Nocturnal time lapse at Joby's "Whirly" propeller testing rig. © Joby Aviation.

Listen to this article

This audio is generated using AI

As with any investment, your capital is at risk. Past performance is not a guide to future returns.

JoeBen Bevirt’s childhood was isolated but bucolic - up in the mountains of Santa Cruz, where his parents generated their own power and grew much of their food. Much of JoeBen’s spare time was spent tinkering with agricultural machinery and in 2009, he sought to properly scratch his engineering itch by founding Joby Aviation, with the aim of unshackling commuters from their dependency on decaying terrestrial infrastructure.

In the early days, the development of Joby’s electric Vertical Take Off and Landing (eVTOL) aircraft took place in Bevirt’s parent’s barn. But today, JoeBen has over 1500 colleagues who describe him as someone who can see ten years into the future but also focus on the minutiae of a single rotor blade1. The vision is to revolutionize aviation in a way that doesn’t further compromise the earth’s environmental solvency. “We’re not solving easy problems,” he often reminds his team. “But that’s why what we’re doing matters.” Baillie Gifford has been a shareholder in Joby privately since 2019 and the company IPO’d a year later and we took a holding for the Long Term Global Growth portfolio LTGG in mid-2023.

Since then, Joby has made great strides on a number of fronts. The third stage of FAA Type Certification has been cleared - a critical step in the quest to launch commercial passenger services. The successful test flight programme has continued, leading to pre-commercial operations in Dubai and New York. Deepening partnerships with Toyota and The US Department of Defence have significantly bolstered Joby’s balance sheet whilst the collaboration with Uber unlocks the potential ability to integrate eVTOL services into the Uber platform. A new manufacturing facility has been successfully set up, enabling Joby to move from prototype development to scaled manufacturing. In short, progress has been mighty impressive - so it’s strange that this holding’s share price has been a little lacklustre since we first bought it for LTGG.

Why is this? Because early-stage innovation of this nature remains deeply unfashionable. Most investors have been focussed on other things. Following the stock-market this year has been rather like watching a five year olds’ football match. There’s no shortage of enthusiasm, but scant recognition that the best way to win might be to create a bit of space, rather than chasing the same ball as everyone else. In the first half of 2024, the febrile energy was directed mainly towards a narrow cohort of AI related companies. Recently though, it has been expended on any company that might have a chance of benefitting from Trump’s proposed tax cuts and the widely anticipated bonfire of US regulation.

In a market like this, our advantage as long term stock pickers is predicated on our ability to step back from the noise to unpick what matters in the long term.

Here are five of the things that have been on our minds of late:

1. The implications of global investing in a less globalised world

Talk of deporting immigrants and introducing more tariffs is notable but it’s not confined to the US. Over 2,500 measures in support of protectionist industrial policies have been introduced worldwide over the last year or so. A return to pre-second world war mercantilism seems likely.

No-one has a real handle on when and how further tariffs might be deployed. But history suggests that there will probably be some surprising second order effects. The Smoot-Hawley Tariff Act of 1930 was initially intended to protect American farmers, but it ultimately spanned 20,000 imported goods. The winners included Heinz which cornered the domestic ketchup market following restrictions on other tomato products. The losers included goldfish importers and the purveyors of “bawdy books" (Senator Smoot allegedly stashed numerous copies of Lady Chatterley’s lover under his desk in a crazed attempt to block their passage).

For all the uncertainty, we’d tentatively posit that LTGG is well placed to thrive in world of deteriorating trade relations and geopolitical uncertainty. This is partly because the portfolio contains some of the most flexible companies in the world thanks to the explicit focus on corporate adaptability in our investment research framework. It is also because a number of holdings are helping to address issues or friction that will probably be exacerbated by any further geopolitical friction.

Symbotic is a good case in point. The company’s warehouse automation solutions enable companies to radically reduce their reliance on human labour. They have emerged as the partner of choice for companies that need to build more resilience and flexibility into their supply chains. The evolution of their relationship with Walmart - from toe in the water in 2021 to key strategic partner today - hints at the supply chain efficiencies that can be unlocked by Symbotic’s systems in a world of trade friction and labour shortages. This helps to explain rapacious revenue growth in a hugely underpenetrated market. Any further shrinkage of the US workforce2 would further swell Symbotic’s growing order backlog. Cloudflare is also benefitting from the creeping miasma of distrust. The number of global data breach victims has quadrupled this year so demand for Cloudflare’s expanding portfolio of online threat protection offerings continues to grow. Following continued investment in their software and data platform, Cloudflare can now handle over 100 million threats per second and we believe that the company will enjoy handsome returns on this prescient investment well into the future. Beyond this brace of examples, several other holdings are benefitting from accelerating tailwinds -not despite geopolitical ructions but because of them.

But in some pockets of the portfolio, the dynamics of trade tensions are a bit more complex. Five years ago, you’d have been laughed out of the room if you’d suggested to a Western auto executive that a Chinese mobile phone company (Xiaomi) would sell eighty thousand models of its first car in twenty four hours. Or that VW would cede its talismanic sponsorship of the European Football Championship to a Chinese battery company (BYD) that had turned its hand to making some very decent cars. At around 40 million cars per annum, China’s EV manufacturing capacity now sits at over twice domestic demand and this has interesting implications for the holdings in Tesla and Rivian. Both are heavily vertically integrated so enjoy some of the highest gross margins in the industry. They could be amongst the last companies standing as the industry is forced into brutal consolidation in the years ahead. Rivian is building one of the strongest new brands in the industry and it could be a big beneficiary of American patriotism. The main challenge will be executing effectively on ambitious ramp up plans3 . Tesla on the other hand, has an ageing lineup in need of a refresh - but also the potential of consolidating its share of the US EV market if reduced tax credits drive local upstarts out of the market and tariffs knock Chinese competitors on the head. There’s also its second act to consider in the form of Full Self Driving technology whose regulatory pathway in the US looks increasingly well lubricated. At the same time though, it seems increasingly likely that China will want its own local champion in a field as strategically important as autonomous driving. This plays into our recent purchase of Horizon Robotics for the portfolio.

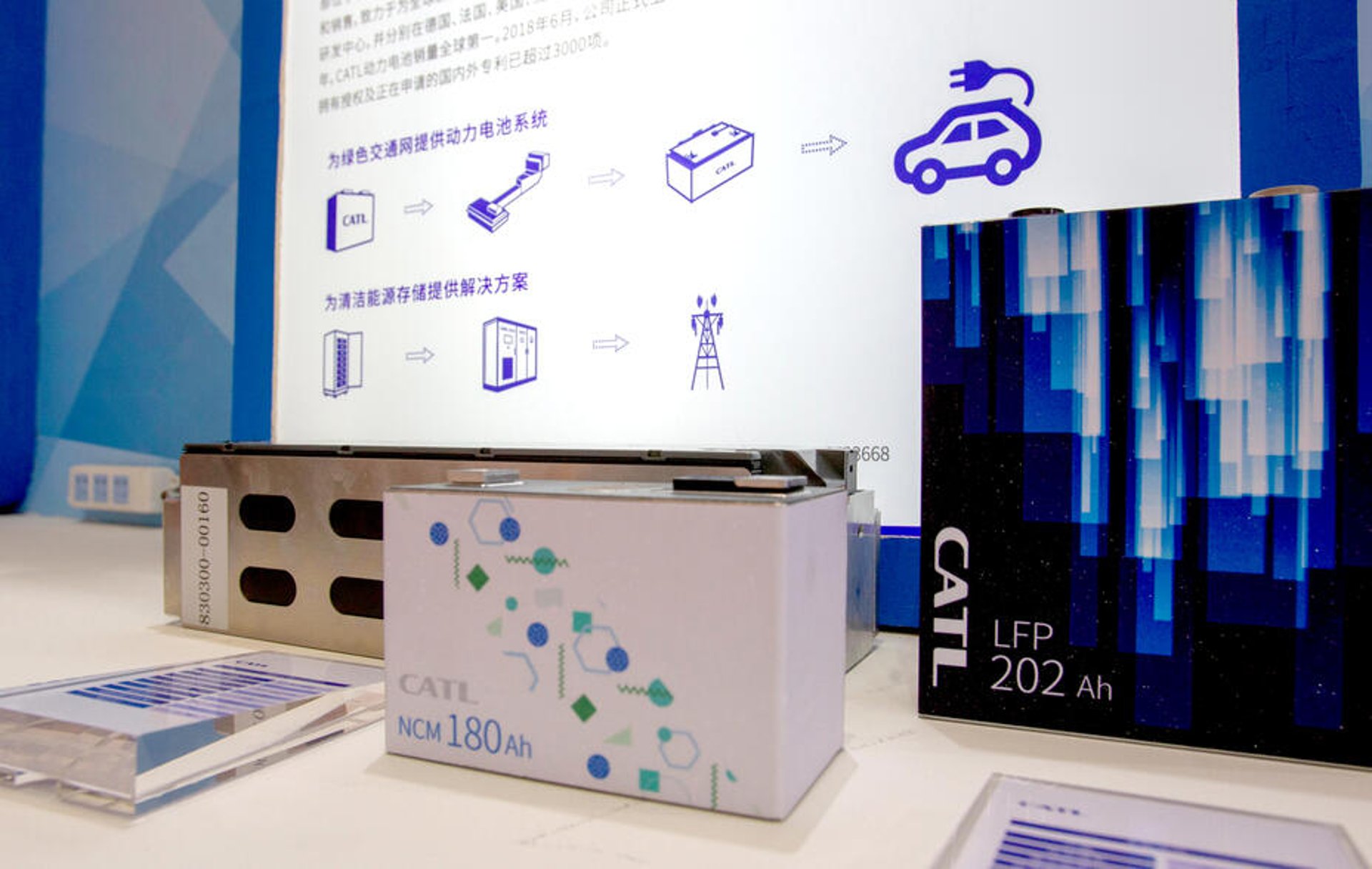

With a leading share of the global battery market, CATL is another energy geopolitics lynchpin. Under the guidance of the mercurial Robin Zeng, the company continues to blaze its way through the periodic table in a quest to improve performance. CATL’s latest Shenxing PLUS prototype has a range of 1000km and takes just 10 minutes to recharge. This could be highly disruptive for global charging infrastructure requirements. Meanwhile, the portfolio’s young holding in solar inverter company Enphase has recently been caught up in a renewables basket trade vortex on market fears that the incoming US administration will curtail or remove renewable subsidies. But it is not clear to us that these factors undermine the investment case and in fact the opposite might apply. Whilst Trump’s deregulatory agenda is an anathema to the left, some progressives have argued that an overly bureaucratic permitting system is slowing the buildout of renewable energy. It remains the case that just 5 per cent of US domestic roofs have solar panels versus 30 per cent in other sunny markets like Australia. Solar installer is one of fastest growing jobs in the US and Enphase’s competitive advantage remains intact by virtue of a network advantage with small independent installers and significantly better performance than competitors like Solaredge. The path to $4bn of revenue and gross margins of 50 per cent remains intact. From where we’re sitting, the market cap of under $10bn doesn’t seem to factor this in which is why we’ve been adding.

CATL's innovation could be highly disruptive for global charging infrastructure requirements. © Imaginechina Limited/Alamy Stock Photo.

2. Shifting sands in value chains

But it’s not all about geopolitics. Other shifting sands have been on our minds in recent months.

Commerce and Advertising

A couple of circles in the Long Term Global Growth Euler diagram of portfolio exposures relate to changes in the domains of commerce and advertising. Any stroll around the retail parks of North America, the high streets of Europe, or indeed many malls in China provide forlorn validation of the thesis that online retail will continue to take share from physical shops and we’ve recently been discussing two related protagonists in the form of PDD and Bytedance.

Since we bought PDD for the LTGG portfolio in mid-2019, its revenues have grown approximately a hundred fold thanks to an enticing offering that blends the gamification of commerce with low prices and convenience. In the eyes of many Western commentators this level of growth is utterly implausible and there’s a presumption that the numbers must be fabricated. But this is to misunderstand PDD’s uniquely asset-light model which has enabled them to leapfrog the userbase of erstwhile holding Alibaba, with one-tenth of the headcount and massively superior margins. The rapacious expansion of PDD’s Temu platform into nearly eighty overseas markets has been equally remarkable. Temu is the most downloaded app by US GenZers and it’s giving Amazon’s Andy Jassy some pretty sleepless nights. In recent months, it’s been important for us to explore whether PDD’s single-digit earnings multiple can be explained solely by the stock market’s current Sinophobia and we’ve commissioned input from our network of external experts in order to dig into the detail and sense check what we might be missing. Input from the likes of Tim Clissold4, GMT research5 and a range of deep dive interviews with PDD’s consumers and merchants has been broadly reassuring and we think that PDD could be one of the most mispriced opportunities in our portfolio. There are however, areas for PDD to work on. The VIE structure could be improved (particularly from a tax efficiency perspective) and PDD could help to overcome the sceptics with some fairly quick wins around financial disclosure. They also have significant work to do on the environmental reporting front and we plan further engagement with them around their scope 1 & 2 emissions.

We’re also keeping a close eye on Bytedance - still private so not a current LTGG holding - whose TikTok platform is the other elephant in the retail room. Traffic wise, TikTok is now half the size of YouTube and it threatens to put a serious dent in the competitive advantage of Sea, the South East Asian ecommerce holding which, (with ecommerce revenue up over 40 per cent year-on-year) has been on an operational and share price tear of late.

We see further structural shifts in the nature of the advertising models that feed into commerce. Just under four years ago we took a holding in The Trade Desk. Their algorithms scan almost a billion potential advertising impressions every single minute before recommending which ones its advertising customers should buy in order to maximise their return on investment and measure the returns on an ongoing basis. The stock is motoring along nicely as an increasingly broad number of customers (including, notably, Netflix earlier this year) integrate their tools. The recent purchase of Applovin is a continuation of the view that there is massive scope for young ad tech piranhas to nibble on the lunch of Meta, Alphabet and other legacy advertisers in this $1 trillion market. Applovin’s software platform helps app developers (mostly game makers at the moment) to reach new users who will download the apps and become paying customers. Axon, the company’s artificial intelligence powered recommendation engine sits at the heart of Applovin’s competitive advantage and it helps app owners to grow in game advertising revenue. The trebling of Applovin’s share price in the immediate aftermath of our purchase prompted an immediate revisit of question ten6 but there remains ample scope for the company to more than quintuple from here as the addressable opportunity moves beyond games into broader ecommerce.

Healthcare

In the domain of healthcare though, some of the sands are shifting less rapidly than we’d like. The LTGG jury is out on the holdings in Moderna and BioNtech. As we saw during Covid, the technology of both companies is highly disruptive and there remains no doubt that gene-based therapies have transformational potential beyond Covid. Our questions revolve around a couple of other areas.

Firstly, we’re questioning the timescales that will be required for these companies to derive material revenue from their non-Covid franchises (firstly through broader respiratory disease applications and ultimately from their ability to address a much broader range of conditions such as cancers and rare genetic conditions).

Secondly, we’re reflecting on whether the companies can successfully translate amazing technology into a business model that meets our requirement for strong financial returns. These questions are particularly relevant for Moderna because it has much more in-house manufacturing and is rapidly burning through its cash pile. Moderna’s market cap is now almost back to where it was when we bought the holding in mid-2020 and the outcome from here feels quite binary. BioNtech is in a financially more comfortable position. It is structurally more capital light and its R&D costs are comfortably covered so the main question there is whether a stock with over forty early stage clinical trial moonshots, a big cash pile, a fascinating culture but a somewhat stagnating core is a good philosophical fit for the LTGG portfolio.

Chips and computing

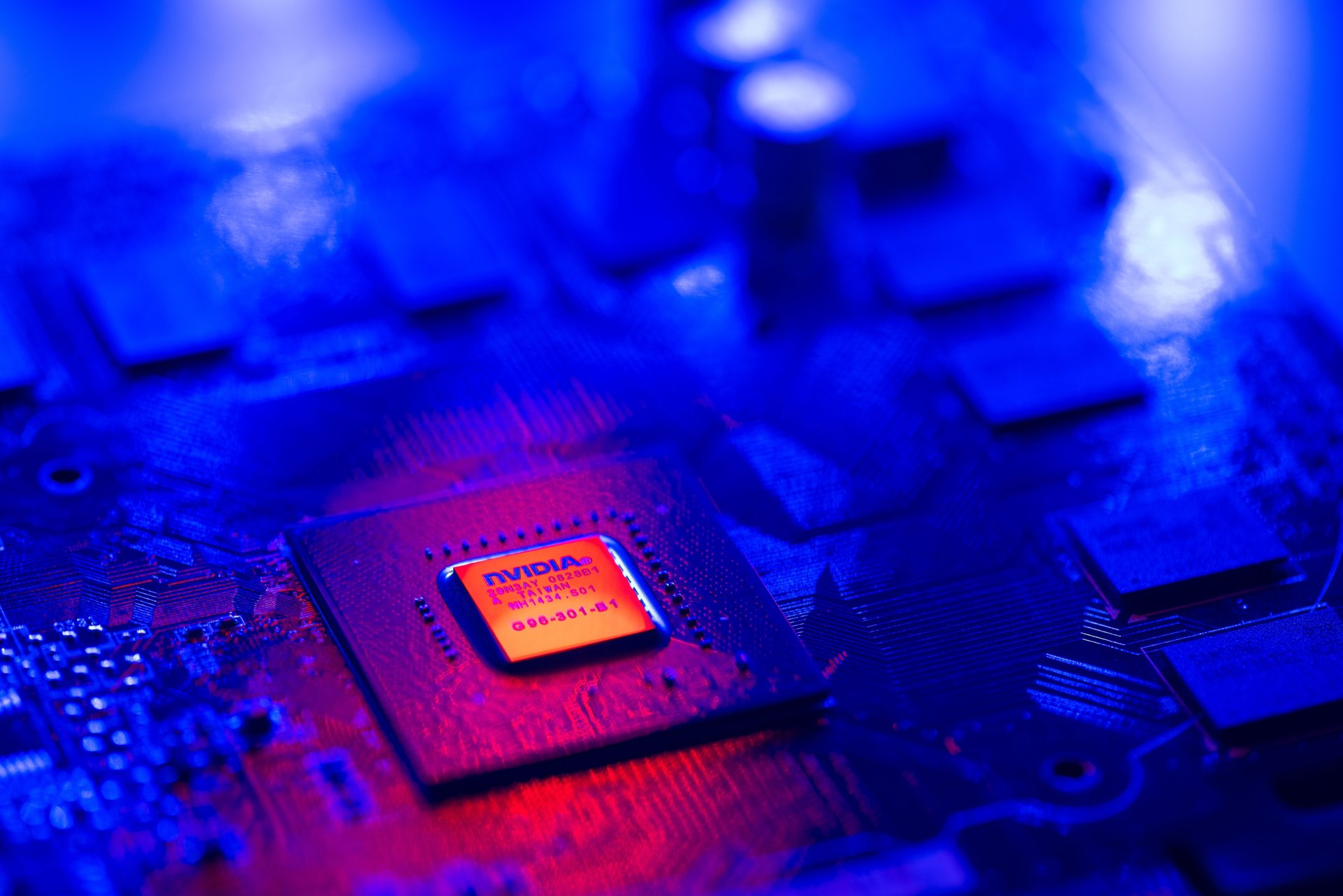

This year, we’ve talked at length about how we are navigating the revolution in Artificial Intelligence. The level of investment going into this area remains mind boggling. The capex of Amazon alone will come in at around $75bn this year – with a great deal of that going into AI. NVIDIA has grown its top line by around 125 per cent over the last twelve months and it retains a formidable grip on chip design – a low marginal cost domain which explains the company’s spectacular returns structure. But there’s a lot priced in and over the year, it’s become harder to articulate where our view differs to the market which is why we’ve recycled a good chunk of capital out of the stock, using it as a piggy bank for funding exciting new ideas.

From here, we think that more of the incremental shareholder value might shift towards the manufacturing end of the supply chain. Chip manufacturing is a minimal marginal cost activity that requires massive amounts of tacit knowledge gained through experience. With almost two thirds of the market, TSMC is interesting from this perspective and we are taking a deeper look at the stock.

NVIDIA retains a formidable grip on the chip design ecosystem. © Shutterstock/Nor Gal.

3. Climate - divining materiality from noise

Regardless of what Trump says (and irrespective of frustratingly divergent industry pressures pertaining to trade bodies such as CA100 and NZAM), our investment approach to climate considerations remains unchanged. Over our investment timeframe, the companies in the portfolio will have to contend with increasingly material physical, societal and financial changes pertaining to climate change and we continue to engage with the management teams of the portfolio holdings on this topic. By way of example, conversations with the likes of Tencent, NVIDIA and AMD have focussed on the energy intensity of data centres and artificial intelligence whilst discussions with Moutai have focussed on the resilience of the water sources that form part of their provenance.

At present, thirteen of the portfolio holdings are considered to be leading their industries with regard to climate change preparedness and we are able to share examples of their strong business practices with other holdings in the portfolio. Some of the developing market based online commerce companies have the most work to do and we continue our discussions with the likes of Coupang on where we’d like to see them improve.

External experts remain key to furthering our understanding of this area. By way of example, we’ve been collaborating with the climate specialists at the University of Exeter Global Systems Institute7 to assess climate related physical risks pertaining to Tesla’s global manufacturing sites and value chain. Across our industry, it is fair to say that most company disclosures on actual and potential physical change have languished – with many saying nothing, adding a useless boiler plate comment, or providing a world map with alarming icons of rough seas and wildfires. Regulators8, auditors and insurers are waking up to these deficiencies, recognising that they mask material unpriced liabilities. The work on Tesla has revealed an underrepresentation of wildfire risks in consensus modelling and a small number of highly vulnerable suppliers. In the short term, drought poses the biggest risk to Tesla’s manufacturing sites but in the long term, heat stress will become the more severe hazard. Having engaged with Tesla on the results of this work, we have now established direct links between the company and the Exeter group in order to develop the peer to peer discussions.

4. Valuation disconnects

This year, performance has been strong in absolute terms for both LTGG and the index. It is interesting to unpack the drivers of these returns because for the index, performance has overwhelmingly been driven by multiple expansion rather than operational growth, whilst the inverse is true for LTGG9. We regularly explore the nuances beneath these headline numbers with our investment risk colleagues. When we assess the growth levels needed to deliver 5x returns at different exit multiples or review how stock weights in different price to earnings or price to sales buckets compare with history, we’re not expecting any one parameter to give us a “killer answer” on the valuation of a particular holding. But we do expect the overall mosaic of metrics to feed into our thinking on the shape and skew of the portfolio.

Although our investment philosophy is aimed at running winners in order to tap the inherent asymmetry of equity markets, we also recognise that we shouldn’t accept a creeping increase in position size on the back of strong share price appreciation unless our answer to question 10 remains strong. In the current ebullient equity market, it is imperative that we constantly check that the market disagrees with our view for each holding – and where that’s not the case, then we should be prepared to pare back the position to recycle the funds into areas where our view is more different to that of the market. This explains much of the turnover over the past year. We’ve recycled around twelve percent of the portfolio out of NVIDIA and a couple of other stocks where we’ve felt that the market has partially caught up with our near term view. This has enabled us to add to a number of positions where the strength of our answer to question 10 has improved. Additions to the likes of Joby Aviation, Enphase, Samsara and Rivian in the latter part of the year are cases in point.

China is worth a specific mention here as well. Clearly the country is not without its challenges (a third D for Donald can now be added to Deflation and Demographics), but it remains the case that we are being asked to pay very low multiples for what appear to be solid growth opportunities. Some will be ephemeral because of the competitive jungle that China represents - but for the long-term winners it appears to us that the rewards on offer to patient investors will be outsized and the risks are well worth taking if they are appropriately managed and limited in an overall portfolio context.

Innovation in China remains firmly intact.

5. The importance of a strong core

Given the harassing melange of climatic, technological and societal unpredictability in the world today, it’s important to reflect on portfolio robustness. The LTGG portfolio may be concentrated by design and volatile as a conscious consequence10, but that doesn’t mean it shouldn’t be more resilient and robust than the index. We can see this in the superior balance sheet strength of LTGG, the higher levels of investment in Research & Development - and also the higher levels of alignment through management skin in the game. We can see it in the operational performance as well. The average top line growth rate for the LTGG portfolio remains in the high twenties, over five times faster than the index. Free cashflow growth is almost thirty percent11.

In LTGG, it has always been important for us to have a balanced blend of growth muscle via stocks that can deliver 5x payoffs in different ways. Stocks such as Joby Aviation and Horizon Robotics give us exposure to greenfield opportunities such as electric air taxis and autonomous driving. The opportunity here relates to the market’s inability to conceptualise the scale of the opportunity, to embrace the high levels of uncertainty and to wait patiently for profitability. Meanwhile, the likes of Meituan and Atlassian provide access to companies with firmly established moats in settled but fast-growing markets such as food delivery and cloud based enterprise. In these cases, the market inefficiencies that we can exploit pertain to the underappreciated depths of the moats that they have established and the ultimate market size. Disruptive companies such as Adyen and e.l.f Beauty are building on AI capabilities to upend sleepy incumbents in areas such as payments and cosmetics and our opportunity pertains to the fact that their business models don’t fit the neat models of the industry analysts. Then, through high end luxury companies such as Hermès, Moncler and Moutai we are able to unlock extreme payoffs through the power of extreme longevity where, time and again, the market has failed to properly comprehend the alchemy of compound growth over protracted time periods.

Combined, these different growth muscles equip the LTGG portfolio with an enviable degree of futureproofing and torque. And although we don’t look at the index very often, it’s hard not to be struck by the contrast. In some regards, the index resembles a body builder that has been focussing too hard on their torso and biceps at the expense of their legs. It’s out of balance - plenty of bluster and flex on top but with puny underpinnings in terms of financial robustness and business model resilience.

And as we look forward, it’s an equally exciting picture. Based on independent estimates for the next three years, three quarters of the portfolio is fits into the top two forecast earnings growth quintiles of the investment universe – and 55 per cent in the top quintile. Given that share prices follow earnings, this is an invigorating observation.

In Conclusion

We recently checked in on the value that has been added for Long Term Global Growth clients over the past couple of decades. The latest tally is over $50 billion over and above what they’d have earned by investing in the index. This additional value has been generated because we’ve been able to play a different game, and as we press on with the third decade of LTGG, it feels as though the gap between our approach and the market’s has never been wider.

In the stock market, as with politics, the ability to see both sides of a question or issue is no longer considered a strength. Nuance has been abandoned. Many journalists and market commentators think they are analysing when they are simply rearranging their prejudices. Our competitive advantage revolves around our comfort in recognizing how little we know and therefore asking different questions to other industry participants. It is also based on our preparedness to go out on uncomfortable limbs because that’s where the fruit is.

Speaking to visionaries like JoeBen Bivert helps us to avoid getting sucked into the insanity of the circus. His long term objective is to eat Boeing from the inside out. Boeing’s market capitalization is around twenty five times larger than Joby’s. As it happens, VW’s market capitalisation was a similar multiple of Tesla’s when we bought the Tesla holding in 2013. A decade later, the tables have turned: Tesla’s market capitalisation is now close to twenty five times larger than VW’s.

As with Tesla a decade ago, there’s still a good chance that Joby fails in its mission. And even if it succeeds, the ride from here will be a bumpy one for shareholders. The volatility phobic market will struggle badly with that, as it does with so many of our LTGG holdings. And there, in a nutshell, resides our opportunity.

1 The quarry near JoeBen’s parents’ commune, is used today for propeller testing and located here: https://maps.app.goo.gl/AjQDWqQAhtT9qhLE6

2 The deportation of the 8 million or so unauthorised immigrants in the US would shrink the US workforce by around 5 per cent.

3 Even VW seems to recognise this. They recently invested $5bn. What odds on their Rivian stake one day being worth more than the rest of the company?

4 His book, Mr China, is a corker and highly recommended.

5 An accounting due diligence firm.

6 As a reminder, this question – the last in our research framework – explores why and how the broader market view differs to our own.

7 Climate Risk, Resilience and Adaptation | Global Systems Institute | University of Exeter

8 The new UK regulation on Transition Plans asks for more on physical risk, the EU CSRD reinforces the requirements to address physical issues specifically, and the SEC climate rules passed in early 2024 retreated on Scope 3 but leaned into physical risk disclosures in the financial statements.

9 Over the twelve months to end November 2024, over 90 per cent of LTGG’s return was driven by operational growth whereas over three quarters of the index return was driven by multiple expansion.

10 Look out for a great paper on this from Gemma Berkhuizen coming soon.

11 5 year sales growth to end November ’24: 27.3 per cent vs. 5.2 per cent for the index. 5 year Free Cash Flow growth to end November ’24: 29.0 per cent vs 8.4 per cent for the index.

|

|

2020 |

2021 |

2022 |

2023 |

2024 |

|

Long Term Global Growth Composite |

102.0 |

2.4 |

-46.4 |

37.3 |

25.7 |

|

MSCI ACWI Index |

16.8 |

19.0 |

-18.0 |

22.8 |

18.0 |

|

|

1 year |

5 years |

10 years |

|

Long Term Global Growth Composite |

25.7 |

13.9 |

15.5 |

|

MSCI ACWI Index |

18.0 |

10.6 | 9.8 |

Source: Revolution, MSCI. US dollars. Returns have been calculated by reducing the gross return by the highest annual management fee for the composite.

Legal notice: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

129415 10052075