Overview

Aims to be a core investment for private investors seeking income. Its objective is to grow the dividend at a faster rate than inflation by increasing capital and growing income. The focus of the portfolio is on global equities but investments are also made in bonds, property and other asset types.

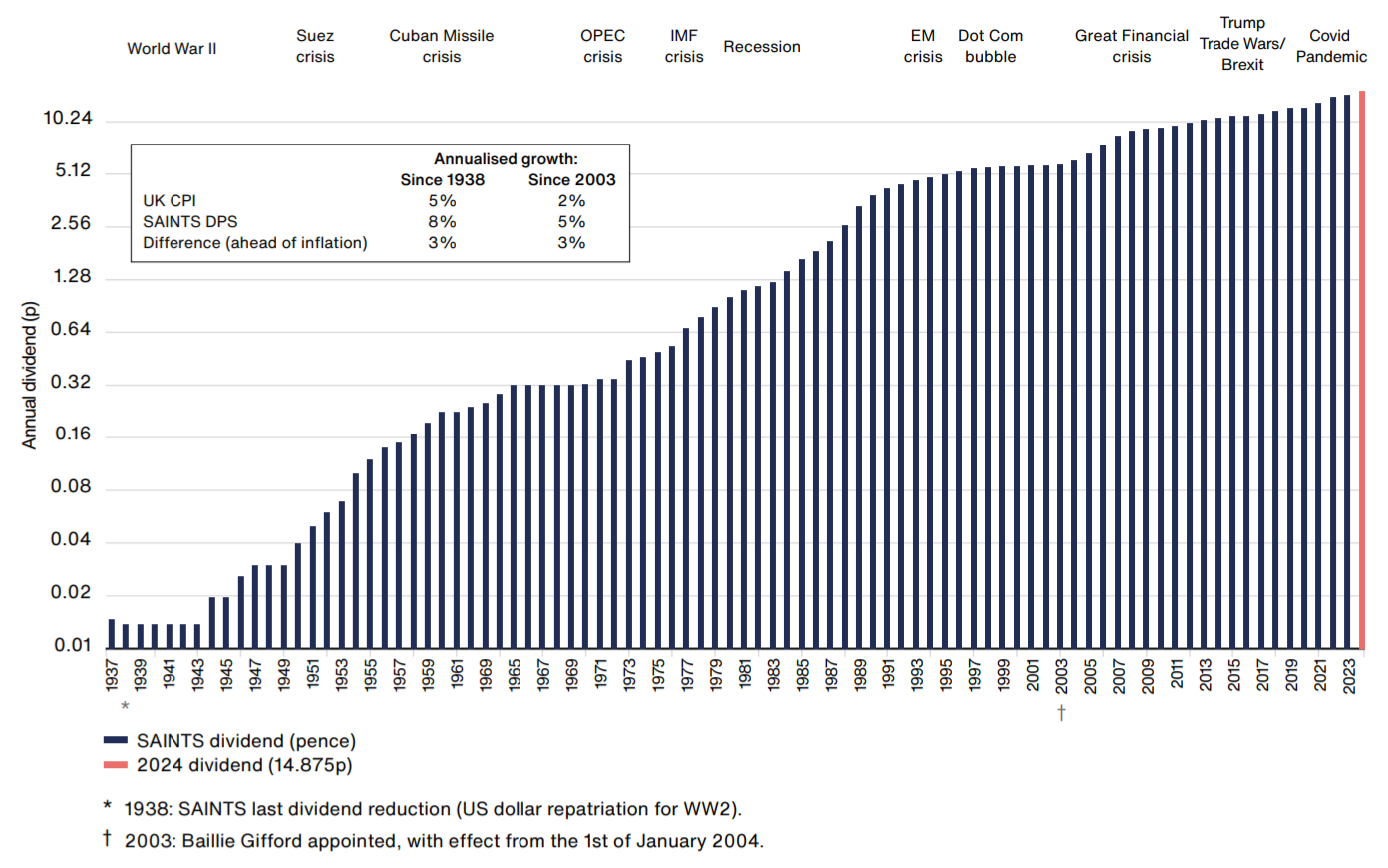

An income that grows ahead of inflation is valuable. Better still if that income is resilient through thick and thin. SAINTS has delivered annual dividend increases for over fifty years and we are wholly focussed on doing so in the future.

Performance & Portfolio

Periodic Performance

All figures to 30/04/2025 1 Year

3 Years

5 Years

10 Years

Share Price 1.9% 7.5% 47.7% 169.1% NAV 2.0% 19.1% 72.6% 183.5% Benchmark* 5.5% 27.8% 78.7% 176.5%

Discrete Performance

Annual Performance to 31 March each year 31/03/2020

31/03/202131/03/2021

31/03/202231/03/2022

31/03/202331/03/2023

31/03/202431/03/2024

31/03/2025Share Price 36.7% 11.9% 3.4% 1.8% 0.6% NAV 34.4% 14.8% 8.0% 9.4% 1.5% Benchmark* 39.6% 12.8% -0.9% 21.0% 5.5% Please bear in mind that past performance is not a guide to future returns. The value of your investment may go down as well as up, and you may not get back the amount you invested.

NAV is calculated with borrowings deducted at fair value for 1, 3 and 5 years and book value for 10 years.

*FTSE All World Index.

Performance source: Morningstar and relevant underlying index provider, total return in sterling.

Performance 30/04/2025Performance figures appear in GBP. Benchmark data is limited to a 5 year period from the current date.

The graph has been rebased to 100.

Long-term Dividend Record

No dividend reductions in the past eighty years.

Past performance is not a guide to future performance. We have chosen to use a logarithmic scale for the dividend price to more clearly display the consistent level of dividend increase over the years.

The investment trusts managed by Baillie Gifford & Co Limited are listed UK companies and are not authorised or regulated by the Financial Conduct Authority. The value of their shares, and any income from them, can fall as well as rise and investors may not get back the amount invested.

Source: Scottish American Investment Trust Annual Reports, Baillie Gifford. Dividends are shown net of withholding taxes since 1973, when Advanced Corporation Tax was first introduced in the UK. Dividends from 1965-1973 are shown net of the 45% Corporation Tax introduced in the Finance Act of 1965. Dividends prior to 1965 are shown as if the Corporation Tax had existed before 1965, on a comparable basis.

Holdings - 30/04/2025

Fund % 1 Deutsche Börse 3.8% 2 Fastenal 3.5% 3 Microsoft 3.2% 4 Procter & Gamble 3.0% 5 Apple 2.7% 6 Partners 2.7% 7 Coca-Cola 2.4% 8 CME Group 2.4% 9 Wolters Kluwer 2.4% 10 Admiral Group 2.3% Total 28.5% Property Portfolio

More detail on the property portfolio of the Scottish American Investment Company can be found within the annual report.

Active Share 30/04/2025Relative to FTSE All-World Index. Source: Baillie Gifford & Co, FTSE.

Asset allocation of total assets 30/04/2025Fund %

- 1 North American Equities 34.10

- 2 South American Equities 1.71

- 3 European Equities 36.43

- 4 African and Middle Eastern Equities 0.85

- 5 Europe 1.31

- 6 Asian Equities 12.45

- 7 Australasian Equities 2.04

- 8 Fixed Interest 1.19

- 9 Property 9.19

- 10 Net Liquid Assets 0.74

- Total 100.00

As the Fund invests in overseas securities, changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co.

Please note that totals may not sum due to rounding.

Insights

View all InsightsMeet the Managers

Baillie Gifford

James Dow

James is head of Global Income Growth and manager of the Scottish American Investment Company PLC (SAINTS). He joined Baillie Gifford in 2004 and became a partner in the firm in 2023. Prior to this he was an investment manager in our US Equities Team. Before joining the firm, he spent three years at the Scotsman, where he was economics editor. James is a CFA Charterholder. He graduated MA (Hons) in Economics and Philosophy from the University of St Andrews in 2000 and MSc in Development Studies from the London School of Economics in 2001.

Ross Mathison

Ross joined Baillie Gifford in 2019 as an investment manager in the Global Income Growth Team and became Deputy Manager of The Scottish American Investment Company PLC (SAINTS) in August 2023. Previously, he spent a year at Aviva Investors and prior to that nine years at Standard Life Investments as an investment manager, first in the European Equity Team and latterly in the Global Equity Team. Ross is a CFA Charterholder and graduated MA (Hons) in Business and Finance from Heriot-Watt University in 2008. He also sits on the board of directors at Aberlour, a Scottish children’s charity.

OLIM - Property managers

Matthew Oakeshott

Joint founder of OLIM where he managed UK commercial property and equity portfolios from 1986 to 2006 and purely commercial property since then. S.G. Warburg & Co 1976, Director of Warburg Investment Management 1978. Investment Manager of Courtaulds Pension Fund 1981 to 1985. He led a management buyout of OLIM Property in 2012.

Louise Cleary

Qualified as a Member of the Royal Institution of Chartered Surveyors in 1996. She has over 20 years' experience of commercial property investment at Hermes Real Estate Investment Management, Land Securities and Asda Property Holdings and joined OLIM in 2009 and OLIM Property in 2012.

Sarah Martin

Qualified as a Member of the Royal Institution of Chartered Surveyors in 2008. She has over 15 years’ experience at the Estates Gazette, JLL/King Sturge and joined OLIM Property in 2019.

Jo West

Qualified as a Member of the Royal Institution of Chartered Surveyors in 1992. She has 20 years of commercial property valuation and investment experience at Donaldsons, Gooch & Wagstaff, CBRE and British Land and joined OLIM Property in 2018.

Documents

You can access any literature about the Fund here, either by downloading or requesting a copy by post (where available).

To download any document you will need Adobe Reader. Please note that we can now provide you with Braille and audio transcriptions of our literature on request. It may take up to 10 days for the transcription to be completed dependent on the size of the document.

Annual reports

Corporate governance

Interim reports

Investor disclosure document

Philosophy and process documents

Portfolio valuation

Portfolio voting disclosure

RNS announcements

Sustainability-related disclosures and climate reports

PRIIPs key information document

Disclaimers

FTSE Disclaimer

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®" and “Russell®” are trade marks of the relevant LSE Group companies and are used by any other LSE Group company under license. “TMX®” is a trade mark of TSX, Inc. and used by the LSE Group under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.