Key points

- Monks’ first quarter performance was driven by a range of companies from leading-edge technology providers to operators in the industrial and infrastructure space

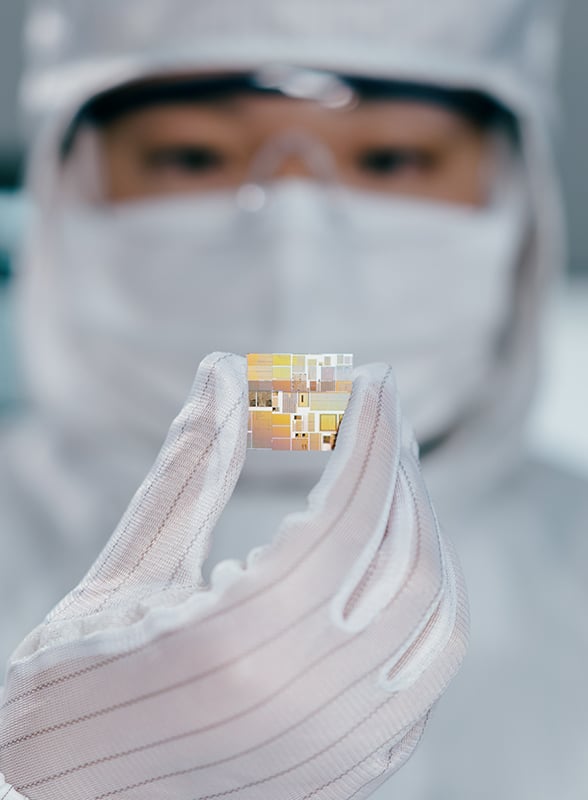

- This included gains from materials and construction leaders such as CRH, Martin Marietta and Eaton as well as semiconductor businesses NVIDIA, ASMI and Entegris

- The Trust’s optimism is based on the fundamental strengths of our well-managed and reward-seeking companies

Your capital is at risk

Since the birth of Silicon Valley in the late 1950s, the US West Coast has been synonymous with innovation. More so than ever now, with Amazon and Microsoft in Washington State and Alphabet, NVIDIA and Meta just south of San Francisco.

But world-changing inventions don’t just happen in investor-crowded clusters like the Bay Area. Drive 400 miles south via Highway 101 to the ports of Long Beach and LA, you’ll see another great 20th century innovation everywhere you look. The modern shipping container or ‘twenty-foot equivalent unit’, was invented at the same time Silicon Valley was getting started. Arguably, it’s been just as transformational.

The first of these giant metal boxes were sent from Newark, New Jersey down to Houston, Texas in 1958. Today, a staggering 20 million are crisscrossing the oceans at any time. Around 90 per cent of goods now reach us by sea, which shows how container traffic has reshaped the global economy.

The point is this: gritty port infrastructure and logistics can count as much as semiconductor-powered glitz. That’s the diversity that the Monks portfolio seeks to embrace.

It’s pleasing to see this variety reflected in the contributors to the portfolio’s net asset value (NAV) return of 10 per cent over the latest quarter to the end of March. The top contributor was NVIDIA, designer of the graphics processing unit (GPU) chips fundamental to recent startling progress in artificial intelligence (AI). Its shares continued their remarkable ascent, nearly doubling over the three months.

The other strong contributors are somewhat more surprising. They include CRH in aggregates and Comfort Systems, the heating, ventilation, and air conditioning business.

Is there anything that unites these contrasting exemplars of glitz and grit? We believe so – scarcity. We discussed the rising importance of scarcity in our latest Research Agenda. We are already taking advantage of this opportunity in a variety of ways across the portfolio.

Rising demand meets supply constraints

AI beyond the obvious

It’s in semiconductors where this rewarding imbalance of demand and supply is perhaps most visible. Demand for AI has taken the world by storm. NVIDIA’s growth is truly staggering (revenues grew 265 per cent year-on-year, and data centres almost double that).

However, the Monks portfolio also has exposure beyond the obvious. This quarter, for instance, we added to our holding in Samsung, arguably the world’s cheapest play on AI, with a leading position in high-bandwidth memory chips. These are vital for storing the vast amounts of data that generative AI models create and consume. We also made additions to both TSMC and Texas Instruments.

Our investments span the emerging AI value chain, including vital equipment in the production of the most advanced chips, such as ASMI (advanced deposition equipment) and Entegris (which helps filter, clean and purify during the semiconductor manufacturing process). More broadly, we think over a third of the portfolio is positioned to benefit from AI. Much more will probably follow as AI applications proliferate – won’t every company need intelligence to succeed?

Healthcare

Novo Nordisk, a new addition to Monks’ portfolio, sits on the right side of both compelling capital and supply scarcity dynamics. The Danish pharmaceutical company is experiencing a step-change in growth as its GLP-1 drug, Wegovy, experiences extraordinary demand.

The world is only starting to see obesity as a treatable disease, and the potential patient population is enormous. There are over a billion obese people in the world today, and that number is growing as waistlines around the world continue to expand. Novo Nordisk has an imposing competitive advantage in manufacturing and plans to spend more than $5bn per year in the next few years to ramp up capacity, further deepening its moat. While the shares have been on a strong run over recent years and valuation has risen (the stock is trading on around 36 times forecast 2024 earnings), we believe Novo remains an exceptionally well-positioned business still in the early foothills of expanding supply of one of the most transformational drugs the world has ever seen.

Infrastructure

Scarcity can be created by careful consolidation of resources, supply or distribution. That has been the strategy for US building materials companies CRH and Martin Marietta Materials for many years. Their industry-leading positions allow them to raise prices while maintaining efficient operations, leading to strong free-cashflow growth. They’re now well-positioned to deploy capital as they potentially enter what Albert Manifold, CRH’s chief executive, calls a ‘golden era’ for construction. The demand side of the equation matters as the US government commits vast sums of capital to renew vital infrastructure.

The need is clear: the American Society of Civil Engineers said 43 per cent of US public roads need repair. More broadly, we believe the portfolio’s grittier holdings, such as Eaton and Advanced Drainage Systems – will continue to thrive as advanced economies confront the urgent need to reconstruct everything from stormwater drainage to power grids.

To return to Comfort Systems, sometimes companies find themselves uniquely positioned to provide a critical resource, such as labour, that’s in short supply. Comfort Systems has bolstered its competitive position by managing the impact of the skilled labour shortage for many years, using technology to improve productivity as well as more practical solutions, such as acquiring an in-house recruitment agency. This has left the company exceptionally well placed to ride the boom in demand, particularly in the buildout of data centres.

Competition for capital

There has been a modest uptick in our sales this quarter. It has been something of a spring-cleaning exercise, tidying up where conviction has waned or where companies have failed to meet our expectations and exhausted our patience. For example, we have moved on from German sportswear giant Adidas. Despite incremental signs of a turnaround in fortunes under new management, the share price has moved ahead of this progress, so we decided to redeploy funds where we see greater upside prospects.

This discipline reflects a healthy competition for capital. Additionally, we reduced holdings in Eaton, Entegris and Martin Marietta, where strongly rising shares are running ahead of fundamentals. Each remains a great business, but we are aware of valuations becoming stretched.

We have deployed this capital into new opportunities or existing holdings where our conviction has deepened and where valuations remain attractive. In addition to Novo Nordisk, we added the 100-year-old entertainment titan Disney, which we believe is similarly poised for its next phase of growth. Disney’s movies, theme parks, resorts and merchandise underpin an incredibly durable growth business with timelessly valuable assets. We have also made a small addition to another streaming service, Spotify, which we consider to be committed to improving financial characteristics.

Beyond Disney and Spotify, we added to holdings in CATL, China’s world-leading advanced battery maker and Block, the disruptive fintech business. These are two companies where strengthening fundamentals have so far gone unrewarded.

Disneyland © iStockphoto.com/ImagePixel

The turning tide

Monks’ willingness to incorporate both the glitz of the AI revolution and the grit of industrial winners, makes our opportunity set both broad and deep. From AI to plastic pipes, from blockbuster drugs to payment solutions, we embrace that diversity through a collection of companies where growth is overlooked or underappreciated. Across the portfolio, companies are attuning operations to the present and the future. High-calibre management teams ‘get it’, the fundamentals of the portfolio have strengthened substantially – and we believe your patience will be rewarded.

The portfolio’s growth outlook is encouraging – aggregate earnings growth for the next three years is forecast to be 15 per cent per annum. That rate of growth, if delivered, is consistent with our return hurdle, a doubling in share price.

Zooming in, beneath the aggregate numbers, we see a portfolio of companies thriving in the current environment and exposed to diverse structural growth drivers. It is fundamentals that matter most to share prices, and in that regard, we are confident and increasingly optimistic about the future.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Monks Ord | -2.9 | 66.9 | -17.5 | -12.7 | 18.7 |

| Monks NAV | -4.2 | 67.4 | -9.4 | -7.8 | 20.2 |

| FTSE World Index | -6.0 | 39.9 | 14.9 | -0.7 | 22.5 |

Performance source: Morningstar, FTSE, total return in sterling

Past performance is not a guide to future returns.

Important information

This communication was produced and approved in April 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

The Trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

This article does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available at bailliegifford.com.

FTSE index data

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell ®, is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

102106 10046872