As with any investment, your or your clients' capital is at risk. Any income is not guaranteed and can fall as well as rise.

2001 was not simply a space odyssey but a year that saw Apple release its first iPod, the launch of Wikipedia and Baillie Gifford introduce its High Yield Bond Fund to the UK market.

A relatively new development, the European high yield market had started to grow substantially with the introduction of the euro in 1999. By 2001, it included a variety of issuers with diverse financing needs – hence we spotted a new and exciting opportunity to deliver superior long-term returns for clients.

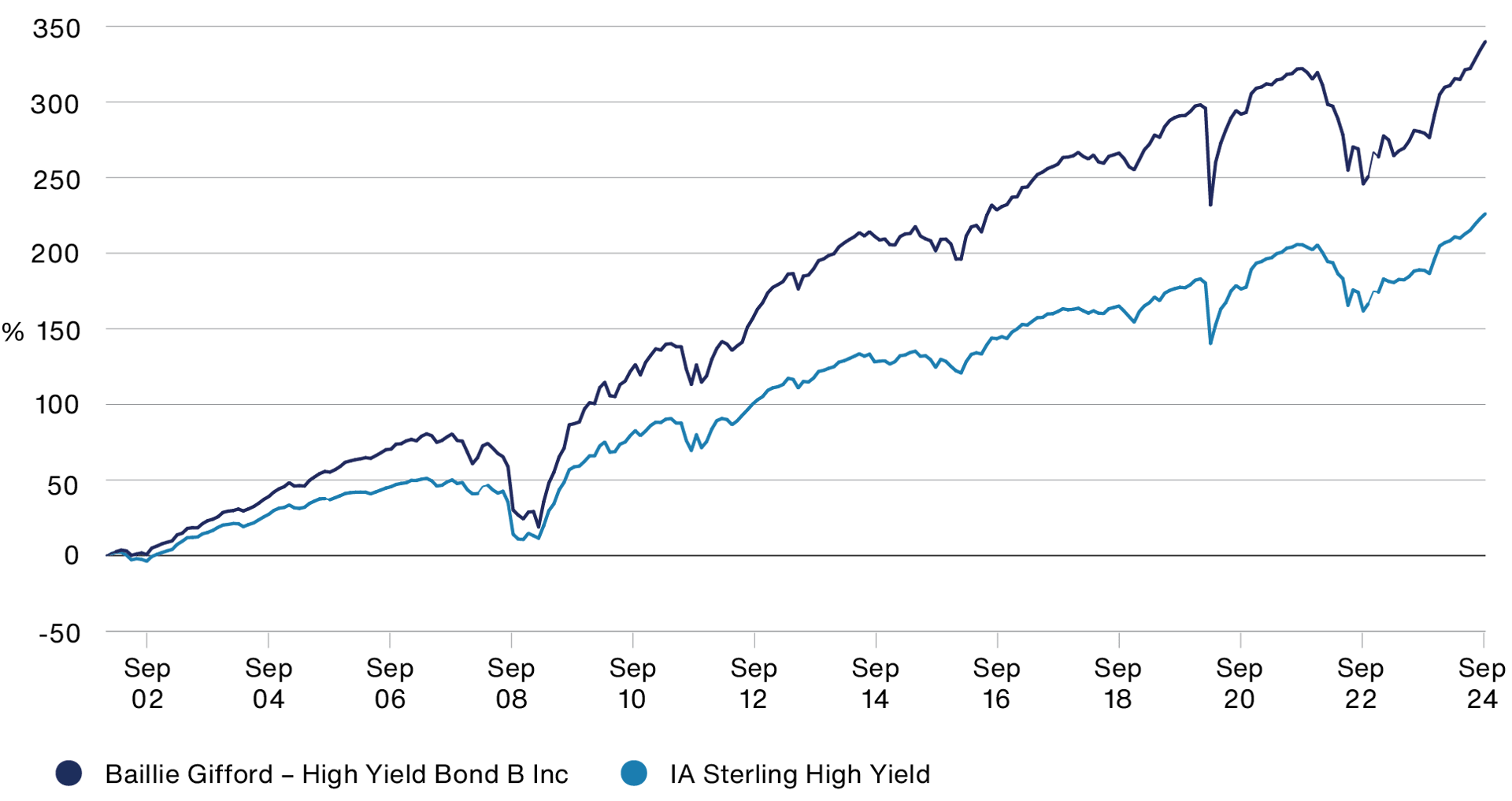

Baillie Gifford High Yield Bond Fund performance

The Baillie Gifford High Yield Bond Fund launched on 30 November 2001. Source: FE. Class B Inc shares. Data from 28/02/2002 to 30/09/2024. Past performance is not a guide to future returns.

In the two decades since, the Fund has successfully executed on that opportunity, delivering an annual return of 6.8 per cent, outperforming its peer group by 1.4 per cent per annum. This success has been built on a foundation of specialist company research and a clear focus on adding value by investing with patience and conviction in attractively valued bonds issued by resilient companies.

This sounds simple, but as we all know, investing isn’t easy, and we must never rest on our laurels in the pursuit of strong long-term returns for the Fund's clients.

In this regard, our most recent efforts have seen Arthur Milson appointed as co-manager of the Fund in January 2023. An industry veteran, Arthur has been investing in the market since 2006 and brings substantial experience to the broader credit team at Baillie Gifford.

In March, he was joined by Faisal Islam, an experienced US high yield specialist investor. With Arthur and Faisal at the helm, the Fund is managed by exceptionally talented managers with the skillsets required to drive performance over the years ahead.

They are supported by nine investment analysts who conduct in-depth, forward-looking credit research for the team.

The opportunity from here

The current portfolio consists of a well-diversified core of predominantly single-B rated corporate bonds, i.e. bonds in the middle of the credit quality spectrum within the high yield universe. This engine room for income is supplemented by a selection of attractive total return opportunities.

As a result, the portfolio outyields the market, currently offering a gross redemption yield of c. 7 per cent and holds potential for capital growth. Redemption yield is a strong indicator of the annual returns that can be derived from a bond portfolio in the future.

The Fund’s holding in B-rated bonds issued by Sunrise Medical is a perfect example of a resilient core bond that enhances the Fund’s yield.

The company’s story is one of innovation and dedication to improving the lives of people with mobility challenges. Its QUICKIE wheelchairs revolutionised the industry by introducing personalised ultra-light products to the mass market, eventually cementing its status as a global leader. We like the fact that its business has high barriers to entry and is “asset light” meaning it can easily adjust its expenses, providing a platform for more predictable cash flows.

These strong fundamentals and the above-market yield on offer mean that these bonds hold the potential to deliver an attractive income for the Fund over the long term.

We are also excited about the potential of our holding in Mobico, which rebranded from National Express in 2023. Mobico has steadily expanded from its roots as a state-owned UK bus company in the 1970s to a diversified transportation business with attractive assets across European and North American markets.

Mobico’s ability to adapt and grow while maintaining its core values of safety, reliability, and customer satisfaction has made it a trusted name in public transport for decades. Its recent downgrade to high yield has created an attractive investment opportunity in our view.

We believe the market is underestimating Mobico's potential to sell assets to pay off existing debt. This would reduce the risk of the company defaulting on its debt payments, driving an improving bond price and therefore enhancing the Fund’s returns.

We are incredibly proud of the long-term performance we have delivered to investors over the past 23 years and want to build on this for the future. However, we believe this is only just the beginning.

We don’t know which product launch in 2024 will measure up to the iPod in 2001, but we do know that the Baillie Gifford High Yield Bond Fund is well-placed to deliver strong returns for patient investors over the years ahead.

Bringing together a highly experienced team and best-in-class bond selection capabilities results in a robust, attractively valued, high-potential bond portfolio.

Past performance

Annual Past Performance to 30 September Each Year (%)

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Baillie Gifford High Yield Bond Fund | 0.3 | 7.7 | -18.1 | 9.7 | 16.0 |

| Sector Average* | -0.4 | 10.6 | -14.3 | 10.2 | 13.0 |

Source: FE. Net of fees, total return in sterling. Class B Inc shares. Share class and Sector returns calculated using 10am prices.

*IA £ High Yield Sector.

The manager believes that appropriate comparisons for this Fund are the Investment Association Sterling High Yield sector average, given the investment policy of the Fund and the approach taken by the manager when investing.

Past performance is not a guide to future returns.

Important information and risk warnings

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research.

The Fund's share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

Bonds issued by companies and governments may be adversely affected by changes in interest rates, expectations of inflation and a decline in the creditworthiness of the bond issuer. The issuers of bonds in which the Fund invests, particularly in emerging markets, may not be able to pay the bond income as promised or could fail to repay the capital amount.

Further details of the risks associated with investing in the Fund can be found in the Key Investor Information Document or the Prospectus, copies of which are available at bailliegifford.com.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.