Capital at risk

Global Alpha

Our core task is the identification and patient, engaged ownership of companies with the potential to deliver superior but underappreciated earnings growth. We are flexible and open-minded in seeking these opportunities, aware of the ways growth can be achieved. Our research draws on the work and insights of the entire Baillie Gifford investment floor.

Enduring growth

An ambitious approach to investing in growth companies with exceptional potential from right across the spectrum of opportunity. Our philosophy is to make long-term investments in well-managed businesses with sustainable competitive advantages.

Global Alpha: our philosophy

Investment manager Helen Xiong introduces Global Alpha, reflecting on the exciting opportunities ahead.

High-quality companies with exceptional potential

We aim to identify companies that can grow their earnings at a superior rate to the market over sustained periods, with great potential that is not reflected in their price. As share prices are ultimately driven by earnings growth, this approach underpins our objective to deliver returns 2 per cent to 3 per cent per annum ahead of the benchmark over rolling five-year periods before the deduction of fees. The resulting portfolio of around 90 holdings represents the most attractive opportunities from across the growth spectrum at any point in time.

Diversified and differentiated

We embrace the diversity of growth available to us, splitting the portfolio across our three growth profiles – compounders, disruptors and capital allocators. The compounders profile looks to benefit from the underappreciated power of the long-term compounding of earnings. In disruptors, we seek to identify earlier-stage companies with the potential for major success. Capital allocators back skilled management teams, often in cyclical industries.

At the heart of Global Alpha’s patient approach to long-term capital growth lies our belief in diversity. We don’t rely on a single definition of what ‘growth’ means.

Meet the managers

Documents

Philosophy and process

Explore our investment philosophy and the processes around how the Global Alpha team construct the portfolio through its three key growth profiles (compounders, disruptors and capital allocators).

Quarterly update

Get the latest investment commentary, portfolio overview, transactions and performance information alongside governance engagement and voting.

Stewardship report

Find out about our conversations with portfolio companies, shareholder vote activity and consideration of environmental, social and governance matters.

Global Alpha Research Agenda 2024

How can we invest in quality companies with the potential to generate sustainable returns in a changing market?

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 July 2025

| # | Holding | % of portfolio |

|---|---|---|

| 1 | NVIDIA | 6.31 |

| 2 | Meta Platforms | 4.94 |

| 3 | Microsoft | 4.79 |

| 4 | Amazon.com | 4.27 |

| 5 | TSMC | 3.64 |

| 6 | Prosus | 3.42 |

| 7 | DoorDash | 2.23 |

| 8 | Mastercard | 2.17 |

| 9 | Martin Marietta Materials | 2.08 |

| 10 | Service Corporation International | 1.93 |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

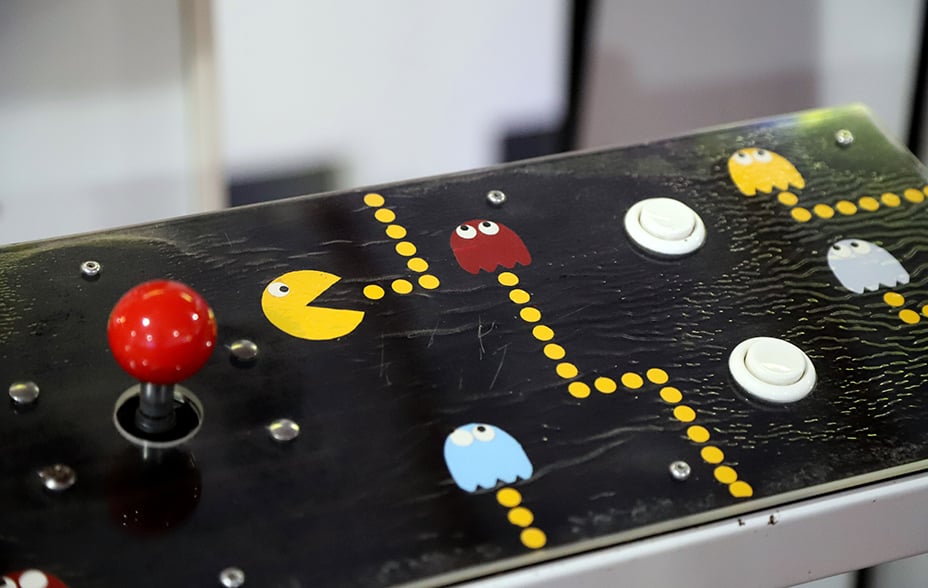

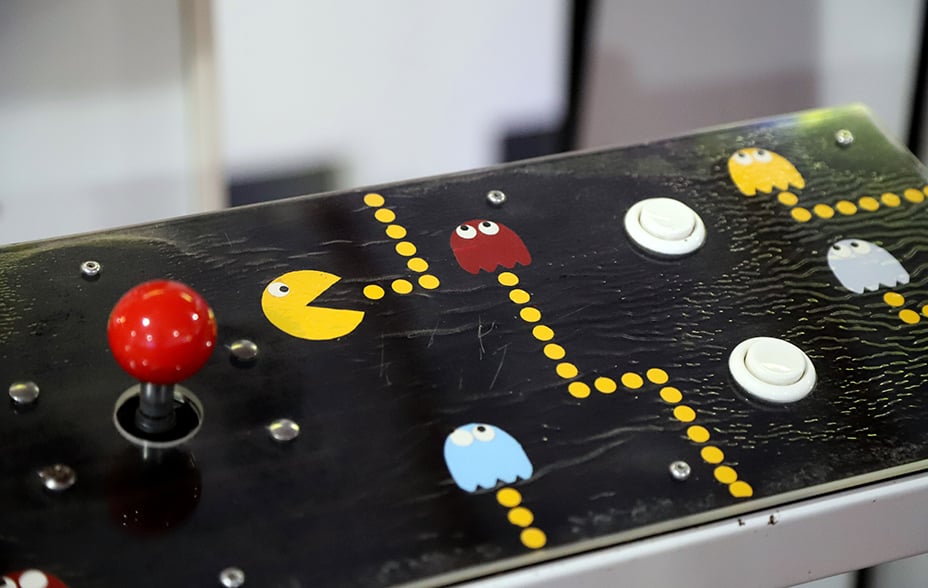

Global Alpha insights: power-up mode

Turning a potential AI threat into a strategic advantage, what is software company EPAM Systems' game plan?

Cloudflare: Stock Story

Ben James highlights how one cybersecurity approach is redefining digital infrastructure.

Global Alpha Q2 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q2 update

Investment manager Helen Xiong reflects on recent performance, portfolio changes and market developments.

Uncommon understanding

Global Alpha’s investment managers reveal how they spot what others don’t see.

Global Alpha: an enduring focus in a changing world

Explore 20 years of Global Alpha in our anthology of articles covering the past, present and future.

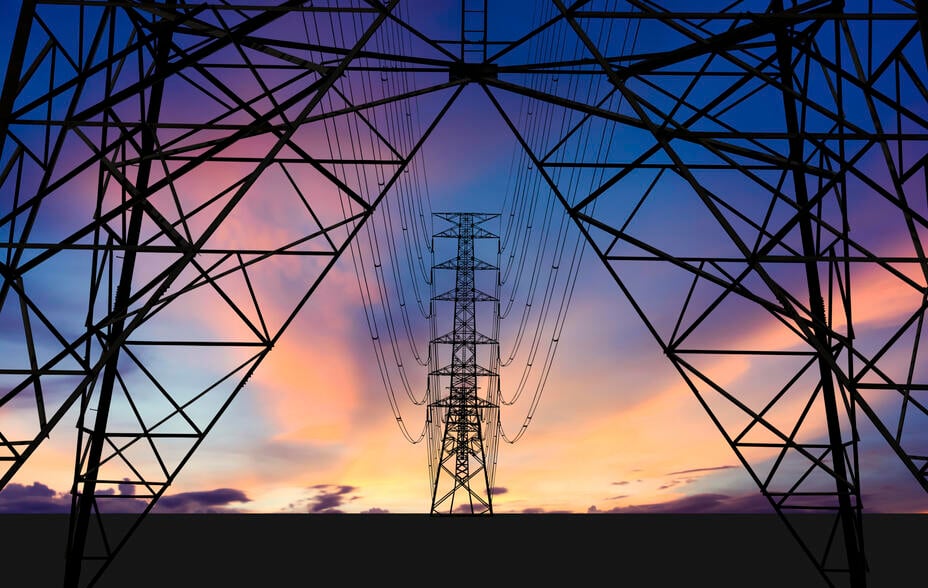

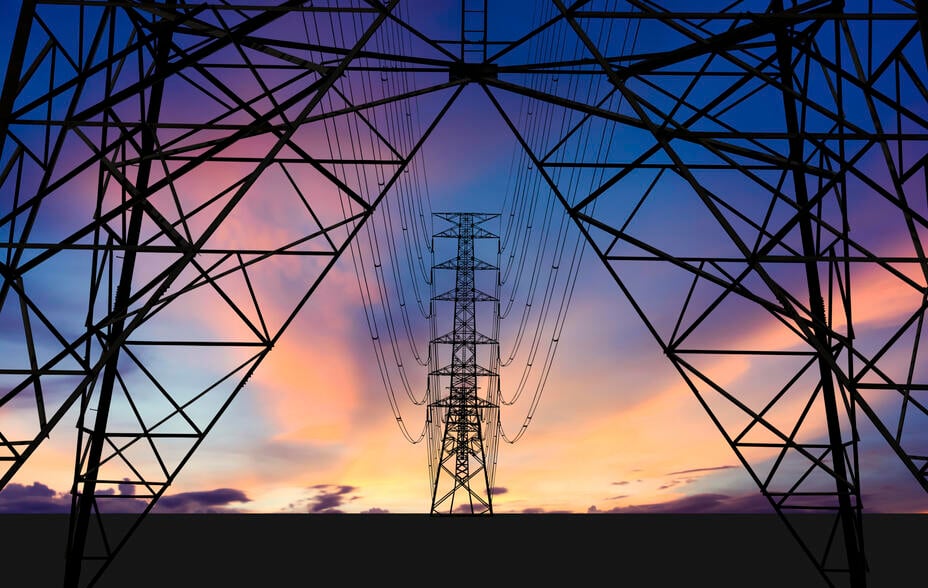

Global Alpha insights: infrastructure

Why companies like Martin Marietta are set to benefit from increased spending on infrastructure.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Global Alpha: introducing Michael Taylor

Investment manager Michael Taylor joins Global Alpha as a decision-maker. We explore his background, strengths, and vision for the portfolio’s future opportunities.

Global Alpha insights: turbulent times

How can we participate in long-term progress without it being undone by every policy turn?

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: a time to trade?

Explore how we're evolving the portfolio as the investment environment enters a period of rapid change.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

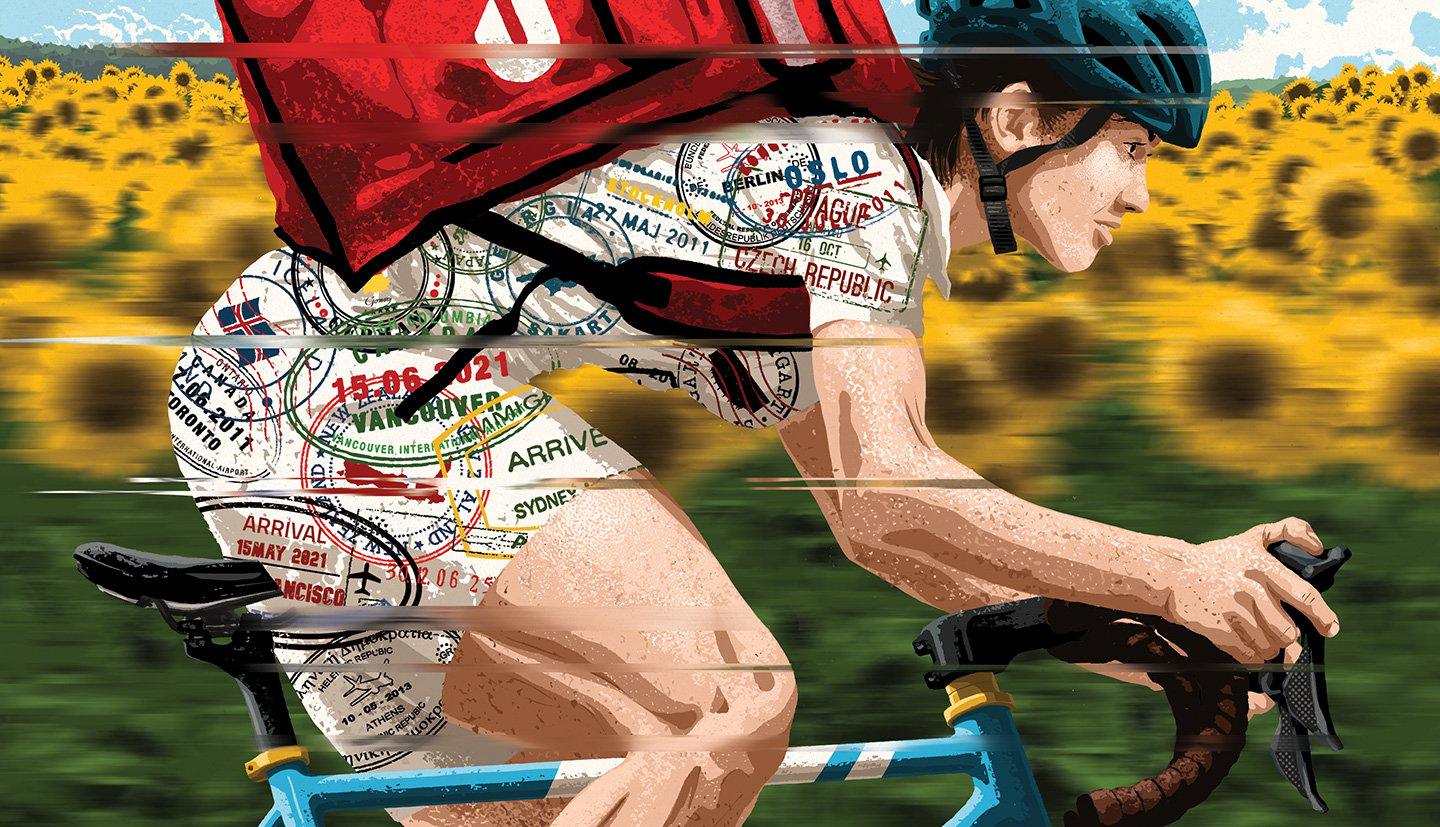

DoorDash: delivering the goods

How DoorDash’s ambitions extend far beyond restaurant deliveries.

Global Alpha Insights: investing in resilience beyond political cycles

Why the Global Alpha Team believes elections don't impact stock market returns.

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: Rakuten and the 'Dog Shogun'

Richie Vernon, investment specialist, explains why the Global Alpha Team has a different perspective on Rakuten's future market growth.

Global Alpha Q3 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments

Why growth investors can’t ignore China

China’s electric car, battery and other advanced manufacturers are on the rise.

Global Alpha Q3 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: unlocking the magic of Disney

Why the Global Alpha Team believes there is a magical journey ahead for Disney.

Future Stocks: Our best ideas in the US

Ben James explains why DoorDash, The Trade Desk and CoStar stand out as growth stocks.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Kweichow Moutai: spirit of China

The fiery spirit that’s a profitable symbol of Chinese culture and luxury.

Beyond NVIDIA: investing in semiconductors

Why some of the leading computer chip makers and companies enabling them have room to grow.

China: the new shoots of growth

Why advanced manufacturing and social context are key to investing in tomorrow’s Chinese giants.

Global Alpha Q2 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

왜 지금 성장인가?

어려운 시기에 발휘되는 파트너십 지배구조의 강점: 급격한 변화 속에서 적응하고 성장할 수 있는 이유에 대해 분석합니다.

Global Alpha Research Agenda

From AI to infrastructure – Global Alpha homes in on the growth areas and companies best placed to exploit opportunities.

Global Alpha: back to growth

The managers tell a London Investment Forum about new sources of opportunity and optimism.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

How Microsoft got its mojo back

By shifting the focus from Windows and embracing AI, the firm has revitalised its fortunes.

Global Alpha: manager update

The managers discuss the market environment, portfolio positioning and current opportunities.

Global Alpha Q3 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q2 update

The Global Alpha team reflects on recent performance, portfolio changes, and market developments.

Making health insurance manageable

How Elevance Health uses its scale to smooth a path through the US health system’s maze.

Global Alpha Q1 update

Global Alpha Team reflects on recent performance, portfolio changes, and market developments.

Global Alpha Research Agenda 2023

How can we invest in quality companies with the potential to generate sustainable returns in a changing market?

Digital Disruption and the future

Online infrastructures and digital developments in the education, energy, and transport sectors make for an exciting future.

Global Alpha 2022 Research Agenda

In their Research Agenda for 2022, the investment managers consider the benefits of deep work in helping them find growth opportunities.

Growth or value: it’s not a black or white choice

Operational performance is a better indicator of growth than inflation. Malcolm MacColl shares why.

Harnessing growth for the next decade

Investment manager Malcolm MacColl and Senior Governance and Sustainability Analyst Kieran Murray outline believed growth drivers and the development of Global Alpha’s ESG process.

Highlights Video: Harnessing growth for the next decade

Watch the highlights from the recent Global Alpha webinar: Harnessing growth for the next decade.

글로벌 알파 리서치 어젠다.

모든 투자전략에는 이익과 손실의 가능성이 있고, 이는 귀사 또는 귀사 고객의 자산 손실로 이어질 수 있습니다.

The importance of looking forward

This recording has been prepared for professional investors and is not for further distribution. Baillie Gifford takes no responsibility for the reliance on this recording by any other person who did not receive this recording from Baillie Gifford.

Global Alpha research agenda

In this year’s Research Agenda, Global Alpha’s investment managers share their thoughts on how change can help shape the portfolio.

Global Alpha – mental models highlights

Client director Jon Henry talks through the highlights of the recent Global Alpha webinar on ‘Mental Models’, a concept introduced earlier this year in the Global Alpha Research Agenda.

Global Alpha - 10 minutes with Helen Xiong

Ben Drury, client director, talks to Helen Xiong, an investor and soon-to-be key decision-maker for the Global Alpha strategy.

Back to the future

This webinar has been prepared solely for the use of professional investors outside of the Unites States and is not for further distribution. Baillie Gifford takes no responsibility for the reliance on this webinar by any other person who did not receive this webinar from Baillie Gifford.

An enduring focus in a changing world

Marking 20 years of Global Alpha, we share an anthology of three articles reflecting on the past, examining the present and looking ahead to the future. We highlight the enduring principles that shape our investment approach in a changing world and guide us towards tomorrow's opportunities.

Global Alpha insights: power-up mode

Turning a potential AI threat into a strategic advantage, what is software company EPAM Systems' game plan?

Cloudflare: Stock Story

Ben James highlights how one cybersecurity approach is redefining digital infrastructure.

Global Alpha Q2 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q2 update

Investment manager Helen Xiong reflects on recent performance, portfolio changes and market developments.

Uncommon understanding

Global Alpha’s investment managers reveal how they spot what others don’t see.

Global Alpha: an enduring focus in a changing world

Explore 20 years of Global Alpha in our anthology of articles covering the past, present and future.

Global Alpha insights: infrastructure

Why companies like Martin Marietta are set to benefit from increased spending on infrastructure.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Global Alpha: introducing Michael Taylor

Investment manager Michael Taylor joins Global Alpha as a decision-maker. We explore his background, strengths, and vision for the portfolio’s future opportunities.

Global Alpha insights: turbulent times

How can we participate in long-term progress without it being undone by every policy turn?

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: a time to trade?

Explore how we're evolving the portfolio as the investment environment enters a period of rapid change.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

DoorDash: delivering the goods

How DoorDash’s ambitions extend far beyond restaurant deliveries.

Global Alpha Insights: investing in resilience beyond political cycles

Why the Global Alpha Team believes elections don't impact stock market returns.

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: Rakuten and the 'Dog Shogun'

Richie Vernon, investment specialist, explains why the Global Alpha Team has a different perspective on Rakuten's future market growth.

Global Alpha Q3 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments

Why growth investors can’t ignore China

China’s electric car, battery and other advanced manufacturers are on the rise.

Global Alpha Q3 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: unlocking the magic of Disney

Why the Global Alpha Team believes there is a magical journey ahead for Disney.

Future Stocks: Our best ideas in the US

Ben James explains why DoorDash, The Trade Desk and CoStar stand out as growth stocks.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Kweichow Moutai: spirit of China

The fiery spirit that’s a profitable symbol of Chinese culture and luxury.

Beyond NVIDIA: investing in semiconductors

Why some of the leading computer chip makers and companies enabling them have room to grow.

China: the new shoots of growth

Why advanced manufacturing and social context are key to investing in tomorrow’s Chinese giants.

Global Alpha Q2 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

왜 지금 성장인가?

어려운 시기에 발휘되는 파트너십 지배구조의 강점: 급격한 변화 속에서 적응하고 성장할 수 있는 이유에 대해 분석합니다.

Global Alpha Research Agenda

From AI to infrastructure – Global Alpha homes in on the growth areas and companies best placed to exploit opportunities.

Global Alpha: back to growth

The managers tell a London Investment Forum about new sources of opportunity and optimism.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

How Microsoft got its mojo back

By shifting the focus from Windows and embracing AI, the firm has revitalised its fortunes.

Global Alpha: manager update

The managers discuss the market environment, portfolio positioning and current opportunities.

Global Alpha Q3 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q2 update

The Global Alpha team reflects on recent performance, portfolio changes, and market developments.

Making health insurance manageable

How Elevance Health uses its scale to smooth a path through the US health system’s maze.

Global Alpha Q1 update

Global Alpha Team reflects on recent performance, portfolio changes, and market developments.

Global Alpha Research Agenda 2023

How can we invest in quality companies with the potential to generate sustainable returns in a changing market?

Digital Disruption and the future

Online infrastructures and digital developments in the education, energy, and transport sectors make for an exciting future.

Global Alpha 2022 Research Agenda

In their Research Agenda for 2022, the investment managers consider the benefits of deep work in helping them find growth opportunities.

Growth or value: it’s not a black or white choice

Operational performance is a better indicator of growth than inflation. Malcolm MacColl shares why.

Harnessing growth for the next decade

Investment manager Malcolm MacColl and Senior Governance and Sustainability Analyst Kieran Murray outline believed growth drivers and the development of Global Alpha’s ESG process.

Highlights Video: Harnessing growth for the next decade

Watch the highlights from the recent Global Alpha webinar: Harnessing growth for the next decade.

글로벌 알파 리서치 어젠다.

모든 투자전략에는 이익과 손실의 가능성이 있고, 이는 귀사 또는 귀사 고객의 자산 손실로 이어질 수 있습니다.

The importance of looking forward

This recording has been prepared for professional investors and is not for further distribution. Baillie Gifford takes no responsibility for the reliance on this recording by any other person who did not receive this recording from Baillie Gifford.

Global Alpha research agenda

In this year’s Research Agenda, Global Alpha’s investment managers share their thoughts on how change can help shape the portfolio.

Global Alpha – mental models highlights

Client director Jon Henry talks through the highlights of the recent Global Alpha webinar on ‘Mental Models’, a concept introduced earlier this year in the Global Alpha Research Agenda.

Global Alpha - 10 minutes with Helen Xiong

Ben Drury, client director, talks to Helen Xiong, an investor and soon-to-be key decision-maker for the Global Alpha strategy.

Back to the future

This webinar has been prepared solely for the use of professional investors outside of the Unites States and is not for further distribution. Baillie Gifford takes no responsibility for the reliance on this webinar by any other person who did not receive this webinar from Baillie Gifford.

Invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

How to invest in this strategy

You can invest in this strategy through the following fund(s).

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

By clicking on South Korea, you have confirmed that you are based in South Korea and that you meet the following requirements.

The information in this area of the website is intended for qualified professional investors and consultants based in South Korea. It is not intended for use by any other persons including members of the general public or investors from other jurisdictions.

Please remember that all investment strategies have the potential for profit and loss and your or your clients’ capital may be at risk.

Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients. Both are authorised and regulated by the Financial Conduct Authority. Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-Discretionary Investment Adviser.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong, Telephone +852 3756 5700.

The information provided does not constitute an offer of or solicitation for purchase or sale of securities or provision of any investment services. Any general enquiries regarding Baillie Gifford should be directed to the relevant individual as noted in the Contact Us section.

The information contained in this website has been compiled with considerable care to ensure its accuracy at the date of publication. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Nothing in this information or elsewhere in this website shall exclude, limit or restrict our duties and liabilities to you under the United Kingdom's Financial Services and Markets Act 2000 or any conduct of business rules which we are bound to comply with.

This website is informative only and the information provided should not be considered as investment advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.