As with any investment, your capital is at risk.

The mantra ‘New Year, new you’ can be hard to resist. But our rash self-promises rarely last into the New Year, and we already know what to do.

It’s as simple as it is complicated: follow a healthy diet, exercise, get enough sleep and do so consistently long term.

Likewise, switching to index investing because others are doing so or trading in and out of investments stylistically on the recent bounce in growth might impact your long-term financial health.

It’s as simple and complicated as growth investing works if you give it the required time.

Where earnings grow, share prices follow over time

Stock market history attests that companies with the highest earnings growth rates reap the highest share price returns over almost any time period.

Investors identifying rapid or sustained earnings growth can take comfort in knowing that share prices will invariably follow in the long run, regardless of the economic backdrop.

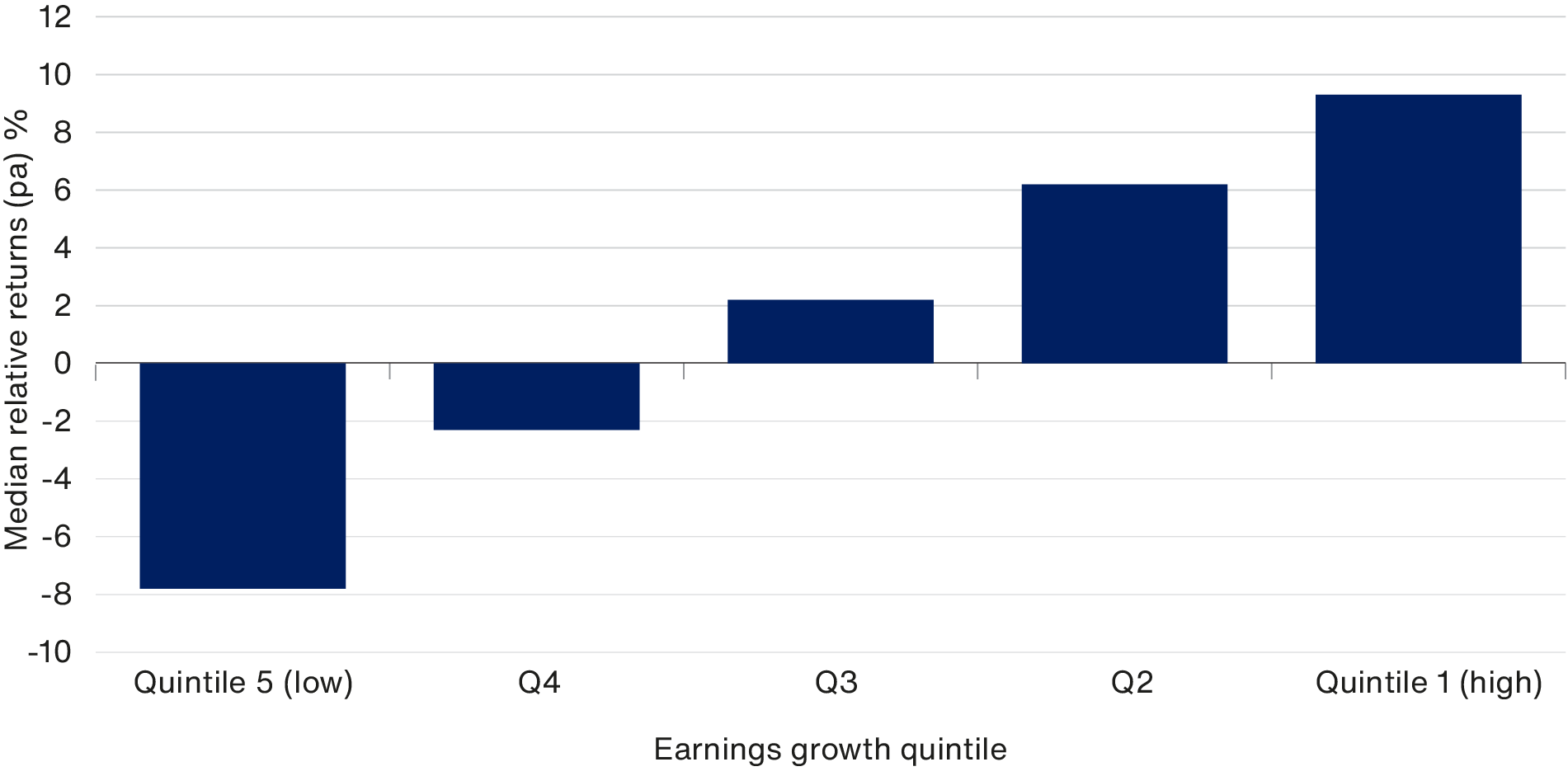

The chart below shows the returns above and beyond the index return between 1989 and 2023 by earnings growth quintile.

It demonstrates that identifying growth is the most significant factor over five-year rolling horizons.

Companies with much higher revenue growth rates than the market are more likely to create and maintain margins, don’t require as much or any debt, and can translate higher sales into higher earnings.

An active growth manager’s purpose and measure of success is their ability to find as many of these companies as possible.

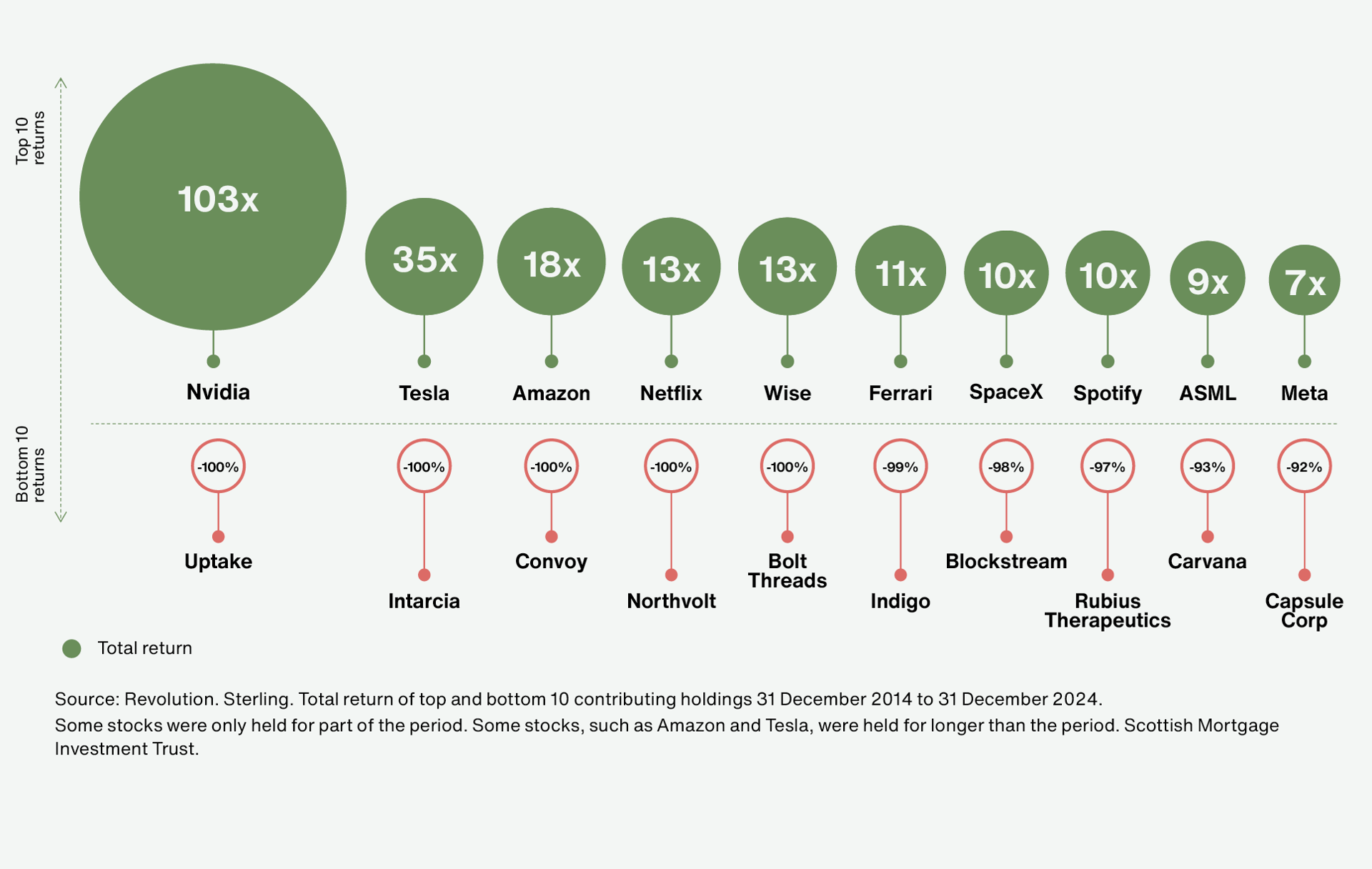

That takes us to our next point: the beauty of equity investment is its asymmetric return potential. The downside is capped at losing your initial investment, but the upside is unlimited with the right companies.

Share prices follow earnings

Source: Source: FactSet, FTSE, MSCI. US dollars. The universe consists of all stocks listed in the FTSE World and MSCI ACWI Indices at each starting point excluding repetitions. Median relative returns by earnings growth quintile. From 31 December 1989 to 31 December 2023.

That’s why thinking about long-term investing in terms of growth cycles versus value investing or any other investment style is overly simplistic and could lead you off course if you overly rely on it for asset allocation purposes.

Instead, investors should focus on investing in companies with the potential for rapid or prolonged earnings growth to outgrow today’s valuation significantly.

Investing specifically in perceived undervalued companies that the market may have overlooked or targeting companies with optically strong fundamentals and stable earnings today might offer consistent returns and lower volatility.

However, if it is asymmetric return potential that investors are hunting, then companies growing their sales and profits much faster than the overall market is demonstrably the best route.

Asymmetry of returns

The chart above illustrates this point by showing the extent to which the total return of Scottish Mortgage’s top absolute stock contributor, NVIDIA, over the ten years to 30 September 2024, swamped the downside from the bottom ten absolute stock contributors.

Making the most of asymmetry

Growth investing focuses on longer-term potential and competitive advantage and is particularly suited to the current era of technological and economic transformation.

Structural trends such as digitisation, decarbonisation, artificial intelligence and healthcare advances provide significant opportunities for companies to transform industries or create new ones and generate returns for shareholders.

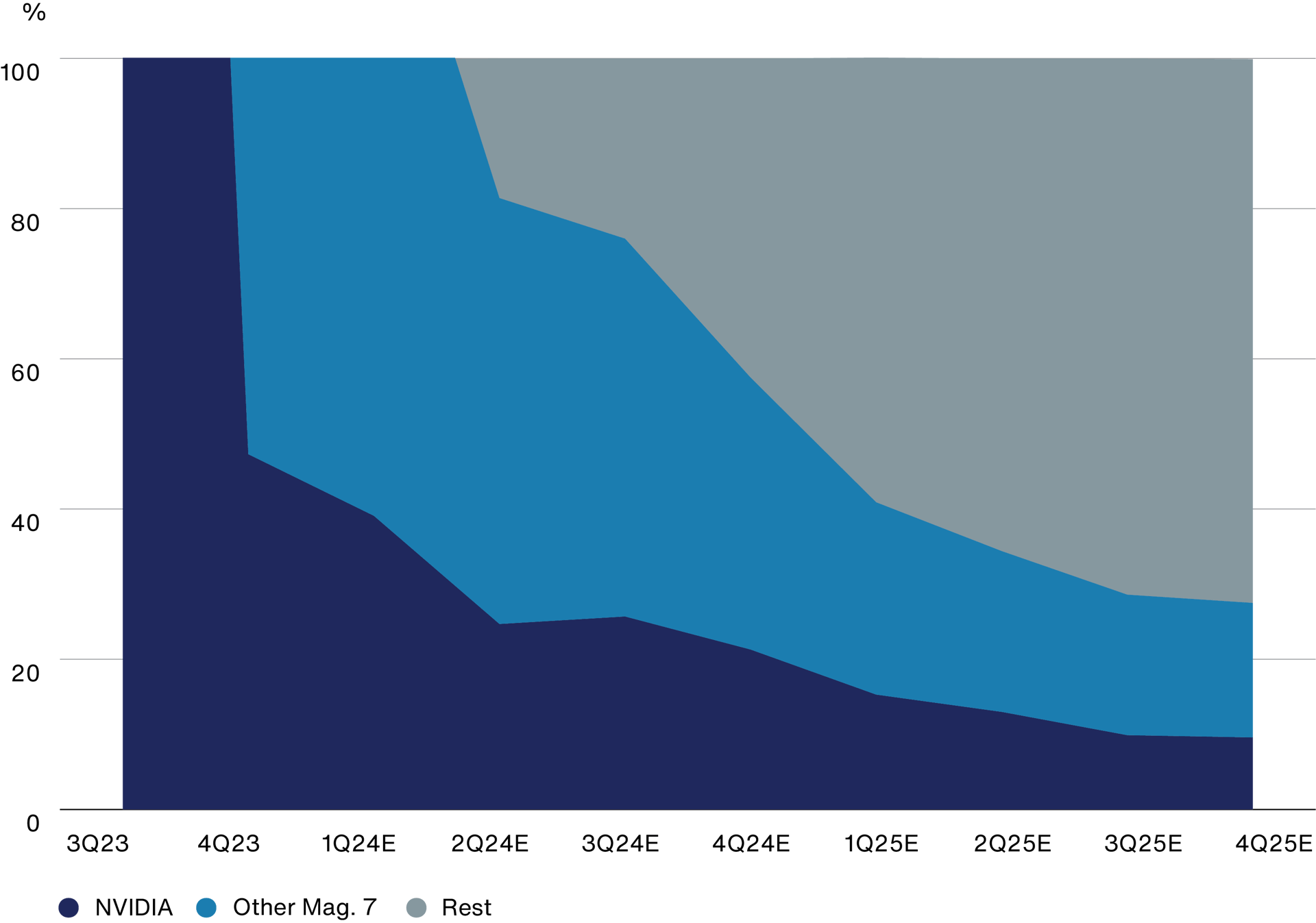

In the US, growth is no longer just concentrated in the mega caps. Eight of 11 sectors had earnings growth in Q3 2024. This evidences the broadening out we had been anticipating on the back of strong fundamentals driving the wider market higher (at the time of writing). The growth is there for those attuned to finding it, provided you have the patience to stick with it.

US growth is broadening

% contribution of S&P 500 earnings growth YoY

Source: BofA Global Research, Factset as at 20 August 2024.

Growth investing is not ‘moonshot’ investing. It’s not throwing capital at unprofitable enterprises hoping they succeed – it’s trying to find outstanding companies performing better than the others, and able to maintain this for long periods.

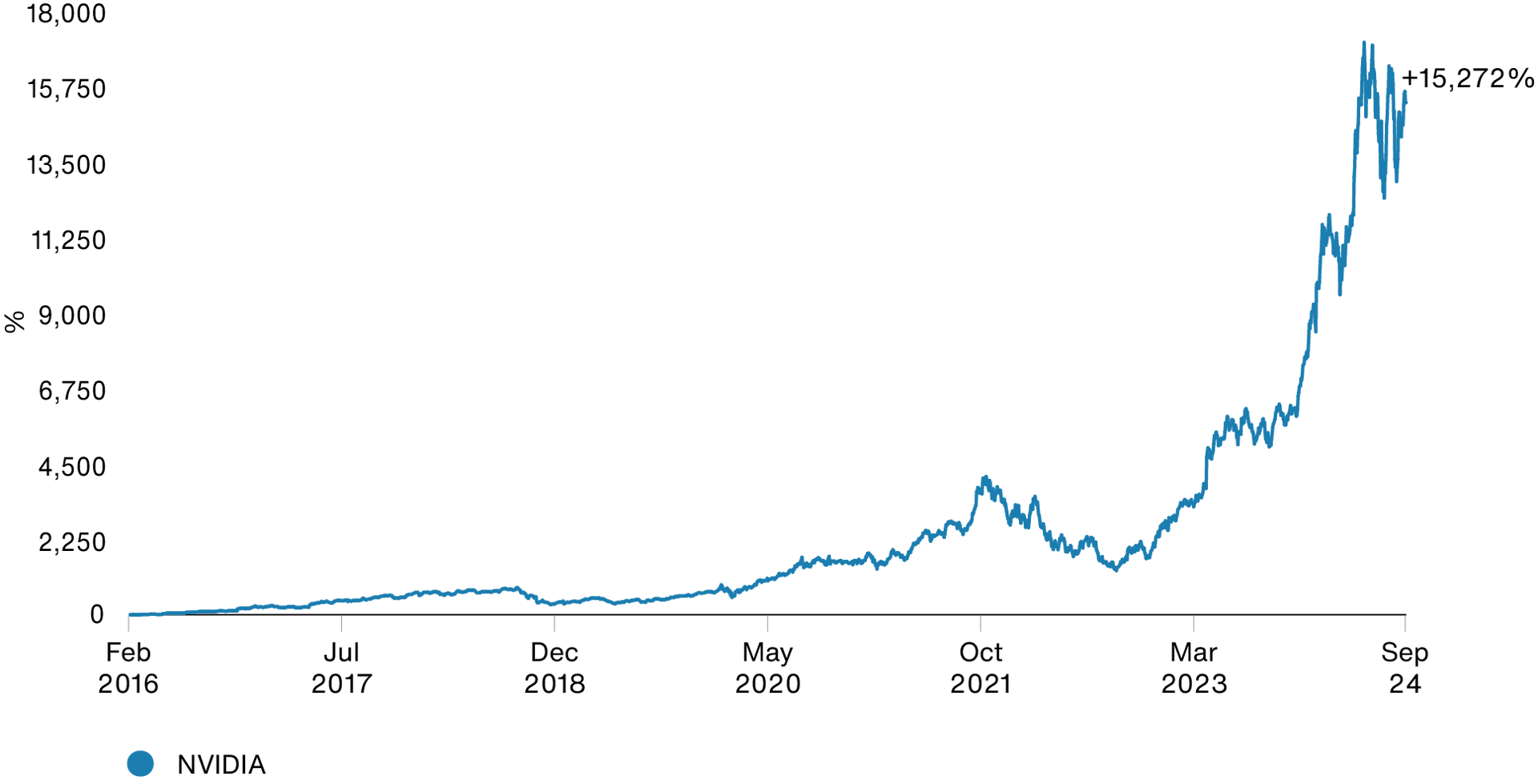

If you follow this logic, trading growth companies in the short term or using market timing strategies can be damaging as they shorten the potential for asymmetric returns to accrue. As we will see later in the NVIDIA example, selling out of it in 2021 when the share price depreciated would have been wrong for us and our clients.

That’s why patience is required. It might take five years or more and will involve mistakes. However, the returns generated by the winners demonstrate the power of harnessing an asymmetric return profile, where the upside potential outweighs the downside risk.

Looking forward to tomorrow’s giants

The flip side is that the market's short-termism creates opportunities for us. We search for companies that have the potential to grow their sales and profits much faster than the overall market but may yet have achieved this.

The benchmark-agnostic, growth-focused, and concentrated nature of many of our strategies leads us to identify the few most compelling growth opportunities in the world. Importantly, because we aim to hold them over time – if the business case remains, ideally ten years plus – this increases the potential for delivering a more pronounced compounding effect.

For example, investing early in some of the historic outliers has not only generated strong returns for our clients but has also enabled us to recycle proceeds from these big winners into the next generation of outliers, when we see higher growth potential elsewhere.

For example, after investing in Amazon in 2004, we recycled some proceeds to take a holding in Tesla in 2013 and NVIDIA in 2016. From this, we have been recycling some proceeds into many of the newer names in our portfolios today, including Block, Tempus and Aurora.

NVIDIA's share price return since Baillie Gifford first invested

Source: Refinitiv Workspace. US dollar. Baillie Gifford first invested in NVIDIA on 23 February 2016. As at 30 September 2024.

New Year, new attitude

Why do we have to believe that Baillie Gifford’s approach works and will continue to do so?

Portfolio companies, including Shopify and Adyen, have become stronger and more resilient during a period of relatively higher inflation and interest rates. They have also benefitted by taking market share as weaker companies have faltered under higher debt costs. Doordash and Schibsted, for example, have consolidated their position as market leaders as competitors have fallen away.

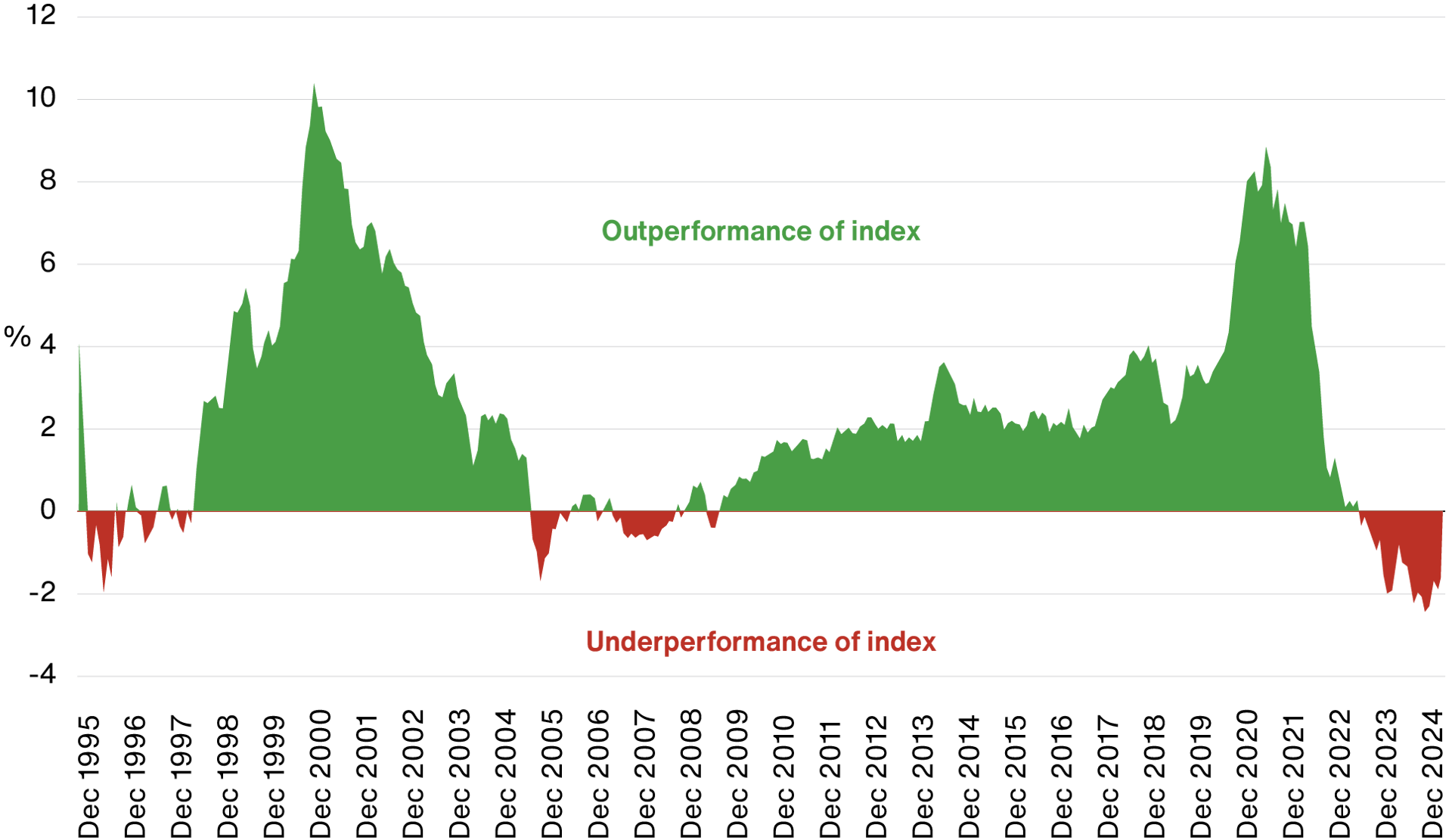

The chart below shows that time is your friend for those measuring their success over the same five-year-plus timeframe that we are.

Delivering consistent added value over shorter timeframes is not always possible. It would also be undesirable because it would limit our ability to search for great companies with growth potential further down the line.

Rolling 5-year annualised returns for our equity funds relative to their indices

Source: StatPro Composites, Revolution and relevant underlying index providers. Rolling 5 year average annualised relative returns are calculated using the overall average of geometric relative, 5 year annualised, Net composite performance of our unconstrained equity-only composites. Data excludes composites that include Fixed Interest, Multi Asset and Investment Trust portfolios and any portfolios that invest in Private Companies. The returns presented above are Net of fees. The results reflect the deduction of investment management fees; the return will be reduced by the management fees and any other expenses incurred in the management of the account. For example, an account, paying a 0.8% annual fee, with a given rate of 5% annualised over a 10-year period would result in a net-of-fee return of 4.2% p.a. All investment strategies have the potential for profit and loss. Past performance is not a guide to future returns.

So, as we move into 2025, many will no doubt have broken New Year’s resolutions already. But we're sticking to our principles, reminding clients that growth investing continues to be a beacon of opportunity that offers a compelling advantage over other investment styles.

Successful growth companies are able to adjust and adapt to different environments. Transformative trends that are reshaping our world create opportunities for investors to harness the power of asymmetric returns.

The evidence is clear: there is a strong correlation between higher earnings growth and outperformance. Our commitment to identifying these companies is unwavering, and we hold them in high-conviction portfolios that diverge significantly from the index.

That’s why we believe that ignoring the potential of growth investing would not only be a missed opportunity but also an oversight in the pursuit of maximising long-term investment returns.

If you want to hear more from our intermediary team and fund managers, sign up for our live programme, Upfront.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|

Share Price |

110.5 |

10.5 | -45.7 | 12.5 | 18.7 |

|

NAV |

106.5 |

13.2 |

-39.0 |

10.1 |

23.9 |

|

FTSE All-World Index |

13.0 | 20.0 | -7.3 | 15.7 | 19.8 |

Source: Morningstar, FTSE. Total return in sterling.

Past performance is not a guide to future returns.

Important information and risk factors

This communication was produced and approved in January 2025 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, and Baillie Gifford and its staff may have dealt in the investments concerned.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

Investment markets can go down as well as up and market conditions can change rapidly. The value of an investment, and any income from it, can fall as well as rise and investors may not get back the amount invested.

A Key Information Document is available by visiting bailliegifford.com