are as strong as ever.

Coming back stronger

The good news is that, with lessons learned and the portfolio recalibrated, we are in a wonderful position to deliver on those opportunities.

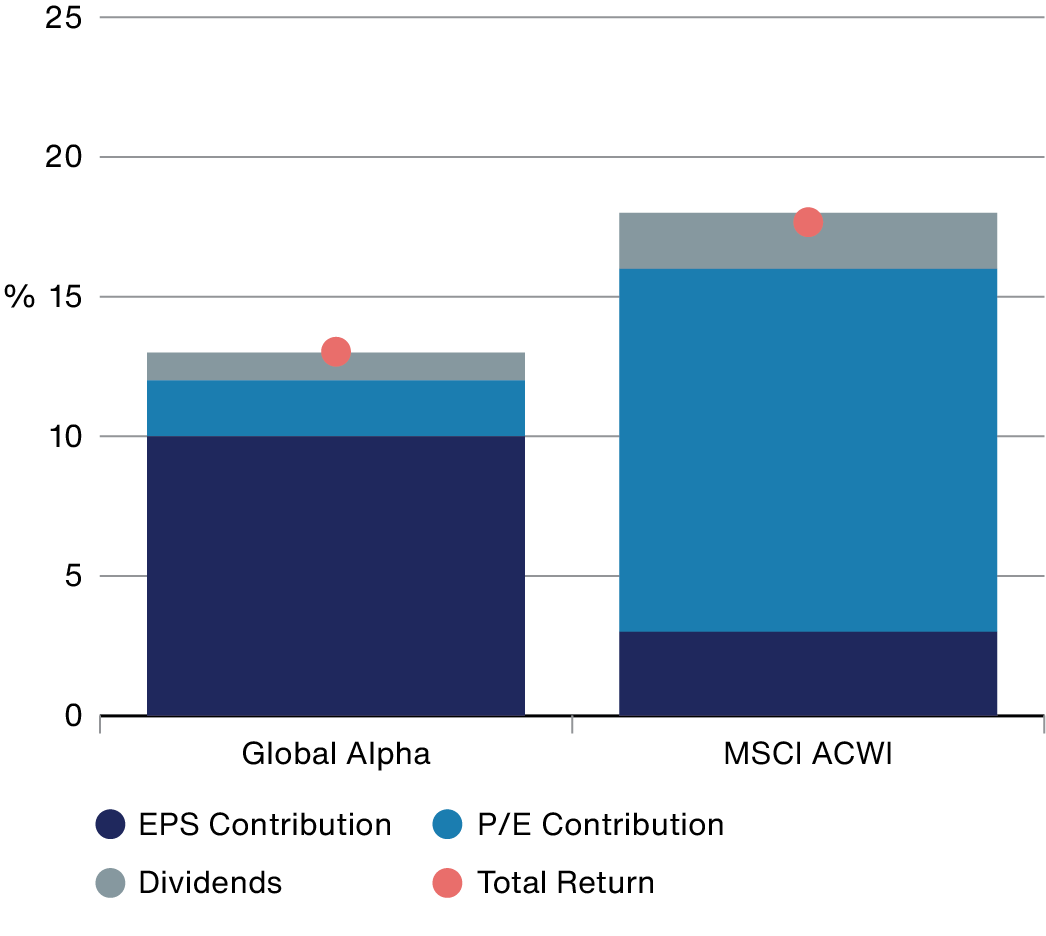

Most of the market return in 2024 came from valuation expansion. Most of our return came from growth. Our return feels inherently more sustainable. We’ve been taking the chance to build positions in holdings where the return opportunity looks greatest while moderating positions where the valuation has heated up relative to growth prospects. Some of that repositioning might have come at the cost of returns in 2024, but we think this will produce substantial payoffs in the years ahead. The broad base of growth drivers that we’ve brought into the portfolio has improved our resilience without compromising on growth. Our valuation premium over the stock market has more than halved over the past two years.

Source: Baillie Gifford, FactSet, MSCI | USD

MSCI ACWI. Return decomposition for Global Alpha and the MSCI ACWI Index from 29th December 2023 to 3rd January 2025.

This places the portfolio on solid foundations which are strengthening relative to the wider market. Our holdings are delivering more growth, have become more cash generative and continue to reinvest at higher rates than the index. We’re excited about the prospects of rewarding our investors, whose willingness to stay the course through the inevitable ups and downs is central to our ability to take a long-term view.

Growing to the sky

Tremendous market attention has been lavished on the largest technology companies, and with good reason. One thing that unites these disparate behemoths is their prodigious cash generation. They have invested at scale in artificial intelligence infrastructure, where the returns are uncertain but carry huge potential. We agree with some of this enthusiasm, but our convictions look very different to the market. We don’t see enough long-term upside from Apple’s current valuation even though we admire its business. Tesla’s valuation asked too much of its nascent ventures in our view to justify its place, and we’ve reduced Alphabet over the year as its core advertising business faces challenges. We have retained large positions in Microsoft and Amazon and have expanded the NVIDIA position in increments over the past couple of years; including another addition this quarter. Our large holding in Meta is based on its ability to deploy AI at scale as few other businesses globally can, and it is building a huge lead over its social media competition. There’s value in being selective at the top end of markets, particularly when market consensus appears unable to imagine a change to the status quo. Immovable objects have a habit of shifting if you watch them for long enough, and the past century of market returns would suggest that the top end of the index tends to repopulate over time.

Breaking out from this group of stocks, companies in the AI value chain represent over a quarter of the portfolio. This spans from the materials suppliers to consumer applications and we expect that we’ll continue to find underappreciated opportunities where scarcity and competitive edges will drive profitable growth. We’ve added to TSMC, the world’s pre-eminent chip manufacturer, this quarter. It looks well-placed in most scenarios but sits at an undemanding valuation. We have reduced the power management business Eaton. We remain enthused about its growth prospects as power grids modernise but have seen some of that potential recognised by share price rises that appear to be attached to Eaton’s booming data centre business.

Holding the very best

We cited an excess of earlier-stage disrupters as a headwind in recent years, and we have worked through those that no longer made the grade in tougher times. We sold the online home furnishings retailer Wayfair, the enterprise software business Snowflake, and disruptive healthcare businesses Novocure and Exact Sciences from the portfolio earlier in 2024.

We have held the best of these businesses through a period of adjustment and we’re now seeing them return to growth with vastly enhanced financial characteristics. They are still growing rapidly from leaner cost bases by pursuing more focused forms of growth. The advertising platform The Trade Desk is growing revenues at 27 per cent p.a. by consolidating the purchase of advertising on the open internet on its platform while producing a 35 per cent free cash flow margin. The ecommerce platform Shopify sold its logistics business to focus on its ‘core quest’ of building better software tools for its merchants. It is growing revenues at 26 per cent a year while generating a 19 per cent free cash flow margin. These are huge shifts from the “growth at all costs” mantra that was almost universal a few years ago. This level of adaptability is only possible because of the strength of each company’s competitive position. Change has been delivered by founder CEOs who have the authority to make bold choices.

We’ve taken the chance to moderate some position sizes this quarter (having added to them previously), including The Trade Desk and Shopify, as share prices have risen with this strong progress. Our “Disrupters” remain the largest single grouping in the portfolio, but there’s not much separating the three groups.

We have reshaped our Chinese and China-related holdings over the past couple of years. We have reduced the number of consumer platforms we invest in and exited from holdings that depend on cross-border trade in favour of industrial companies that are more aligned with the social and economic agenda. Chinese-listed holdings remain a small part of the portfolio following modest additions during the quarter to the ecommerce business PDD, and the EV maker Li Auto. Li Auto is among a group of Chinese competitors wrestling the lead away from any Western car maker. We also added to the Dutch-listed Prosus, which holds a stake in the internet giant Tencent.

Growth in established markets

Huge paradigm shifts in technology drive great growth opportunities, but companies don’t always need to move the earth to create great returns.

The coffee chain Dutch Bros need ‘only’ add $8bn to its market capitalisation to double from here. Dutch Bros’ leverage is in the format it offers and the habits it creates. It offers personalised, stronger, and sweeter drinks than traditional coffee chains in a highly sociable setting. We can see how this format could roll out for years across the US and take share from the established chains. The number of Dutch Bros stores could more than double by the end of the decade and even then it will still have lots of growth to go for in its home market. Because their customers tend to be younger, they may even fundamentally shift consumption habits. Bitter espresso is, after all, an acquired taste that is initially tolerated for the caffeine benefit. What happens if consumers never have to acquire it?

The US car parts retailer Autozone is another recent purchase that we added to this quarter. Recent growth has been slow against a tougher consumer backdrop, but, like Dutch Bros, Autozone’s dedication to the customer experience sets it apart. It has the largest share of a fragmented market and an opportunity to roll out its store network for several years. Although it is an established operator, it has only more recently begun to serve mechanics and garages. Its store network gives it an immediate distribution edge in this untapped additional opportunity. Even if spending on car parts flatlines, Autozone will be able to expand its store network and its range of customers for years. At close to a market multiple, the shares don’t provide nearly enough credit for this durable growth opportunity.

Japanese mobile phone contracts might not sound like a growth market either, but Rakuten’s dramatic entry is shaking things up for the three established providers. We took a holding this year given the progress Rakuten is making. It has spent a lot more than initially expected to add a mobile business to its existing ecommerce and financial services operations but that heavy period of capital investment is behind it and it now has a network architecture that may be materially cheaper than the competition’s. The company had 6 million mobile subscribers when we took a holding in March, passed 7 million in June, and crossed 8 million in October. Prior experience reminds us that companies exiting periods of heavy capital investment can transform their profitability if revenues pour in over a relatively fixed cost base. The upside when that happens can be similarly transformational.

Growth in unfashionable places

We have also found growth potential in companies where cyclical industry pressures can obscure great businesses, occasionally leading to companies trading on low multiples of temporarily low profits. Our time horizon offers us a completely different view. While we can’t predict the timing of inflection points in industries or in stock market sentiment, we can establish holdings when expected returns look high if growth comes through. And wait.

The builders’ merchant Builders FirstSource trades on a low multiple of profits. It’s hard to see much value to be added in providing framing timber for house construction, but Builders FirstSource is using its scale to shift towards higher margin finished products like preassembled panels, roof trusses, doors and windows. They can provide a design service to contractors too, essentially delivering a timber kit to site for assembly. That saves time and labour and reduces waste. Smaller merchants can’t make a return on the investments required to compete with Builders FirstSource, and its lead will widen as it grows. We added to this relatively new position during the quarter.

Our new position in Brookfield takes building to a different scale. It is an alternative asset manager that develops and runs real assets from commercial real estate to power infrastructure, providing another way to benefit from the need to rebuild and upgrade. It is well-financed, is raising funds, and is poised to compound its earnings at 10-15 per cent for years. The shares trade at a discount to the intrinsic value of the assets, or below a market multiple for next year’s earnings. Its complexity may be off putting for some, but there’s a compelling growth opportunity and a superb record of smart capital allocation to back.

The outcome

We end the year with a portfolio that is well-balanced across the three growth profiles, and with a deliberate tilt towards the more disruptive growth companies where the outcomes still look particularly attractive. We have not delivered outperformance during 2024, and we appreciate that this will be a source of frustration. Instead, we have adjusted into holdings where the upside opportunities look at their most compelling. The composition of our return, which has still been strong in the absolute, differs substantially from the index. Much more has come from growth than valuation expansion. Our premium to the wider stock market has fallen while the future growth prospects remain strong. We are widening our range of growth drivers within existing themes (like AI and infrastructure) and bringing completely new drivers into the portfolio at the same time. We are grateful for our clients patience over a testing few years. We look forward to repaying their support as we emerge from this spell with lessons learned, applied, and the portfolio strengthened.

This is a Global Alpha commentary. Not all stocks may be held, but themes of this commentary are also representative of: Responsible Global Alpha, Global Alpha Paris Aligned and Responsible Global Alpha Paris Aligned.

Annual past performance to 31 December each year (net%)

|

|

2020 |

2021 |

2022 |

2023 |

2024 |

|

Global Alpha Composite |

36.4 |

7.3 |

-29.1 |

19.5 |

11.1 |

|

MSCI ACWI Index |

16.8 |

19.0 |

-18.0 |

22.8 |

18.0 |

|

|

1 year |

5 years |

10 years |

|

Global Alpha Composite |

11.1 |

6.6 |

9.0 |

|

MSCI ACWI Index |

18.0 |

10.6 | 9.8 |

Source: Revolution, MSCI. US dollars. Returns have been calculated by reducing the gross return by the highest annual management fee for the composite. 1 year figures are not annualised.

Past performance is not a guide to future returns.

Legal notice: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Risk factors

This communication was produced and approved in January 2025 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford

Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

131205 10052436