The Toniebox reads stories to children when they place a Tonies figurine on top © tonies®

Please remember that the value of an investment can fall and you may not get back the amount invested. This article originally featured in Baillie Gifford’s Spring 2023 issue of Trust magazine.

What do investors get wrong about Europe? Mostly that it’s an innovation backwater, hampered by EU bureaucracy and politics. In many minds, even the Dutch chip-manufacturing equipment maker ASML, one of the world’s most valuable tech companies, doesn’t make up for Nokia and Ericsson’s loss of leadership in telecoms. For technological creativity, most turn to the US and China. These perceptions, a legacy of the dotcom bust, have been self-perpetuating.

As tends to happen after crashes, investors became warier of backing up-and-coming companies, hampering the progress of innovative firms. A European tendency to feel ashamed of failure deterred risk-taking. Tech businesses struggled because investors were intolerant of the early losses often required to gain scale.

But the landscape has changed. From Barcelona to Paris, from Amsterdam to Vilnius, innovative businesses are creating their own luck. European companies, including the online food company Delivery Hero and payments platform Adyen, have gained global stature. Their founders now serve as mentors to a new generation of leaders.

Europe has no shortage of fantastic small- to- mid-cap businesses, often in industrial or business-to-business areas. A tendency to define success in terms of achieving the scale of the US’s Amazon or China’s Tencent can mean missing what’s happening lower down the market value spectrum. You need the right frame of mind to focus on the rich opportunities of this layer, making it an exciting place for the specialist active investor. Here are three companies that prove the point.

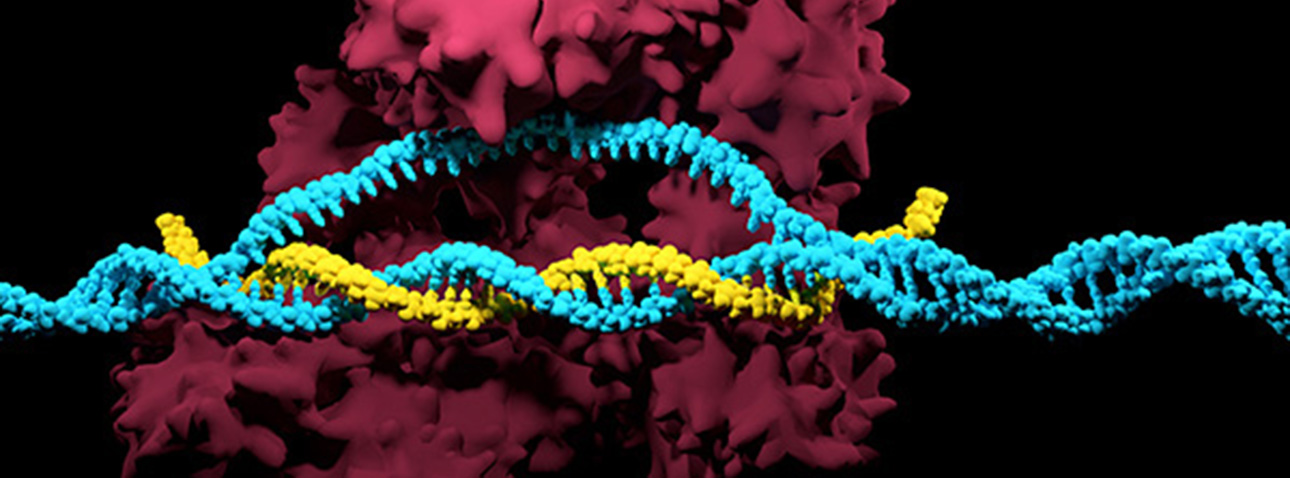

CRISPR Therapeutics

This Swiss-based firm is rooted in a discovery made in 2011 by co-founder Emmanuelle Charpentier. She shared the 2020 Nobel Prize in Chemistry with Jennifer Doudna after the pair discovered a way to adapt the body’s immune defence system to ‘edit’ faulty genes that cause disease.

The technique is called CRISPR-Cas9 and requires complex medical and computer technology to deliver. It is the first to permanently change the gene, making further treatments unnecessary. It’s also faster, cheaper, more accurate and more efficient than previous gene therapies.

The implications are massive. CRISPR Therapeutics has developed a treatment for sickle cell disease, which affects millions worldwide. Its genetic makeup is well understood, making it a good proving ground. Patient trials look hopeful.

The firm could apply CRISPR-Cas9 to many other conditions. And each success will earn money to finance proof-of-concept work on more complex afflictions.

At a time when investors have been reluctant to back early-stage companies, CRISPR Therapeutics’ nearly $2bn of cash and lack of debt put it in a strong position. Sickle cell disease is just the beginning. The firm aims to provide treatments for cancers and diabetes in collaboration with global pharmaceutical giants such as Bayer and Vertex.

I’m impressed by the chief executive, Samarth Kulkarni, a scientist who’s also a former McKinsey partner. He has studied successful and unsuccessful biotech companies of the past. And he knows how to avoid focusing too much on science and forgetting to build a long-lasting commercial business.

Topicus.com

Netherlands-based Topicus.com builds, manages and buys companies that provide specialist software to other businesses and the public sector.

These are the specialist software companies that develop workplace systems for specific purposes, from managing the availability of hospital beds or doctors’ appointments to streamlining the accounting processes of spas, golf clubs or beauty salons.

There are hundreds of these business-to-business niches. Topicus acquires these firms, sharpens their operations, cuts spending and reaps recurring revenues. The approach has proved remarkably successful and scalable in North America for Canada’s Constellation Software, from which the European Topicus was spun out and merged with another Dutch company.

The method is just getting going in Europe, a potentially more exciting growth market.

Why? Because in the US, the leading golf club management software, for example, will already be installed in clubhouses across the country. In Europe, a different product might lead in each market, catering for local languages and nuances.

That means a lot more companies and a lot more scope for deals.

So far, Topicus’s Netherlands-based operation covers 23 sectors containing 136 companies, with a combined total of 44,500 customers.

The firm is hoovering up these small operations and plugging them into a much bigger network, helped by the influence of Constellation, with its many years of experience, as a major shareholder.

tonies

The toy industry hasn’t seen much disruption in the past 50 years, at least not for those under 10. For all the PlayStations and Xboxes targeted at older kids, their younger siblings still play with toys their parents loved.

Two German dads set up tonies after becoming disillusioned with what was on offer for their kids’ relaxation and learning. They came up with a soft, unbreakable cubic speaker containing a Bluetooth receiver.

When you put a character model – also known as a Tonie – on top of the device, it plays stories, lullabies or other music. The founders created some figurines of their own, while others came from licensing deals, including the Gruffalo, Peppa Pig and Barbie.

There’s no screen – getting children away from those was part of the intention. It’s all about engaging and giving them control. Kids can hit the device to change the track and tilt it to raise or lower the volume. It’s simple enough for toddlers.

It’s also a nice business model on ‘razor-and-razorblade’ lines, where you sell a piece of hardware and then get recurring revenue from consumable items.

By April 2022, the company had sold more than 3.5 million boxes and 40 million figurines. Everyone buying the speakers buys multiple Tonies – there’s one sold every two seconds. As kids get older, they want different kinds of content, and the list of available figures and content keeps growing, which keeps them engaged.

There are all sorts of ways this business could evolve. It could be a licensing model whereby any toy could be ‘tonified’ with an embedded chip to trigger content. The company is still young, and not much needs to go right for it to double in value over the next five years. The firm initially targeted German-speaking parts of Europe but has since ventured further afield. I’ve seen its products advertised in the UK. But the US is the huge opportunity, and tonies’ management is making good progress breaking into that market.

At the time of publication, in addition to Baillie Gifford European Growth Trust, the following trusts were invested in the companies mentioned above:

Adyen - Monks, Scottish Mortgage

ASML - Keystone Positive Change, Scottish Mortgage

Delivery Hero - Scottish Mortgage

Topicus.com - Monks

Important Information

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com