Capital at risk

Long Term Global Growth

Long Term Global Growth is an unconstrained equity strategy focused on exceptional companies. We invest over the long term in listed firms with the scope to grow to many multiples of their current size over the next decade.

We seek out transformational growth

We manage a concentrated portfolio of innovative growth companies. We embrace the asymmetry of equity markets by staying optimistic about the future to deliver transformational returns to our clients.

Long Term Global Growth: our philosophy

Investment manager Mark Urquhart introduces Long Term Global Growth, reflecting on the exciting opportunities ahead.

A selective strategy

We take a bottom-up approach to stock selection. Portfolio construction is purely stock-driven, so no reference is made to benchmark indices in our investment process. We are genuinely active, not passive. Portfolio holding sizes are based purely on the magnitude of the potential upside and the associated level of conviction.

This investment approach is consistent with outperforming a typical global equity benchmark by about 3 per cent per annum, net of fees, over the long term.

A concentrated, resilient portfolio

At its core, LTGG’s task is future-proofing. Investing with an eye on the next 10 years instead of the next quarter necessitates adaptability, diligent capital allocation and resilience from our holdings.

This is a high bar for inclusion, resulting in a portfolio of 30-40 stocks, and because we embrace asymmetry, position sizes are often skewed – winners can reach 10 per cent of the portfolio.

We believe that the rewards to the champions of change can far outweigh the losses of incumbents: the best feature of equities is the unlimited upside.

Meet the managers

Documents

Philosophy and process

Explore our investment philosophy and the processes around how the team constructs the portfolio.

Quarterly update

Get the latest investment commentary, portfolio overview, transactions and performance information alongside governance engagement and voting.

Stewardship report

Find out about our conversations with portfolio companies, shareholder vote activity and consideration of environmental, social and governance matters.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Invest through other vehicles

Get in touch to learn about the other ways to invest, including:

- Separate account

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 30 June 2025

| # | Company | Fund % |

|---|---|---|

| 1 | Amazon.com | 6.2% |

| 2 | Netflix Inc | 5.4% |

| 3 | NVIDIA | 5.3% |

| 4 | Cloudflare Inc | 4.9% |

| 5 | Spotify Technology SA | 4.7% |

| 6 | Sea Ltd ADR | 4.0% |

| 7 | Coupang | 3.7% |

| 8 | MercadoLibre | 3.5% |

| 9 | Tencent | 3.3% |

| 10 | Adyen NV | 3.3% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Invest through other vehicles

Get in touch to learn about the other ways to invest, including:

- Separate account

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

LTGG Reflections: Rocket Lab

From a New Zealand shed to challenging SpaceX: why Rocket Lab's remarkable journey captivates LTGG.

Brittle botany

How LTGG cultivates resilience in a fractious world.

Long Term Global Growth Q2 update

Investment manager Mark Urquhart reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Listening beats forecasting

Why we value curiosity over certainty: recent lessons from the road

LTGG Reflections: materiality

Why focusing on long-term business fundamentals, not headlines, drives LTGG's investment success.

LTGG Reflections: Know where your towel is

Why investors should avoid the temptation to throw in the towel during market turmoil.

With the benefit of foresight

Investors must navigate uncertainty to create long-term value in a rapidly changing world.

LTGG Reflections: TSMC, why now?

The 40-year-old company leading AI technology with advanced semiconductor production.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Resisting short-term noise

Mark Urquhart teaches us how to ignore market noise and focus on promising companies.

Climate scenarios: so what?

Six themes we think will influence companies’ futures as the world adapts to climate change.

LTGG Reflections: Politics and portfolios

How we navigate noisy politics to uncover transformative investment opportunities.

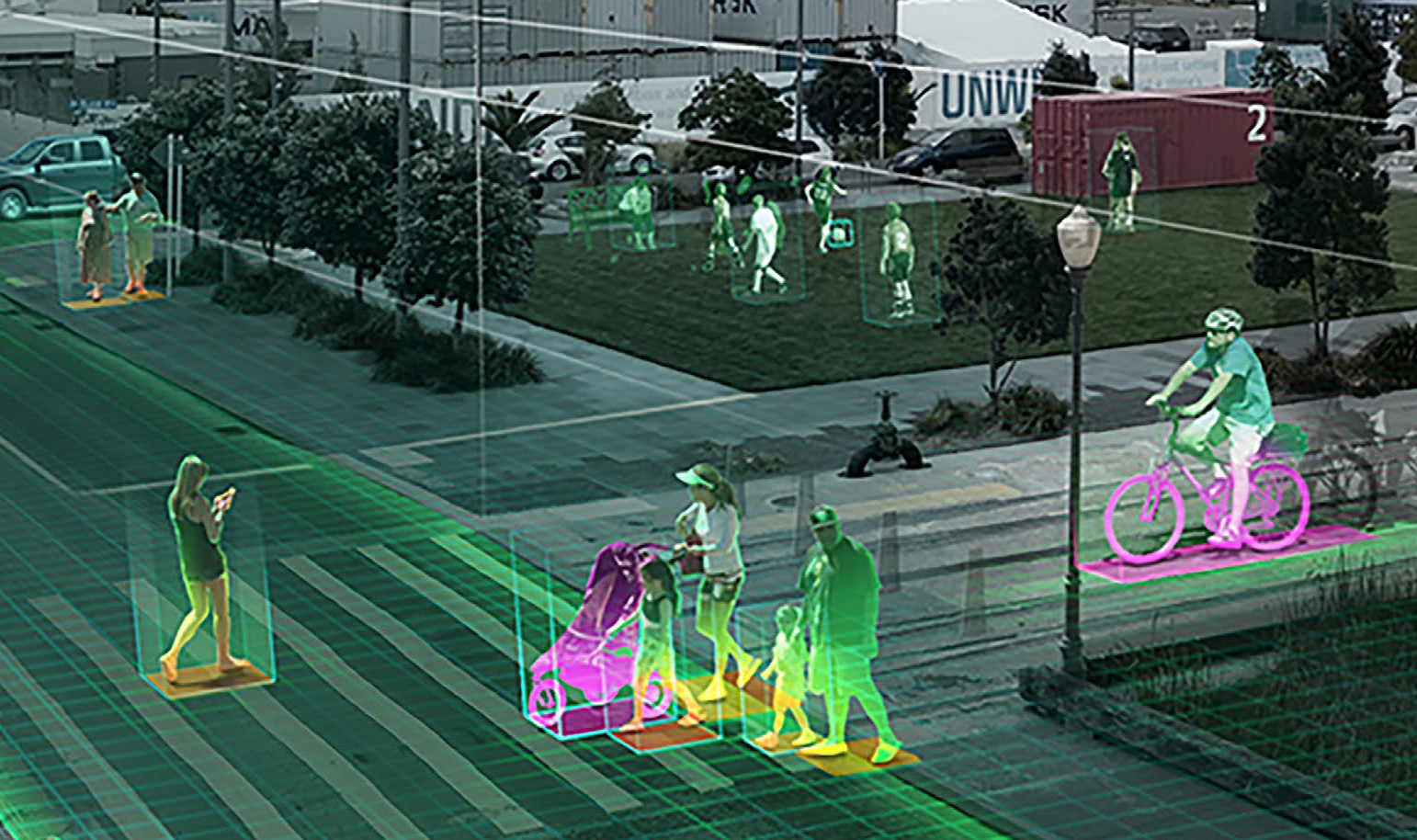

AI revolution: behind the 'overnight' success

AI is revolutionising industries globally. Stewart Hogg explores how AI is reshaping companies and driving long-term growth.

Finding sanity in the circus

An LTGG insight into what really matters for long term growth investing at the current juncture.

Volatility in LTGG: a feature not a bug

Why volatility is crucial to LTGG's strategy of capturing outsized returns.

Long Term Global Growth Q4 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Jewels in the crown

How we consider the balance of tradition and transformation when it comes to investing in India.

LTGG Reflections: Private eyes

Our approach to private market investments and the AI new buy it led to.

LTGG Reflections: When life gives you lemons, make lemonade

Our new portfolio holding AppLovin has an innovative approach to app marketing, driving success in a crowded market.

Long Term Global Growth Q3 investor letter

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments

Long Term Global Growth Q3 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Flying under the radar

Uncovering our portfolio holdings that fly under the radar: Intuitive Surgical, Atlassian and Tencent.

Kweichow Moutai: spirit of China

The fiery spirit that’s a profitable symbol of Chinese culture and luxury.

LTGG Reflections: The value of culture

Why the critical role of corporate culture can be the heartbeat of business success.

Long Term Global Growth Q2 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Sugar rush: LTGG Q2 2024

Highlighting the companies driving portfolio returns and how our appetite for growth compares to market trends.

LTGG Reflections: Skipping the queue with Nubank

Discover how Nubank is freeing Brazilians from endless queues and leading a financial revolution.

Transformations

The LTGG Team explore themes that will be key to the next 20 years of transformational growth.

LTGG Reflections: e.l.f Beauty

Why we believe e.l.f. Beauty's innovative approach and explosive growth make it a must-have in the LTGG portfolio.

LTGG Reflections: Risk

How we identify leading high-growth companies by blending deep fundamental analysis with strategic insights.

Webinar: Why growth? Why now?

Partners Tim Garratt and Stuart Dunbar identify signs of emerging growth.

LTGG Reflections: A robotic reality

From surgery to warehouses, discover how robotics are redefining efficiency and innovation in 2024.

The opportunity in risk: LTGG Q1 2024

How the LTGG team searches for companies willing to take bold risks to become future leaders.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: The year of the dragon

LTGG investment manager Mark Urquhart reflects on his recent trip to China.

Long Term Global Growth Strategy

Investment manager, Mark Urquhart, discusses the Baillie Gifford Long Term Global Growth Strategy.

LTGG Reflections: Llama mile

How the ecommerce giant is slashing delivery times with innovation and an unlikely courier fleet

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

LTGG’s 2023 year-end review

Was 2023 the year that saw transformational growth stories resume their conquest?

LTGG Reflections: Illumina

Why we sold Illumina after more than a decade in the portfolio.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

LTGG Reflections: Solar innovations

Enphase's role in the solar revolution and the potential for long-term growth.

LTGG third quarter 2023 update

A look at portfolio performance over the recent quarter-end.

LTGG Reflections: from biologics to branded fashion

In this monthly update, the team discusses recent research visits to WuXi, Symbotic and Moncler.

LTGG Reflections: NVIDIA - chipping away at success

Following a successful quarter, the LTGG team consider the future of NVIDIA.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

LTGG Reflections: The transformative potential of AI

Artificial intelligence is not as new as you think it is, as the LTGG portfolio reveals.

LTGG Reflections: Defying data disorder

Why Datadog's ability to master the chaos of cloud computing offers an attractive opportunity.

LTGG second quarter 2023 update

An update on portfolio performance, and the importance of adapting for the future.

LTGG Reflections: Kaizen – continuous improvement

Reflections on performance, holdings and continuous improvement.

LTGG Reflections: Jevons paradox - a case for Samsara

How Samsara's data-driven insights help its customers optimise their business operations.

LTGG: Quarterly Review

LTGG review the first quarter of 2023 and the engines of change.

Reflections: Catch-22 Earnings

Does the market under-appreciate the impact of intangible investments?

LTGG Reflections: Rising from the ashes

An investment portfolio update explaining why holdings have thrived despite economic chaos.

LTGG investor update – January 2023

LTGG’s Stewart Hogg and Gemma Barkhuizen on volatility, business culture, and the long-term view.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

LTGG Reflections: Shifting shades of grey

Short-term, many companies seem grey and similar. But patience will reveal colourful outliers.

LTGG quarterly commentary

A look at recent macroeconomic factors and performance and considerations for the future.

LTGG Reflections: Operational growth hurdles

Why growth is still possible in hard times.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

Looking back going forward

The LTGG Team look back on an extraordinary 12 months and discuss the growth prospects of the portfolio, the rapid development of vaccines and the importance of hold discipline.

Long Term Global Growth Q2 update

Investment manager Mark Urquhart reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Rocket Lab

From a New Zealand shed to challenging SpaceX: why Rocket Lab's remarkable journey captivates LTGG.

Brittle botany

How LTGG cultivates resilience in a fractious world.

Long Term Global Growth Q2 update

Investment manager Mark Urquhart reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Listening beats forecasting

Why we value curiosity over certainty: recent lessons from the road

LTGG Reflections: materiality

Why focusing on long-term business fundamentals, not headlines, drives LTGG's investment success.

LTGG Reflections: Know where your towel is

Why investors should avoid the temptation to throw in the towel during market turmoil.

With the benefit of foresight

Investors must navigate uncertainty to create long-term value in a rapidly changing world.

LTGG Reflections: TSMC, why now?

The 40-year-old company leading AI technology with advanced semiconductor production.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Resisting short-term noise

Mark Urquhart teaches us how to ignore market noise and focus on promising companies.

Climate scenarios: so what?

Six themes we think will influence companies’ futures as the world adapts to climate change.

LTGG Reflections: Politics and portfolios

How we navigate noisy politics to uncover transformative investment opportunities.

AI revolution: behind the 'overnight' success

AI is revolutionising industries globally. Stewart Hogg explores how AI is reshaping companies and driving long-term growth.

Finding sanity in the circus

An LTGG insight into what really matters for long term growth investing at the current juncture.

Volatility in LTGG: a feature not a bug

Why volatility is crucial to LTGG's strategy of capturing outsized returns.

Long Term Global Growth Q4 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Jewels in the crown

How we consider the balance of tradition and transformation when it comes to investing in India.

LTGG Reflections: Private eyes

Our approach to private market investments and the AI new buy it led to.

LTGG Reflections: When life gives you lemons, make lemonade

Our new portfolio holding AppLovin has an innovative approach to app marketing, driving success in a crowded market.

Long Term Global Growth Q3 investor letter

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments

Long Term Global Growth Q3 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: Flying under the radar

Uncovering our portfolio holdings that fly under the radar: Intuitive Surgical, Atlassian and Tencent.

Kweichow Moutai: spirit of China

The fiery spirit that’s a profitable symbol of Chinese culture and luxury.

LTGG Reflections: The value of culture

Why the critical role of corporate culture can be the heartbeat of business success.

Long Term Global Growth Q2 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Sugar rush: LTGG Q2 2024

Highlighting the companies driving portfolio returns and how our appetite for growth compares to market trends.

LTGG Reflections: Skipping the queue with Nubank

Discover how Nubank is freeing Brazilians from endless queues and leading a financial revolution.

Transformations

The LTGG Team explore themes that will be key to the next 20 years of transformational growth.

LTGG Reflections: e.l.f Beauty

Why we believe e.l.f. Beauty's innovative approach and explosive growth make it a must-have in the LTGG portfolio.

LTGG Reflections: Risk

How we identify leading high-growth companies by blending deep fundamental analysis with strategic insights.

Webinar: Why growth? Why now?

Partners Tim Garratt and Stuart Dunbar identify signs of emerging growth.

LTGG Reflections: A robotic reality

From surgery to warehouses, discover how robotics are redefining efficiency and innovation in 2024.

The opportunity in risk: LTGG Q1 2024

How the LTGG team searches for companies willing to take bold risks to become future leaders.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

LTGG Reflections: The year of the dragon

LTGG investment manager Mark Urquhart reflects on his recent trip to China.

Long Term Global Growth Strategy

Investment manager, Mark Urquhart, discusses the Baillie Gifford Long Term Global Growth Strategy.

LTGG Reflections: Llama mile

How the ecommerce giant is slashing delivery times with innovation and an unlikely courier fleet

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

LTGG’s 2023 year-end review

Was 2023 the year that saw transformational growth stories resume their conquest?

LTGG Reflections: Illumina

Why we sold Illumina after more than a decade in the portfolio.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

LTGG Reflections: Solar innovations

Enphase's role in the solar revolution and the potential for long-term growth.

LTGG third quarter 2023 update

A look at portfolio performance over the recent quarter-end.

LTGG Reflections: from biologics to branded fashion

In this monthly update, the team discusses recent research visits to WuXi, Symbotic and Moncler.

LTGG Reflections: NVIDIA - chipping away at success

Following a successful quarter, the LTGG team consider the future of NVIDIA.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

LTGG Reflections: The transformative potential of AI

Artificial intelligence is not as new as you think it is, as the LTGG portfolio reveals.

LTGG Reflections: Defying data disorder

Why Datadog's ability to master the chaos of cloud computing offers an attractive opportunity.

LTGG second quarter 2023 update

An update on portfolio performance, and the importance of adapting for the future.

LTGG Reflections: Kaizen – continuous improvement

Reflections on performance, holdings and continuous improvement.

LTGG Reflections: Jevons paradox - a case for Samsara

How Samsara's data-driven insights help its customers optimise their business operations.

LTGG: Quarterly Review

LTGG review the first quarter of 2023 and the engines of change.

Reflections: Catch-22 Earnings

Does the market under-appreciate the impact of intangible investments?

LTGG Reflections: Rising from the ashes

An investment portfolio update explaining why holdings have thrived despite economic chaos.

LTGG investor update – January 2023

LTGG’s Stewart Hogg and Gemma Barkhuizen on volatility, business culture, and the long-term view.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

LTGG Reflections: Shifting shades of grey

Short-term, many companies seem grey and similar. But patience will reveal colourful outliers.

LTGG quarterly commentary

A look at recent macroeconomic factors and performance and considerations for the future.

LTGG Reflections: Operational growth hurdles

Why growth is still possible in hard times.

ASML: advancing chips to new limits

The Dutch firm driving progress by making it possible to create more intricate computer chips.

Looking back going forward

The LTGG Team look back on an extraordinary 12 months and discuss the growth prospects of the portfolio, the rapid development of vaccines and the importance of hold discipline.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Invest through other vehicles

Get in touch to learn about the other ways to invest, including:

- Separate account

How to invest in this strategy

You can invest in this strategy through the following fund(s).

Invest through other vehicles

Get in touch to learn about the other ways to invest, including:

- Separate account