Key points

This article is part of the Disruptive Innovation series.

- Advances in our understanding of biology will transform the economy and society

- New types of medical treatments are already being made possible by biotechnology companies whose platform-based business models more closely resemble the internet giants than traditional pharmaceutical firms

- This type of disruptive innovation requires a multi-disciplinary approach and the right type of business culture, not just know-how

All investment strategies have the potential for profit and loss. Your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Biology is at an inflection point.

A convergence of technologies - including gene sequencing, biomedical imaging and machine learning – is making it possible to study biology at a scale, depth and speed that was unimaginable a short time ago.

For much of human history, our internal workings have been viewed as a kind of ‘black box’, explained investment manager Rose Nguyen at a Baillie Gifford event exploring disruptive innovation across several industries.

We could observe certain treatments as being effective, but the complexity of what was involved made it difficult to know in advance what would or would not work, she said.

New drug discoveries typically involved a lot of random screening and luck. Indeed, several of the biggest breakthroughs – including the common use of aspirin, penicillin and Viagra – came about in the unlikeliest of circumstances.

Viagra, for example, was originally developed to dilate blood vessels in the heart, but nurses checking on test subjects noticed many of the men were lying on their stomachs. Its active ingredient worked, but on a different body part to that expected. It was consequently developed as an erectile dysfunction treatment.

Vaccines have also traditionally taken years and vast sums of money to develop, with all the risks involved in dealing with live viruses.

But now smaller biotech companies are starting to create therapies via a more rational, automated and industrialised process.

In doing so, they aim to make biology a more predictable and controllable information science.

“The impact on humankind would be tremendous,” said Nguyen.

“And we can all be part of this journey by being supportive, long-term shareholders of the companies that are making this happen.”

WATCH: Baillie Gifford webinar on the biological revolution.

Programming cells

Advances in gene sequencing illustrate how quickly things are moving.

The cost of mapping out all the genes of a human being – known as the genome – was a little under $100m in 2001. It’s since fallen to just $700.

This dramatic drop in cost exceeds even that of Moore’s Law – Intel co-founder Gordon Moore’s observation that the relative cost of computing halves roughly every two years in line with a doubling of the number of transistors that can be put on a chip.

Cost per human genome

The genomic sequencing provider lllumina – in which Baillie Gifford has been an investor since in 2011 – played a significant role in delivering these savings.

But identifying the order of the letters that represent the genetic code is only the first step. The next task is to see how the various genes relate to each other to help figure out the ‘computing language’ of biology.

To do that you have to get down to the cellular level. And there another holding, 10x Genomics, has developed machines that can profile tens of thousands of individual cells in a single run.

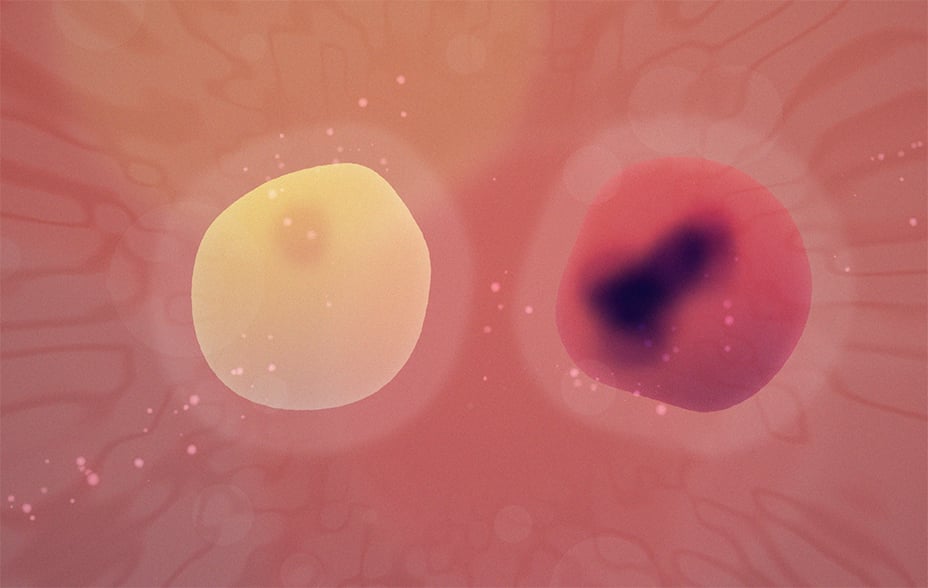

This makes it possible to compare healthy and diseased cells at scale to figure out which genes cause a disease. The technology also helps map out the biochemistry signals passing between cells in different parts of our body tissue. By narrowing down what to target, it’s possible to speed up the development of new drugs and establish which patients will be most responsive to them.

WATCH: Baillie Gifford animation on disruptive innovation

mRNA Covid vaccine

One of the clearest examples of how technological convergence is fuelling biotech advances is the development of messenger ribonucleic acid (mRNA) vaccines for Covid-19.

To understand why, this analogy may help:

Think of a cell as being a restaurant, and the DNA in its nucleus as being a recipe book. Now imagine a photocopy of a page from the book (mRNA) being sent to the kitchen (the cell’s ribosome) to tell the chef how to make a cake (a protein).

By substituting in alternative mRNA, you can cause different proteins to be made.

“Most of the time diseases occur because there are some problems with the information flow,” Nguyen explained.

“mRNA is just a piece of genetic code, and we can send it to the cell to instruct it to produce any protein that we want.

“Historically the problem was to deliver the mRNA to the right cell. But once you’re able to do that you can scale very quickly to treat different diseases of the same cell type simply by tweaking the code.”

Moderna, a Baillie Gifford investment, was able to develop an mRNA molecule in just 48 hours after obtaining the genetic blueprint of the virus.

This taught cells how to make copies of the spike protein that drives immunity against the virus.

Incredibly, Moderna was able to download the genetic data it required from the internet rather than having to experiment with the virus itself.

But what’s truly exciting for the future, is that this shouldn’t be a one-off. mRNA has the potential to become a technology platform that creates new drugs to treat cancers, autoimmune disorders and other ailments.

“We can turn our own cells into mini-factories to produce any proteins we want,” Nguyen said.

Scalable technologies

Other biotech investments made by Baillie Gifford’s fund managers include:

- BioNTech. A German biotech company that teamed up with Pfizer to produce an mRNA vaccine to Covid-19. It also develops immunotherapies for cancer and other infectious diseases.

- CureVac. A German biopharmaceutical developing an mRNA Covid-19 vaccine in collaboration with GlaxoSmithKline.

- Argenx. A Belgian antibody specialist developing treatments for rare immune system disorders.

- Exscientia. A Dundee University spin-out that uses artificial intelligence pattern-recognition techniques to precision engineer new drugs.

- Alnylam Pharmaceuticals. A US biotech that uses RNA interference therapeutics to destroy faulty mRNA, preventing the creation of disease-causing proteins.

- Lyell Immunopharma. A Californian start-up, which is reprogramming T-cells to help fight off solid tumour cancers.

All the companies mentioned above have something in common: they are trying to create a means to deliver multiple treatments over time rather than a single drug.

“Our approach is to identify companies that have a scalable technology platform that can be applicable to many different diseases,” Nguyen said.

“We believe repeatability is really key to commercial success, but also key in terms of the impact that they can deliver to society.”

Scalable technologies can lead to higher success rates and lower costs of drug development. For example, compared with the historical success rate of 10 per cent of drugs tested in humans, Alnylam has achieved an impressive success rate closer to 60 per cent.

However, for companies operating at the intersection of biology and technology, success can come down to their culture.

It’s not merely a matter of bringing together data scientists and biologist under one roof, Nguyen explained. Companies must also foster an environment in which the two have mutual respect and can understand each other’s language.

“We have seen quite a few examples of companies that have failed because they could not foster that sort of collaborative culture,” Nguyen added.

“It starts at the top. You need the executive teams to be able to understand what it takes to do research in biology, what it takes to do research in computing, and what it takes to bring the two worlds together.”

Exscientia is one example.

Co-founder and chief executive Andrew Hopkins has a background in both drug development and data science. With this he was able to assemble an interdisciplinary team whose skills span medicinal chemistry, bioinformatics and machine learning

Accelerating change

The route to our current understanding of how best to provide medical care had been arduous.

Bloodletting was the standard for more than two millennia, Nguyen noted.

“President George Washington died after his doctors drained litres of his blood to treat him for a throat infection,” she said

It took just over 200 years to get from there to a point that a novel virus could have its genetic code sequenced and a vaccine molecule developed in a matter of days.

Now a confluence of technologies and a select number of companies capable of harnessing biology’s power means there’s an opportunity to accelerate the pace of change still further.

And while some investments may not achieve their promise, over the long term there should be major returns for patients as well as those who backed the healthcare revolution.

About the investment manager

Rose Nguyen

Rose joined Baillie Gifford in 2013 as an investment analyst. Rose worked on various regional and global strategies before joining the Health Innovation team as a Portfolio Manager. Having observed the innovations in multiple industries, she believes that the great convergence of different technologies and sciences will ultimately transform life science. Biology can move from alchemy and randomness to become a more predictable, deterministic and repeatable science, that will give rise to a plethora of exciting investment opportunities. She joined the Health Innovation team in September 2018 at the inception of the strategy. Rose graduated BA (Hons) in Economics and MPhil in Finance and Economics from the University of Cambridge in 2012 and 2013 respectively.

Words by Leo Kelion

Assistant editor, Intellectual Capital

You can read our other articles on disruptive innovation via the links below.

Important Information and Risk Factors

The views expressed in this article are those of the speaker(s) and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in October 2021 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Some Baillie Gifford portfolios have a significant exposure to private companies. These assets may be more difficult to buy or sell, so changes in their prices may be greater.

The allocations of investment securities set forth herein are hypothetical. There is no assurance that any specific security will be allocated to you. Allocations may ultimately change for various reasons, including among others the need to comply with applicable legal and regulatory requirements in certain jurisdictions, such as US Executive Order 13959 of November 12, 2020 (EO 13959), which prohibits US Persons from engaging in any 'transaction in publicly traded securities, or any securities that are derivative of, or are designed to provide investment exposure to such securities, of any Communist Chinese military company' as defined by EO 13959.

Any stock examples mentioned are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

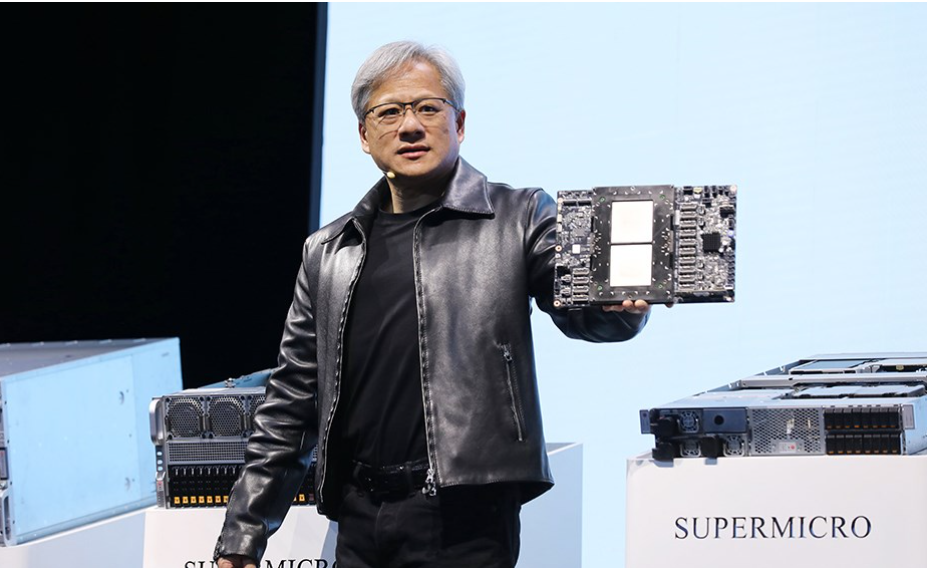

The images used in this article are for illustrative purposes only.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This article is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this article by any other person who did not receive this article directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions ("FinIA"). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (“BGO”) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.