Please remember that the value of an investment can fall and you may not get back the amount invested.

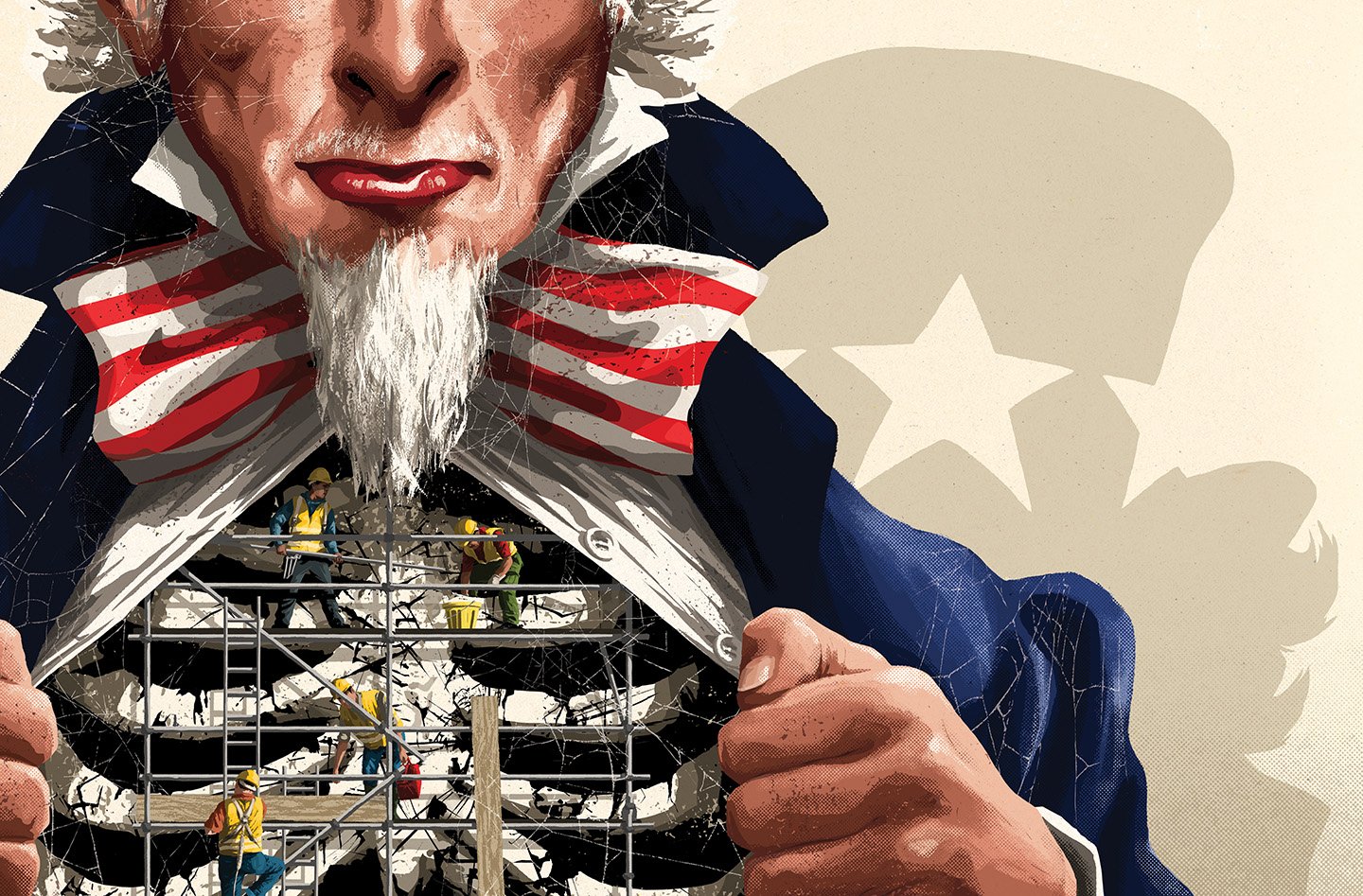

From code to concrete: the nature of growth is changing, according to Baillie Gifford's Spencer Adair.

“If software has been the pre-eminent source of growth over the past 20 years, perhaps physical hardware will replace it as the main source of growth for the next 20,” he says.

Adair believes that gritty, physical companies that build things in the material world – gravel producers, plastic pipe makers, electrical contractors – are poised to thrive as advanced economies confront the urgent need to reconstruct everything from highways to power grids.

That bodes well for our holdings, such as Eaton, Comfort Systems USA, Martin Marietta Materials and Advanced Drainage Systems, all of which stand to benefit from the great American rebuild.

Adair is anticipating an epic swing towards the material world as the US legislates for a jaw-dropping $2.2tn to be spent over the coming decades upgrading the country’s tired infrastructure.

Potential beneficiaries include global firms involved in the energy transition and producers of critical raw materials.

Boomtime for builders

Among the builders and builders’ merchants, Adair points to Eaton, an electrical contractor. In a recent update, the American-Irish company totted up all the building projects announced in 2022 in the US and Canada. It came up with a total of $860bn in planned megaproject spending – about three times the normal rate.

“We think this is a 10-year-plus period of abnormally high growth for the likes of Eaton,” Adair says.

The unusual level of growth is already putting strain on a limited supply of skilled labour. Comfort Systems USA employs roughly 15,000 people and installs heating, ventilation and air conditioning systems.

Historically, about half of the Houston-based company’s revenue was booked by the start of the year. That has surged to 90 per cent as customers pay upfront to ensure access to Comfort’s highly trained workforce.

Other key shortages are developing in raw materials. Adair enthuses, for instance, about the outlook for Martin Marietta Materials, an owner of quarries that produce construction aggregates, such as sand and gravel. As builders scramble for supply, prices for those aggregates are soaring at their fastest rate in decades. Yet Martin Marietta doesn’t have to worry about new competition emerging any time soon because getting permits to develop a new quarry typically takes five years.

“And that is before you even start constructing the quarry,” Adair says. “It’s probably seven to 10 years before you actually begin to produce materials.”

Illustrations by Mark Smith

A new Marshall Plan

To be sure, it’s not just traditional building materials that should get a lift from the infrastructure boom. Innovators, including Advanced Drainage Systems, should also benefit. The Ohio-based company has developed plastic storm drains that are lighter and faster to install than conventional concrete ones.

“Advanced Drainage is one of North America’s leading plastic recyclers and makes storm drains that last 100 years,” Adair says. “It’s a faster, cheaper, greener alternative,” he adds, that could be a winner over a long infrastructure boom ahead.

To put the scale of that projected spending in perspective, Adair reaches back to the late 1940s. “Think of the Marshall Plan,” he suggests.

That world-shaping US initiative to rebuild post-war Europe’s shattered economic infrastructure was worth about $170bn in today’s money.

In comparison, the $2.2tn stimulus laid out in the last few years of legislation amounts to the equivalent of 13 Marshall Plans.

A good chunk of this massive outlay will go towards fixing the country’s crumbling roads, bridges and water systems. In its most recent assessment, in 2021, the American Society of Civil Engineers said 43 per cent of US public roadways were in poor or mediocre condition. It noted that somewhere in the US, a water main breaks every two minutes on average.

“Much of the current installed base was built during the boom times after the Second World War,” Adair says. “It is badly in need of renewal.”

Wider economic transformation

However, it’s not just the need to patch up the disintegrating legacy of the past that is propelling today’s infrastructure boom. It also reflects how Washington wants to re-orient the US economy.

Covid-19 exposed the fragility of global supply chains. It demonstrated how easily a crisis could shut down far-flung manufacturing networks and cause shortages of crucial components.

US policymakers are now determined to make their national economy more resilient. They want to encourage industries to make products domestically rather than relying on China as the go-to manufacturing destination. Increasing friction between Washington and Beijing has added a further note of urgency. Notably, the US no longer wants to depend on Taiwan as the sole source for many key computer chips – the island’s proximity to an increasingly militant China makes it just too vulnerable.

To prevent future disruptions, the recent CHIPS (Creating Helpful Incentives to Produce Semiconductors) Act includes generous tax breaks and subsidies to encourage semiconductor makers to set up plants in the US.

The Inflation Reduction Act adds a further large dollop of money for green energy. It aims to foster the installation of more wind turbines, solar panels and electric vehicles. That, in turn, boosts the need for smarter, more adaptable electrical grids to connect new power sources to homes and factories.

Could a change of administration in Washington disrupt this happy course? Adair thinks a spending U-turn is unlikely. Much of the recent legislation passed with bipartisan support. Furthermore, the need for infrastructure spending is based on long-term trends difficult for any administration to ignore, such as the need to replace ageing roads and the shift to green energy.

Moreover, Adair sees many of the same trends playing out in Europe and argues that an infrastructure boom could also happen there. Investors searching for a new theme should take heed: it’s time to get physical again.

Important information

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co.

Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

92918 10045408