Capital at risk

Diversified Growth

We’ve been investing in multi-asset portfolios since 2009. Our edge is our wide opportunity set and asset allocation mix, which allow us to create nimble portfolios prepared for different economic conditions.

Our strategy is actively managed and diversified – an important approach when seeking attractive long-term returns at lower volatility than equity markets.

A breadth of opportunity

Our mission is simple – we take advantage of a breadth of opportunity across a diverse range of asset classes, aiming to deliver attractive returns with lower volatility than equity markets.

Multi Asset Q1 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments over the last quarter.

High variation, low volatility

We seek to provide a diverse portfolio of asset classes that has dual objectives with an equal focus on return and risk.

We take a broad opportunity set and turn it into a single fund. We know this offers our clients a simple and effective way to achieve diversification at lower volatility levels than equity markets.

Our objectives:

- A return that is at least 3.5 per cent more than the UK base rate over rolling five-year periods

- A positive return over rolling three-year periods

- Volatility of returns below 10 per cent over rolling five-year periods

Investing with the future in mind

Our portfolios avoid complexity and are positioned to achieve returns with low volatility.

We identify the major drivers of markets and apply our expertise to construct a portfolio that invests across asset classes, incorporating:

- Macroeconomic views

- Long-term return expectations

- Risk and near-term scenario analysis

The result is a top-down, macroeconomic and research-led portfolio, which seeks to generate value for our clients throughout economic cycles.

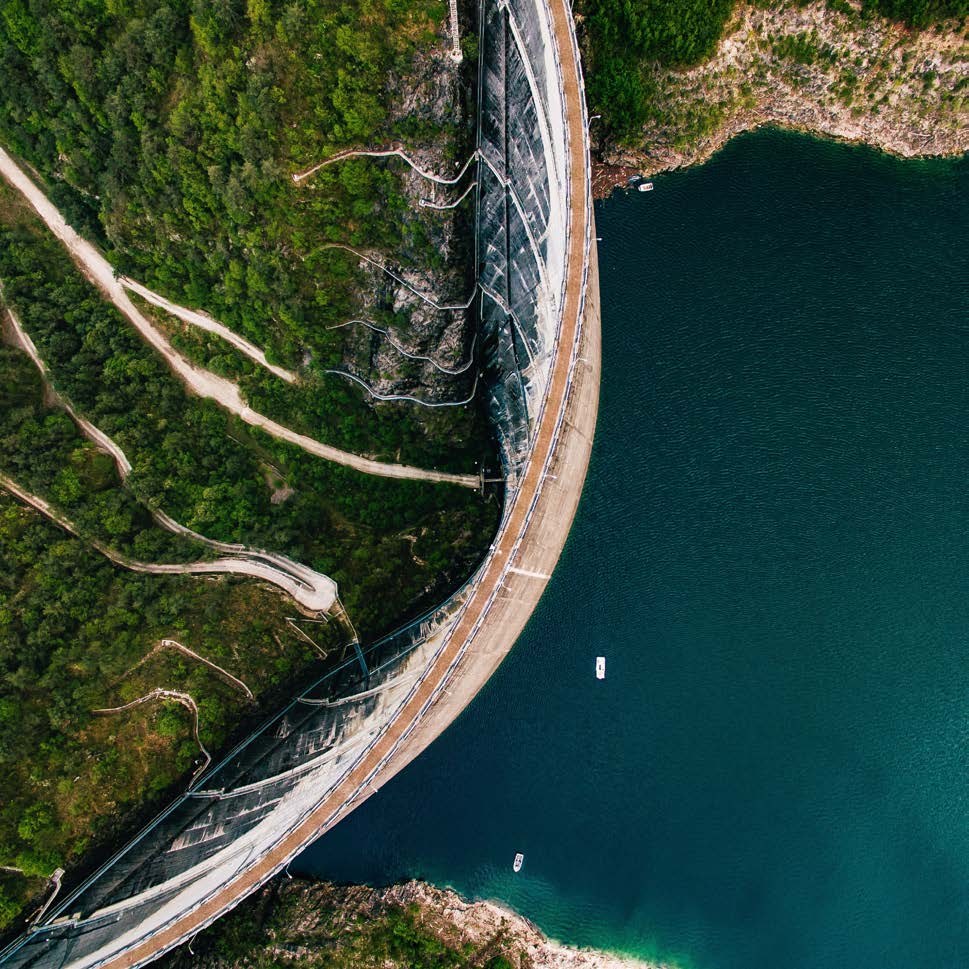

Change brings opportunities. Short-term changes can be as unpredictable as the meander of a river, but by focusing on long-term trends, we think it’s possible to figure out the destination.

Meet the managers

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 March 2025

| # | Holding | % of portfolio |

|---|---|---|

| 1 | Leadenhall UCITS ILS Fund | 4.0% |

| 2 | Baillie Gifford Long Term Global Growth Investment Fund | 3.6% |

| 3 | Baillie Gifford American Fund | 3.4% |

| 4 | Baillie Gifford Emerging Markets Leading Companies Fund | 3.1% |

| 5 | Galene Fund | 3.0% |

| 6 | Baillie Gifford Global Income Growth Fund | 2.9% |

| 7 | Blackrock GBP LEAF Fund | 2.9% |

| 8 | Aegon ABS Opportunity Fund Acc | 2.5% |

| 9 | Dimensional Global Value Fund | 2.4% |

| 10 | Accunia European CLO Fund EUR | 2.0% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

Multi Asset Q1 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

Climate scenarios: so what?

Six themes we think will influence companies’ futures as the world adapts to climate change.

Climate scenarios: preparing for uncertainty

How scenario analysis and climate adaptation can unlock exciting investment opportunities in resilient companies.

Climate and energy scenarios

Explore four climate transition scenarios, their economic impacts and investment strategies for a low-carbon future.

Multi Asset Q4 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments.

The Plutus CLO Fund: seizing market opportunities

How leveraging opportunities in the European CLO market enhanced our structured finance solutions.

Too long to drive, too short to fly

Meet the rail company reshaping high-speed intercity travel across the US.

The clean energy election

Will the US election result affect investors in US renewables? Felix Amoako-Kwarteng finds out.

Resurgence of insurance-linked securities

Exploring the ILS resurgence: capital cycle shifts, disaster impacts and sustainable economies

Multi Asset Q3 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments.

The Climate Scenarios Project: part 2

The impact of Disorderly Transition scenarios on macro indicators and market outcomes.

Multi Asset Q2 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments.

The case for UK water investments

Uncover the resilient UK water companies showcasing their growth prospects in the face of regulatory and environmental hurdles.

Japan: the land of the rising yield

How Japan's changing economy is reshaping the Multi Asset investment landscape.

Multi Asset investment update

An update on performance, portfolio developments and where we see new opportunities.

Multi Asset investment update

An update on the portfolio, market environment and outlook for the year ahead.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Multi Asset: Investment process evolution

Focusing on the central pillars of our multi-asset investment process has sparked an evolution.

From Leeds to LA

Creating a high conviction, best ideas, global and unconstrained property portfolio.

Multi Asset Q3 investment update

How is the portfolio adapting to risks and opportunities? Scott Lothian explains.

Multi Asset quarterly update

James Squires reflects on the current environment influencing Multi Asset portfolios.

Why now for multi-asset investing

Who benefits from the new macro environment? Why multi-asset investing remains a viable option.

Multi Asset quarterly update

Scott Lothian explains how Multi Asset is riding out the ups and downs of market volatility.

Productivity’s slowdown unravelled

Casting fresh light on why productivity growth lost steam and why it might be about to pick up.

Why excess global savings matter

The savings surplus affects companies that want to issue financial assets to fund investment.

The robots are coming

Robots won’t take all our jobs, but they will affect labour markets and, with them, inflation.

The productivity surge of the 2020s

Are the days of productivity growth over? The Multi Asset Team does not think so.

On the grid

David McIntyre and Calum Holt summarise their thoughts on the potential transformation of the European energy industry and how this is being embraced in our Multi Asset funds.

Multi Asset Q1 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Multi Asset Q1 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

Climate scenarios: so what?

Six themes we think will influence companies’ futures as the world adapts to climate change.

Climate scenarios: preparing for uncertainty

How scenario analysis and climate adaptation can unlock exciting investment opportunities in resilient companies.

Climate and energy scenarios

Explore four climate transition scenarios, their economic impacts and investment strategies for a low-carbon future.

Multi Asset Q4 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments.

The Plutus CLO Fund: seizing market opportunities

How leveraging opportunities in the European CLO market enhanced our structured finance solutions.

Too long to drive, too short to fly

Meet the rail company reshaping high-speed intercity travel across the US.

The clean energy election

Will the US election result affect investors in US renewables? Felix Amoako-Kwarteng finds out.

Resurgence of insurance-linked securities

Exploring the ILS resurgence: capital cycle shifts, disaster impacts and sustainable economies

Multi Asset Q3 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments.

The Climate Scenarios Project: part 2

The impact of Disorderly Transition scenarios on macro indicators and market outcomes.

Multi Asset Q2 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments.

The case for UK water investments

Uncover the resilient UK water companies showcasing their growth prospects in the face of regulatory and environmental hurdles.

Japan: the land of the rising yield

How Japan's changing economy is reshaping the Multi Asset investment landscape.

Multi Asset investment update

An update on performance, portfolio developments and where we see new opportunities.

Multi Asset investment update

An update on the portfolio, market environment and outlook for the year ahead.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Multi Asset: Investment process evolution

Focusing on the central pillars of our multi-asset investment process has sparked an evolution.

From Leeds to LA

Creating a high conviction, best ideas, global and unconstrained property portfolio.

Multi Asset Q3 investment update

How is the portfolio adapting to risks and opportunities? Scott Lothian explains.

Multi Asset quarterly update

James Squires reflects on the current environment influencing Multi Asset portfolios.

Why now for multi-asset investing

Who benefits from the new macro environment? Why multi-asset investing remains a viable option.

Multi Asset quarterly update

Scott Lothian explains how Multi Asset is riding out the ups and downs of market volatility.

Productivity’s slowdown unravelled

Casting fresh light on why productivity growth lost steam and why it might be about to pick up.

Why excess global savings matter

The savings surplus affects companies that want to issue financial assets to fund investment.

The robots are coming

Robots won’t take all our jobs, but they will affect labour markets and, with them, inflation.

The productivity surge of the 2020s

Are the days of productivity growth over? The Multi Asset Team does not think so.

On the grid

David McIntyre and Calum Holt summarise their thoughts on the potential transformation of the European energy industry and how this is being embraced in our Multi Asset funds.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

How to invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.