From economic supremacy to electronic powerhouse (cornering the market with cameras, consoles, and of course, the Sony Walkman) to the birthplace of the Prius. Whether you associate Japan with corporate reform, manga, sushi or sake, we would argue that this enigmatic collection of islands offers far more than what first meets the eye.

Indeed, the country appears to have once again piqued international interest. Having escaped the shadows of the past and reaching new market highs, the most apt question is: where do the opportunities now lie?

The following four themes are experiencing accelerating momentum and appear poised for reappraisal…

01. From paper to platforms: a domestic digitalisation story

Whether it's due to the limited supply of labour, rising wages, or the need for productivity gains and scale advantages, Japan is slowly but surely shifting online.

Having lagged other developed markets across most areas of digitalisation, such as ecommerce, cashless payments, software-as-a-service, and general enterprise IT investment, Japan has now recognised the critical need to develop these labour-saving solutions. This shift opens up significant long-term growth opportunities. Although this opportunity is still in its infancy – and is therefore far less prominent than in other developed markets – it is often accessible at little to no premium to the broader market.

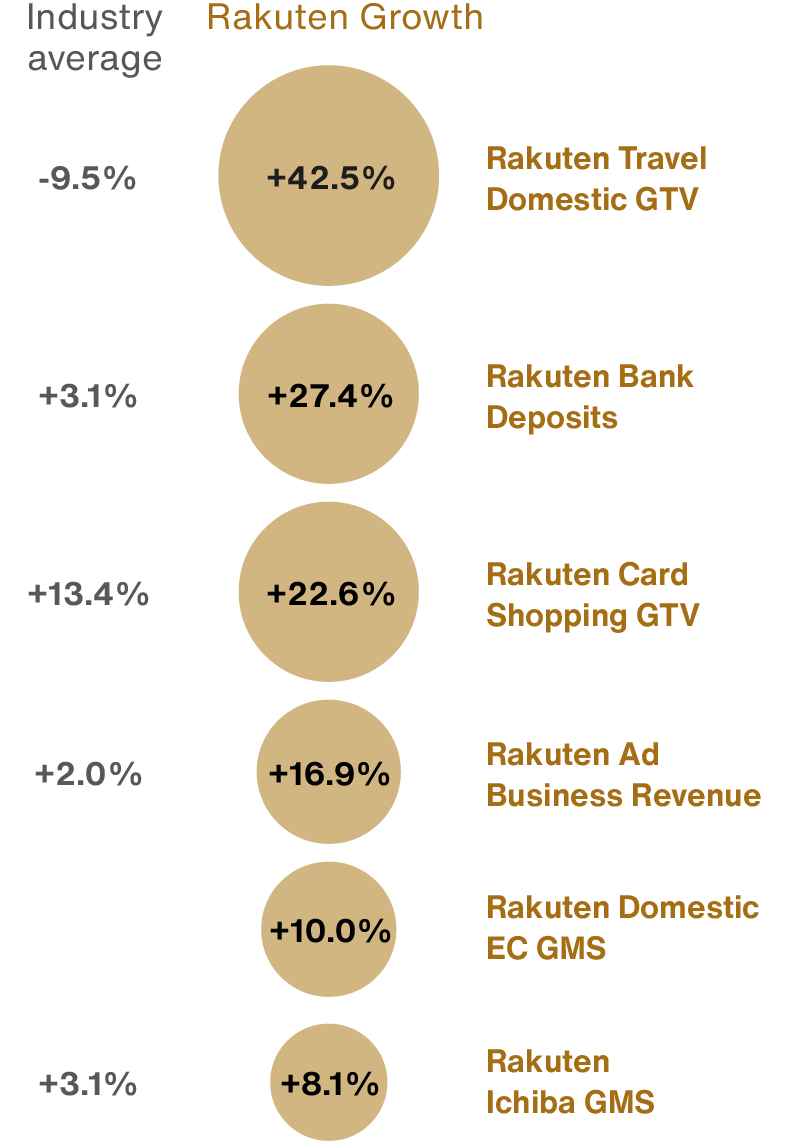

Rakuten's ecosystem of services

Rakuten is home to Japan’s largest points-based ecosystem with over 100 million users accessing upwards of 70 online services (from hotel bookings to brokerage and banking). Despite consistently growing its top line for 27 years since inception, the company trades at a mere 0.6x sales, which is half that of the market average, because of the capital-intensive decision it made to develop its mobile phone network. Although this new venture required significant outlay, an accelerating pick-up in paying subscribers could soon see the network become profitable by year-end. As a standalone, we believe it could double the enterprise value of the group. Beyond that, we think it has the potential to add value to the entire ecosystem. By adding another customer touchpoint, it is improving its access to data and raising the potential to cross-sell more of its services.

Other examples include:

GMO Internet is the leading provider of internet infrastructure, dominant in domain registration, hosting, cloud services, online security, esignature, cybersecurity and cashless payments. It offers picks and shovels exposure to Japan’s growing digital gold mine. Despite boasting such a long list of services, the group trades at a discount to the sum of its parts, creating the potential for significant upside on otherwise conservative growth assumptions.

SBI Holdings, an offshoot of Softbank Group in 2006, has quickly become the largest brokerage business in the country. It has used that dominance to spread its tentacles into peripheral areas of finance such as insurance, banking and asset management, upsetting the sleepy incumbents. Even though the company has outpaced its peers, growing at a 24 per cent CAGR for 5 years, it still trades a similar multiple to the broader banking sector.

CyberAgent, a Sony-esque collection of synergistic businesses including gaming, media and online advertising. Although the build-out of its on-demand media platform, AbemaTV, has eaten into margins, it has recently become profitable. Since activating the service, the platform’s weekly active users have increased to 24 million and continue to grow at rates exceeding 20 per cent.

Although Softbank Group has less domestic revenue exposure than those mentioned above, it is still notable for being equally underappreciated despite its prominent global role in funding disruptive technology. What is more, the company’s fortunes seem to have turned around. The equity value of its holdings has doubled over the last 12 months, the asset exposure has shifted away from China and unlisted equities towards a more globally diverse play on mainly listed equities. And Softbank's historically low gearing gives it a substantial war chest for opportunistic growth. Despite these improvements, the share price still lags the growth in its NAV. We believe this offers significant potential as the discount begins to widen.

02. Accelerating automation

The rise of Japan’s auto industry in the 1980s, coupled with the country’s cultural proclivity for quality and continuous improvement (or Kaizen), has helped cement its place as a veritable powerhouse for robotics and automation. Today, the country caters to half of the world’s industrial robotic demand.

Demand for robotics and automation is only accelerating. Automated solutions provide firms with insurance against geopolitics, vulnerable supply chains, and pandemic-proof production lines. An ageing population and rising wages are also reducing their payback period.

Their application or addressable market is also beginning to expand beyond the factory floor and unpopular 3D (dangerous, degrading, and dirty) jobs. Technological improvements in dexterity and sensory systems, AI, and the Internet of Things allow for an array of new opportunities, from assisting the elderly and infirm to field-based robotics, such as fruit picking.

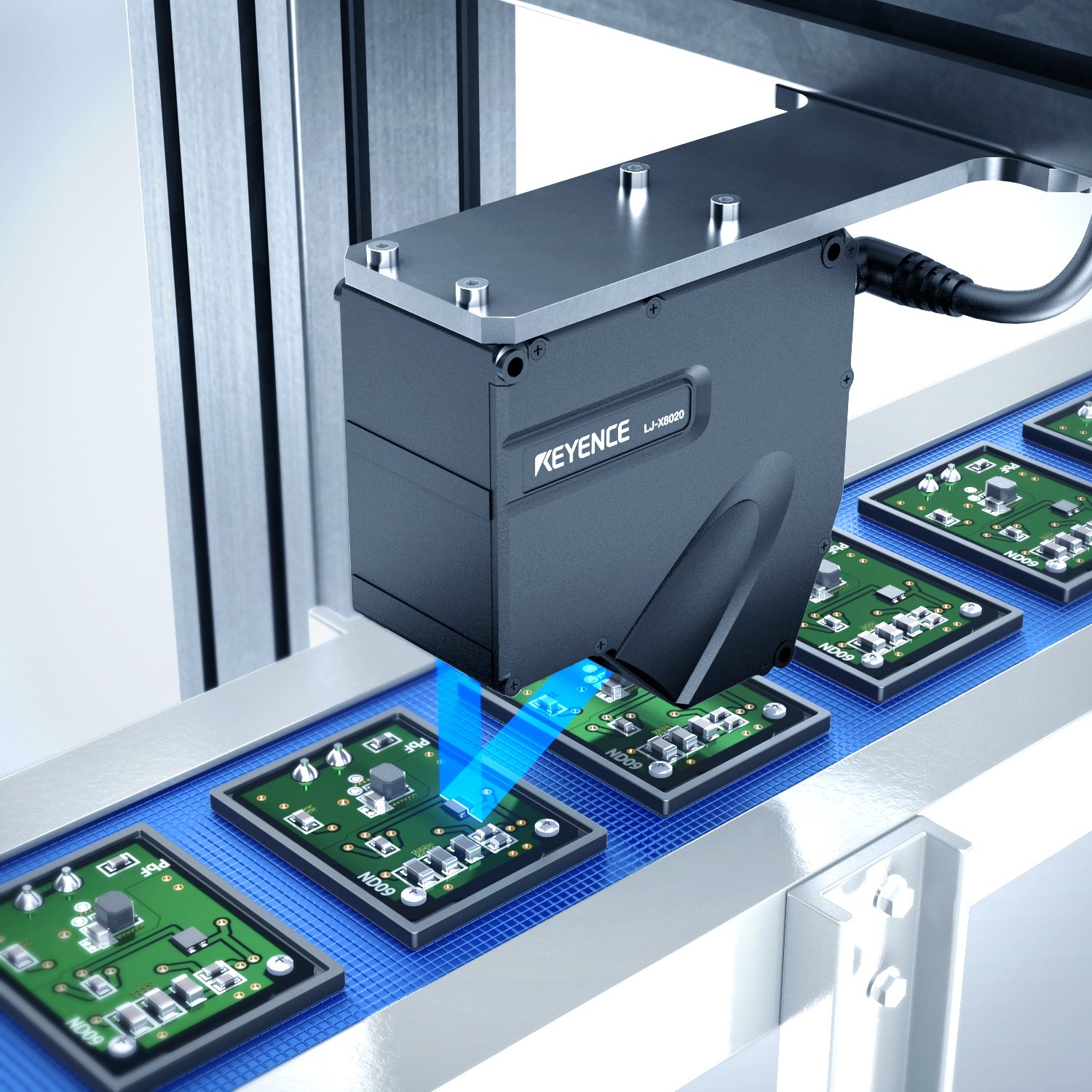

Keyence, a fabless factory automation company specialising in machine vision, is arguably the best individual example of Japan’s pre-eminence in this field1. They provide the eyes of robots; the unblinking lenses and flickers of patterned light that check the seal of your yoghurt cup or catch a single flawed spiral amongst a million tumbling screws.

As automation penetrates new processes, this is an area that is expected to outpace global CapEx and grow twice as fast as robots.

© Keyence Corporation

Keyence’s enduring edge expands beyond its comprehensive machine vision product offering, their direct-sale, consultant-style business model aimed at identifying customer pain points and solving them, allows them to eke out tech-like margins (GPMs of over 80 per cent and OPMs over 50 per cent) and remain a lead innovator in this field, with 70 per cent of products being world-firsts. This incumbent giant – with a strong brand and superlative customer relations – looks well set to ride several structural growth trends into the future.

DMG Mori, a child of both Japanese and German precision engineering, stands as a beacon of innovation in the machine tool industry. Their superior 5-axis machines (that boast 1 micron accuracy levels, smaller than a virus), allow precision manufacturing at scale – cutting manufacturing costs by replacing the need for multiple machine tools by 50 per cent, reducing the number of operators required on the factory floor, and increasing utilisation rates by cutting idle machine time. With sales supported by several structural trends, the bottom line will likely receive a boost as these 5-axis machines (currently only 20 per cent of sales) become a larger part of the pie.

03. Tapping the rising wealth of Asian neighbours

Asia is home to a lot of people: 60 per cent of the global population, 5 billion and counting. Many of these are young (two-thirds of the world’s youth live in Asia) and getting wealthier (roughly 113 million people will join the global middle class this year alone, and most will come from Asia).

This presents a big volume market with rising discretionary/disposable spending power, creating various premiumisation trends across several product types. The ‘Made in Japan’ brand stamp has become widely synonymous with prestige and high quality across the region, putting the country and its brands at the forefront of this opportunity.

Skincare is just one example, where per capita spend in China is only $36, compared to over $100 in South Korea, Taiwan and Singapore. This product type not only supports the creation of durable, powerful brands, but also benefits from a strong interplay between scientific innovation and strong consumer emotions related to appearance and youthfulness. Additionally, it offers the freedom for extensive advertising. The attractiveness of the skincare sector is further enhanced by the “chronic” treatment feature, which fosters a lifelong commitment to product lines as consumers must continue using them to maintain benefits.

© Shiseido Company, Limited

Shiseido is at the forefront of this trend. It began as Japan’s very first western-style pharmacy in 1872 before branching off into cosmeceutical products in 1897 to create Eudermine (‘Shiseido’s red water’), which is still available in its latest iteration today.

The company continues to develop its expertise in skincare technology, historically spending far more on R&D as a percentage of sales than both L’Oréal and Estee Lauder.

Although depressed Chinese consumption has dented profit margins, Shiseido’s focus on prestige brands in skincare for Asian consumers puts them right within the sweet spot of the Venn diagram and, in our opinion, poised for the greatest long-term growth potential.

04. Addressing the ailments of an ageing nation

Japan’s demographic picture is well documented. The population has been in decline for over a decade, with one in ten now over the age of 80. Although the situation is stark, it is not isolated. Globally, one in ten are over 65 years of age, and in just three decades it is estimated that this will rise to one in four for European, North American, and Asian residences.

This has various economic and social implications, one of which is the increasing prevalence of age-related diseases, like Alzheimer’s Disease (AD): the most common type of dementia and the leading cause of death in the UK. It is estimated that 10 per cent of those over 65 and about 50 per cent of people over 85 suffer from the disease. This presents a patient population that is expected to explode as the population pyramid bulge shifts upwards.

Eisai, a Japanese pharma company with a focus on neurology and oncology, appears on the front foot of this ageing endemic. They have a rich history with AD that dates back to the 90s with Aricept (donepezil), which became the world’s best-selling AD drug, addressing some of the symptoms of the disease. Their recent partnership with Biogen has since resulted in Leqembi (lecanemab), which is the world’s first drug to target the root causes of the disease: amyloid-beta plaque build-up within the brain. It has now been approved in the US, Japan and China.

© Eisai Co, Ltd

This opportunity offers significant potential for growth, marking a first in the industry with the promise of enhancements, notably through more straightforward delivery methods. Additionally, the market for this product is expanding, especially as diagnostic advancements may enable Eisai to focus on individuals in the pre-clinical stages of AD.

Olympus is a camera company which reframed its opportunity away from recreational use towards the medical field. It now commands 70+ per cent market share in gastro endoscopes, cameras used to detect and diagnose problems within the gastrointestinal tract. Although Covid 19 diverted short-term medical expenditure, it has amplified the importance and need for the provision of diagnostic services in the long run. China’s lack of diagnostics, for example, has resulted in a five-year survival rate for gastric cancer of only 35 per cent, which contrasts with an 80 per cent rate in Japan. This provides a healthy prognosis for industry incumbents like Olympus.

The following are some of the most prominent themes within the portfolio that are emblematic of the broader opportunity set.

What next for Japan’s recent cyclical stars?

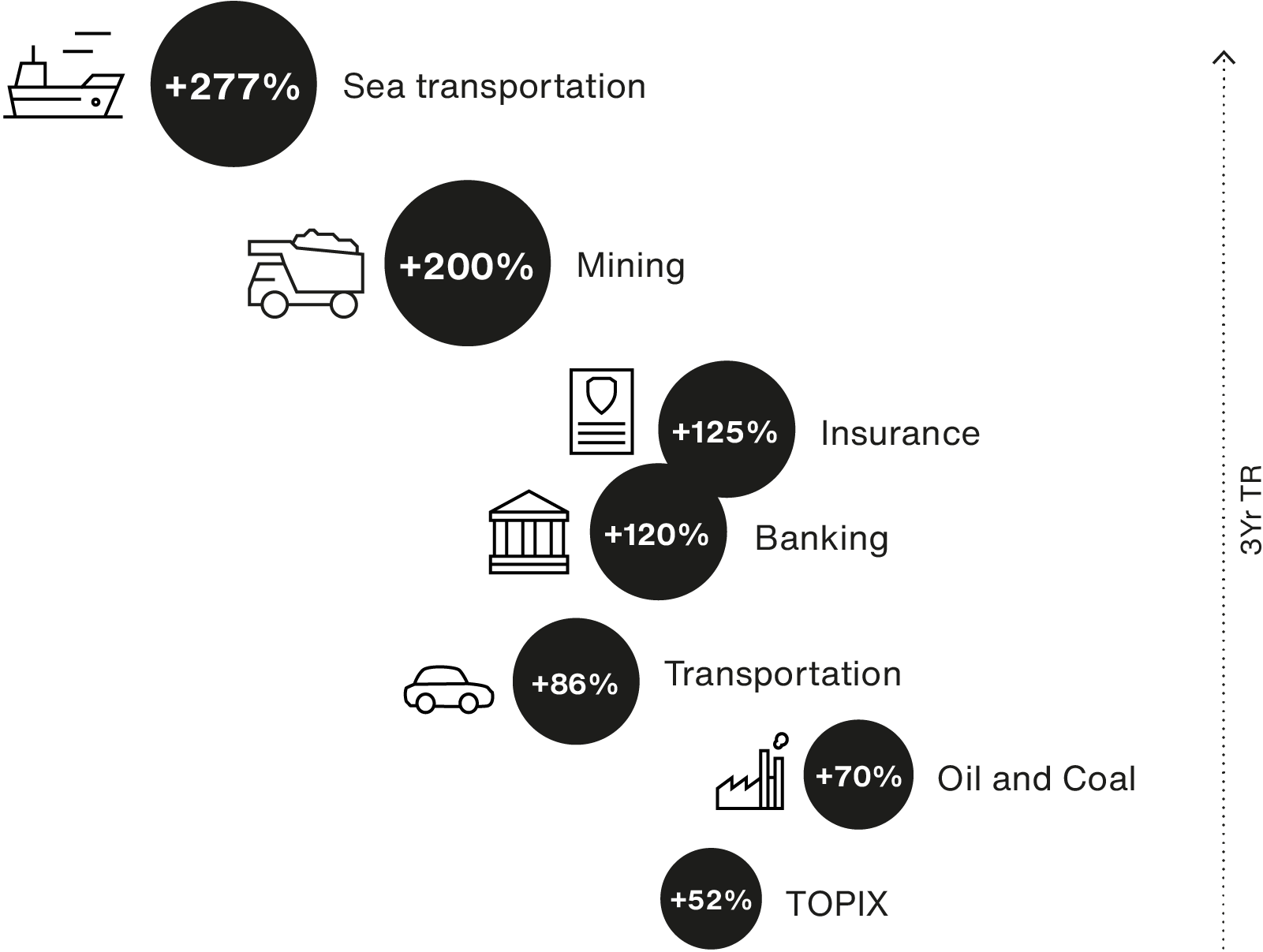

In spite of these many, exciting growth prospects, recent investor enthusiasm has been centred around Japan’s cyclical constituents, which encompass many of the country’s biggest companies.

For example, to outperform the market over the past three years, you needed to invest in the following sectors: transport, resources, and finance.

A period defined by concentrated cyclical returns

Source: Japan Exchange Group. As at 1 April 2024.

The question is whether Japan’s large liquid cyclical blue chips can maintain this momentum, or is their fortune more of a short-term phenomenon?

01. Are Japan’s autos running on empty?

The economic bounce-back from Covid has clearly helped revive a market that remains geared towards a global economy. Nowhere is this more evident than in the auto market, Japan’s largest industry and export.

The post-Covid recovery has resulted in a sharp acceleration in volumes, with the global auto industry enjoying double-digit growth for the second time in over 20 years. This has aided the largest player, Toyota, which has seen its market cap double as a result.

Source: CLSA Research, 2024.

As expected, an inevitable slowdown in volumes, coupled with a broader transition towards electrification (Honda expects its adaptation to cost in the region of ¥10tn), could cast doubt over sustaining this level of earnings growth. Indeed, at the time of writing, Toyota had already downgraded its forward OP guidance by ¥1tn below consensus estimates.

02. Dining out on a weak yen, how long can this continue?

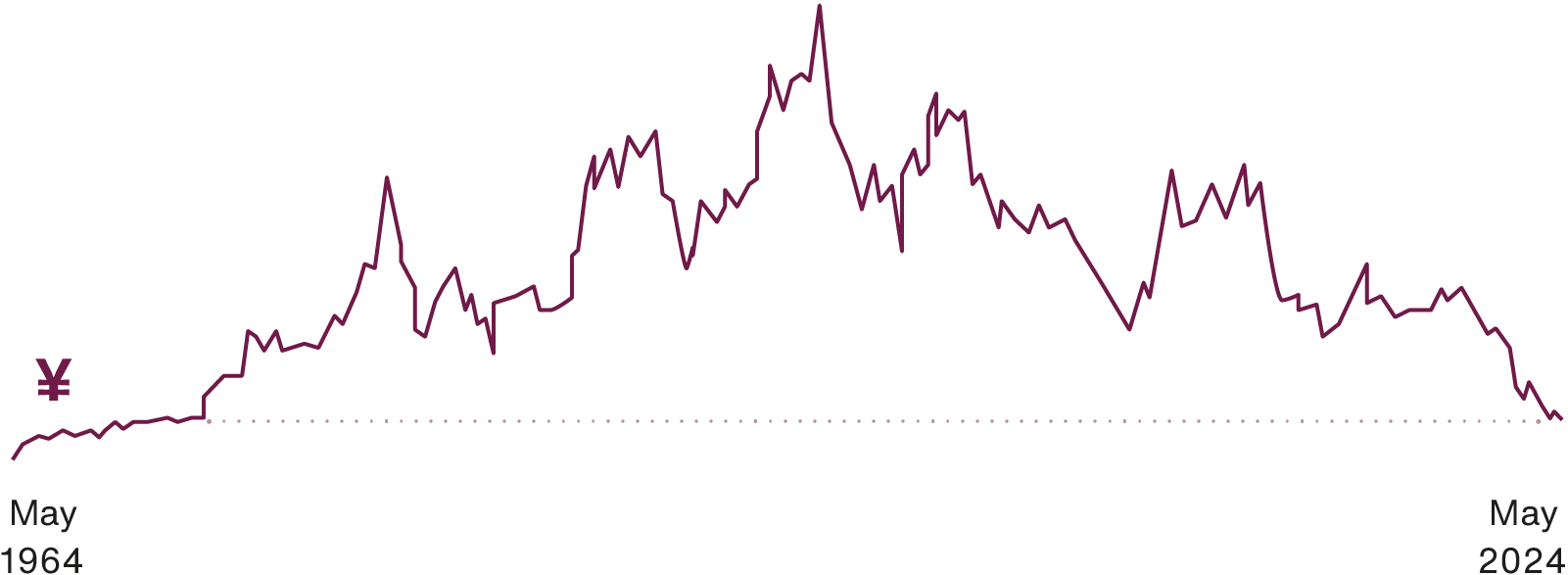

In addition to the economic bounce-back, Japanese exporters and USD earners have been helped by the currency's decline. It is now back to where it was in 1990, when Thatcher was prime minister, the same year Mandela left prison, and Germany reunited. This is extreme, even before relative prices are accounted for.

On a purchasing power parity basis, the yen is now almost 50 per cent undervalued, with the real effective exchange rate at levels not seen since the summer of 69!

Japan real effective exchange rate

Source: CLSA Research. As at 10 May 2024.

The Big Mac Index- a look at exchange rates based on pricing-power parity

Source: Statista, 2024. Details: Worldwide;

IMF; McDonald’s; Thomson Reuters; The

Economist; January 2024; GDP-adjusted.

Using the ‘Big Mac Index’ to measure purchasing power parity between nations, you can starkly see the weakened yen to the US dollar. Although this could persist, it appears highly anomalous that the currency of the world’s fourth-largest economy is trading at such a disparity.

03. Corporate reform: quick fix for corporate inefficiency?

The reinvigoration of Japan’s well-versed corporate reform story has provided another stimulus to the cyclical ones mentioned above.

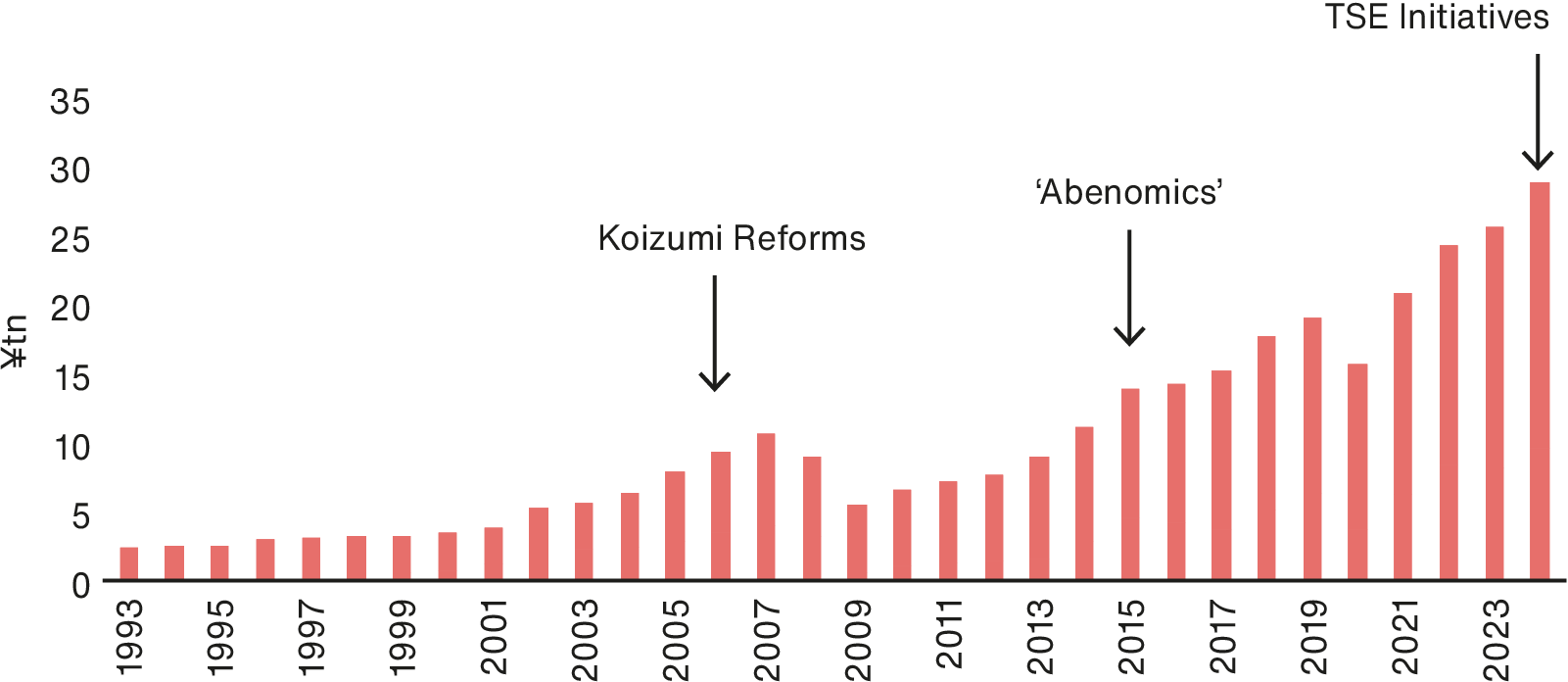

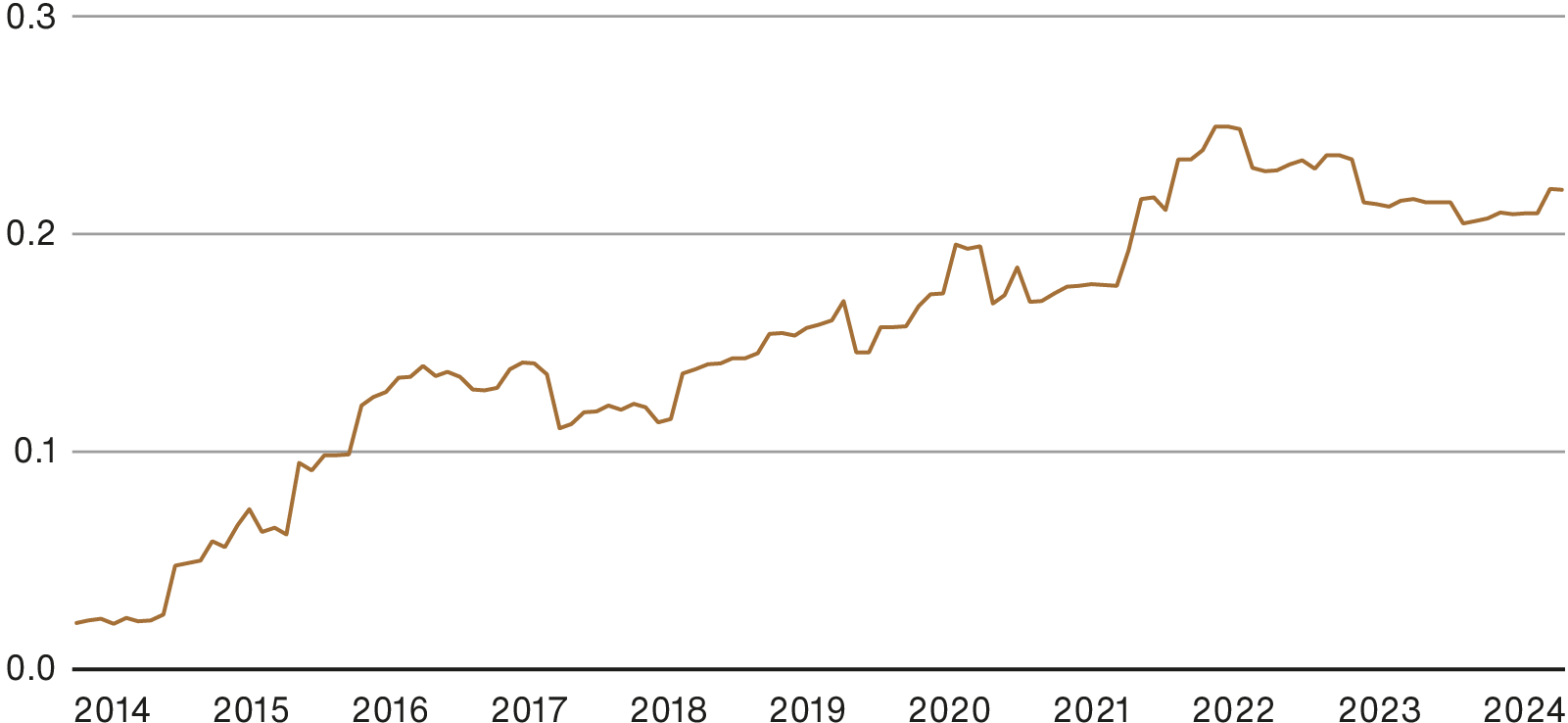

Corporate governance reform clearly provides a rising tide event for Japan and merits celebration. However, as with previous attempts (Koizumi reforms, ‘Abenomics’) investors should not rally around policy-induced initiatives in the hope they provide a quick fix to misaligned and poorly managed businesses. What is important is the direction of travel, which continues to progress thanks to several years of actioned initiatives.

Shareholder returns: dividends and buybacks

Source: Nomura. As at April 2024.

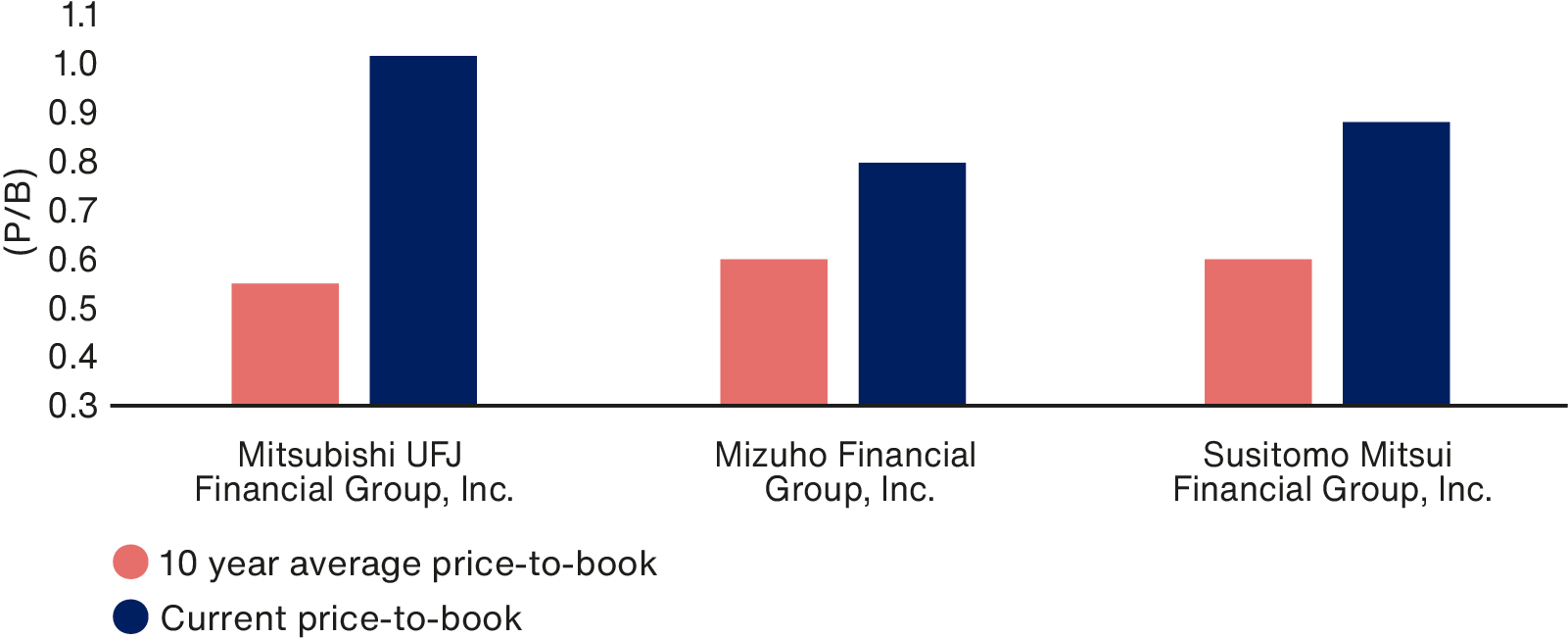

One area where this is evident is the banking sector; a typical salaryman sector awash with cross-shareholdings. Many constituents now trade on multiples on par with western peers and well above their long-term averages despite the structural impediments the sector faces: oversupply, significant overhead costs, and commoditised services vulnerable to more nimble online entrants.

Price to book multiplies for Japan's megabanks

Source: Japan Exchange Group. As at 28 May 2024.

Putting these prospects into (portfolio) perspective

There appear to be two diverging opportunity sets. At one end is a market/benchmark populated with cyclical constituents – autos, banks, and resources – that have been bid up on the back of favourable but arguably fleeting market conditions. At the other is a portfolio filled with stocks at the vanguard of various structural growth trends, now showing strong signs of sustainable operational progress yet no longer priced at a premium. In our opinion, this imbalance is anomalous and likely to be corrected.

Indeed, delivered underlying growth and consensus expectations appear to support this thesis.

Our portfolio aims to combine unique growth opportunities, each with the potential to outperform the market. It has consistently achieved this goal, even amidst the recent backdrop of cyclical inflation.

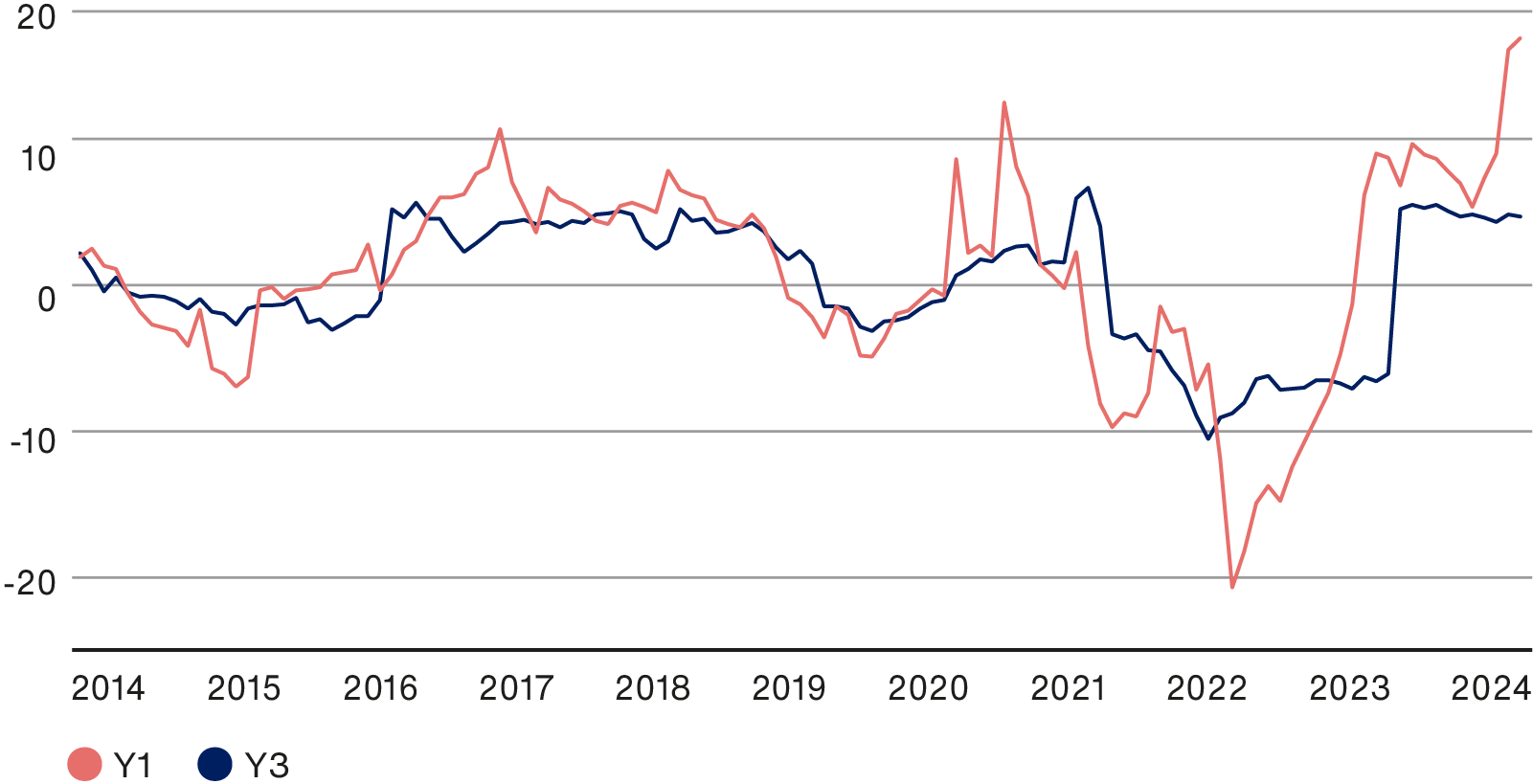

Delivered sales growth spread versus the markets

Looking forward, market consensus estimates suggest that this growth gap is likely to expand at the fastest rate in 10 years. Adding further weight beyond our own conviction.

The spread in 3Y forward sales growth expectations versus the market

Source: Baillie Gifford & Co, Japan Exchange Group. As at 31 March 2024. Yen. Based on a representative Japan All Cap portfolio vs TOPIX. Three year forward sales growth spread. Forward sales growth excludes negative earnings. Log scale.

This is also reflected in the bottom line, we anticipate the portfolio to deliver far greater earnings growth than the market (on both a one- and three-year basis) – recovering after an unusual two-year period of relative returns in which the benchmark benefited from a hard cyclical rally.

The spread in 3Y & 1Y forward EPS growth expectations versus the market

Source: Baillie Gifford & Co, Japan Exchange Group. As at 31 March 2024. Yen. Based on a representative Japan All Cap portfolio vs TOPIX. One and three year forward earnings growth spread. Forward earnings growth excludes negative earnings.

Conclusion

'Past performance is no guarantee of future results'. Although that statement is peppered across all forms of financial literature investors often fail to heed the advice, and instead anchor their expectations on the recent past. That problem poses a particularly acute risk for Japanese equity investors right now: some may be tempted to double down on bid-up cyclical stocks assuming that the drivers are more enduring in nature; others may be fleeing the market believing the best is now behind us.

We believe there is a third option that offers the greatest upside potential: a shift towards the several uncorrelated areas of the market exposed to structural growth trends (be it the online migration, rising wealth within Asia, or demographic-driven healthcare spending), where companies are now delivering sustainable sources of operational earnings growth. Although they have been broadly overlooked by the market, their drivers are not only accelerating, but they are also becoming conspicuous parts of our everyday lives.

Our ability to identify and back such businesses is simply a product of our pedigree – 40 years of managing Japanese mandates – and our patient long-term approach (of 5+ years in stark contrast to the 20-month average time horizon of the industry). Both offer us privileged insight and a greater perspective on how best to navigate these cycles and calibrate our expectations. This approach allows us to back only the companies that we believe will persist and emerge fitter for the future. This time is no different.

1Keyence is not held in the Japanese Income Growth strategy

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Japanese Equities All Cap Composite | -13.1 | 59.2 | -12.2 | -11.3 | 11.0 |

| Japanese Equities Growth Composite | -11.8 | 55.8 | -17.5 | -12.7 | 11.6 |

| Japanese Equities Income Growth | -13.6 | 50.8 | -10.0 | -7.8 | 11.4 |

| TOPIX Index | -7.2 | 38.9 | -7.2 | -3.5 | 24.3 |

| 1 year | 5 years | 10 years | |

| Japanese Equities All Cap Composite | 11.0 | 3.6 | 6.3 |

| Japanese Equities Growth Composite | 11.6 | 2.0 | 5.3 |

| Japanese Equities Income Growth | 11.4 | 3.8 | N/A |

| TOPIX Index | 24.3 | 7.5 | 7.0 |

Past performance is not a guide to future returns.

Source: Baillie Gifford & Co and TOPIX. USD. Returns have been calculated by reducing the gross return by the highest annual management fee for the composite.

Legal notice: The TOPIX Index Value and the TOPIX Marks are subject to the proprietary rights owned by Tokyo Stock Exchange, Inc. and Tokyo Stock Exchange, Inc. owns all rights and know-how relating to the TOPIX such as calculation, publication and use of the TOPIX Index Value and relating to the TOPIX Marks. No Product is in any way sponsored, endorsed or promoted by Tokyo Stock Exchange, Inc.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in June 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

105915 10048027