Capital at risk

Responsible investment

We invest in long-term growth. And we think companies that act sustainably and treat society fairly have better growth prospects.

What is responsible investment?

We consider every investment we make on an individual basis. In assessing each company’s growth potential, we consider a range of factors, including how environmental, social and governance matters might affect long-term financial performance. Where a strategy has a specific sustainability focus, it may go even further by setting social and environmental goals for holdings to fulfil alongside financial returns.

Our approach rests on three pillars:

- Excellent research.

- Engaged ownership, building enduring relationships with companies to support their pursuit of long-term goals.

- A focus on material outcomes, meaning issues we think are critical to companies achieving their long-term growth potential and, when relevant, sustainability targets.

We have the patience and skill to analyse how our investments affect people and the planet, and vice versa. We believe this will strengthen our clients’ long-term returns.

Actual ESG

We believe that understanding the environmental, social and governance (ESG) credentials of our investments deepens our insight. It isn’t about us trying to impose a moral or ethical imperative on our clients, or ticking boxes. Rather, it’s about how we find great growth companies that will endure over five years and beyond.

We generally think businesses that consider their environmental impact, treat their staff well and responsibly manage supply chains will prosper. Moreover, those that earn the public’s trust and support can gain a competitive advantage.

Our ESG specialists help our investment teams to consider these issues. And we have the resources and patience to do this thoughtfully.

Responsible investment insights

Read articles, watch videos or listen to podcasts on our responsible investment beliefs.

ESG: beyond the growing pains

Stewardship and integration

We seek constructive relationships with each business we invest in. We do this company by company, taking into account their growth stage, scale and geographic reach. This helps us understand and support their leaders’ long-term goals, which is often critical to delivering strong returns.

Since we aim to only invest in well-run businesses, we trust the executives involved but seek accountability if that trust is broken.

Our approach

Too often in asset management, active ownership or stewardship and ESG matters are an afterthought. As a truly long-term investor, Baillie Gifford considers these issues as central to how our teams invest, how we manage our own affairs and how we interact with our clients.

Stewardship principles

We have framed our approach to stewardship of our clients’ assets around four principles:

- Long-term value creation

- Alignment in vision and practice

- Governance fit for purpose

- Sustainable business practice

ESG integration

We aim to identify and hold high-growth investments that enjoy sustainable competitive advantages.

To help find these opportunities we consider the environmental, social and governance elements that are most material to the investment case, giving us a more rounded understanding of our holdings.

Voting

In voting, we will always evaluate proposals on a case-by-case basis, based on what we believe to be in our clients’ best long-term interests. Voting analysis and execution is carried out in-house by our dedicated voting team in conjunction with investment teams.

Latest voting and engagement reports

Voting Disclosure Report

See the latest version of our global voting activity.

Company Engagement Report

Browse our recent record of engagement on environmental, social and governance topics.

Stewardship codes

We are signatories to five stewardship codes spanning the globe:

- UK Stewardship Code

- Japan’s Stewardship Code

- Investor Stewardship Group (ISG) Principles

- European Fund and Asset Management Association (EFAMA) Stewardship Code

- International Corporate Governance Network (ICGN) Principles

These let us evidence our commitment to active ownership in a manner appropriate to the markets we invest in.

As part of our commitment to these codes, we produce an annual report that demonstrates our adherence to their principles. This report is provided to our regulated entities boards.

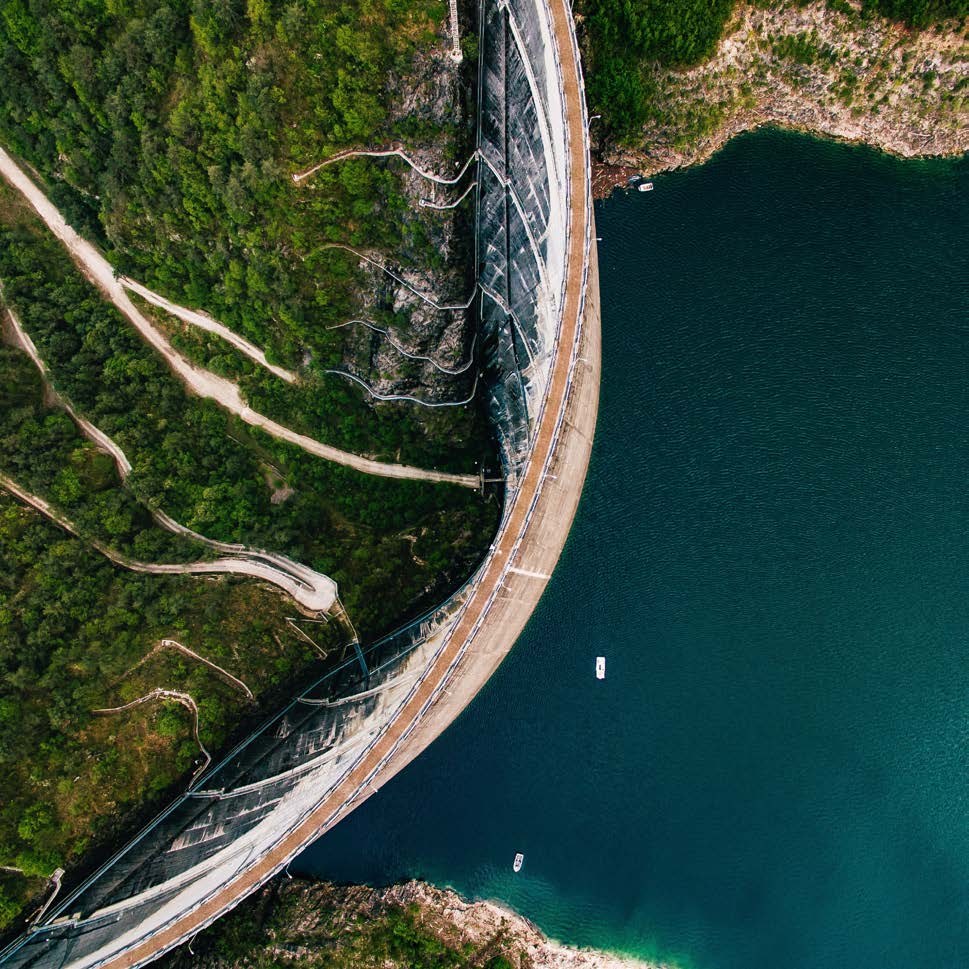

Climate and environment

We are living through twin disruptions, linked but also quite separate. Climate change is affecting our physical environment. Innovation is delivering new ways to source and use energy. Both will likely impact the way we live and behave.

We expect this deep transformation to drive further innovation and create new long-term investment opportunities.

Investing with purpose

We act in clients’ best interests: delivering long-term returns, using research and engagement to deepen understanding of climate opportunities and risks.

We believe a successful transition that keeps increases in global temperatures to well below 2C, and ideally to 1.5C, this century offers our clients a better opportunity for strong long-term investment returns than a failed transition.

Climate report

Climate change and the global response are set to have a huge influence on companies, including their ability to deliver long-term investment returns. Learn how we manage climate-related risks and opportunities.

Climate insights

Explore how the climate and energy transitions inform our pursuit of long-term growth.

Climate scenarios

Discover how we navigate uncertainty, using plausible stories about the future.

Documents

Browse our library of responsible investment policies and reports.

Our Stewardship Approach

Discover how our teams integrate ESG matters into our investment processes and act as stewards of our clients’ assets.

Stewardship Activities Report

We aim to be thoughtful, active and responsible investors on your behalf. Explore case studies describing some of our recent conversations with portfolio companies.

Climate Report

Climate change and the global response are set to have a huge influence on companies, including their ability to deliver long-term investment returns. Learn how we manage climate-related risks and opportunities.

Product-level sustainability-related disclosures

Find sustainability-related disclosures for individual funds (eg product-level TCFD reports, SFDR website disclosures).

How to invest

To help you explore our products, we have grouped them into three high-level capabilities defined by their responsible investment styles.

This gives you the choice to invest in a way that suits you.

Integrated

Contains strategies that consider ESG matters among other factors that may affect returns.

ESG focus

Features strategies that invest in assets with sustainability characteristics.

Impact

Backs companies with the potential to make a positive, measurable change and create long-term growth.

Important information

Qualified Investors include those that the Financial Services Act (FinSA) defines as Professional or Institutional Clients, which range from central banks to private investment structures with professional treasury operations created for a high-net-worth retail client. If you are not a qualified investor please select “Change” at the top of this page.

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (Reference number C182354) as an Alternative Investment Fund Manager and UCITS Manager to Baillie Gifford Worldwide Funds plc. Its registered office is 4/5 School House Lane East, Dublin 2, D02 N279, Ireland.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation to buy, sell or hold a particular investment. You can read details of our Legal and Important Information here.