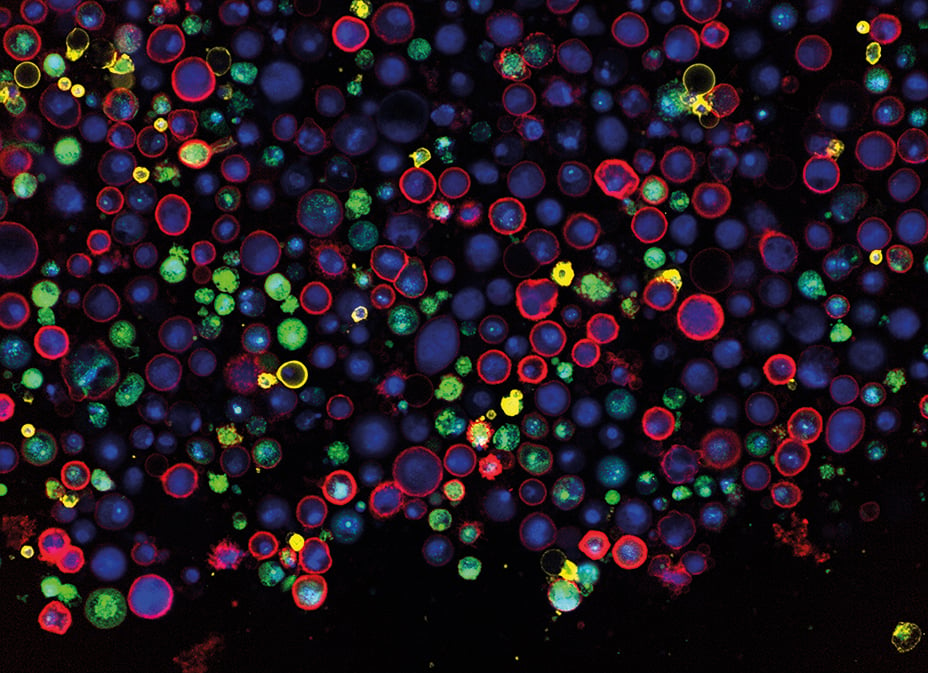

Tissue cells used by Exscientia to develop customised treatment

Please remember that the value of an investment can fall and you may not get back the amount invested.

Two seemingly unrelated questions: How do we best treat the estimated 40 per cent rise in new cases of bowel cancer predicted in the next two decades? And why does the cost of sending money across international borders remain so high and the charges incurred so opaque?

For Milena Mileva, the connection is that they are two examples of the ‘hard global problems’ that Baillie Gifford UK Equities Team companies – electrosurgery specialist Creo Medical and Wise, a foreign exchange fintech – are addressing.

She believes that the portfolio’s up-and-coming companies, “disruptors at the leading edge of innovation,” are well-placed for growth over a 10-year time horizon. Already, she says, they’re “bucking the perception that the UK is not a very exciting place to invest.”

Mileva highlights UK companies taking on some of the biggest global challenges:

Creo Medical

The firm develops medical devices for surgical endoscopy – operations carried out by tiny devices inserted into the body via small incisions.

Speedboat, its leading product, is attached to an endoscope and used to cut out or vaporise pre-cancerous growths in the digestive tract before they spread.

“Creo enables medics to detect diseases and intervene earlier, giving a better chance of recovery,” Mileva explains.

“Endoscopes are traditionally only used in investigative procedures to diagnose disease. Creo’s advanced energy platform and surgical tools enable endoscopes to perform treatments. These procedures benefit the patient and save money for healthcare systems.”

Mileva points to Creo’s June 2022 licensing partnership with Intuitive Surgical, the global leader in robot-assisted surgery. To her, the tie-up is evidence of the broader applicability of the UK firm’s technology: “The fact that a $6bn-revenue company such as Intuitive is partnering with a small business like Creo is a strong endorsement.”

Exscientia

The ‘pharma tech’ company “precision engineers” drugs tailored to individual cancer patients and those with other diseases. This involves using artificial intelligence (AI) at each drug discovery and development stage.

“The company is made up of a 50-50 split between biologists and technologists,” Mileva says.

“From the AI generation of the first novel molecules to the design of a potential therapy typically takes Exscientia around 12 months. The industry average is four-and-a-half years.”

The firm has 25 new therapies in its pipeline, including the first three AI-designed drug candidates to enter phase one clinical trials – the first step in testing a new treatment in humans.

Headquartered in Oxford Science Park and listed on New York’s Nasdaq exchange, Mileva is hopeful that “Excscientia will become the next AstraZeneca. The academic credibility of the people involved gives me confidence that it can.”

Wise

Wise has pioneered low-cost, super-transparent international money transfers.

Because it uses its own account in the destination country to pay a recipient an amount akin to the real exchange rate, money does not cross international borders and incur additional costs. Wise is upfront about the (usually lower) fees it charges.

Founded as TransferWise in 2010, the firm has grown rapidly, grabbing market share from banks and other incumbent foreign exchange brokers.

It listed on the London Stock Exchange last year and reported 38 per cent annual revenue growth in its last financial year.

“Individuals and companies transfer an estimated $18tn every year. Over 60 per cent of that is in the hands of banks, where transactions are riddled with hidden charges. It’s expensive and slow,” says Mileva.

“Banks can’t or won’t compete with the scalable technology infrastructure that makes Wise cheaper and faster.”

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions. This communication was produced and approved in October 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 28509 10071940