Please remember that the value of an investment can fall and you may not get back the amount invested. This article originally featured in Baillie Gifford’s Spring 2022 issue of Trust magazine.

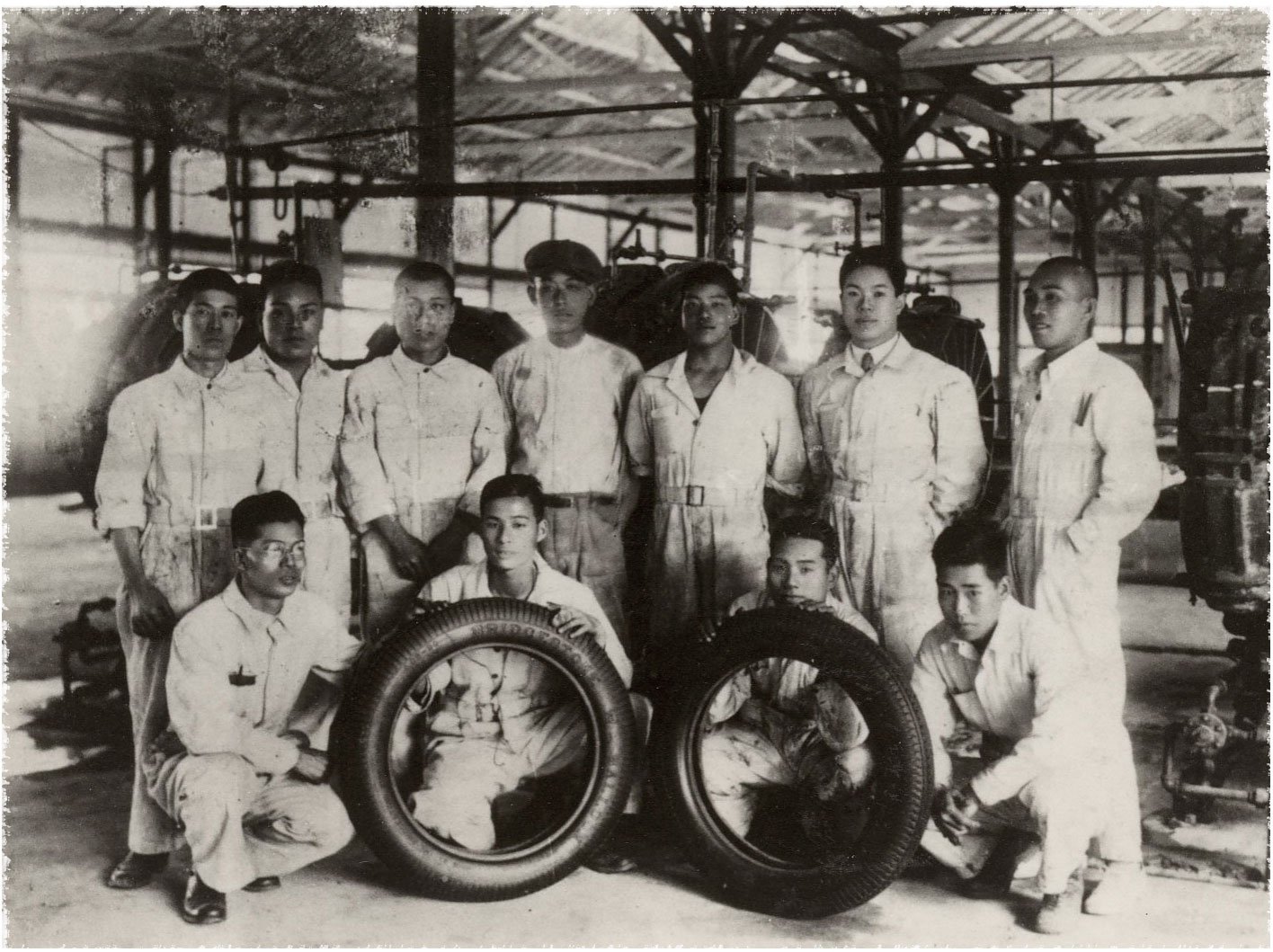

In ultra-modern Tokyo, construction workers balancing at vertiginous heights on skyscraper scaffolding still rely on traditional split-toe tabi boots for grip and agility in precarious conditions. Bridgestone – the world’s number one tyre maker – has roots going back more than a century crafting footwear, which still holds a trusted place in contemporary Japanese life thanks to its qualities of traction, durability and comfort.

Bridgestone is destined not only to survive the mobility revolution but emerge stronger

Bridgestone (an anglicisation of founder Shojiro Ishibashi’s surname) no longer makes tabi. But according to Matthew Brett, manager of The Baillie Gifford Japan Trust, global leadership in making “shoes for cars” explains why its future looks bright amid radical disruption in transport, for many of the same reasons its original product still thrives.

Autonomous cars, electric vehicles (EVs), hydrogen fuel cells, ride-hailing and car-sharing apps all attest to an automotive world transforming at dizzying speed. Yet no matter how cars develop, Brett says, “it’s really hard to design out the tyre. That’s good news for industry leaders.”

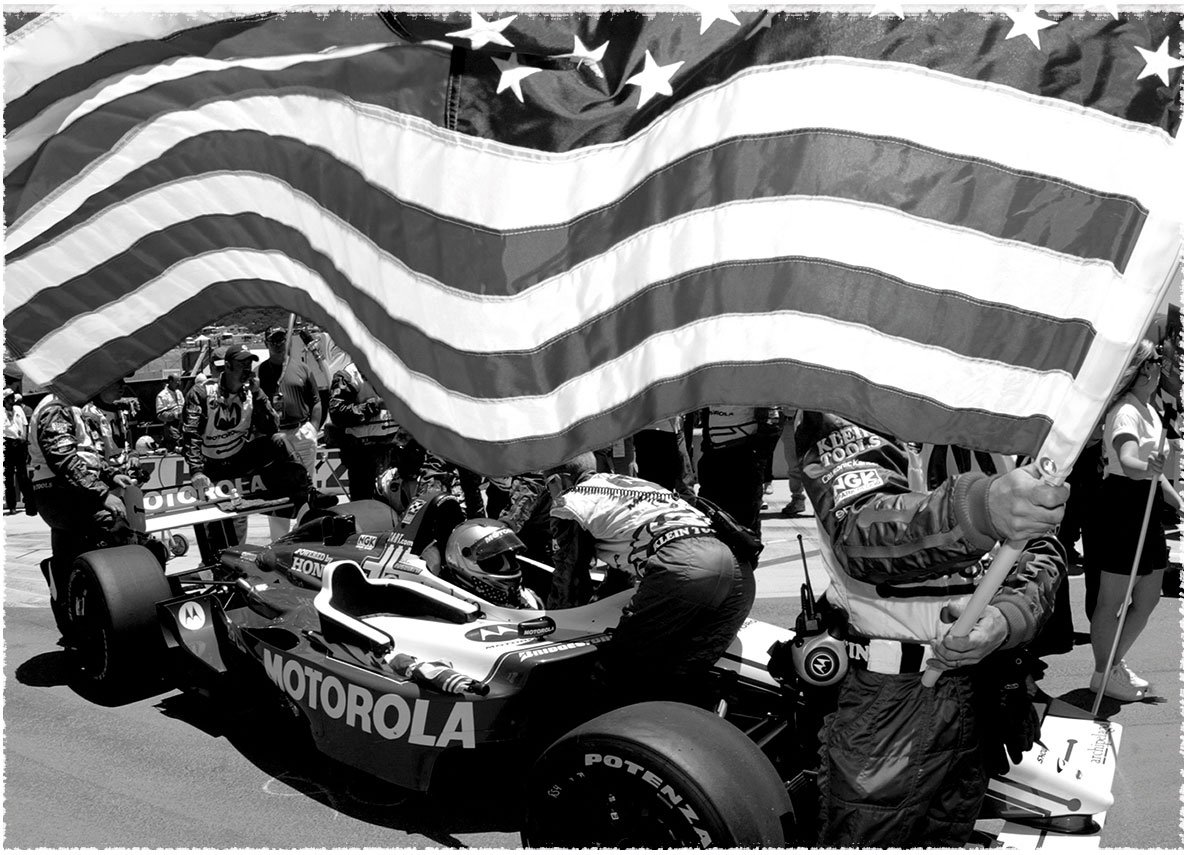

Like tabi, tyres fulfil a critical role in situations where there’s no room for failure, whether that be driving the kids to school or taking Indy 500 circuit curves at 120 mph. Being a constant in an era of flux, Brett explains, brings key long-term advantages. Bridgestone is unlikely to be “sideswiped” by change as some carmakers have been. Instead, it can leverage a globally recognised brand and its research and development war-chest to increase its lead.

With roughly 14 per cent of the global tyre market – and a reputation for quality, innovation and smart management – Brett argues that Bridgestone is destined not only to survive the mobility revolution but to emerge stronger. That’s why the Tokyo-headquartered firm represents an enduring source of value for the astute investor, despite the beating it took last year in markets thanks to slumping pandemic demand.

“Bridgestone has always done a really good job of broadening and deepening its competitive advantages,” Brett says. “Fundamentally, we cannot work out a future of road transport without tyres. So for Bridgestone, that degree of confidence in the future is a great starting point for us in considering it as a long-term investment proposition.”

For an idea of how Bridgestone can benefit from disruption to our means of mobility, consider electric vehicle acceleration. The Tesla Model S Performance takes a mere 2.4 seconds to reach 60 mph. That’s a shade less than the Bugatti Chiron, the world’s fastest car.

As EVs enter the mass market, extreme acceleration will go mainstream. That will put a heavy strain on tyres, requiring better materials to prevent them from wearing thin or blowing out. As the global leader, with a market capitalisation of $30bn as at 31 January 2022, Bridgestone has unrivalled resources to do what it has done for decades: invent superior tyres for each new chapter in the mobility story.

“Bridgestone is on a constant drive for improvement, to get better compounds, better tread patterns,” says Brett. “One thing I’ve learnt is that it’s not worth trying to save a few pounds on your tyres. Technologies such as EVs and autonomous vehicles now make premium tyres even more important.

“With Bridgestone, we have a classic definition of a franchise, something that’s profitable and hard to replicate. Because if you’re a newcomer you have a to-do list that’s really long and challenging to get right.”

As upstarts face Bridgestone’s barriers to entry, the Japanese firm can focus on the future of tyre technology. This includes telematics – smart monitoring of tyre and road conditions – and tyres-as-a-service (TaaS), in which tyres for large fleets are not bought but recycled through distribution centres.

Bridgestone is on a constant drive for improvement

Brett invites us to “imagine a world where at 3am the self-driving car takes itself off to the garage to have its tyres changed because that’s the optimal time to do it. We’re seeing the beginning of such scenarios with telematics that gauge tyre pressure. Bridgestone should enjoy significant advantages in the future.”

On the environmental front, the tyre industry is certain to face increasing pressure. Tyre making has a high carbon footprint, while old tyres are hard to dispose of cleanly. Here too, Bridgestone is better placed than most to turn its business green. And this gives it opportunities to shut out smaller competitors.

Bridgestone is a leader in retreading, in which worn casing is replaced by new rubber, a promising way to extend tyre life. It has also made well-judged acquisitions of distribution firms, giving it a growing network from which to build more eco-friendly ways of servicing tyre users.

“There are environmental challenges. But for a company such as Bridgestone, this is actually a competitive advantage,” Brett says. “Dealing with high environmental cost products, it has the resources to build eco-friendly solutions. Over time it will be more difficult for some small competitors to even have a business going forward due to the complex and costly environmental factors.”

Overall, Bridgestone’s global lead in premium tyre production and innovation gives it breathing space to widen an already formidable competitive lead.

“It’s possible that retreading is going to be the most important technology, or perhaps telematics. The important thing is that Bridgestone has all these things covered,” says Brett. “We think Bridgestone is well placed to benefit from these technology shifts over time.”

Bridgestone is defined by a culture of dantotsu – the Japanese term for being not just the best but head-and-shoulders above the competition. From its first steps in tabi footwear to its present supplying elite motorsport tyres, that ethos has been a talisman of value. Bridgestone has an advantage few others possess: a firm grip on the road ahead.

This article first appeared in the Spring 2022 issue of Trust, Baillie Gifford’s bi-annual investment trust magazine. To register for a free copy, delivered to your door or to your inbox please visit bailliegifford.com/trust

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates. The Trust’s exposure to a single market and currency could increase risk.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com