Philosophy and values

To find our clients long-term growth opportunities, we think in terms of years and decades rather than months and quarters. And when we unearth companies poised to prosper from change, we aim to be long-term shareholders on our clients behalf, supporting management to achieve the best possible results.

It's about time

We don’t speculate on short-term shifts in financial markets or try to out-guess macroeconomic forecasters. Instead, our investment teams engage in deep, bottom-up analysis of companies. We try to find those that are disrupting existing ways of doing things. And we look for those with a deep-seated competitive advantage so they aren’t dependent on external factors they can’t control. Whether investing for capital growth or a sustainable income, we determine our success by understanding individual companies and how they can execute on their opportunities.

United in purpose, independent of mind

We actively engage with the companies in our portfolios. We try to build constructive relationships with management and so contribute to good outcomes rather than just speculate on share prices at arm’s length. Although we seek to be long-term supportive shareholders, if we think the opportunity is waning or management is not behaving as we would like despite our efforts, we do not hesitate to sell and move on.

Our investment teams have much in common but don’t always agree with each other. Nor are they under pressure to do so. Baillie Gifford doesn’t have a ‘house view’ about what to buy or sell. While our managers draw on each other’s research, they reach their own conclusions about individual companies’ prospects and how to construct their portfolios.

Fine-tuned by time

The investment management industry has considerable influence because of the assets we allocate. We don’t treat that lightly. As a business, our primary goal is to generate investment returns for our clients, but we must not be irresponsible in how we do it. We seek to set an example by:

- charging fair, reasonable and transparent fees

- acting as responsible owners of companies on clients’ behalf

- focusing on how our deployment of capital can create useful economic growth that benefits everyone

We believe this approach is consistent with generating excellent long-term outcomes for our clients.

Our investment beliefs

Ever wondered what active, low-turnover investing is? Or what we mean by asymmetric returns? Discover more about our long-term philosophy and get concise answers to common questions.

What does it mean to be an Actual investor?

For more than a century, Baillie Gifford has invested in growth opportunities across the globe. We strive to place our clients capital in the most competitive, innovative and efficient companies, mindful that they operate in ever-changing conditions.

Unusual thinking

We prize the diversity of our specialists and rigorous in-house research methods. But we also acknowledge that others can help us think distinctively.

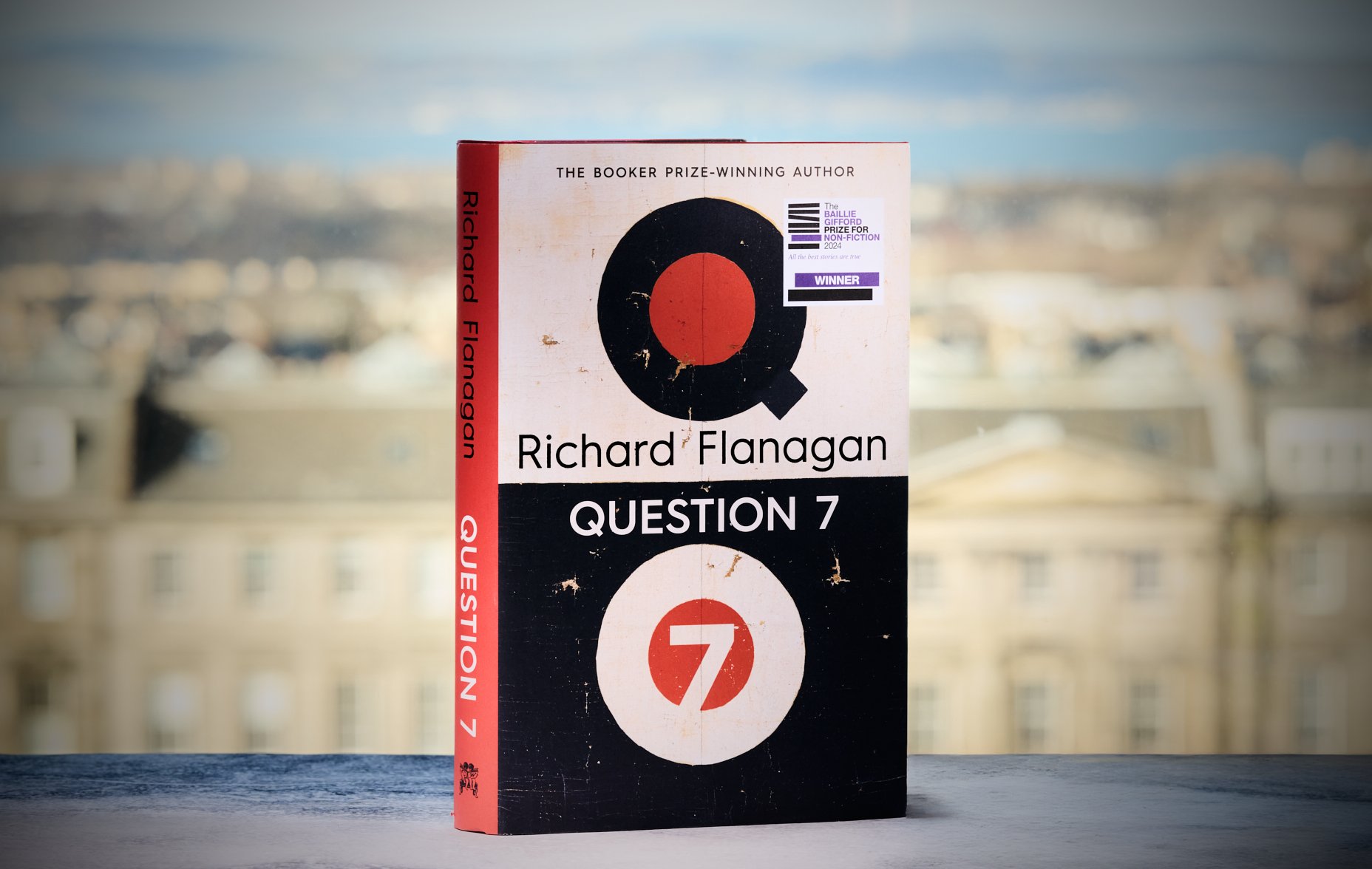

Contrarian insights from academia encouraged us to invest in Tesla and Illumina, among others. So we treasure our relationships with academics and other experts. And by speaking to authors, we encourage the flow of ideas and expose ourselves to new voices.

Stability and expertise

Discover Baillie Gifford’s rich history, a firm committed to identifying long-term global growth opportunities since its inception. Explore our founders’ story and witness how the solid foundations they laid continue to benefit our clients more than a century on.

Responsible investment

Products to fit our clients choice of investment style, asset type, type of fund and geographic region.