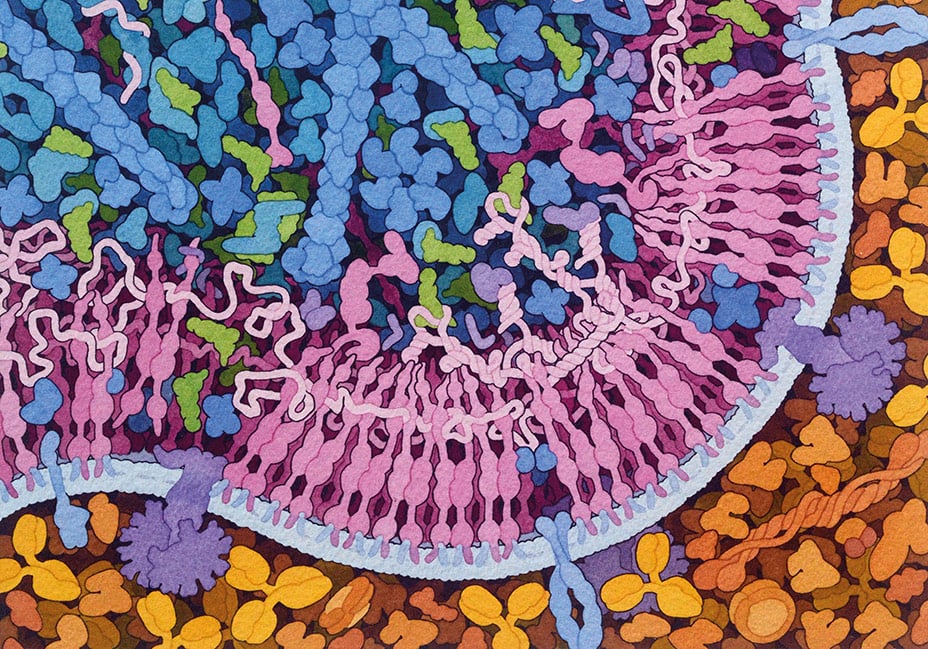

Illustration by David S. Goodsell, Scripps Research and RCSB Protein Data Bank. doi: 10.2210/rcsb_pdb/goodsell-gallery-037

Please remember that the value of an investment can fall and you may not get back the amount invested. This article originally featured in Baillie Gifford’s Autumn 2023 issue of Trust magazine.

Alzheimer’s, high blood pressure, diabetes. These three illnesses kill millions every year. All stem from faults in the protein circuitry that regulates our organs and tissues.

If we could find a way to sort out or ‘silence’ the troublemaking genes believed to cause these diseases, we could shrink the death toll.

According to Douglas Brodie, manager of the Edinburgh Worldwide Investment Trust, Alnylam Pharmaceuticals is helping us to look in the right place.

Our genes hold manufacturing instructions for every protein in our bodies. Hence the excitement when scientists first mapped the human genome in 2000.

President Clinton declared then: “With this profound new knowledge, humankind is on the verge of gaining immense new power to heal.”

A significant discovery

Hopes were high that drugs to regulate proteins would swiftly follow.

Some did, but not as many as researchers had hoped. Gene sequencing helped reveal which proteins were going rogue in which diseases, but it didn’t equip researchers to modify protein production.

“The pharmaceutical industry still lacked a way to turn that new genetic information into therapies that actually helped patients,” explains Brodie.

Then two winners of the 2006 Nobel Prize for Medicine caught his eye. The pair had discovered ‘RNA interference’ (RNAi) – the natural mechanism through which cells control the number of proteins they produce.

Today, manipulating RNAi is one of the most promising and dynamic frontiers of drug development.

Massachusetts-based Alnylam is leading a revolution in protein modification. Edinburgh Worldwide first invested in 2011.

“Alnylam is realising the potential for this technology to progress beyond its focus on rare genetic diseases to tackle those big public health threats,” Brodie says.

“Its success has led several major pharmaceutical companies to sit up and notice them as potential partners.”

Molecular photocopiers

But what is ‘interference’? How does it work? And how did Brodie spot its commercial potential?

Inside every cell sits the molecular equivalent of a photocopier. It makes RNA copies of our genes, which then get translated into proteins.

About 25 years ago, scientists discovered another piece of bio-machinery that gave new meaning to the phrase ‘shooting the messenger’. It turns out that some of these copies, known as messenger RNAs (mRNAs), never make it to their destination but are gobbled up by cellular paper shredders called small interfering RNAs (siRNAs) instead.

Through this process, every cell can regulate the amount of each targeted protein it produces and even ‘silence’ certain disease-causing genes.

Experiments showed that this process could also be stimulated by introducing bespoke genetic sequences into cells, allowing researchers to suppress targeted genes.

Combatting toxic proteins

The investment case for a company pursuing this path lies in the potential demand because many diseases are associated with protein overproduction.

In Alzheimer’s, for example, toxic clumps of beta-amyloid protein accumulate in the brain. Pharmaceutical companies could potentially piggyback on a biological process to temporarily silence the faulty genes believed to be responsible.

They could also suppress proteins that control physiological processes such as blood vessel constriction, providing new ways of addressing conditions such as hypertension.

It’s partly thanks to Alnylam that this dream is getting closer. In 2018, the US Food & Drug Administration approved the world’s first siRNA-based drug.

The firm’s Onpattro (also known as patisiran) treats the severe nerve damage caused by a rare but painful inherited disease called hereditary transthyretin (hATTR) amyloidosis. It can cause mobility problems, heart and kidney failure and other life-limiting symptoms.

Tests have found that patients injected with Onpattro were able to walk further and faster than previously and were reporting improved quality of life.

Five years later, Alnylam has had three further siRNA-based drugs approved for other rare genetic diseases, which cause overproduction of proteins in the liver. Now it has those big killers in its sights.

Brits mean business

The credentials of its US founders helped convince Edinburgh Worldwide Investment Trust to invest in Alnylam 12 years ago. As the company matures, two business-minded British doctors have taken the helm.

Dr Yvonne Greenstreet became its chief executive in 2021. She isn’t shy about proclaiming Alnylam’s “phenomenal” and “mindblowing” potential. Greenstreet has more than 25 years in the biopharmaceutical industry and an MBA from the European business school INSEAD. An expert in scaling up complex global biopharmaceutical businesses, she is one of only six women to have run a major pharma company.

Alnylam’s president is Dr Akshay Vaishnaw. He joined Alnylam as vice president of clinical research in 2006. A research and development specialist, he was appointed president last year.

Brodie credits the new leadership with an easing of the brakes on Alnylam’s previously cautious approach to commercialisation. “The ambition and confidence, for me, now feels higher,” he says.

“I have had meetings with them when you come out thinking the implications of what they’re doing are huge. They’ve refreshed my enthusiasm for what it means to be an investor.”

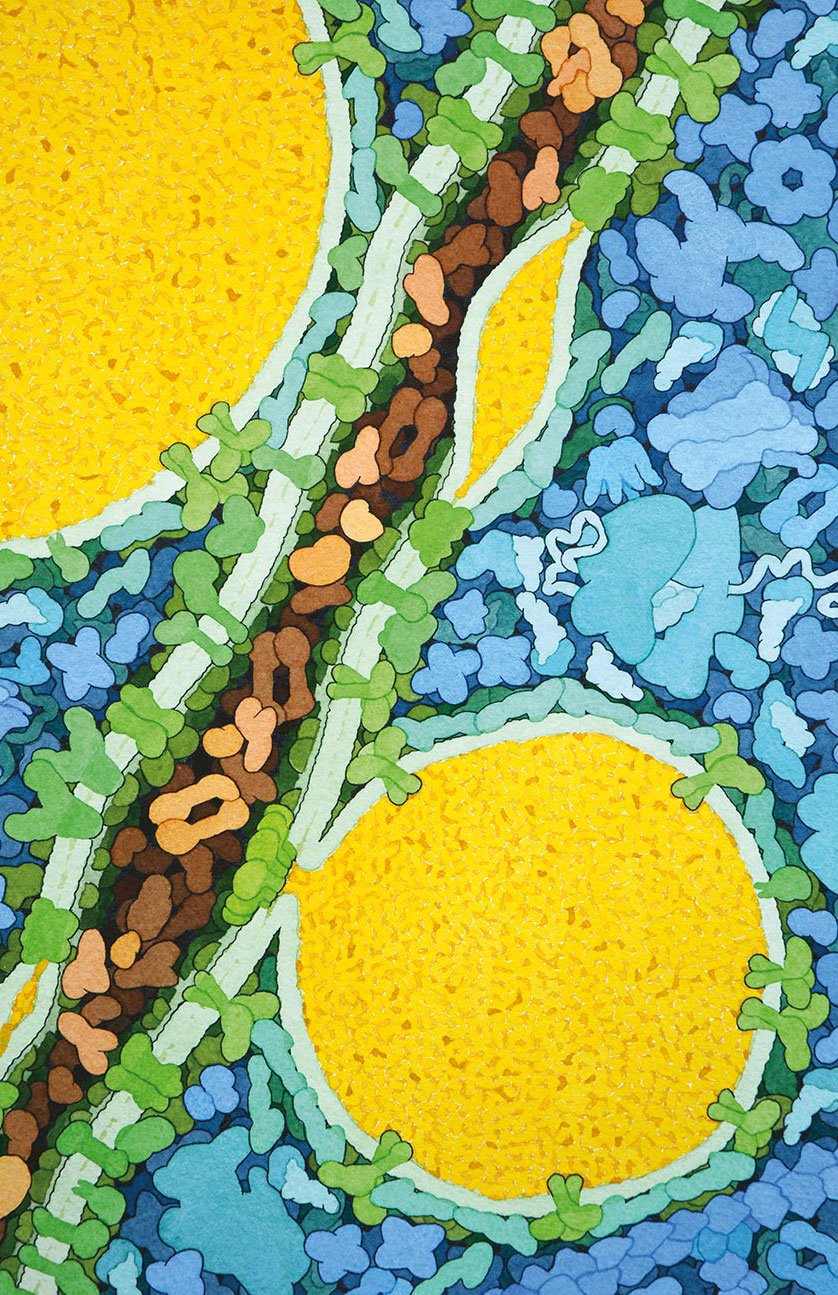

Illustration by David S. Goodsell, RCSB Protein Data Bank. doi: 10.2210/rcsb_pdb/goodsell-gallery-017

Trailblazing science

Key to Alnylam’s appeal is that its drugs all piggyback on the same molecular process – gene silencing.

Assuming they know the sequence of the gene and therefore the messenger RNA they wish to shoot down, Alnylam’s scientists can design a drug at speed. This one strategy serves very different diseases.

Another benefit is that this form of gene silencing lasts. Patients take most drugs one or more times a day, but they might need to inject Alnylam’s only once every three to six months. That makes them more likely to stick to their treatment.

Since Edinburgh Worldwide invested, Alnylam has gone from an unproven biotech platform with drugs in early clinical trials to a fully commercial enterprise with “probably the most exciting and diverse clinical and preclinical development programme in the industry”, according to Brodie.

Other companies are developing siRNA-based drugs, but Alnylam is further along the approval process.

Brodie is particularly excited about the prospects for its experimental Alzheimer’s drug, ALN-APP. In April, the company announced positive interim results from early-stage human trials, encouraging further investigation.

A pipeline of potential

Why the excitement? Existing antibody-based Alzheimer’s treatments can already bind to and clear toxic clumps of proteins from the brain, but only those outside the nerve cells.

By contrast, ALN-APP can get through a cell’s outer membrane to where 90 per cent of proteins are found. Once inside, it can target and silence the proteins thought to be responsible for neurodegeneration.

Alnylam’s pipeline of treatments is based around four therapeutic areas:

- genetic diseases

- cardio-metabolic diseases such as diabetes and high blood pressure

- infectious liver diseases

- diseases of the central nervous system or eye

That list already contains huge life-saving and commercial opportunities, but it could be just the beginning.

“By acting at the genetic level, and with high specificity, RNAi-based drugs can ‘turn down’ or ‘turn off’ any gene with pinpoint precision,” says Brodie.

“As understanding grows about how genes cause and influence a wide range of diseases, Alnylam’s proprietary platform offers a unique way of intervening.”

With all the noise around CRISPR gene editing, it’s notable that the more established technology of gene silencing has passed under many investors’ radar.

Alnylam, with a market value of more than $25bn, is hardly obscure, but it’s only now that industry analysts are waking up to its full potential. The adage ‘silence is golden’ never rang truer.

Alnylam is also held by The Monks Investment Trust and Baillie Gifford US Growth Trust.

Important information

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

The views expressed in this article should not be considered as advice or a recommendation to buy, sell or hold a particular investment. The article contains information and opinion on investments that does not constitute independent investment research, and is therefore not subject to the protections afforded to independent research.

Some of the views expressed are not necessarily those of Baillie Gifford. Investment markets and conditions can change rapidly, therefore the views expressed should not be taken as statements of fact nor should reliance be placed on them when making investment decisions.

Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority and are based at: Calton Square, 1 Greenside Row, Edinburgh EH1 3AN.

The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the Financial Conduct Authority.

A Key Information Document is available by visiting bailliegifford.com

58615 10035559