The value of an investment, and any income from it, can fall as well as rise and investors may not get back the amount invested. Past performance is not a guide to future returns.

1. Valuations have soared in the US in the last couple of years, despite very recent volatility. How do you think about valuations?

A common refrain at the moment is, ‘are we in a bubble?’. It is important to make a distinction between a downdraft and a true bubble bursting. The best way to think about the difference is in terms of fundamentals. Share price downdrafts are something we are inclined to look through, caused by changes in sentiment in the short term but where the long-term investment case remains intact. A bubble bursting sees fundamentals come to a screeching halt.

The way we think about valuations is to focus on the fundamental investment case, stock by stock. Every company in the portfolio has a forward-looking hypothesis which we monitor. We pair this with periodically revisiting the upside case for growth. Given share prices have seen significant moves over the past 18 months, we have revisited the upside case for many of the holdings to get our bearings in what has been a very unusual environment. For the most part, this has not led to changes in the portfolio. While share prices have seen significant volatility, operationally the companies we invest in have also shown huge progress, therefore, most of our long-term investment hypotheses remain intact. As a long-term, growth investor, with a fundamental belief in the asymmetry of stock market returns, volatility is the rule not the exception. It is important in times of volatility to recognise there is a difference between share price volatility and fundamental volatility. Sentiment will ebb and flow, but in the long run fundamentals drive share prices.

2. Acknowledging that you are bottom-up investors, what’s your view on potential rate hikes in the US and how could this impact future growth?

We are looking to invest in businesses that we believe are driving structural change. This influences how we consider interest rate increases in two respects. First, businesses driving structural change are delivering utility; creating and competitively pricing innovative and differentiated products. Although a hike in rates could impact short-term performance and create volatility for what are fairly long duration holdings, the value-added of their products positions them well on a five to ten-year view to ride out shorter-term fluctuations in rates. Second, investing in structural change involves asking far broader questions about the future of industries. As an example, we believe more cars will be electric on a ten-year view, whether the interest rate is 3, 4 or 5 per cent. In the short run, rates could impact the pace of adoption but not the direction of travel. The same holds for many disruptive industries.

3. How do you consider environmental, social and governance (ESG) matters and climate change issues when investing in the US?

We believe sustainability is inextricably linked to being a long-term investor. We think of companies as participants in complex and interconnected networks. Their influence and impact will depend on many factors and we certainly won’t predict all of them. Instead we seek to understand how they can positively contribute to society and how that could enhance their durability, and how the negative implications of their growth might diminish that. In the US team we write a societal contribution hypothesis for every company that we own. It is a direct output of the first of our eight question investment framework, ‘What might the world look like if they are successful?’, and considers a company’s purpose, the problem it is solving, and the positive and negative implications of its success.

In addition we have completed ‘climate unlocks’ for every US holding in the portfolio, which specifically consider each company’s risks and opportunities in relation to climate change and carbon emissions. We use these to inform our investment thinking and our engagement priorities with companies. We have small, but important, opportunities to influence companies and we can only make the most of these by understanding the context that each company operates in. Carbon emissions will be relevant to almost every company on a long-term view, but for some it will matter much more than others.

4. Sometimes relationships come to an end. What prompts you to sell a company? How do you make sure that you don’t fall in love?

Focusing relentlessly on capturing long-term returns is not easy. We have accepted we cannot be the world’s best holders of companies and the world’s best sellers. The asymmetry of long-run equity returns means it is in our clients’ interests to relentlessly strive for the former.

Our ‘sell discipline’ is driven by our buy discipline and an overarching desire to identify and own outliers for a long period of time. The main triggers for a review of the investment case are, first, a significant change in the share price in either direction and second, muted long-term performance. Two key factors would lead to a sale i) there has been a fundamental change in the investment case which threatens our hypothesis, ii) our view is no longer sufficiently different to the market. In the case of our recent sale of Zillow, the largest online real estate portal in the US, it was the former which triggered us to disinvest as they wound down an initiative of direct buying and selling of homes, a key driver of our original investment case.

5. Amazon, Tesla, and Moderna have been significant holdings for the Managed Fund – what are you excited about at the moment and how do you keep ideas fresh?

We believe the best ideas come from allowing individuals in the investment team to follow their interests. We do not have sector coverage or any requirements for periodic review. Trying to keep abreast of new areas of innovation, some of which may not yet be investable, is important for both knowledge development and bringing new challenge to our existing holdings.

For the past 20 years or so, the digital tools of the information technology revolution have been limited to a few sectors of the economy, mainly retail and advertising. But when we look at the market today, we are beginning to see these digital tools impacting a far broader range of industries – insurance, energy, finance, transportation, healthcare and education. There are many digitally-disruptive companies in the US portfolio that we are excited about. For example:

Recursion is a biotechnology company building a new model for drug discovery, driven by machine learning and experimental biology. The company aspires to build a high-resolution digital map of human cellular biology that could predict biological and chemical relationships in healthy and diseased cells. This could mark the beginning of some deflationary forces in healthcare, where more predictable and efficient drug discovery methods result in lower costs for patients.

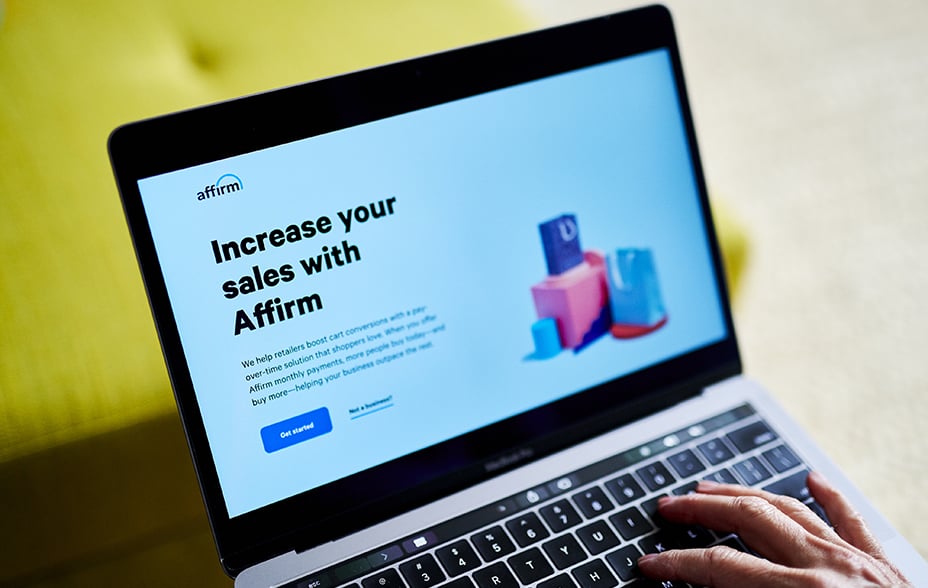

Affirm is a financial technology company that provides consumers with simpler, more transparent and fairer financial products, eschewing practices such as hidden or late fees that create misalignment between the lender and the consumer. Its initial focus is point of sale credit through online merchants. This is a cost-effective way to acquire customers, giving Affirm a platform to build its brand while spending very little on marketing. This provides a strong foundation for Affirm to be integrated in the financial lives of its customers and merchants.

We believe the next decade could be transformational in terms of innovation. While progress is unlikely to follow a smooth path, the potential for structural change is vast, and this makes being a long-term US growth investor today, a particularly exciting time.

We believe that the Managed Fund’s US equity holdings are a collection of the best US businesses in leading global positions and should add value for the fund’s investors over the long term.

Important information and risk factors

The views expressed in this article are those of Kirsty Gibson and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in February 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced. Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

The Fund has exposure to foreign currencies and changes in the rates of exchange will cause the value of any investment, and income from it, to fall as well as rise and you may not get back the amount invested.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated. The images used in this article are for illustrative purposes only.

This is a marketing communication and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. No reliance should be placed on these views when making investment decisions. This article does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Baillie Gifford Managed Fund B Acc |

15.0 | -2.6 | 21.3 | 33.9 | 4.3 |

| Sector Median* | 10.0 | -6.1 | 15.8 | 5.3 | 10.9 |

Source: StatPro, net of fees, in sterling. Class B Acc shares, total return in sterling. Returns reflect the annual charges but exclude any initial charge paid. *IA Mixed Investment 40-85% Shares Sector Median (Net). The manager believes this is an appropriate comparison given the investment policy of the Fund and the approach taken by the manager when investing.

Past performance is not a guide to future returns.

Ref: 13735 10005535