All investment strategies have the potential for profit and loss, capital is at risk.

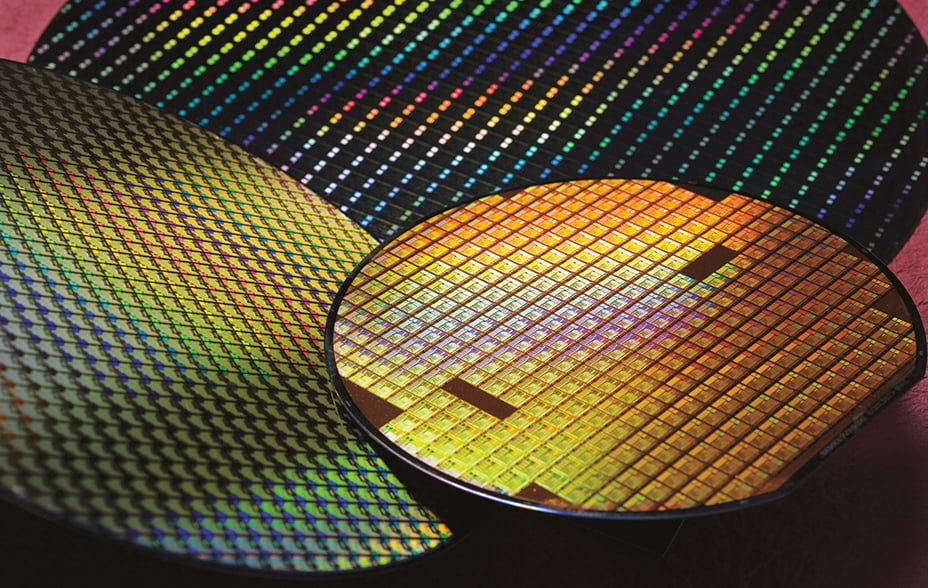

Most investment managers are familiar with the attractions of the world-leading chip company TSMC. Responsible Global Equity Income remains excited about the opportunity offered by this powerhouse of advanced semiconductor innovation.

But, as long-term investors, we also must consider and assess potential obstacles to the company’s continued ability to generate stellar compound growth. Some of these are bound up with Taiwan’s challenges on the road to net zero. The subject has featured recently in our discussions, and in our dialogue with TSMC management.

The net zero challenge comes from Taiwan’s heavy reliance on imported fossil fuels. In 2021, almost 98 per cent of energy came from abroad. For electricity, imported coal, oil and natural gas provided over 83 per cent of the island’s generation, while renewables generated just under 6 per cent. The lion’s share of the rest, approximately 9.5 per cent, was generated by nuclear power.

This reliance on imports is uncomfortable – particularly when energy markets are volatile. From an environmental, social and governance (ESG) perspective, however, TSMC needs to stay closely engaged in Taiwan’s decarbonisation challenge.

© Taiwan Semiconductor Manufacturing Co., Ltd.

Energy policy

Energy policy is politically sensitive in Taiwan and nuclear power is a partisan issue. The ruling Democratic Progressive Party (DPP) has been anti-nuclear since it was founded in 1986, only months after the Chernobyl disaster. In 2017, the year after it won office, the DDP amended the island’s Electricity Act, directing it towards a nuclear-free future by 2025. The catalyst was the Fukushima disaster, but the decision was linked to long-standing anti-nuclear sentiment in Taiwan.

The main opposition party, the Kuomintang, has called for a repeal of the 2025 target. A 2018 referendum reamended the Act, allowing retention of nuclear beyond 2025. Nonetheless, the DPP retains that goal. A further referendum, in late 2021, on whether to restart a mothballed fourth power plant went against that proposal. The politicisation of these matters, and numerous referenda, have introduced uncertainties in policymaking. The fact that the two main parties have switched positions on some issues complicates things even further.

Towards decarbonisation

The revised 2017 Electricity Act also set Taiwan's 2025 ambitions for:

• increases in renewables - 20 per cent up from 5.4 per cent in 2020;

• increases in imported liquefied natural gas (LNG) - 50 per cent, up from 35.7 per cent;

• reduced reliance on coal - 30 per cent, down from 45 per cent;

• and the aforementioned phaseout of nuclear - down from 11.2 per cent.

However, progress on renewables has been anaemic. To illustrate: 2021’s 6 per cent contribution from renewables to electricity generation is only a marginal increase from 4.8 per cent in 2016.

There are several reasons for the slow progress towards greener energy. Solar power installation is challenged by a lack of available land for large-scale arrays: Taiwan is densely populated, with two-thirds of its land rendered undevelopable by mountains. Wind farm development has been hindered by pandemic-related supply chain delays and, offshore, by environmental concerns. Last year, the Taiwanese Ministry of Economic Affairs revised its 2025 goal for renewable electricity generation down from 20 per cent to 15 per cent. LNG expansion has been stymied by a debate about the environmental impact of a proposed offshore terminal, necessary (according to the DPP) to increase LNG’s contribution to Taiwan's energy mix.

Even if Taiwan were to reach its new 2025 goal of 15 per cent renewables and zero per cent nuclear, estimates suggest this will represent a net increase in thermal electricity generation to its grid, although LNG increases might lower grid carbon intensity.

LNG tanker

Implications for our holdings

Taiwan's limited progress on its clean energy transition represents a significant challenge to TSMC's decarbonisation ambitions. The Responsible Global Equity Income team see this as an increasingly material threat to the company’s long-term success.

TSMC is by far the largest user of Taiwan’s electricity, consuming approximately 6 per cent of the entire grid. This percentage can be expected to increase significantly as the company adopts extreme ultraviolet lithography, a more energy-intensive technology for the production of more advanced semiconductor chips, and expands its manufacturing base on the island. Approximately 62 per cent of TSMC’s reported carbon emissions come from its electricity use. If the company is to decarbonise, much depends on Taiwan’s progress more generally. We believe TSMC recognises this challenge and takes it seriously. We believe this to be appropriate as we do not consider TSMC’s decarbonisation drive to be solely an environmental or moral imperative.

Many of TSMCs customers have ambitions to reduce their own carbon footprint beyond their immediate operations – the wider ‘scope 3’ emissions covering all upstream and downstream activities and connections. These ambitions are driven by their perceptions of ongoing shifts in regulation, cost and customer expectations.

The company’s task, therefore, will be to align its technological leadership with an understanding of market developments around the net zero transition.

It is in our interest as long-term shareholders to understand the specific challenges the company faces and patiently encourage it to pull every available lever. Fundamentally, the pace of innovation in renewable generation technologies suggests that over time wind and solar sources will enable TSMC to access power at lower cost and lower price volatility.

The evidence tells us it’s trying hard. The company recently improved its target, aiming to derive 40 per cent of its electricity consumption from renewable sources by 2030. It signed the world’s largest power purchase agreement with Ørsted and, although our estimates suggest that even accounting for this contribution still makes its 2030 goal challenging, there are other examples of TSMC ambitiously pursuing renewable purchasing. For instance, it has been buying almost 99 per cent of available renewable energy credits in Taiwan, is installing renewables on new fabrication plants and supporting suppliers to purchase renewable power.

Supporting our companies

Taiwan has a profound decarbonisation challenge. Electricity demand is forecast to rise significantly and this is set against constrained supply, policy obstacles, a highly politicised energy landscape, geopolitical tensions, an ongoing reliance on imports, a fragile grid, a lack of energy storage and more.

As long-term, supportive investors we need to stay aware of these issues and the various bottlenecks in Taiwan’s decarbonisation process. Engaging with experts from numerous Taiwan-based energy-focused think tanks, who have studied these issues for years, has helped further. Through doing this, we believe we can arrive at a better-informed position from which we can engage with our holdings with operations in Taiwan, leading to better outcomes for Responsible Global Equity Income’s investors.

Responsible Global Equity Income team members have discussed what we have learned with TSMC, to convey our understanding of the situation and to encourage the company to continue doing what it can to support the roll-out of renewable power in Taiwan. We encouraged the company in its ambitions to get ahead of the curve on these issues, expressing our full support as long-term shareholders for the company incurring the short-term costs needed to ensure the future sustainability of its electricity supply.

The ESG issues many companies face are deeply complex and embedded in local as well as global circumstances. We believe that investing our time to understand the nuance, rather than being satisfied by a tick-box approach to the data, is likely to lead to better long-term relationships, more effective engagement and better outcomes.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in July 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 37543 10019577