© Universal Images Group/Getty Images

Please remember that the value of the investment can fall and you may not get back the amount investing. Past performance is not a guide to future returns.

1873

The Scottish American Investment Company, usually known as SAINTS, is founded in Edinburgh by entrepreneurial lawyer William Menzies. A frequent visitor to the US, he is encouraged by his New York and Chicago contacts to fulfil a vision of a new investment company tapping into the vast potential of the emerging economic giant. The focus of the new venture – the first investment vehicle established as a limited company – is on railroad mortgages and government stocks.

1890

Founder manager William Menzies faces down a shareholder revolt over investing reserves in ordinary shares on which further calls on capital can be made. Prior to this disquiet, the young company had weathered successive financial ‘panics’ and provided shareholders with a steady flow of increasing dividend payments. Further unrest arises intermittently caused by lack of transparency. As the US economy enters its Gilded Age, SAINTS invests more in US industrial and public utility stocks.

1916

With the First World War raging, and nearly all of the Company’s £4m assets invested in North America, SAINTS switches £1.3m to UK government war bonds. This patriotic act proves well timed as valuations plummet soon afterwards following US entry into the war. Unlike many peers, SAINTS goes on to survive the war’s upending of global finance. Despite battered capital reserves shareholders receive consistently high dividends throughout the conflict.

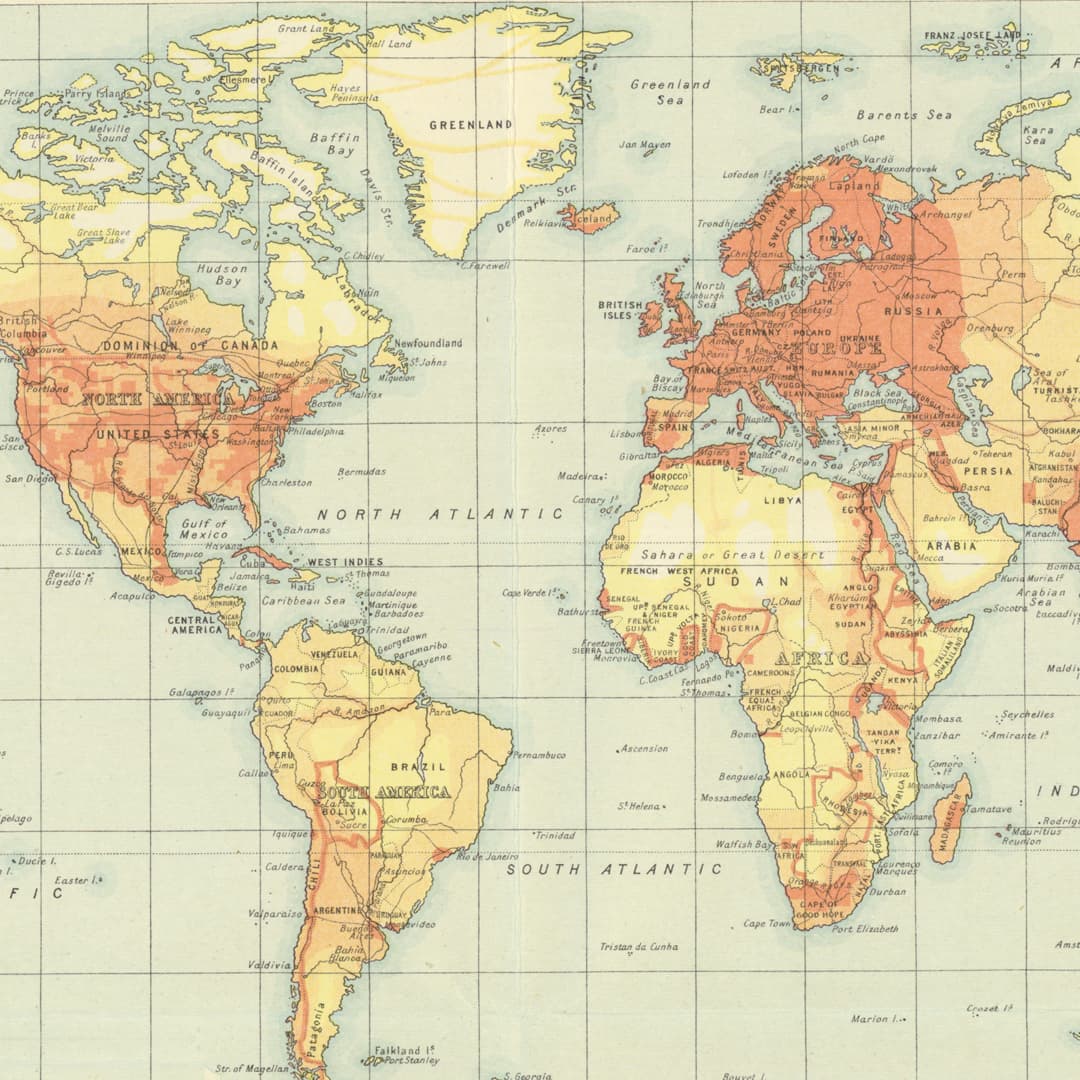

1922

SAINTS’ board takes the momentous decision to allow it to invest “in any part of the world”, enabling a transition towards global equities. Although more than half of its assets are still invested in the US, the portfolio now includes many UK industrial, chemical and energy stocks, which help to bolster performance.

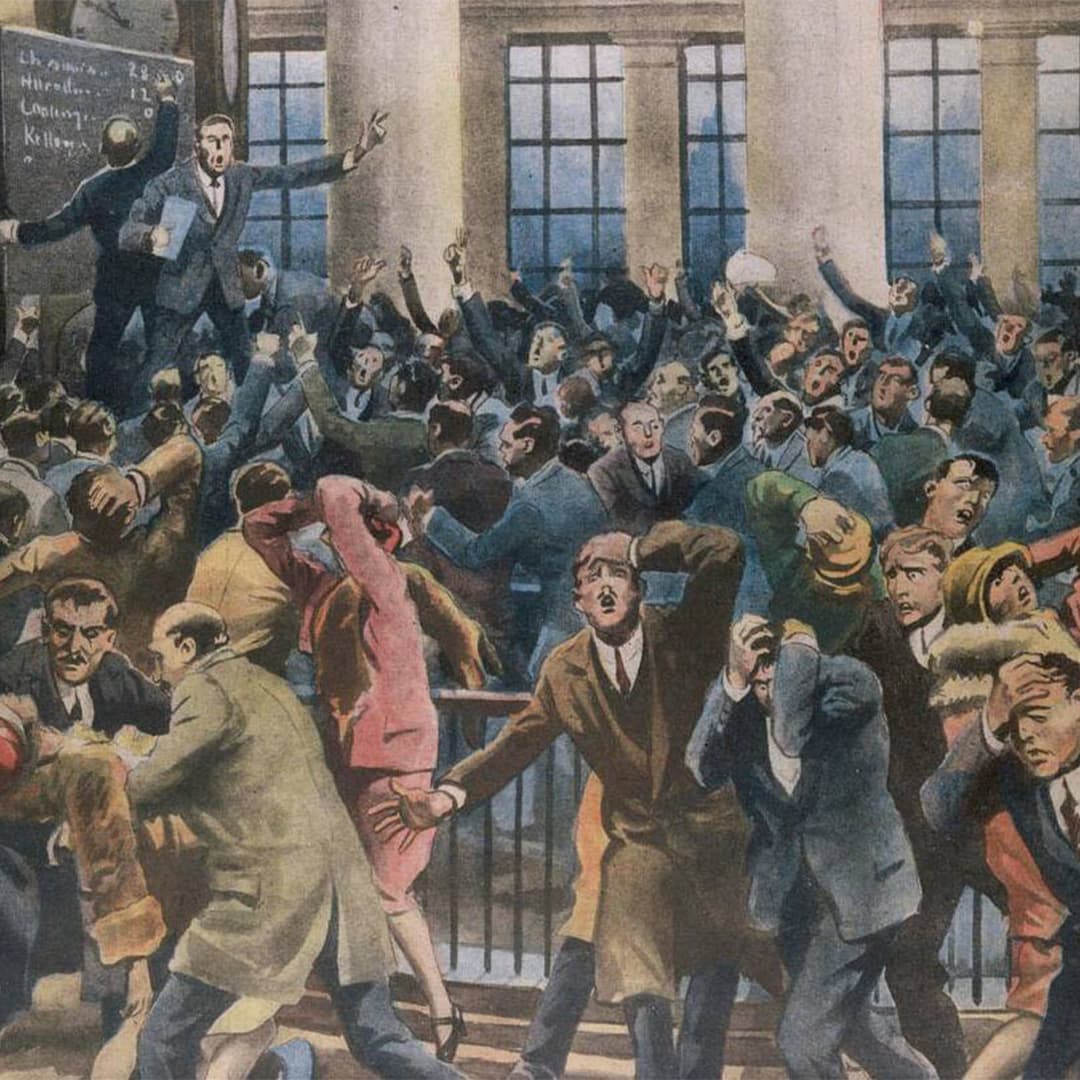

1929

Foresight and close cooperation between manager and board help SAINTS navigate the Wall Street Crash. In July, concerned by reports of excessive frenzy in US markets observed by then manager Charles Munro, SAINTS sells £2m of US securities mere months before October’s market collapse. This realisation of around 40 per cent of US assets at good prices enables the Company to survive the worst slump of the 20th century, showcasing SAINTS' combination of on-the-ground intelligence and perspective.

1938

In the year of the Munich Agreement, with war clouds gathering, SAINTS makes the last of several dividend cuts that spanned the Depression years. It turns out to be an especially significant one, being the last to date. The company uses the proceeds from portfolio sales to reduce short-term loans and prepare for the looming conflict. The same year it sells the 123 George Street office, its home for 55 years, and moves round the corner to 45 Charlotte Square, where it stays until 2000.

1948

The Companies Act heralds a new age of financial transparency in the UK, requiring the filing of annual reports and improved regulation against insider trading. The timing proved unfortunate as SAINTS reveals a slump in value (of £9.2m, 5 per cent down from the previous year). But better times follow, and by the early 1950s, the deadweight of global depression and war finally falls away.

1965

James Callaghan, Chancellor in Harold Wilson’s Labour Government, introduces a Finance Act, increasing corporation tax and capital gains tax and reducing double taxation relief on overseas investments. The effect is to curtail dividend increases and necessitate extra paperwork for investment trust administrators. Despite such hurdles, SAINTS makes good progress through the turbulent 1960s, a decade that includes the devaluation of sterling in 1967, the Vietnam War and Common Market negotiations.

1973

SAINTS celebrates its centenary on 29th March by issuing a ‘scrip’ or bonus share for every two ordinary shares plus a 0.5p increase in the 3.75p total dividend paid the previous year. The award followed a year in which the net asset value per share rose by 35 per cent. Total assets soared to a new peak of £91m, aided by the advent of North Sea oil.

1996

Managerial agreement with OLIM Property, with which the then SAINTS managers Stewart Fund Management had a well-established relationship through its Value and Income Trust. The arrangement gives SAINTS specialist access to the burgeoning UK property market. The property investments are funded by a 25-year debenture which provides additional capital. The OLIM portfolio provides ballast against the volatility of SAINTS' equity portfolio.

2004

Following a period of poor performance and significant buybacks, SAINTS’ board appoints Baillie Gifford as manager following a 'beauty parade' of City and Scottish firms. Along with its investment record, the Board cites the Edinburgh firm's positive attitude to internationalising SAINTS’ UK-heavy portfolio. The first SAINTS manager from Baillie Gifford, Patrick Edwardson oversees three years of outperformance before the Great Financial Crisis leads to an uncomfortable period, but the bounce-back in 2009 is emphatic.

2010

With SAINTS fully recovered from the Great Financial Crisis, Baillie Gifford establishes the Global Income Growth portfolio team to manage all of the firm’s equity income mandates on a global basis and enhance its pursuit of dependable dividends. SAINTS subsequently benefits significantly from the team’s analytical resources, and reaps the advantages of a single, holistic global equity portfolio.

2023

A FTSE 250 company since 2020, SAINTS celebrates its first century-and-a-half having weathered the market upheavals around the global Covid-19 pandemic and the effects of war in Ukraine. Managed by James Dow and Toby Ross since 2017, the Company has 90 per cent of its portfolio invested outside of the UK and boasts a strong record of seeking out resilient dividend-paying companies. Chairman Sir Nicholas Macpherson expresses his aspiration to raise the annual dividend for the 50th successive year.

This timeline is based on John Newlands’ compelling new history SAINTS – The first 150 years: A history of The Scottish American Investment Company P.L.C. 1873–2023. Hardback copies can be ordered from bailliegifford.com/SAINTS150th. Please note copies are limited. A digital version is available here.

Important information

The Scottish American Investment Company P.L.C. is managed by Baillie Gifford & Co Limited and is listed in the UK. The value of its shares, and any income from them, can fall as well as rise, and investors may not get back the amount invested. Past performance is not a guide to future returns.

This publication was produced and approved in March 2023 and has not been updated subsequently. It represents views held at that time and may not reflect current thinking.

It should not be considered as advice or a recommendation to buy, sell or hold a particular investment. It contains information on investments which does not constitute independent investment research. Accordingly, it is not subject to the protections afforded to independent research and Baillie Gifford and its staff may have dealt in the investments concerned. Investment markets and conditions can change rapidly. As such the views expressed should not be taken as statements of fact nor should reliance be placed on these views when making investment decisions.

All data is source Baillie Gifford & Co unless otherwise stated.

Risk factors

Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority. Baillie Gifford & Co Limited is the authorised Alternative Investment Fund Manager and Company Secretary of the Scottish American Investment Company P.L.C..

A Key Information Document for the Trust is available at bailliegifford.com

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

The Trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

The Trust can borrow money to make further investments (sometimes known as ‘gearing’ or ‘leverage’). The risk is that when this money is repaid by the Trust, the value of the investments may not be enough to cover the borrowing and interest costs, and the Trust will make a loss. If the Trust’s investments fall in value, any invested borrowings will increase the amount of this loss.

The Trust can buy back its own shares. The risks from borrowing, referred to above, are increased when a trust buys back its own shares.

a discount) or above (at a premium) the net asset value (NAV). The Company may issue new shares when the price is at a premium which may reduce the share price. Shares bought at a premium may have a greater risk of loss than those bought at a discount.

Market values for securities which have become difficult to trade may not be readily available and there can be no assurance that any value assigned to such securities will accurately reflect the price the Trust might receive upon their sale.

The Trust can make use of derivatives which may impact on its performance.

The Trust has some direct property investments, which may be difficult to sell. Valuations of property are only estimates based on the valuer’s opinion. These estimates may not be achieved when the property is sold.

Corporate bonds are generally perceived to carry a greater possibility of capital loss than investment in, for example, higher rated UK government bonds. Bonds issued by companies and governments may be adversely affected by changes in interest rates and expectations of inflation.

The Trust is listed on the London Stock Exchange and is not authorised or regulated by the Financial Conduct Authority.

This information has been issued and approved by Baillie Gifford & Co Limited and does not in any way constitute investment advice.

| 1 year | 3 years | 5 years | 10 years | |

| Share price | 8.7 | 49.4 | 67.3 | 204.8 |

| NAV* | 9.6 | 59.0 | 75.5 | 206.1 |

| FTSE All-World Index | 2.5 | 43.2 | 57.3 | 179.2 |

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Share price | 7.7 | -4.1 | 36.7 | 11.9 | 3.4 |

| NAV* | 10.6 | -3.6 | 34.4 | 14.8 | 8.0 |

| FTSE All-World Index | 10.7 | -6.2 | 39.6 | 12.8 | -0.9 |

*Capital and income with borrowing at fair

| Year to December | 2018 | 2019 | 2020 | 2021 | 2022 |

| Dividend per share (p) | 11.50 | 11.875 | 12.00 | 12.675 | 13.82 |

| Year on Year Change (%) | 3.60 | 3.30 | 1.10 | 5.60 | 9.00 |

Source: Refinitiv/Baillie Gifford & Co.

Performance source: Morningstar, FTSE, total return in sterling.

Notices Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

44611 10020489