Capital at risk

Responsible Global Equity Income

Long-term dividend compounding is the eighth wonder of the world.

We focus on companies that can compound earnings and dividends effectively over long periods. These are rare but can deliver attractive returns.

Investing for a lifetime of income

Whether you require an income for years to come or are simply looking for attractive long-term capital appreciation, dividend growth investing could be what you’re looking for.

Responsible Global Equity Income Stewardship Report

Find out about our conversations with portfolio companies, shareholder vote activity and consideration of environmental, social and governance matters.

Responsible and dependable growth

We aim to deliver a dependable income and real growth in capital over the longterm by investing in responsible companies.

We believe the best way to do this is to invest in firms which can pay dependable dividends across the cycle, with the prospect of real profit growth, which will in turn lead to growth in dividends and capital.

These are rare and highly attractive to clients seeking income today and well into the future.

What do we mean by responsible? Beyond the exclusion of sin sectors, we mean investing in companies that are trying to address environmental, social and governance (ESG) issues and future-proofing their business.

A carefully selected portfolio

Our portfolio is a collection of carefully selected dividend-paying companies with attractive growth prospects.

Their sustainable earnings growth have the potential to support real growth in dividends, and they typically have resilient business models

Our strategy is managed with a growth mindset and a lengthy time horizon, focusing on dividend growth, not short-term yield.

Long-term dividend compounders are the unsung heroes of the market

Meet the managers

Documents

Philosophy and process

Explore our investment philosophy and the processes around how the team constructs the portfolio.

Stewardship report

Find out about our conversations with portfolio companies, shareholder vote activity and consideration of environmental, social and governance matters.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 March 2025

| # | Holding | % of portfolio |

|---|---|---|

| 1 | Fastenal | 4.6% |

| 2 | Deutsche Börse | 4.5% |

| 3 | Procter & Gamble | 4.2% |

| 4 | Apple | 4.0% |

| 5 | Microsoft | 4.0% |

| 6 | Watsco | 3.9% |

| 7 | TSMC | 3.4% |

| 8 | CME Group | 3.0% |

| 9 | Partners | 3.0% |

| 10 | Schneider Electric | 2.8% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Responsible Global Equity Income Q1 investor letter

The Responsible Global Equity Income Team reflects on recent performance, portfolio changes and market developments.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Responsible Global Equity Income Q4 investor letter

The Responsible Global Equity Income Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Global Income Growth Q2 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

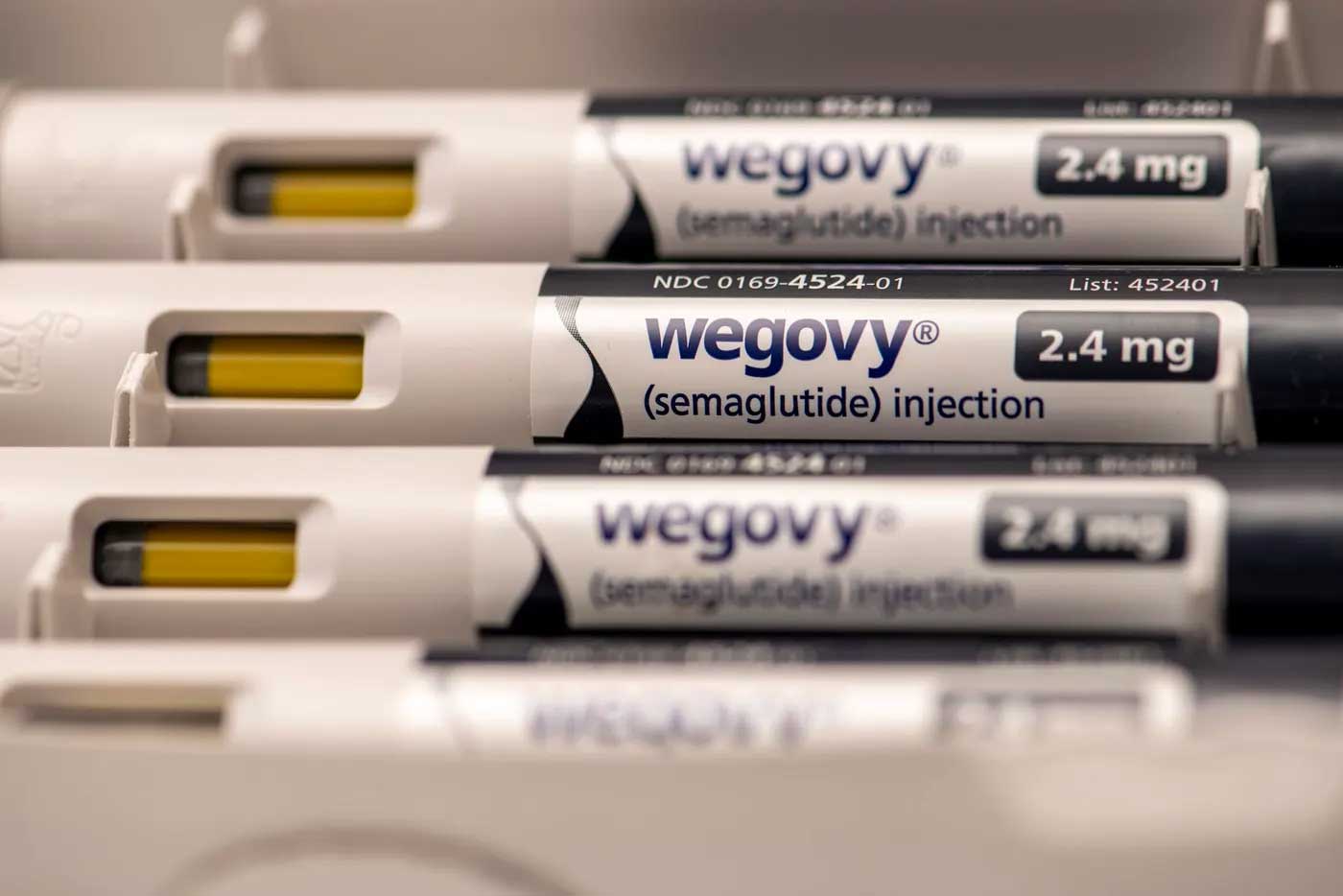

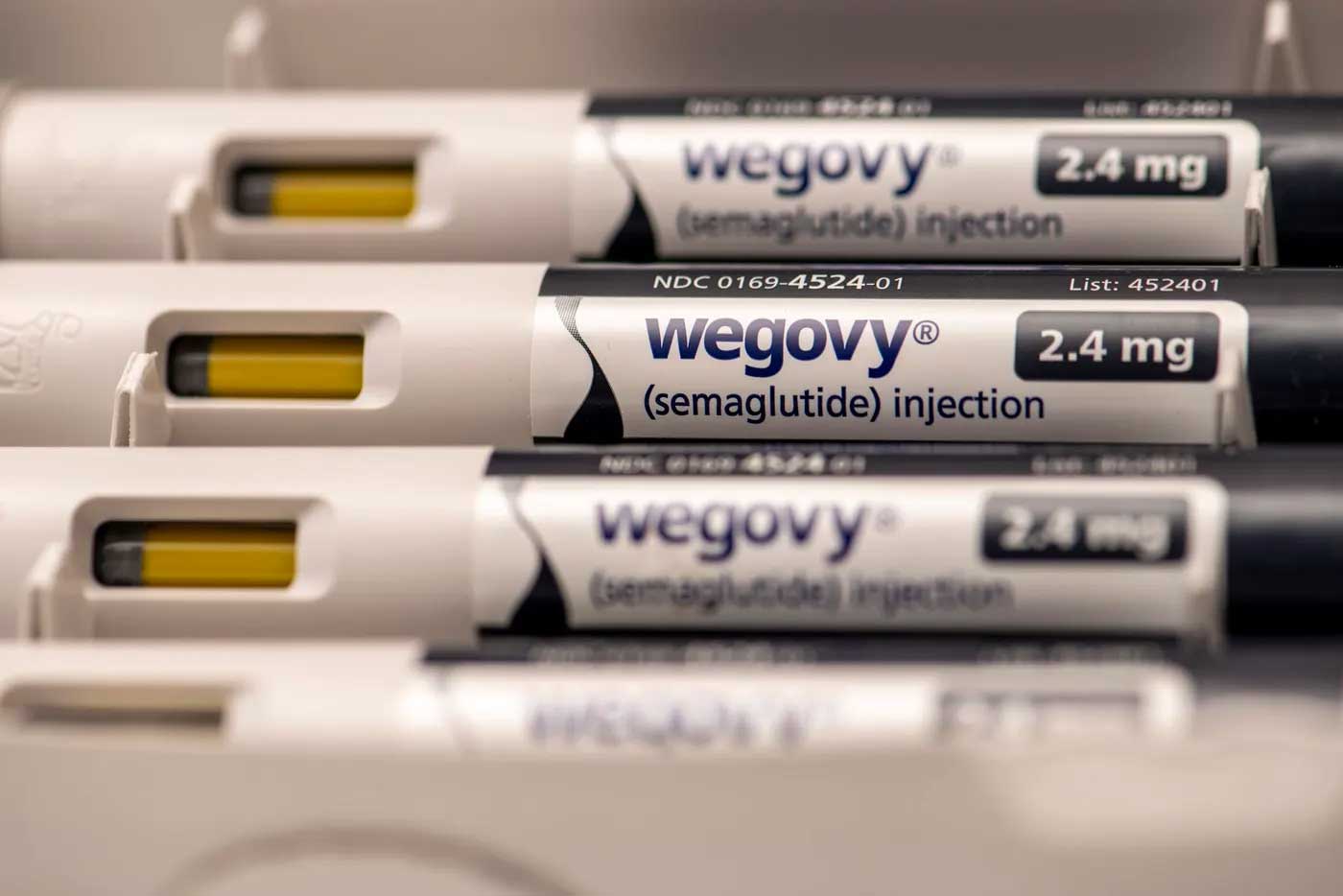

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

Five years of Responsible Global Equity Income

Investment specialists reflect on the first five years of the Responsible Global Equity Income Strategy.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Albemarle: salt flats and social responsibility

Why the lithium giant Albemarle engages in research and data monitoring.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

TSMC’s decarbonisation dilemmas

TSMC’s progress in securing greener energy supplies in Taiwan.

Responsible Global Equity Income strategy update

Portfolio managers James Dow and Ross Mathison discuss current views and portfolio positioning against the backdrop of rising interest rates and market volatility.

Global Income Growth Q2 update

The Global Income Growth team reflects on recent performance, portfolio changes, and market developments.

The Baillie Gifford Responsible Global Equity Income Fund

The Baillie Gifford Responsible Global Equity Income Fund is the first and only fund of its type in the Global Equity Income sector.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Responsible Global Equity Income Q1 investor letter

The Responsible Global Equity Income Team reflects on recent performance, portfolio changes and market developments.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Responsible Global Equity Income Q4 investor letter

The Responsible Global Equity Income Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Global Income Growth Q2 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

Five years of Responsible Global Equity Income

Investment specialists reflect on the first five years of the Responsible Global Equity Income Strategy.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Albemarle: salt flats and social responsibility

Why the lithium giant Albemarle engages in research and data monitoring.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

TSMC’s decarbonisation dilemmas

TSMC’s progress in securing greener energy supplies in Taiwan.

Responsible Global Equity Income strategy update

Portfolio managers James Dow and Ross Mathison discuss current views and portfolio positioning against the backdrop of rising interest rates and market volatility.

Global Income Growth Q2 update

The Global Income Growth team reflects on recent performance, portfolio changes, and market developments.

The Baillie Gifford Responsible Global Equity Income Fund

The Baillie Gifford Responsible Global Equity Income Fund is the first and only fund of its type in the Global Equity Income sector.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

How to invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.