Images courtesy of Climeworks.

All investment strategies have the potential for profit and loss, capital is at risk. Past performance is not a guide to future returns.

“I was delighted and impressed. So impressed I bought the company.”

In one of the iconic advertising moments of the late 1970s, entrepreneur Victor Kiam made the fairly obvious observation that if a company produces great products, which serve a purpose better than competitors, that’s a decent indicator of its long-term attractiveness as an investment. The phrase sprang to mind recently when Baillie Gifford started to use the services of Climeworks to remove part of our carbon footprint. The logic runs backwards in this case – we made the investment for relevant clients some time before our internal climate group elected to start working with Climeworks – but the point is the same: if we see the value of something to our own business, it might well be judged as valuable by others.

For this reason, we have formal and informal investor links within Baillie Gifford. Our IT team periodically meets with investors to discuss how we select our own software and technology vendors, for example. Generally, if we think a company’s products are compelling for our own use, it’s useful to incorporate these ideas into our investment research as we consider the addressable market and competitive advantage. Conversely, if we invest in a company which provides a relevant product that we don’t use, it’s useful to consider why not. For instance, we adopted Grammarly after seeing the merits of its editorial programme.

With that in mind, let’s look more closely at Climeworks. In this case, we think there are compelling reasons for other firms to mirror our interest. Indeed, many household names are already doing so. But first, let’s take a step back to consider why and how companies are committing to net zero carbon emissions.

Complex commitments

The ‘why’ is fairly straightforward: some companies no doubt make net zero commitments out of a sense of wider duty, but generally we see companies responding out of self-interest. Governments are already enacting tighter regulations which mean continuing to produce emissions will lead to relentlessly rising costs. Meanwhile, transparency and reporting requirements are combining with greater consumer awareness about the gravity of our climate challenge. This influences purchasing decisions, driving custom towards companies which demonstrate responsible approaches.

The ‘how’ is rather more complicated. First and most easily understood is the simple (but not easy) task of reducing directly-created carbon emissions. We are seeing an increasing focus on initiatives like discouraging employee travel and using more renewable power. For energy-intensive industries, where the rising cost of emissions is potentially more existential, we are seeing concerted efforts to scale greener manufacturing processes for things like steel, concrete and protein. It is crucial that firms don’t see carbon removal as an excuse not to address emissions at source: there are nowhere near enough carbon removal capacities in the world to get to net zero and, as we will see, not all removals are equal. To rely on carbon removal while allowing unmitigated carbon emissions is to put yourself at the mercy of an auction in which credible supply won’t meet demand anytime soon. So, direct emissions reductions generally should be the first priority. Most firms – ours included – are really only beginning to get to grips with the implications of a serious emissions reduction plan.

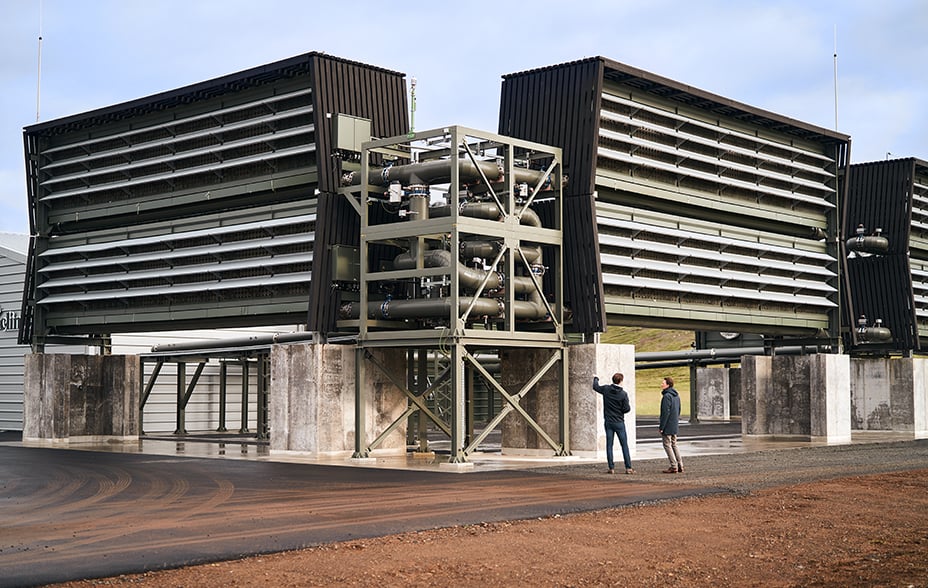

Jan Wurzbacher (left) and Christoph Gebald, the founders of Climeworks, at their carbon capture plant in Iceland

Once direct carbon emissions have been addressed, many firms will be left with a residual which is challenging to get rid of. Additionally, their legacy emissions that have already been released into the atmosphere will continue to contribute to global warming, if they are not removed. This is where high-quality carbon removals have a role to play and where Climeworks comes into its own as a company that is scaling its technology to capture carbon directly from the atmosphere. The carbon can then be stored permanently underground, creating accurately measurable and highly durable removals. Using technology powered by 100 per cent renewable energy – facilitated by siting activities in places such as Iceland where geothermal power is abundant – Climeworks offers the ability to directly filter carbon dioxide from ambient air. This is then mixed with water and pumped deep underground by Climeworks’s CO2 mineralisation partner Carbfix, where it mineralises and stays put.

Carbon removal solutions like Climeworks’ direct air capture (DAC) technology contrast with the more widely defined ‘carbon capture’ (or carbon capture and storage (CSS)), which means attempting to capture the carbon output of manufacturing or electricity generation processes at the point of pollution. While this approach only avoids adding emissions into the atmosphere, carbon removal solutions like DAC actually set out to reduce the concentration of carbon dioxide already in the ambient atmosphere.

A price worth paying

The practical efficacy of carbon markets is a large and sometimes contentious topic. The cost of carbon credits varies hugely depending on whether they are voluntary or mandatory, the quality and clarity of the removal, and whether the removal is demonstrably permanent. Climeworks’s approach is attractive because it is precisely measurable, highly scalable and removes carbon dioxide permanently for thousands of years. Unfortunately, given the novelty of this industry, it currently comes with a hefty price tag.

To put this in context, Baillie Gifford currently pays about £30 per tonne to address our carbon emissions across various schemes, of which Climeworks is the highest quality but also by far the most expensive. This does not make us pioneers: like many others, we are spending what we think is reasonable and affordable in the knowledge that we’d do more in a perfect world. Our cost is about eight times higher than the price certain airlines pay directly to offset the carbon burnt by their aircraft. Some airlines don’t pay directly but give passengers the option to offset their emissions – in one example we calculate this to be anything between £28 per tonne and £189 per tonne depending on the mix of carbon offsets, removals and use of cleaner aviation fuels. Meanwhile, the price of the cheapest voluntary market carbon credits – which can vary with market forces – is around only £3 per tonne at the time of writing.

Value-for-money in carbon offsets

Let’s take a small-scale theoretical example: I have a lot of mature trees in my garden. I have no intention of cutting them down, but I could sell my decision not to cut down those trees in the form of a carbon credit. I could limit this commitment to (say) the next 20 years. Since I have no intention of cutting down the trees – because I like them, I’m environmentally aware and I haven’t got the time or inclination to find a logging company – selling the carbon credit for anything more than zero would be a win for me and create carbon credits for the buyer, even though there is no real-world impact. Admittedly this is an over-simplification, but it’s the gist of what’s happening at an industrial scale in certain parts of the world, and why some carbon credits cost 50 times more than others.

What are we to make of this wildly different pricing? The key point is that not all carbon removals are equal. The cost of extracting a tonne of CO₂ from the atmosphere and permanently storing it is a large multiple of the cost of paying for someone not to cut down Amazonian rainforest when they say they otherwise would (not cutting down rainforest may be far more pressing from a biodiversity point of view, but that’s for another article…). In particular, the permanence point is key – even legitimate carbon offsetting schemes which actually plant new trees are, in the long run, likely to be only carbon neutral. Trees eventually die and release their carbon back into the air. The problem we’re dealing with is the release of tens of millions of years’ worth of dead organisms being burnt as fossil fuels in what amounts to the blink of an eye evolutionarily (there’s a reason they’re called ‘fossil’ fuels). We estimate – almost entirely academically, given the vast difference between investor and geological timescales – that permanence alone should command a premium of at least 10 times the cost of decent tree-planting offset schemes on a 1,000-year net present value basis.

The question of scaling

In time, as scale in direct air capture technology is achieved, pricing should decline sharply. Part of Baillie Gifford’s willingness to pay a high price to remove a relatively small part of our carbon emissions is the understanding that by doing so we help to enable this scaling. It also looks relatively sure that governments will use various mechanisms to ratchet up the price of carbon emissions, including better regulation and forcing up the quality (and price) of the worst offset schemes. One way to glimpse the future is to look at the pricing achieved by the EU’s Emissions Trading Scheme for high-emitting industries. It’s tightly regulated and, to some extent, raises the floor on the quality of offsets, so prices can’t be artificially driven down to the levels of purely voluntary carbon markets where the cheapest offsets have almost no impact. The current (early 2023) price of a 1-tonne carbon credit within the EU scheme is €77. Sadly, that’s still a lot less than the amount Climeworks charges to remove the same amount of carbon. As Climeworks scales, and as cheap-but-ineffective offset schemes become less acceptable, we can see huge long-term potential. But we are far away from convergence and much more capital will be needed to get there.

The Orca plant, Iceland

Of course, nothing is certain in investments (or climate change). There may not be the global political will to tighten regulations to the point where the real cost of carbon emissions is imposed. As noted earlier, there are huge issues of international fairness. Consumers may have good intentions but baulk at the cost of true carbon neutrality in practice. It could still be a very long time before the financial and social costs of climate change are compelling enough to force serious change, and at worst it could just be too big a problem to solve. From an investment point of view, the longer progress is delayed, the more we will need to protect clients’ interests by focusing on the opportunities arising from climate adaptation as well as technological solutions. For now, we think and hope that greater opportunities arise from prevention.

What we do know is that (1) at some point in the not-too-distant future we both need to, and should be able to, stop the net additions of carbon to our atmosphere, and (2) the companies that can seriously contribute to that outcome – not just appear to contribute – have the potential to be hugely successful.

Enabling a bright future

I am quite sure that Baillie Gifford is not the only company that seriously wants to achieve net zero emissions from its own operations. It will take time and it needs to become more affordable. But as the complexities of carbon reduction, offset and removal become better understood, we think a lot of firms will follow our reasoning. Not just because it’s the right thing to do, but because it makes good commercial sense.

In the future, we may even find that once society has reversed the net additions of carbon, governments will collaborate to actively reduce the amount of carbon in the atmosphere. But we’re not going to get back to the levels of atmospheric CO₂ that we have even today by regrowing all the organic matter we once had. That’s just not compatible with a world population that’s surpassed eight billion and citizens who want ever-rising living standards. That means a very long runway for the direct removal and storage of carbon from the air. If we’re right, there will be many more companies like Baillie Gifford using Climeworks’s services, and it has the chance of a very bright future indeed.

You can watch a short film on Climeworks’s technology here: Introducing Orca - the world's first largest direct air capture and storage plant - YouTube

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in March 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions ('FinIA'). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a 'wholesale client' within the meaning of section 761G of the Corporations Act 2001 (Cth) ('Corporations Act'). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a 'retail client' within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 36623 10018836