Illustration by Mark Smith

Please remember that the value of an investment can fall and you may not get back the amount invested.

You’re surrounded. From your washing machine and smartphone to your car and microwave oven, semiconductors are everywhere. About 1.1tn chips are sold to product makers a year – roughly 140 for every person on the planet.

Moreover, semiconductor use is set to keep rising over the very long term. Sectors such as healthcare and education are only just starting to use digital tools in earnest. The internet and smartphones helped drive this, and over the coming years we expect artificial intelligence will accelerate the trend.

Historically, Moore’s Law was the key to unlocking new capabilities, as smaller transistors – tiny switches that turn on and off billions of times a second – made it possible to pack more on a chip. At the peak of the PC revolution, the performance of CPUs (central processing units) – computers’ ‘brains’ – improved 100-fold over 10 years.

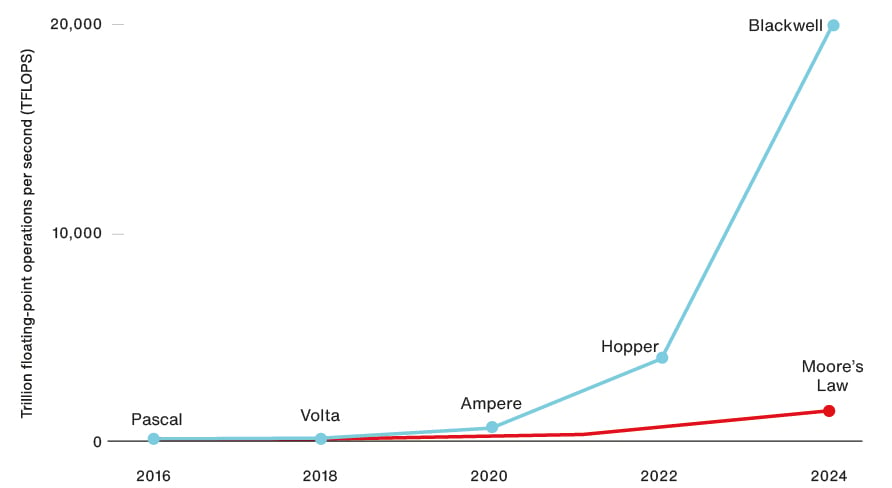

More recently, however, Global Alpha holding NVIDIA has made even faster gains with its GPUs (graphics processing units), which are particularly adept at AI tasks.

In March, chief executive Jensen Huang said that the performance of its top-of-the-range chips had increased 1,000-fold in eight years. This lets its customers develop larger, more complex AI models, fuelling breakthroughs in chatbots, image recognition and autonomous driving.

Accelerating performance

NVIDIA’s top AI chip, Blackwell, is 1,000 times more powerful than its equivalent eight years ago

Source: NVIDIA

NVIDIA became one of the few companies to achieve a $3tn valuation earlier this year, thanks to surging demand for its products. But other companies further ‘upstream’ that enable its success have also benefited, as has Global Alpha. We took advantage of a post-Covid slump in semiconductor-related stocks to increase our clients' exposure to the sector in 2022 and 2023.

Shrinking transistors

Chief among these is Taiwan Semiconductor Manufacturing Company (TSMC), the world’s leading producer of advanced chips. Two trends are driving its growth: the complexity and size of the semiconductors it manufactures are both increasing.

One reason chips have become faster and more capable over time is that they contain ever-increasing numbers of transistors. NVIDIA’s new Blackwell GPU features a record-setting 208bn. If you laid the same number of £1 coins side-by-side, they could stretch to the moon more than 12 times over.

To achieve this density and limit energy use, TSMC makes each generation of transistors smaller than the last and layers more of them vertically above each other in a process called 3D stacking. It also charges more for the privilege. In 2014, the firm reportedly sold its densest wafer for $3,000. By 2020, the price was $16,000. Today, the sum is over $20,000.

Simultaneously, high-end chips are getting physically larger, meaning fewer can be fitted on and carved out of each wafer. Blackwell, for example, is twice the size of its predecessor, Hopper. This, again, is driving TSMC’s sales upwards.

Making memory

AI is also fuelling demand for high-performance memory, favouring another of Global Alpha's holdings, Samsung Electronics.

Building the models that power modern chatbots involves optimising billions of variables. The quicker those parameters and associated training data can be accessed, the faster the process.

This concept, known as memory bandwidth, is often the biggest bottleneck. Samsung is the largest supplier of memory and one of only three companies capable of supplying ‘high-bandwidth memory’ needed for AI training.

Putting those models to practical use, what’s known as ‘inference’, is also memory intensive. Datacentres use Samsung’s memory to run smart assistants and support the increasing number of AI features offered by Microsoft, Alphabet and Meta, among our other holdings. In addition, as we deploy AI into the real world, so-called ‘end devices’, such as smartphones, PCs and cars, also need more memory to run AI services locally.

Global Alpha also invests in ‘enablers’ whose products make manufacturing the chips described above possible. One of these is the Dutch firm ASM International.

In particular, the firm accounts for over 50 per cent of the market in atomic layer deposition (ALD). This involves placing ultra-thin, highly uniform layers of material on silicon wafers, which makes the 3D stacking of transistors possible and minimises electrical current leakage.

One analogy is building a sandwich. Imagine you have a very thin slice of bread and repeatedly add single layers of cheese and ham. ALD uses special gases to add one ‘ingredient’ layer at a time to a surface, which helps make very thin and precise coatings for semiconductors. Some layers conduct electricity, while other layers insulate, giving the silicon wafer its ‘semiconductor’ properties.

Clean rooms and contaminants

Entegris is another firm with a market-leading position in its semiconductor market segment. The US-based company makes the gases and liquids used to purify the clean rooms where chips are made and high-purity chemicals to make the final products erosion-resistant.

Airborne particles invisible to the naked eye can cause chips to malfunction or completely fail, and as transistors continue to shrink, they become susceptible to even smaller contaminants. This increases demand for Entegris’s specialised substances and filters.

Global Alpha also invests in several datacentre ‘enablers’. These include Eaton, the Dublin-headquartered power management specialist. It provides clients with ways to efficiently power racks of computer servers, monitor each rack’s usage and provide backup protection in case of outages.

We also hold Comfort Systems, a specialist in installing and servicing air conditioning and other cooling systems that prevent the servers from overheating. And we own a stake in Stella-Jones, a major supplier of the wooden poles that hold electrical cables overhead across the US and Canada.

These utilitarian examples might seem surprising until you realise that for every £1 spent on datacentre equipment, another 65 pence is spent on the building – things like power management and cooling. Moreover, AI datacentres consume four to five times as much power as traditional equivalents, meaning there needs to be a lot more investment in energy generation and distribution.

Other factors also feed into these three companies’ growth prospects, including the green energy transition, the electrification of transport and the US’s renewed investment in infrastructure.

Cyclical sales

More broadly, we’re mindful of risks. One example is trade tensions between Washington and Beijing. China buys more than 50 per cent of the world’s chips and has a long-term incentive to become less reliant on external suppliers – although some are easier to replace than others.

Another is that, despite AI’s impact, semiconductors are likely to remain cyclical, with periods of oversupply. So if and when valuations become too high, we will adjust our position, just as we did when stocks became undervalued.

That said, part of Global Alpha's strength lies in the breadth of companies we have invested in, and I’ve only touched on some of the related stocks we hold. The big picture is that the world’s use of semiconductors continues to grow, and there will consequently be multiple winners.

We can’t know for certain where the next waves of disruption will strike or what business models will emerge. However, Global Alpha can pursue long-term growth by investing in a select group of companies that supply the products and tools that underpin the 21st-century economy.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in September 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

116528 10049578