Key points

- The increased resilience and strong growth prospects of emerging markets mean they merit a fresh look

- We believe high-quality companies, including Shenzhou International, Raizen, Luckin Coffee and Delhivery, are underappreciated, despite their strong performance and potential

- These companies often command the strategic heights of future industries and consumer behaviour

WATCH: Investment manager Ben Durrant (right) explains how emerging markets offer some of the most exciting growth companies in his Disruption Week briefing

Your capital is at risk.

Remember the Great Emerging Markets Collapse following the US’s 2022 interest rate hikes?

You don’t, because it never happened.

While the West struggled with the macroeconomic shock of higher inflation, there wasn’t a sudden outflow of investors’ money from these rising markets, as there might have been in previous decades.

“Emerging markets did just fine in Covid, and in the commodities slump a decade before,” investment manager Ben Durrant notes in his recent Disruption Week briefing.

“They have built enough reserves for their currencies to absorb these shocks. Any imprudence these days is more likely to be found in developed markets.”

That big shift towards stronger financial systems, lower debt levels and more diversified economies is one of the reasons Durrant gives to rethink the asset class, which he describes as encompassing the “least-wealthy, highest-potential” parts of the world.

And he highlights that emerging market companies play a vital role in powering the age of high-performance computing and AI, and providing critical raw materials and components for the energy transition, whether it be copper and nickel or solar panels and electric car batteries.

To find exceptional companies to invest in on our clients’ behalf, he and his colleagues regularly meet with management on their home turf to better understand their potential, including recent trips to China, Brazil, India, Vietnam and Kazakhstan.

Emerging markets, Durrant explains, are full of companies with built-in resilience against shocks.

Take China’s Shenzhou International, which makes sportswear for Nike, Puma, Adidas and Lululemon, among other brands. Durrant acknowledges that it wouldn’t be immune to the tariffs that President-elect Trump has proposed, but notes it has reduced its exposure by basing “the majority of its production outside of China, in Vietnam and Cambodia, where labour costs are lower”.

Greater resilience at the national and company level is just one of the pillars of Durrant’s optimism. The three others are:

- his belief the markets currently undervalue many emerging market stocks

- the number of growth drivers in their favour

- the increasing number of world-class companies to choose from

Undervalued assets

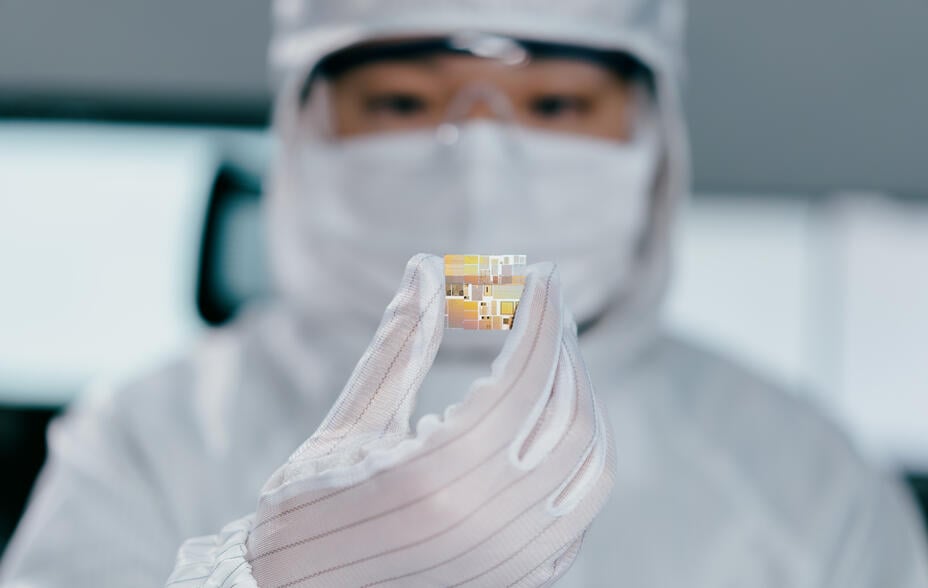

Durrant believes that the companies he and his team have identified as emerging market stars are now trading at “historic” low valuations, share prices are wildly out of sync with their operational and financial performance. As an example, he gives the Taiwanese chip manufacturer whose advanced chip-making techniques are powering much of the AI revolution.

Taiwanese chipmaker TSMC might be more highly valued if it were US-based

© Getty images

“TSMC makes NVIDIA’s logic chips and much else,” Durrant says. “If you own an Apple phone, you've got a TSMC-made chip in your pocket. Yet TSMC's valuation metrics are significantly lower than its customer NVIDIA’s.

“We think TSMC is still deeply undervalued largely because it’s headquartered in Asia, not the US.”

Strategic positioning

TSMC is just one example of an emerging market company that’s integral to one of the likeliest global growth industries of tomorrow. Another is Brazil’s Raizen, a pioneer in ‘second-generation ethanol’.

“Raizen takes waste from sugar cane and turns that into useful fuel,” Durrant explains.

“It isn't like one of the companies you see in the US, where they take by-products that would otherwise be used as animal feed. This is making use of waste. Something that would otherwise be burnt is now being used to fuel cars.”

For now, the bulk of Raizen’s earnings stem from domestic sales. However, Durrant spies an opportunity in the nascent market for sustainable aviation fuel.

“Because it’s an innovation, others are focusing on the cost of the product and whether it can be made to work, but we see the potential for compelling long-term value.”

The inexorable rise of the middle class is already entrenched as a reliable driving force for many of the companies in Durrant and colleagues’ emerging market portfolios.

Policy Bazaar is one holding benefitting from this dynamic. “It’s the default place for anyone to go for insurance or savings products,” Durrant explains, giving customers’ a platform to compare, buy and store their policies.

“It’s like the UK’s Compare The Market but so much better and in a massively bigger market. Its app has become indispensable to a populace that’s often suspicious of personal finance offerings.”

He adds that the firm is now expanding its physical branch network, helping it to sell higher-premium policies and extend its reach.

More quality, more quantity

Moving onto the theme of world-class companies, Durrant cites Luckin Coffee as an example. With more than 18,500 stores, it is China’s biggest coffee chain and has dozens of stores in Singapore.

China's Luckin Coffee opened over 8,000 outlets in 2023, including 30 in Singapore

© Getty images

“It has out-competed Starbucks in every respect in China,” Durrant says. “It produces around 100 different new flavours a year, just to see what works. And now it’s expanding to other parts of Asia and the Middle East, using social media ingeniously to build its brand.”

Durrant also highlights a holding in Nubank, which in less than a decade has become the first digital bank outside of Asia to attract more than 100 million customers thanks to its popularity in Brazil, Colombia and Mexico. And he mentions Kaspi.kz, whose ‘super app’ offers Kazakhstan’s citizens the ability to shop, pay bills, travel and take out loans, in addition to running other platforms in Central Europe.

Then, returning to India, he draws attention to a firm pioneering a hi-tech approach to logistics.

“Delhivery does everything from truckload deliveries to smaller ones for small businesses, as well as outsourcing the entire supply chain for whole companies,” he explains, describing how it uses a ‘mesh network’ rather than the traditional hub-and-spoke model.

This is highly complex to achieve, but the firm has developed software to determine the fastest way to route parcels between small centres without having to go via a large facility, dynamically accounting for traffic and other changing conditions in real-time.

Building the required software involved significant capital expenditure, but Durrant says that as the network achieves critical mass, it should be more efficient and cost-effective than the legacy approach.

“Delhivery is reaping the benefits of its vision,” Durrant says.

A positive environment

Emerging markets may have underperformed in the past, but Durrant argues that macroeconomic forces and the increasing prevalence of exceptional companies mean investors should now take a second look.

“Because emerging market countries know they can’t rely on the benevolence of foreign capital, which tended to rush out when times were bad, they’ve had to painfully build up their reserves and reduce their debts,” he explains.

“That means patient investors can not only expect to reap the benefits of the most compelling growth stocks increasing in value but also potentially benefit from their domestic currencies increasing in value as investors catch up with the incredibly compelling opportunity this presents.”

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Words by Colin Donald

124232 10051128