Capital at risk

Emerging markets equities

We’ve been managing dedicated emerging markets portfolios for three decades. We are targeting a wide range of growing emerging market companies.

Why invest in emerging markets?

Emerging markets can give you access to many of the world’s most dynamic, high-growth companies. Over the past two decades, the breadth and quality of these businesses have significantly improved, and the economies themselves have become more robust. However, not all opportunities are equal. With our extensive experience and unique approach, we strive to pick only the fastest-growing businesses from a diverse range of countries and industries for you.

How do we invest in emerging markets?

We consistently find that the companies which outperform are those that grow their profits faster than the market in hard currency terms over several years.

Our goal is to discover these businesses, assess their long-term growth potential and then patiently hold them, allowing our research-driven decisions to generate returns for you.

Emerging market strategies

Emerging Markets All Cap

Our longest-standing Global Emerging Markets portfolio, targeting the world’s best Emerging Market companies with a diversified approach.

Emerging Markets ex China

Seeking to provide exposure to the best Emerging Market opportunities outside of China, an increasingly common consideration for investors.

Emerging Markets Leading Companies

A more concentrated Global Emerging Markets portfolio of 35-60 stocks. Seeking strong opportunities to own for the long term.

All our investment capabilities

Insights

Key articles, videos and podcasts relating to our emerging markets equities investment capabilities:

Emerging Markets: our philosophy

Investment manager William Sutcliffe introduces Emerging Markets, reflecting on the exciting opportunities ahead.

Monthly insights

Related insights

Emerging Markets Q2 update

Investment manager Will Sutcliffe reflects on recent performance, portfolio changes and market developments.

Emerging markets: the next engines of global growth

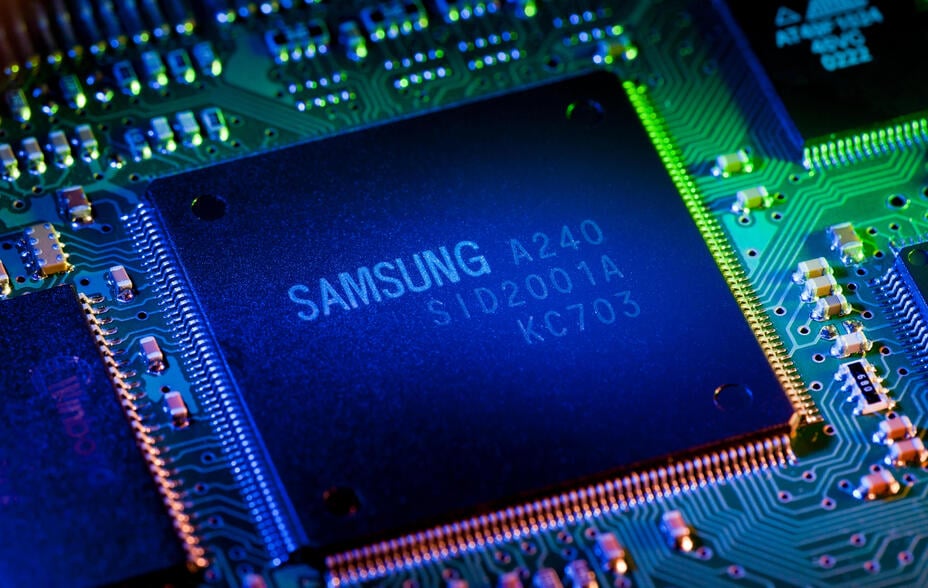

From lithium mining to a do-it-all super-app, companies capitalising on transformational trends.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments over the last quarter.

EM: how we do what we do

How do we implement our emerging markets philosophy in practice?

EM: Why we do what we do

Why do we invest in emerging markets in the way that we do?

Emerging Markets: our philosophy

Investment manager William Sutcliffe introduces Emerging Markets, reflecting on the exciting opportunities ahead.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Asia and energy transition

Exploring the emerging energy opportunities in Asia.