Capital at risk.

March was a momentous month for Japan as it raised interest rates for the first time in 17 years. The Bank of Japan (BOJ) ended two extreme monetary policy actions, namely, its Negative Interest Rate Policy (NIRP) and Yield Curve Control (YCC). The reason? Increasing confidence that inflation was moving ‘sustainably’ to its 2 per cent target.

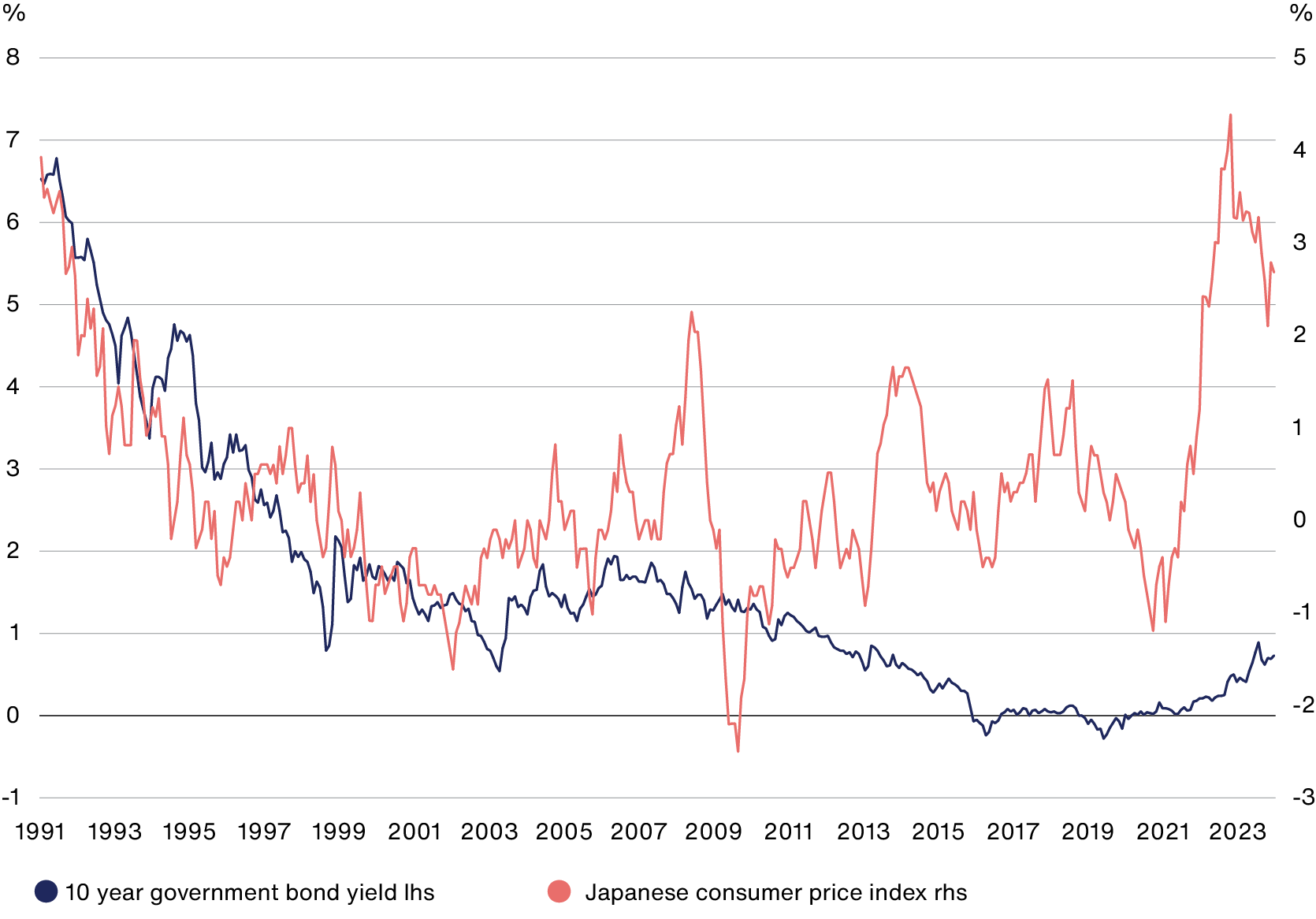

The yen has nearly halved in value over the last decade and inflation in Japan has been above 2 per cent for two years. Core inflation is 3.5 per cent, its highest level since 1982. The Nikkei, the Japanese stock market’s [primary/principal] index, is up nearly 20 per cent this year and is the best-performing developed market stock market. In contrast, 10-year Japanese bond yields remain around 0.7 per cent and are far from pricing in sustained inflation at 2 per cent. We believe the chances of this level of inflation have increased materially and are positioning our portfolios accordingly.

What has changed?

Japan has long been lambasted for not managing to escape deflation. From 2000 onwards, the BOJ cut interest rates to zero and enacted Quantitative Easing1 (QE) in its bid to increase inflation. In 2006, it claimed some success by getting inflation up to ‘around zero’, which was the pre-determined trigger to begin normalising policy. In the following year, it more than halved the size of its balance sheet and made two interest rate hikes. But sustained inflation above zero eluded them and following the Global Financial Crisis (GFC) the rate of deflation hit a new low of -2.5 per cent.

In 2012, the election of the late Prime Minister Shinzo Abe brought in a new era of easy monetary policy as part of the ‘three arrows approach’ alongside fiscal easing and structural reform, known simply as ‘Abenomics’. During this time, the BOJ increased the rate of QE and took its balance sheet from 30 per cent GDP at the start of Abe’s term to 100 per cent GDP by 2020 before the pandemic hit. Quite incredibly ‘Abenomics’ only succeeded in creating an average core inflation rate of about 0.4 per cent over that period, far from the 2 per cent target.

This time, it’s different

Pandemic shortages, exceptional weakness in the yen (helped by every other central bank globally hiking interest rates aggressively) and more overt support for labour union wage demands have created a step change in Japanese inflation. We think this will continue for three key reasons:

- The Japanese government and central bank are united in their desire for inflation. The government are cajoling businesses and supporting unions to achieve higher wage growth, while the central bank is indicating they will run exceptionally easy monetary policy until inflation becomes prevalent.

- Pandemic-related inflation was large enough to trigger second round effects. As inflation reached over 4 per cent, labour unions have a strong rationale to demand significant wage rises. That in turn will put pressure on Japanese companies to raise prices to protect their margins and start the wage rise cycle again. In BOJ parlance, this is the “virtuous cycle between wages and prices”.

- We do not see an imminent global recession risk. In 2006/7, the last time the BOJ raised interest rates, the world had built up a huge amount of debt in the private sector. This was the trigger for the GFC which upended Japan’s chances of achieving sustained inflation. This time the world is awash with pandemic savings and only governments have gorged on debt.

So, what to do?

The Multi Asset team initiated a position in Japanese government bonds in 2023. If bond yields rise, these investments will make money and vice versa. We have increased the position over the past year as our milestones for inflation have been hit. The rationale is relatively simple. If inflation stays at 2 per cent, as we expect, interest rates will likely rise, potentially to above 2 per cent if the BOJ need to act to control inflation. Currently, 10-year bond yields are well below 1 per cent, which means the position offers attractive asymmetry: limited downside if we are wrong as bond yields are so low, and attractive upside if we are correct.

Thus far, bond yields have moved very little relative to inflation, as illustrated by the blue line in the chart below. The last time inflation was close to 3 per cent, bond yields were over 5 per cent, a far cry from the 0.7 per cent yield they offer currently. Indeed, this asymmetry increases when we consider a potential debt ‘crisis’, where investors question the ability of the Japanese government to pay back its debt. We have seen yields spike in other developed markets, notably in Ireland and Italy in 2011-2012, and even here in the UK during the ill-fated reign of Liz Truss and the disastrous ‘mini budget’. And while we think this an unlikely scenario, it's worth consideration that Japan currently has the highest percentage of debt to GDP of any country in the world.

Japan Inflation vs 10 year bond yields

Consumer inflation has moved away significantly from government bond yields which presents an opportunity for our portfolios.

Source: Macrobond

We also have a position in the Japanese yen. Although one can argue that this is ‘doubling up’ on our view, it offers some differentiating characteristics that make it attractive.

Our central scenario is one which sees the BOJ tightening policy. Raising interest rates should increase the attractiveness of the yen and result in investors buying the yen versus other currencies (of countries which have now paused interest rate hikes and are looking to cut their interest rates).

An alternative scenario that gives us pause for thought is one where inflation in the US remains sticky and interest rates remain higher for longer. Given recent history, that should pressure the yen to depreciate. However, what gives some comfort in this scenario has been the verbal confirmation by Japanese officials that they will intervene, followed by the physical intervention by providing support to the currency where necessary.

[In our view], this results in an attractive asymmetry: limited downside in the higher US yield scenario; good performance in our central case; and, exceptional performance should a global growth slowdown play out.

Concluding thoughts

The Japanese economy has faced numerous challenges in escaping deflation over the last few decades, but there are signs of hope for the future. The BOJ's policy decisions and the global economic climate will play a crucial role in determining the country's economic trajectory. By addressing structural issues and raising inflation expectations, Japan has the potential to overcome its current challenges and achieve sustainable inflation.

This potential, coupled with the portfolio diversification benefits of these positions, makes both investments attractive propositions for our Multi Asset portfolios.

1Quantitative easing: the introduction of new money into the money supply by a central bank.

Risk factors and important information

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in May 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act. This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America. The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law,5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and Type 2 licence from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong, Telephone +852 3756 5700.

101654 10046996