As with any investment, your capital is at risk.

It's hard to beat the formidable US stock market. Over the past decade, after delivering a remarkable 13.1 percent annualised return, around 90 per cent of active managers have underperformed. Against this backdrop and following a particularly challenging period in 2021-22, it is pleasing to have delivered US Growth clients with outperformance over 10-years.

In the past couple of years, part of the challenge has been a rise in market concentration to a level we haven’t seen in over half a century. The top 10 names command over a third of the S&P 500 index and over half of the Russell 1000 Growth index, both of which are commonly used benchmarks for US equities1.

Driving the phenomenon, investors have crowded into the world’s largest companies, the so-called Magnificent Seven (or Mag 7 for short) – Alphabet (Google’s parent company), Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla.

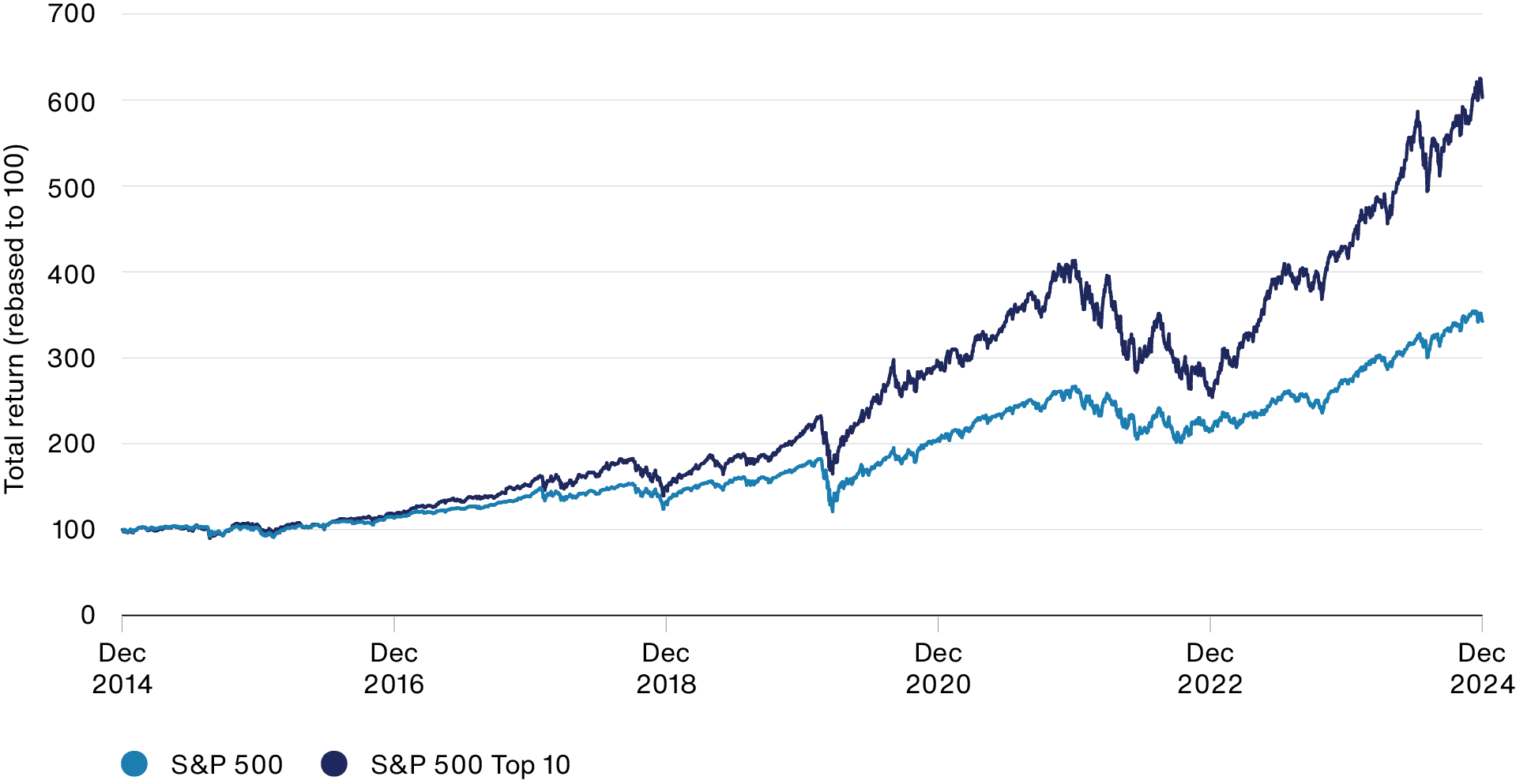

Why does this matter for active managers? Historically, since 1957, the 10 largest stocks in the S&P 500 underperformed an equal-weighted index of the remaining 490 stocks. Yet, the last decade marks a notable departure from this trend, with the top 10 stocks outperforming by an astonishing 5.8 per cent annually2. Their influence prompted S&P to launch a 'Top 10' index in 2023, shown below.

The US stock market has been led by the largest companies

Source: Factset, S&P. US dollar. Top 10 companies by market capitalisation. Data 31 December 2014 to 31 December 2024.

These concentration levels mean the largest companies in the index have dominated returns; over the past two years, more than half of the S&P 500’s total return was generated by the Mag 7, and NVIDIA alone accounted for almost a third of that.

The temptation for investors might be to seek safety in the index. It was once said, “No one ever got fired for buying IBM”. That is probably today’s conventional wisdom for passive investing. The S&P 500 index is widely considered a safe bet. It consistently delivers the average result (the US market return minus a little in fees), but we believe that perceived safety comes at a high price – opportunity cost.

Every investment decision has an implicit opportunity cost. With the Mag 7 now commanding a collective market cap of around $18tn, even the most bullish investors face a challenge in expressing a positive view on these mega-caps on a relative basis. It requires allocating a disproportionate amount of capital in a portfolio.

Take Apple, for example, at more than 7 per cent in the S&P 500 and 12 per cent in the Russell 1000 Growth. To express a modest active weight (say, 2 or 3 per cent) means eating up 10-15 per cent of the portfolio3. Most of that capital will not affect relative returns, meaning, it is effectively dead wood.

Investing large amounts in such companies may come at the expense of other, potentially more promising opportunities elsewhere. Strikingly, when looking at the broader Russell 3000 Growth index over the past year, 457 stocks have outperformed the median return of the Mag 7, and 48 stocks surpassed NVIDIA’s remarkable return4. For those looking for upside, there are ample opportunities to outperform the index and exceed the returns of the Mag 7 and even NVIDIA.

Expectations and upside

Research shows that over the long term, returns follow fundamentals. The stock market rewards companies that deliver the greatest earnings growth. It also shows that the greatest relative returns can be found in companies where the market does not anticipate or appreciate that growth – it pays to think differently.

Based on S&P 500 Index. Rolling quarterly three year attributions from December 2000 to September 2024.

Five years ago, NVIDIA and Tesla were very different-looking investment propositions - substantially smaller, with evolving addressable markets and uncertain growth and profitability. However, exceptional operational progress has generated returns for NVIDIA (+2,600 per cent) and Tesla (+1,500 per cent), which now include them among the Mag 7 roster. That starkly contrasts with the much larger and more mature names Apple and Microsoft, where multiple expansion has made a significant contribution.

Our outlier philosophy focuses on identifying individually unlikely but rewarding opportunities we think are materially undervalued – exceptional growth companies. Part of our analytical framework is building conviction in a company’s addressable opportunity relative to its current size. Through the lens of asymmetry, we are positively disposed to companies earlier in their growth journey, companies with the potential for greater upside. Where we have sufficiently differentiated insights, the opportunity for the greatest relative returns lies. That is reflected in our investment decisions and portfolio construction5.

It was true of NVIDIA in 2016 when we first invested, but it is less accurate today. The fear of missing out on the graphic processor unit (GPU) specialist’s AI-fuelled growth and earnings has propelled the company to over $3tn in market cap. It was backed up by a pattern of beating estimates and raising guidance, which shares responded to accordingly. For the company’s most recent results, sales and earnings doubled year-over-year, yet shares declined, suggesting expectations may have caught up with the company’s extraordinary growth.

Worth considering is the fact that the Mag 7 are the most researched companies in the world today. The number of analysts covering them ranges from 45 to 68, the highest in the S&P 500. In our view, the best opportunities will likely lie away from the most analysed stocks.

Consequently, we’ve harvested gains from NVIDIA to fund other investments where the growth opportunity is at an earlier stage, asymmetry is more pronounced, or we have growing conviction in the upside prospects.

Abundant opportunity

Our job is to identify what will drive future returns. Through the lens of prospective upside, we think stock market concentration is a distraction and an opportunity cost from the abundance of other companies with the potential for far greater upside - those that could be the outliers of the next decade.

To that point, the portfolio’s top-returning stock over the past year was not NVIDIA but a salad restaurant business named Sweetgreen. Sweetgreen is harnessing automation with its Infinite Kitchen technology to produce salads 50 per cent faster than a human can. It’s not only terrific for speed, quality and portion control, but it improves restaurant profitability, too. We’ve been impressed by a management team with bold ambitions and a willingness to embrace technology, and we see successful store rollout fuelling growth in the years ahead.

The rise of generative AI has added fuel to the dominance of the "Mag 7" tech giants. However, companies such as Cloudflare are uniquely positioned to thrive in this new era. Cloudflare's global edge computing network, with data centres spanning 330 cities, provides unparalleled speed and efficiency for AI applications. Its Cloudflare Workers platform is already winning customers, demonstrating its critical role in AI inference. This unrivalled network infrastructure gives Cloudflare a significant competitive edge in the burgeoning AI landscape. Could Cloudflare become the next major cloud platform outside the tech giants?

We think the portfolio contains many other companies with the potential for substantial upside, from DoorDash excelling in last-mile logistics to Block disrupting financial services. What excites us about the US is that the investment opportunities are diverse, and the market often underestimates the effect of sustained growth. We are focused on our mission of finding and nurturing the next generation of exceptional growth companies.

Final thoughts

Today's Mag 7 casts long shadows across the investment landscape, dominating the indices. Yet the greatest opportunities for outsized returns likely lie away from the largest and most researched companies. We see extraordinary potential in companies such as Sweetgreen, Cloudflare, and many others across the portfolio - businesses reimagining their industries with technological innovation and ambitious visions for growth.

While market concentration dominates headlines and column inches, we remain committed to the pursuit of investing in exceptional businesses with outlier potential. These companies may appear modest against today's mega-caps, but they possess the fundamental characteristics that could propel them to become tomorrow’s market leaders. We believe that identifying and nurturing these opportunities is the path to generating outstanding long-term returns for our clients.

1 We refer to the S&P 500, Russell 1000 Growth and Russell 3000 Growth indices in this article. For index more information, please refer to the index providers websites.

2 by an average of 2.4 per cent per year. Source: GMO.

3 Remarkably, that concentration level exceeds some regulators’ concentration limits in certain markets.

4 Based on analysis of the past 12 months to 29 November 2024, for the Russell 3000 Growth index (a representable investable growth universe).

5 Active share of around 80 per cent versus the S&P 500.

|

|

2020 |

2021 |

2022 |

2023 |

2024 |

|

US Equity Growth Composite |

128.3 |

-4.0 |

-55.5 |

46.6 |

30.6 |

|

S&P 500 Index |

18.4 |

28.7 |

-18.1 |

26.3 |

25.0 |

|

|

1 year |

5 years |

10 years |

|

US Equity Growth Composite |

30.6 |

13.3 |

15.3 |

|

S&P 500 Index |

25.0 |

14.5 |

13.1 |

Source: Revolution, S&P. US dollar. Returns have been calculated by reducing the gross return by the highest annual management fee for the composite. 1 year figures are not annualised.

Past performance is not a guide to future returns.

Legal notice: The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE®” “Russell®”, “FTSE Russell ®, is/are a trade mark(s) of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

129533 10052212