© Universal Images Group/Getty Images

Please remember that the value of an investment can fall and you may not get back the amount you invested. Past performance is not a guide to future returns.

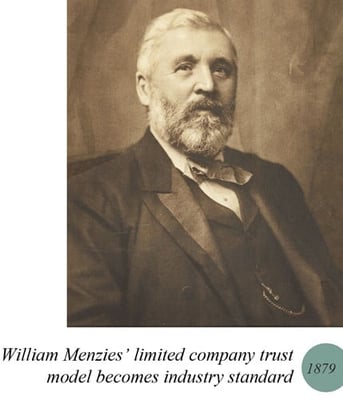

The US was emerging into its Gilded Age when a young Scots lawyer called William Menzies first crossed the Atlantic in 1864. That trip, and further visits in 1867 and 1872, convinced him that no ambitious investor could afford not to enter such an exciting and fast-growing market.

Thus in 1873, in an era when it was a lawyer’s job to offer investment guidance and administration, Menzies presented his plans for a company focused on the unbounded potential of the US.

The prospectus he wrote eloquently and presciently hyped up the investment opportunity:

“The growth of America in population, resources and wealth, is too well known to require any statement… The wonderful fertility of the virgin soil, the multitude and variety of its products and manufactures, the rapid development of its railroad system… and the enormous immigration taking place in America all combine to the development of almost illimitable resources and the creation of material wealth.”

William Menzies. © National Galleries of Scotland. Gift of the Merchants Company Edinburgh

SAINTS’ chosen investment areas were mainly railroad mortgages, but also government, state and municipal stocks. But it was the structure of the company that proved revolutionary.

Other early investment schemes in those days, including Foreign & Colonial (1868), and Robert Fleming’s Tayside-based vehicles, had been formed as legal trusts. Menzies’ genius was to take this idea and improve it.

He did this by introducing the structure of a limited company, a move made possible by the Companies Acts of 1862 and 1867.

In those days, any scheme to pool money and invest in other companies, each of which saddled you with unlimited liability for losses, would make today's cryptocurrency look as safe and predictable as government bonds.

Menzies’ idea was borne out when F&C and all the other early legal trusts were forced to convert to the limited company form after a High Court ruling in 1879.

Now every fund in the roughly £270bn UK investment company sector uses the limited company form. So SAINTS can claim to be the UK’s first investment company as we recognise the term today.

The new scheme was fully subscribed within a month, without, as William Menzies put it, “our having resorted to any pushing [ie marketing] such as is common in London.” The original investors, who included an Edinburgh plasterer and a fish curer from the Fife seaside town of Anstruther, gained a good return, despite all the market upheavals of the late 19th century.

One historian estimates that a founding investment of £1,000 in SAINTS’ ordinary shares in 1873 would, by 1929 have been worth some £70,000. Annual dividends on the same holding rose from £40 to £3,000 in that period. As the company’s fortunes rose, so did demands by shareholders for more transparency from managers. 1879 saw the stirrings of a shareholder revolt, successfully quelled by Menzies and his board, against the lack of information about the value of securities.

Bankrupt investor Walter Thornton tries to sell his luxury roadster for $100 cash on the streets of New York City following the 1929 stock market crash.

© Bettmann Archive/Getty Images

By the late 1920s, the board was worried about the bull market. Manager Charles Munro travelled to the US in October 1928 and reported back that “our friends seem to be all at sea and nervy… profits are a grand thing to take just now”. By the following summer, just a few weeks before the Wall Street Crash, SAINTS had sold £2m, or about 40 per cent, of its US stocks.

Although the decision to start re-investing was taken a little too early in 1930, the Company survived the worst economic slump in global history. It lived on to pay out dividends every year, and has done so without a cut since 1938.

During the Second World War, SAINTS had to sell its numerous dollar holdings in US companies to the British Government, cannily using the proceeds to pay down short-term debt. By late 1941 equity share prices were so low the board decided they were unlikely to get any worse and started buying, a move that helped SAINTS to maintain its dividend through thick and thin.

As post-war recovery gathered pace, the value of the company’s investments would increase from £9m to £26m during the 1950s and to £56m by the end of the swinging sixties.

For nearly a century, SAINTS’ managed its own investment portfolio. In the more complex world that had emerged by the 1970s, the need to pool costs and fund investment research became more pressing. In 1970, Stewart Fund Managers, later Stewart Ivory, was appointed to manage the company’s investments. That company had morphed into First State Investment Management by 2004, when, following a review, Baillie Gifford was appointed the new manager.

By spring 2007, chairman Sir Brian Ivory reported that SAINTS had outperformed its benchmark for the third year in a row. The Great Financial Crisis made a dent, but SAINTS rebounded in 2009 with a total return of 49 per cent rise in net asset value (the total value of a trust's assets minus its liabilities), beating the FTSE All World Index's 25 per cent, marking the start of a 10-year bull market.

In 2015 Baillie Gifford partner Patrick Edwardson stepped aside as manager of what was by then a half-billion-pound investment trust. He was succeeded by his deputy Dominic Neary, supported by colleagues James Dow and Toby Ross. The latter duo took over as joint managers in 2018.

In the meantime, Sir Brian Ivory had been succeeded as chairman in 2016 by Peter Moon, a former chief investment officer of the Universities Superannuation Scheme. He was in turn succeeded in April 2022 by Lord Macpherson of Earl’s Court, former Permanent Secretary to the Treasury and a Principal Private Secretary to Chancellors Ken Clarke and Gordon Brown.

Under the new managing duo, the biggest contributions to performance were an eclectic international bunch

- Anta Sports Products (China, sportswear)

- Partners Group (Switzerland, private equity)

- Kering (France, luxury goods)

- B3 (Brazil, stock exchanges)

- Cochlear (Australia, hearing devices)

Three years and three UK prime ministers later, despite Covid-19, inflation and war in Ukraine, the merits of SAINTS’ focus on dependable, growing streams of income have been borne out.

With net assets now exceeding £900m, SAINTS has entered the Association of Investment Companies’ pantheon of ‘dividend heroes’. Membership requires an increase in total annual dividends for at least 20 years in a row. SAINTS’ 50th year of successive increases is on the horizon in 2023.

A century and a half of dividend payouts put SAINTS in the rare position of over-delivering over decades on a promise coined by marketeers: “income again and again”.

For the full story of the Company, see John Newlands' new history SAINTS – The first 150 Years: A History of The Scottish American Investment Company P.L.C. 1873–2023. Hardback copies can be ordered from bailliegifford.com/SAINTS150th

A full digital version and a short digital summary are also available.

Important Information

This communication was produced and approved in May 2023 and has not been updated subsequently. It represents views held at the time of presentation and may not reflect current thinking.

This communication should not be considered as advice or a recommendation to buy, sell or hold a particular investment. This communication contains information on investments which does not constitute independent investment research. Accordingly, it is not subject to the protections afforded to independent research and Baillie Gifford and its staff may have dealt in the investments concerned. Investment markets and conditions can change rapidly and as such the views expressed should not be taken as statements of fact nor should reliance be placed on these views when making investment decisions.

Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority. Baillie Gifford & Co Limited is the authorised Alternative Investment Fund Manager and Company Secretary of the Trust.

A Key Information Document for The Scottish American Investment Company P.L.C. is available here.

All data is source Baillie Gifford & Co unless otherwise stated.

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

The Trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

The Trust can borrow money to make further investments (sometimes known as “gearing” or “leverage”). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust’s investments fall in value, any invested borrowings will increase the amount of this loss.

Market values for securities which have become difficult to trade may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

The Trust can make use of derivatives which may impact on its performance.

Share prices may either be below (at a discount) or above (at a premium) the net asset value (NAV). The Trust may issue new shares when the price is at a premium which will reduce the share price. Shares bought at a premium can therefore quickly lose value.

The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

The Trust has some direct property investments, which may be difficult to sell. Valuations of property are only estimates based on the valuer's opinion. These estimates may not be achieved when the property is sold.

Corporate bonds are generally perceived to carry a greater possibility of capital loss than investment in, for example, higher rated UK government bonds. Bonds issued by companies and governments may be adversely affected by changes in interest rates and expectations of inflation.

The Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

This information has been issued and approved by Baillie Gifford & Co Limited and does not in any way constitute investment advice.

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Share Price | 7.7 | -4.1 | 36.7 | 11.9 | 3.4 |

| NAV* | 10.6 | -3.6 | 34.4 | 14.8 | 8.0 |

| FTSE All World Index | 10.7 | -6.2 | 39.6 | 12.8 | -0.9 |

Performance source: Morningstar, FTSE, total return in sterling.

*Capital and income with borrowing at fair.

| Year to December | 2018 | 2019 | 2020 | 2021 | 2022 |

| Dividend per Share (p) | 11.50 | 11.875 | 12.00 | 12.675 | 13.82 |

| Year on Year Change (%) | 3.60 | 3.30 | 1.10 | 5.60 | 9.00 |

Source: Refinitive/Baillie Gifford & Co.

Past performance is not a guide to future returns.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" "Russell®", is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

46214 10020818