All investment strategies have the potential for profit and loss, capital is at risk. Past performance is not a guide to future returns.

© Yoshio Tsunoda/AFLO/Shutterstock

Remember Yahoo!? The web portal was once one of Silicon Valley’s biggest success stories before it was sold to Verizon for mere pennies on its peak valuation. Meanwhile, its corporate cousin Yahoo! Japan has been far more fortunate.

Set up in 1996 as a joint venture between Yahoo! Inc (supposedly an acronym of ‘Yet Another Hierarchical Officious Oracle!’) and Softbank, with the latter taking 60 per cent control, Yahoo! Japan evolved independently to serve the Japanese market, where it quickly became synonymous with the internet itself.

Among the reasons for its success are:

- Adopting ‘time machine’ management:

The company took advantage of the slower progress of the Japanese internet to see what worked in the US and then rapidly replicated the right parts to stay ahead of the competition. - Exploiting strong local knowledge:

Softbank supremo Masayoshi Son helped the company avoid the mistakes of its US forerunner, which fumbled the transition to mobile. Softbank group’s broader portfolio of businesses also helped create an ecosystem tailored to local tastes – there’s anecdotal evidence of Son using his Vision Fund connections (such as Paytm) to develop similar business models in Japan. - Diversifying beyond search:

Unlike Google and Yahoo! Inc, which originally focused their advertising revenue-raising efforts on results pages from searches, Yahoo! Japan developed other revenue streams, becoming a news aggregator and an auction site, as well as operating various online shopping malls. The auction business, in particular, highlights how the US and Japanese firms’ destinies diverged. After failing to convince founder Jerry Yang to merge Yahoo! Inc with eBay in 1999, Son resolved to create online auctions at home in Japan. When eBay tried to enter the Japanese market in partnership with IT giant NEC Corporation in 2000, Son led a diehard resistance, charging no fees until eBay retreated, which it did a few years later. The auction business later became one of Yahoo! Japan’s fattest cash cows.

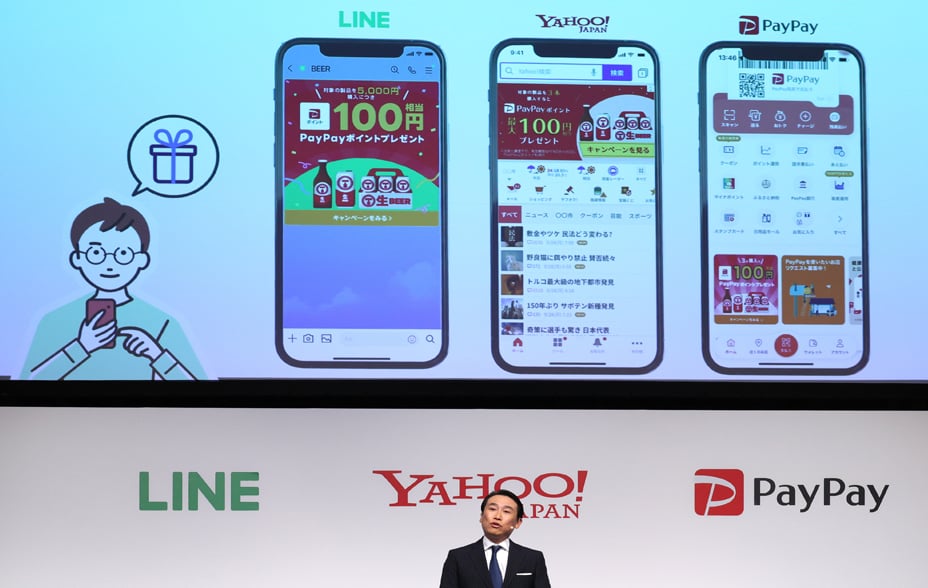

Two decades on, it is now held across several Baillie Gifford portfolios. Its opportunity has evolved within three distinct areas following its merger with LINE, the country’s dominant online messaging platform. It has gone, so to speak, ‘from Y to Z’ by adopting the name Z Holdings. Binding these businesses will inevitably take time but it allows the potential emergence of a ‘super app’.

Leading in digital advertising

Combining Yahoo! Japan, Japan’s number one website (with an estimated 14 per cent market share of digital advertising), with the number one messaging app, LINE (with an 8 per cent market share), creates a company with significant advertising real estate and unparalleled first-party user data. This will be ever more important after Apple restricted third-party cookies in 2021, degrading the ability of Facebook and other advertisers to target users. In due course, this should result in Z taking more of the digital ad market and, in turn, a share of the total ad market.

Challenging for the ecommerce top spot

Although Yahoo! Japan ranks as third most successful in Japan's ecommerce space behind Rakuten and Amazon, its expanded offering makes it a formidable force. It is now well-positioned across the entire ecommerce landscape, with Yahoo! Shopping offering the broadest range of products of any ecommerce platform. This, complemented by PayPay Mall, offers a more premium offering, with the latter also hosting Zozotown, Japan’s leading online apparel store. It also operates in the consumer-to-consumer space with Yahoo! Auctions and PayPay Flea Market, which are encroaching on Mercari’s dominance of the second-hand ecommerce space.

Disrupting domestic payments

Just over six years ago the current chair of Z, Kentaro Kawabe, and Masayoshi Son met with Jack Ma, founder of Alibaba. Reportedly all Ma would talk about was Alipay. He was asked to educate Yahoo! Japan on digital payments and the best way they could tap the potential of a ¥600tn ($5.5tn) domestic consumer payment market.

The outcome was PayPay, launched in 2018. It has quickly become the de facto digital payment solution in Japan, accounting for well over 50 per cent of the QR code payment market.

© LightRocket/Getty Images

This astonishing growth was supported by Softbank Corp, leveraging its oligopolistic position in telecoms to broaden the app’s appeal across ‘mom-and-pop’ merchants. PayPay QR is now one of the only ways to pay without cash in small and medium-sized stores (SMEs). LINE, Ikkyu (a Z company facilitating high-end restaurant and hotel reservations), Yahoo! Japan, and Askul (another Z company for B2B office supplies) are all linked to PayPay and give a social and service edge that other payment providers cannot match. Z has also been undercutting credit cards by 66 per cent, with commission rates of less than 1 per cent versus 2–3 per cent, and in some cases offering a 0 per cent take rate to entice SMEs. Commission rates can then be raised once incumbency in e-money is achieved.

Starting with 1 per cent penetration, there is huge upside potential in gaining share from both cash (which accounts for 67 per cent of transactions in Japan) and credit card transactions (27 per cent of transactions). The Japanese government is targeting a 40 per cent cashless rate by 2025; Kawabe believes it’s more likely to hit 80 per cent, given the economic benefits to both consumers and companies.

Beyond payments lies the potential to monetise similar areas, by moving into banking, investments, insurance and other financial products. This is what Ant Group has done successfully, providing an obvious playbook to follow that takes the business into profit pools beyond the basic model of taking a cut on flows. Encouraging the use of points and rebates for cross-use of services within the ecosystem will also allow the group to amass valuable credit data for providing small-ticket loans (a particularly profitable part of Alipay, which uses client’s usage data on Taobao/Tmall to reduce bad debt risk).

Z clearly enjoys immense advantages. Its customer reach through Yahoo! Japan (86 million monthly active users or MAUs), LINE (92 million MAUs in Japan, with another 81 million abroad), PayPay (47 million MAUs) and parent company, SoftBank Corp (39 million subscribers) will give it unprecedented referral traffic. Also, rather than being potentially one ‘super app’, the company's CFO, Ryosuke Sakaue, claimed that Z was an amalgam of three super apps: Yahoo! Japan; PayPay; and LINE. These three appealing areas provide significant breadth in its product and service offering that should provide new paths for growth well into the future.

Important information

This communication was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available by visiting our Documents page.

Any images used in this content are for illustrative purposes only.

Ref: 37476 10019475